March 21, 2016

By: Bobby Casey, Managing Director GWP

The solutions to extreme situations often are quite extreme themselves. Debt is no exception. There is manageable debt, but there is also unmanageable debt. There’s the debt you put on a credit card for the points and pay off each month, and there’s the debt that precariously rides off nothing going wrong in your life. There’s the car and house payment that are manageable on one or two incomes, and there’s those same lines of credit who rely solely on one income.

Well, the United States is in one of the more desperate and unmanageable situations. When China was buying up all our debt, things were fantastic! Our line of credit was amazing! But now, China needs a weaker dollar, so she’s selling off US treasuries by the ton. It relies on staying artificially cheap to keep its exports going. Basically it is desperately trying to hold on to its place in the price war on exports.

This isn’t sustainable, since even as they are the largest holders of US foreign debt, they have a finite amount to sell. What’s next? China’s problem is that she’s addicted to centralized policies that force and engineer things a certain way, regardless of its sustainability.

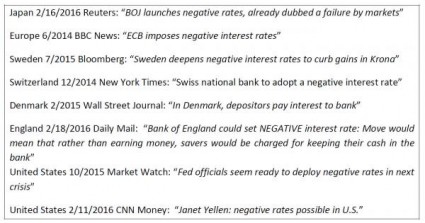

The US is, as we’ve mentioned, dabbling in the notion of negative interest rates (or NIRP) in addition to its multiple quantitative easing policies. While the US likes to condemn China for currency manipulations, the US sits here screwing around with its interest rates and printing money out of thin air. How many more cranks can our jack-in-the-box take before it’s pop-goes-the-weasel?

These are just some of the desperate monetary moves being seen in the world. Japan and many European countries are also in on the NIRP (Source: Zerohedge)

There is, however, an unlikely responsible player out there. I say unlikely only because of their tight alignment with China. While they are one of China’s biggest cheerleaders on the global stage, they maintain their maverick independence when it comes to their own policies.

Ladies and gentlemen, may I present Russia! She may falter, but she doesn’t fall. And Putin has taken an exemplary direction with regards to their monetary policies. Credit where credit is due: Vladimir Putin has implemented some tough love policies if not staged an all-out intervention on Russia.

Since 2000, he has paid down a significant amount of Russian debt. It’s now among the lowest of developed countries.

He is also SAVING money. That’s right. He took Russia’s reserves from $13 billion to $381.1 billion.

“The international reserves consist of foreign exchange, special drawing rights (SDR) holdings, the reserve position in the IMF and monetary gold.” (Source: RT)

While other countries are resorting to spending and debt, Russia toughs it out and not only is saving, but holding its interest rates at 11%.

No deficit spending. No negative interest rates. A nominal debt.

Regardless of what you may think of Putin, Russia, or their other policies, there is no denying that this is far more responsible than some of the other countries. It’s not easy to do this. They are forgoing a lot to right their ship.

Perhaps this is just their rainy day fund, for if/when crude prices fall below their comfortable levels. Russia needs crude to stay above $50/barrel right now. Given the volatility of oil, it is possible Russia is just saving up for the inevitable shortfall. This doesn’t detract from the merits of saving. In fact, it only reaffirms the virtues of Russia’s current policies.

All of this seems to reflect where the focus of these different countries is. Russia isn’t allowing herself to be ruled by the import/export tug-of-war. Not to say that neither are a concern: they absolutely are to any country. But they are riding out their situation without making any knee-jerk decisions.

Meanwhile, the US, China, Japan and the EU are very much concerned with imports and exports. A strong currency means cheap goods coming in. A weak currency means cheap goods going out. What to do? Indeed.

This wouldn’t be such a problem for the West if they just deregulated their industries to offset the cost of a stronger currency. But they impose expensive regulations, price-fix wages, and onerously tax their populations for revenue that it’s taking a toll in their commerce.

A strong currency makes goods appear more expensive. But that appearance is easily mitigated by cutting costs in production and distribution. Alas, in the US alone there are healthcare mandates, taxes, minimum wages, and licensure laws, to name just a few things, which bulk the costs of our goods.

That these governments who are so concerned with import and export would sooner manipulate their monetary policies to offset their expensive and imposing tax and regulatory regimes demonstrates just how desperate and controlling they really are. It’s like the work that goes into keeping up a lie: at some point they will slip up.

This looks like the M.O. of the majority of nations in the developed world, unfortunately. The powers that be will have you paying for it no matter what. Either they will devalue your money, steal your money, or all of the above, but they will have their way, they will have control. This downward spiral isn’t out of control. It’s very much a controlled thing. There are several government leaders and central planners who are at the helm taking shifts at driving this global economy into the ground.

Protect your assets from this nonsense. It used to be people just put their money away in a pension fund or saved it in a bank to prepare for their later years. Not anymore. You need a financial GPS to navigate this. Think globally. Think diversification. Squirrels have the right idea: bury your stash all over the forest. That way, if one fails, you still have others. I can show you how to do just that. Let’s talk! Click here to schedule a consultation.