May 23, 2016

By: Bobby Casey, Managing Director GWP

I’ve never seen socialism bail out a country in dire straits. Every nation under economic hardship has largely relied on capitalism to save itself from total ruin. Individuals are the same way. Sure, there are the bailouts and the welfare programs, but even those run out at some point.

I’ve never seen socialism bail out a country in dire straits. Every nation under economic hardship has largely relied on capitalism to save itself from total ruin. Individuals are the same way. Sure, there are the bailouts and the welfare programs, but even those run out at some point.

Often, the case is that socialism is the very culprit that led to the economic disasters in the first place. Be it Venezuela or Puerto Rico, Greece or Cyprus, these are all a series of circumstances where central planning failed. Capitalism is the default system when there is no system at all. Since it works best under decentralized conditions, it stands to reason that would be the solution to centralized woes.

What sort of centralized woes am I talking about?

Consider these things:

- The cost of regulations in the United States is greater than the German GDP, coming in at $4 Trillion. Germany is the 4th largest economy in the world, and we lose that much in regulations in the US. I had to read that over and stare at it for a good while to wrap my head around it.

- Puerto Rico is struggling. They’ve already defaulted, and in response to that, they are experiencing the largest exodus in history. (Source: Daily Caller) “Puerto Rican residents are leaving the island in record numbers as the government defaults on its $70 billion of debt and its 10-year recession continues. “On net nearly 2 percent of the population has left Puerto Rico for the United Sates, according to a report released Monday by the Institute of Statistics of Puerto Rico. That’s some 64,000 people and the highest recorded figure in the last decade.”

Compounding their problem is the US federal government pushing for a higher minimum wage. The problem with central planning is that is screws over a few to help the most. One of those few is Puerto Rico, where a $7.25 minimum wage is only a few dollars short of the island’s average income of $11.13. (Source: FEE) “[T]he current $7.25 minimum wage constitutes two-thirds of the average wage. This ratio is nearly twice as high as on the mainland.”

It’s painfully out of sync with the local economy and the value of labor on the island. To give you some idea of how destructive an imposition the minimum wage is, if the US were to actually pass a $15 minimum wage on a federal level, Puerto Rico’s situation would be tantamount to asking California to impose a $35/hour minimum wage.

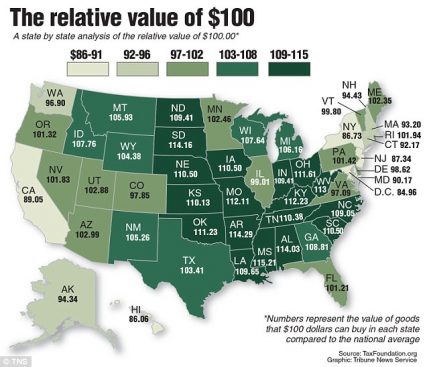

Here’s a chart that shows, just in the US without Puerto Rico, the value of $100. That such a value varies so greatly from state to state, shows that you cannot set a federal standard for the value of labor. It’s a market distortion that will have tragic economic consequences and lead to untold moral hazards.

If a dollar isn’t a dollar everywhere you go, then value isn’t the same value everywhere you go. Centrally fixing wage prices won’t lead to anything but destruction in places like Puerto Rico.

Puerto Rico is experiencing something eerily similar to that of Argentina and Venezuela. (Source: FEE)

“According to a report by International Monetary Fund economists, only 40 percent of the adult population in Puerto Rico is employed or seeking work, compared to 63 percent in the mainland. The other 60 percent are unemployed or working in the vast underground economy. Clearly, there are hundreds of thousands of Puerto Ricans working for less than the federal minimum, employed in the black market. For a nation struggling to service its debt, discouraging economic activity or driving it underground is not a good idea.”

This is not to single out Puerto Rico, but it is doing a damn good job of exemplifying what happens when the marginalized victims of socialized policies have their backs against the wall. Whether they are opting out or are pushed out, if they want to survive, they must operate in a black market system. This is the case in every failed country. This is why the black market is a multi-TRILLION dollar economy world-wide.

