September 1, 2014

By: Kelly Diamond, Publisher

Immigration is still quite the hot topic in the United States, but so is EMIGRATION. Bobby did a piece on this not that long ago, discussing the economic impacts of both. Ultimately, the preponderance of evidence supports two facts:

Immigration is still quite the hot topic in the United States, but so is EMIGRATION. Bobby did a piece on this not that long ago, discussing the economic impacts of both. Ultimately, the preponderance of evidence supports two facts:

1. Immigrants (legal or otherwise) provide MORE benefits than they take to the US economy. In the wake of the economic circumstances affecting the entire world, the US has seen an increase in applications and illegal immigration.

2. Emigration is also on the rise and that will have a negative impact on the economy. In the wake of the economic crisis, another group of people started to mobilize as well: Americans. Individuals as well as businesses are increasingly seeking to sever ties with the US because of the government’s response to the economic crisis: increase taxes, print money (i.e. devalue the dollar), and stalking Americans around the world through the new FATCA legislation.

A common exchange I have with people involves me expressing my discontent with the government and people telling me “If you don’t like it, leave… nothing is stopping you.” OH REALLY?

Let’s talk logistics for a moment, then, because clearly people who can be so glib toward expatriation haven’t the first clue what is entailed in such an ordeal. While we at GWP strongly advocate that people diversify their residencies and citizenships when possible, we also recognize the process and do not make little of the time and monetary investments involved in such a process.

That being said, let’s talk brass tacks. If you are trying to come into the United States, it currently costs $680 for citizenship. WHAT?! That’s cheap! Sign me up! (We will put aside the fact that that number will soon get a $2,000 bump in price.) But before you can become a citizen here, you need to become a legal resident. Well, what’s that go for? Well, let’s start with $5,000 to $15,000 in legal fees just to get you through the green card process. Then there is the indefinite wait. Now, you could be one of the lucky LOTTERY winners (the US State Department draws 50,000 lucky names per year to be eligible for a green card!). Outside of that, you just wait. No checking on the status. No updates. No anything. Just waiting.

What about if you are trying to LEAVE? Oh, well that’s easy. As a matter of law, the Expatriation Act of 1868 made it clear that renunciation of citizenship is “a natural and inherent right of all people” and that “any declaration, instruction, opinion, order, or decision of any officers of this government which restricts, impairs, or questions the right of expatriation, is hereby declared inconsistent with the fundamental principles of this government”. So yeah. You can just leave whenever you want!

NOT SO FAST!!!!!!!!!!!!

Allow me to clarify what’s meant by “whenever you want”. It carries a very similar caveat to the Evil Stepmother in Cinderella who says she can absolutely go to the royal ball… IF…

Four years ago, there was a fee levied on renunciation of citizenship processing of $450. While not totally unreasonable, I am a little cynical as to why this fee even became necessary given the timing. Evidently, our tax dollars don’t pay for these services? Or they did, up until about four years ago. Now the folks over at the State Department are saying they are going to up the price to $2,350.

They claim these fees pay for the costs associated with the processing of renunciation, but what was paying the salary of the person doing this before the fees were levied? What was that guy being paid for prior to the fees being levied? Evidently, the whole renunciation process costs 17 total employee hours at $135 per hour.

The real question is: what sort of process is it that costs that much for someone to just get settled in a new country or leave a country? One could argue there is a lot of paperwork in sorting out nationalities and residencies. Okay, paperwork is time consuming, and no one does time vortexes like the US Government. However, I can’t help but wonder why the process of moving from country to country in South America or within the EU can be far more seamless… or why moving from state to state manages to be rather simple and affordable.

But wait… like a bad infomercial… THERE’S MORE!!!!

Per the IRS and its explanation of the “Expatriation Tax”, if you are a citizen or have been a legal resident for a certain amount of time, and this is you…

- Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation ($147,000 for 2011, $151,000 for 2012, $155,000 for 2013 and $157,000 for 2014).

- Your net worth is $2 million or more on the date of your expatriation or termination of residency.

- You fail to certify on Form 8854 that you have complied with all U.S. federal tax obligations for the 5 years preceding the date of your expatriation or termination of residency.

… then not only do you owe the average of the last 5 year’s income taxes upon your departure, but…

“RC 877A imposes a mark-to-market regime, which generally means that all property of a covered expatriate is deemed sold for its fair market value on the day before the expatriation date. Any gain arising from the deemed sale is taken into account for the tax year of the deemed sale notwithstanding any other provisions of the Code. Any loss from the deemed sale is taken into account for the tax year of the deemed sale to the extent otherwise provided in the Code, except that the wash sale rules of IRC 1091 do not apply.”

Yup. You will sell your property. And it will count against you. And you will be taxed on it upon departure. There are some exceptions and exemptions, but not many.

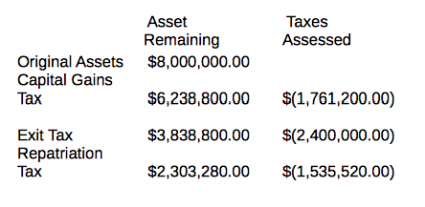

IRS Medic gives a great example of what the Exit Taxes look like in the following scenario:

“For illustration, we used the example of Jack and Jill Uphill. Jack and Jill are a wealthy couple with children in the United States. Jack and Jill’s assets are as follows:

- They own one residence worth $2 million which they purchased in 1970 for $100,000.

- They have $6 million in stock with a cost basis of $500,000.

- If Jack and Jill will their assets to their children based on current tax laws, they are exempt from federal estate tax under IRC 2010. Of the original $8 million, the entire estate passes tax free to their heirs.

“However, let’s imagine that they expatriate. Jack and Jill’s expatriation would fall under IRC 877A. Jack and Jill would be forced to pay capital gains tax on their residence and stock. They would be taxed at the 23.8% capital gains tax rate for the sum of the gain on their house, $1.9 million and their stock, $5.5 million. They would be subject to the 30% exit tax. Lastly, since they are covered expatriates, the money that they leave their children would be taxed at the highest potential estate transfer tax rate, 40%.”

All of this doesn’t even include the costs tied to gaining residency or citizenship in your new country of choice either!

All of this doesn’t even include the costs tied to gaining residency or citizenship in your new country of choice either!

The reality is, the US KNOWS it has a preposterous tax regime. It KNOWS its monetary and fiscal policies are defunct. It knows that many of its wealth producers are wise to the US government’s folly. So not only does it want to penalize you while you’re here, it wants to penalize you for trying to leave. It’s called “buying your freedom”. Despite the fact that our own laws say that expatriation is a RIGHT not to be impeded or infringed upon, every law surrounding the exercise of this right is rather oppressive.

Capital flight is happening and it poses a REAL threat to the government. Corporations are trying to leave as much as individuals. Meanwhile, bureaucrats, regulators and legislators are trying to keep pace to discourage it.

When people tell me I should leave the United States, as Bobby has seen a couple times now, I literally ask them to sponsor my expatriation. Sadly, no one is willing to put their money where their mouths are… yet.