April 1, 2013

By: Bobby Casey

The deal struck for Cypriot Banks targeted “evil money launderers and tax evaders” as well as wealthy oligarchs, but really plunders the hardworking saver and entrepreneurs.

While emotions run high, and the victims of this absurd plunder are myriad, there is a culpable group responsible for this mess, and it’s safe to say it’s not EVERYONE with a Cypriot account holding over EUR100,000.

The Cyprus deal – whether you call it a bail-out or a bail-in really matters little – left a LOT of individuals in the lurch and many others destitute. You begin to see the true colors of how folks feel toward their own, personal, wealth. And sadly, you also tend to see divisiveness regarding who should bear the brunt of consequences. As mentioned in an earlier post, those who hold over EUR100,000 are subject to lose everything above that amount; and nearly one-third of those with that kind of wealth are Russian. Recently, it was discovered that some Russian Oligarchs managed to somehow move large amount of capital out of both the Bank of Cyprus and Laiki (Cyprus Popular Bank) just a day before the deal was struck: when all accounts were supposedly FROZEN. If enough wealth was removed, the whole bail-in/out and destruction of the Cypriot system was for not, as the plan relied on a certain amount of money to make it work.

The Cyprus deal – whether you call it a bail-out or a bail-in really matters little – left a LOT of individuals in the lurch and many others destitute. You begin to see the true colors of how folks feel toward their own, personal, wealth. And sadly, you also tend to see divisiveness regarding who should bear the brunt of consequences. As mentioned in an earlier post, those who hold over EUR100,000 are subject to lose everything above that amount; and nearly one-third of those with that kind of wealth are Russian. Recently, it was discovered that some Russian Oligarchs managed to somehow move large amount of capital out of both the Bank of Cyprus and Laiki (Cyprus Popular Bank) just a day before the deal was struck: when all accounts were supposedly FROZEN. If enough wealth was removed, the whole bail-in/out and destruction of the Cypriot system was for not, as the plan relied on a certain amount of money to make it work.

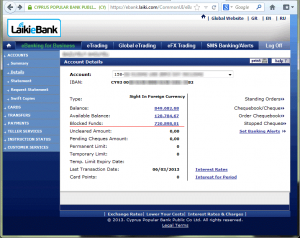

Who’s left then to take the hit? Well, there are the small to midsized businesses who kept accounts in Cypriot banks as liquid working capital, for such day-to-day things like payroll, purchases and operations. What will happen to their employees if there is no cash with which to pay them? What will happen to their store fronts if there is no cash with which to pay bills or rent? One particular business posted its shocking findings on Thursday (Check out the “blocked funds”. Think they’ll be seeing any of that ever again?):

While this offends me to the core, there is a bit of a heroic twist to this story. The business owner posts, “We are moving to small Caribbean country where authorities have more respect to people’s assets. Also we are thinking about using Bitcoin to pay wages and for payments between our partners.” Expatriating and switching to an alternative currency is not only bold, but look at this guy picking himself up by the bootstraps to take his productivity some place where he won’t get the rug pulled out from under him! He is a page right out of “Atlas Shrugged”! A Cypriot John Galt, if you will!

Unfortunately, not all who those adversely affected have the time or ability to do as the business owner in the above story. Just last Friday, the Sydney Morning Herald, did a story about one Cypriot-Australian (65-year-old John Demetriou) who escaped Cyprus during their war with Turkey, fled to Australia, and starting from nothing managed to amass $1 Million AUS. He lived off the interest, and helped his grandchildren and ailing mother of 90 years old. With plans to retire in his native Cyprus, he puts his entire savings into Laiki. As he puts it, “I went to sleep Friday as a rich man. I woke up a poor man.” Due to his heart condition, he cannot return to Australia.

Sadly, his money wouldn’t have been much safer in Australia! If he never touched the principle and lived solely off the interest, their government might very well consider the principle “idle”. And if it has been that way for three years, he could very well have lost it all to a different government by the end of May. Talk about not being able to catch a break!

In his statement, Demetriou goes on to say, “It’s not Russian money, it’s not black money. It’s my money.” While my heart goes out to him and every victim of this senseless plunder, as bystanders, indulging the temptation to assess who “deserves” to get plundered serves no good purpose or end. This man suffered at the hand of that same “reasoning”. The EU defined “rich” as accounts with over EUR100,000. They entertained the class-warfare ideology, and abandoned the tax levy across the board, only to place the burden on the shoulders of those making over a certain amount.

We hear these stories of banks, lenders, investors, oligarchs, and often the sympathy river runs dry rather quickly. Everything from the Occupy Movement to the austerity measures throughout parts of Europe have fanned the flames of class warfare. It has nothing to do with socio-economic status. It has to do with irresponsibility and corruptible power mongers. The state of being wealthy in itself is benign. Being wealthy and responsible is productive and helps society. Being wealthy and manipulatively irresponsible, on the other hand, reveals its consequences in scenarios like bank bailouts and corporate subsidies. The frugal, responsible saver who happens to have wealth bore the consequences for the fast-and-loose bankers and the privileged oligarchs who also happen to have wealth.

At the end of the day, no one deserves to be plundered. Cyprus made a grave mistake, which will have an indelibly adverse effect on the Cypriot economy. The pathetic attempt of the EU at some semblance of a “solution” convinced NO ONE that the EURO is stable or that the EU is anything more than a bunch of German and Dutch autocrats. They overtly punished an ethic, and ultimately condemned Cyprus to an economic tragedy far worse than had the EU left it alone.