by Scott Causey, GWP Resource Correspondent

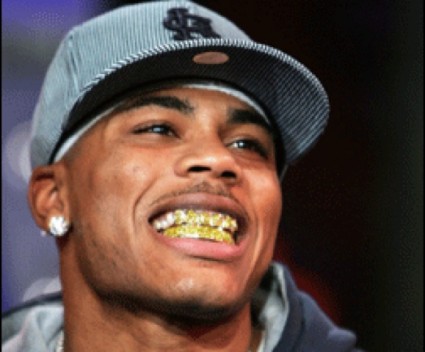

Who knew that the rap artist Nelly was actually a savvy investor? From the song “Grillz”:

Who knew that the rap artist Nelly was actually a savvy investor? From the song “Grillz”:

“Got 30 down at the bottom 30 mo’ at the top

All invisible set in little ice cube blocks

If I could call it a drink call it a smile on da rocks

If I could call out a price lets say I call out alot

I got like PLATINUM and white gold traditional gold

I’m changing grillz everyday like Jay change clothes”

While I don’t recommend you store your precious metals in your “grillz”, many more people would be well advised to pay more attention to platinum these days. Historically speaking, more often than not, platinum has been more expensive than gold. For very good reasons. Not the least of which is that production of platinum is almost totally isolated to one part of the world. 70% of platinum production comes from South Africa. Global mining production of platinum is a tiny 6 million ounces. Less than 5% of the production of gold. Above ground, stockpiles are only enough to meet less than one year of industrial demand.

While Apartheid may have ended years ago, recent events have shown that South African mining production is anything but stable. Just a few days ago, violence erupted in one of the most important platinum regions and mines in the world. The Lonmin platinum mine in South Africa has seen huge protests from miners who obviously feel they have nothing to lose. At the height of the bloodshed, 34 miners were shot and killed by local police that felt threatened by the demonstrations. South Africa has a very long history of this sort of violence and these recent events will do nothing but bring back a lot of bad memories on both sides of the debate.

Why would a man be willing to die to try and get a higher wage from his employer? In a word, FOOD. Most of these workers are paid very meager wages, and while a basic staple like rice going up in price might not affect your family dramatically, that does not mean that these people don’t see it as a matter of life and death.

Everyone surely has heard by now that the drought throughout America has destroyed a huge part of the crop this year. Six months from now, that is going to have enormous implications for food prices going even higher. Shortages in basic food commodities are nothing new in 3rd world countries.

What is fairly new and not going to change anytime soon is the rate at which food prices are going up and how they are outstripping wage increases even in the developed world. This is a guaranteed recipe for continuing battles between all miners and the people in remote parts of the world that they employ. In the short to medium term, this is going to get worse rather than better. What is 100% baked into the cake is further supply disruptions for commodities of all types.

Platinum is such a tiny market production that these kinds of supply disruptions are going to have enormous implications for prices going forward. The largest application of platinum is for automobile catalytic convertors. New car sales in the United States are up 49% in the first half of 2012 from just 3 years ago. China is now selling more automobiles than the United States. Any slowdown of automobile sales is more than likely to be offset and then some by mining supply disruptions due to exploding food costs. Platinum is also seen as a store of wealth by many investors and are minted into 1 ounce coins just as gold is.

If you have ever looked into obtaining physical platinum, it should be obvious just how tight the market is, even before South Africa experienced its recent violence. Delays to take delivery of platinum are already running into months. Lonmin Platinum Mine is the third largest miner of platinum in the world. The chaos in South Africa has also spread to major gold producer, Gold Fields. 12,000 workers have gone on strike there and the company says they are losing 1660 ounces of gold production a day.

If you see parallels between what is going on at these mines and the movie “Blood Diamonds”, you would be absolutely correct. If you have moral reservations about obtaining precious metals because of the conditions that they are produced in, I can understand that. What I would like to ask you rhetorically is this; If the worst does come to pass in your own country and the dollar goes up in smoke, what is your plan for food?