January 5, 2015

By: Kelly Diamond, Publisher

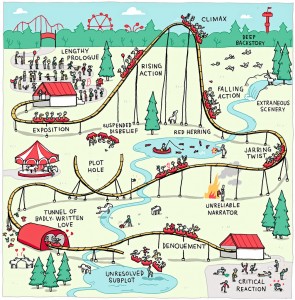

Have you ever seen the movie Pulp Fiction? One of the notable features of that film was how it started off following various unrelated events and characters, but as the movie continued, it shows how those characters and events would culminate into one plot. This picture rather accurately captures some of the economic plots developing around the world today!

Now look at what’s happening with various economies in the world. What’s Japan have to do with Belarus? What’s Belarus have to do with Belgium or Switzerland? What do any of those guys have to do with China? I don’t know… yet. For now, any answers to those questions would be speculative… but not impossible.

Needless to say, it’s all but impossible to get a candid, truthful answer from politicians and bureaucrats. We sit and wait for them to screw up, and based on how frantic they are to back pedal out of their gaff, we can guess how truthful it actually was.

The EU

Perhaps you remember when the then new President of the Eurogroup, Jeroen Dijsselbloem, called Cyprus a template for how future crises could be handled in other countries:

“If there is a risk in a bank, our first question should be ‘Okay, what are you in the bank going to do about that? What can you do to recapitalize yourself?’ If the bank can’t do it, then we’ll talk to the shareholders and the bondholders, we’ll ask them to contribute in recapitalizing the bank, and if necessary the uninsured deposit holders.”

Spain, France, Portugal, and Luxemburg were prompt to deny such a claim had any implication on THEIR banks. Yet Spain and Portugal are just barely keeping their heads above water. Will their banks be instructed to pump more money into the market, regardless of risk? Will that lead to another bail-in?

Meanwhile, EU countries seem to be making a run on gold. Germany has been repatriating its gold from the US and France for a few years now. The Netherlands just decided to repatriate its gold from the US. Now France and Belgium are following suit while Austria is making preparations to fall in line after them.

Japan

So far Japan has been rather careful in how it words its economic activity… but words are a poor substitute for actions, and Japan’s actions are clearly monetizing their debt. As our friend and contributor Claudio Glass very comprehensively pointed out (Japan on Track for Textbook Bust), Japan is setting itself up for some serious hardship… in an effort to mask their current hardships. The boom begotten of credit expansion leads to an inevitable bust.

Belarus

A country who is still suffering from the drop in value of the Russian ruble. Oh sure, Russia got out of its hole with help from China. But Belarus didn’t. Instead it laid some heavy protectionist and isolationist pipe:

- It blocked online stores and news outlets

- It banned FX trading for 2 years

- It put a moratorium on price increases on consumer goods

- It introduced a 30% tax on the purchase of foreign currency

Meanwhile Belarussians are making a run on stores and banks to secure their assets. Riding out the tide might’ve made more sense, but considering the nose-dive the value of the Belarussian ruble has taken over the course of 2014, that last tremor with the Russian ruble was all that little economy could take.

China (and their buddy Russia)

It’s no secret that there are countries who resent the US dollar being the reserve currency of the world. China and Russia are absolutely top contenders on that list. When I think of Russia and China, my mind immediately goes to an old Pet Shop Boys song “Let’s Make Lots of Money”:

“You’ve got the brawn (Russia), I’ve got the brains (China), let’s make lots of money.”

This just went into effect a few days ago:

“China and Russia have effectively switched to domestic currencies in trading using financial tools as swaps and forwards, as they seek to reduce the influence of the US dollar and foreign exchange risks.” (Source: RT)

The swap was reported to be worth around $20 Billion USD. Now:

- Yuan swaps are available in 11 different currencies

- It has set up binary swap lines with over 20 countries and regions (includes: Switzerland, Brazil, Hong Kong, Indonesia and South Korea)

- China has its sights on developing Asia-Pacific countries while having existing dealings with Australia, New Zealand, Brazil, Singapore, Hong Kong, Argentina, and Malaysia

- Russia’s largest bank is offering Yuan backed financing

- Russia and China are gas partners as well. Which is a big deal for the Russian ruble considering it hinges on the health of Russian energy markets. China is set to become Russia’s largest oil consumer.

I wrote about this partnership back in September of last year (Working Around the U.S.), and so I think 2015 is going to be the year of the Dragon and Bear!

What does all this mean? There is no question that these little plots will converge into a much larger story down the line. When and how are the remaining questions to be answered. They aren’t unrelated. Japan is tied to China whether it likes it or not. Belarus is tied to Russia. The EU and the US are both petrified of Russia and China to the point of manufacturing fear campaigns. There is a good mix of desperation and cunning happening here.