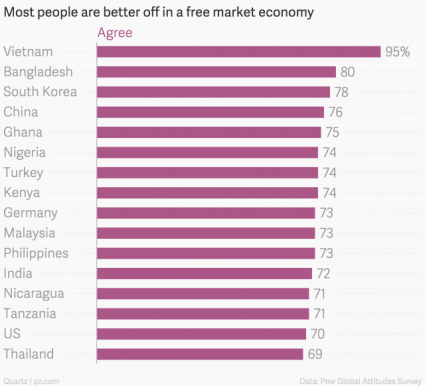

While the black market is the most readily available market alternative, some countries are seeing the light and turning around. We recently wrote about South America and how many of its countries are looking to capitalism and away from the socialism they’ve lived under for decades. China and Vietnam are also interesting examples. They might be authoritarian dictatorships, but while they wish to control on a social level, economically, they are favoring the prosperity that comes with loosening the vice on their markets.

When the Pew Market Research team asked, “Most people are better off in a free market economy, even though some people are rich and some are poor,” this was the response:

“Vietnam has had itself quite a boomlet in recent years. The country is steadily making its way up the manufacturing food chain, depending less on churning out low-skill manufactured goods like textiles and shoes to produce more sophisticated products such as smartphones. And foreign capital has poured in, thanks to global companies’ eagerness to tap pools of labor that remain relatively cheap in comparison to fast rising Chinese wages. That all means that standards of living are going up. The IMF expects the economy to expand by 5.6% this year.” (Source: Quartz)

This article thinks that they are in for a bust since people are hastily expecting these trajectories to continue. It’s certainly possible if they are lending and borrowing at an irrational pace, but that’s not the fault of free market capitalism. The free market bust that comes after such trends is a correction to what is a faulty practice. The boom and bust cycles don’t have to be so tragic if we don’t try to artificially prop up the boom long after it should’ve busted.

A wonderful example of this is the Depression of 1920 in the United States. Presidents Harding was great largely for what he DID NOT do, not for what he did. He did NOT intervene, despite pressure to the contrary. The Fed was not printing money or tampering with interest rates. Basically government not only froze up, but SHRUNK. Taxes were slashed. And recovery came faster than the depression had to set in. So yes, you can have a boom and a bust, but the bust doesn’t have to drag on like FDR’s depression did for over 11 years. It can turn around in as little as a year if you get the government out of the way.

And people see this. Around the world they are seeing that they themselves are the first front line solution to their problems. That the private sector has brought them more wealth and a greater quality of life than the government ever could. Even governments themselves are selling off things to offset the economic devastations their countries are suffering (although arguably the money never gets to the people but stays in the higher ranks of government and its cronies).

Greece might be selling off its assets. They balk at the idea of privatization, but they have things people are willing to pay for. People might not be willing to pay for a bailout with nothing to show for it… but I can see people paying for a Greek island! Greece must learn that money is earned and wealth is produced.

Countries are selling citizenship:

- Antigua & Barbuda

- Bulgaria

- Cyprus

- Dominica

- Grenada

- Hungary

- Malta

- St. Lucia

- St. Kitts & Nevis

- The United States and the United Kingdom both offer similar buy-in programs for citizenship as well, but at a much higher price point than the ones listed above.

Many of these guys are strapped for cash and the easiest thing to sell is a piece of paper since it’s relatively cheap to produce citizenship papers and passports, but highly coveted and valued for the access they offer.

Capitalism is the hero everyone loves to hate and the scapegoat politicians love to blame. I’m grateful it’s an economic model rather than an animate living thing with feelings or it would’ve abandoned mankind eons ago for the slanderous attacks it’s received over the years.

I am a strong believer in decentralization, privatization, and individual action. I have personally experienced the failure and success those bring, and appreciate that through the ups and downs I ultimately had the control to optimize my life to make it better. The responsibility falls squarely on my shoulders, for better or for worse. The good times are better than the government could ever have given me… and the bad times are more manageable than the government could ever make it.

Click here to schedule a consultation or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.