October 12, 2015

By: Bobby Casey, Managing Director GWP

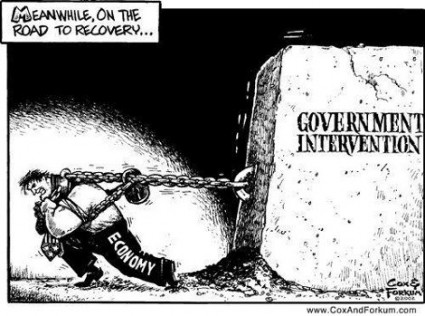

Ever hear, “Ignorance of the law is not an excuse to violate it,” or some derivative of that? While societal laws are often an arbitrary moving target, the laws of economics are about as clear as the laws of physics. They can only be bent for so long before they snap back and right themselves.

Ever hear, “Ignorance of the law is not an excuse to violate it,” or some derivative of that? While societal laws are often an arbitrary moving target, the laws of economics are about as clear as the laws of physics. They can only be bent for so long before they snap back and right themselves.

If quantitative easing has taught us nothing at all, it’s what happens when the government interferes in manipulation of value. The same is obviously true for the minimum wage. It sets expectations for the economically illiterate that are neither sustainable nor reasonable. (I tremble at the implications for American healthcare!)

I can’t say that energy and education are the only two sectors that the government has all but commandeered, but they are without a doubt quickly approaching their economic day of reckoning.

You may or may not remember an article from a couple years back called “For-Your-Own-Good Tax”, which touched on some stories of government taxing and fining individuals for collecting their own natural resources… on their own property. Something similar is on the front burner in California. I’ll let you decide if this is right or wrong, but we can all agree that this wouldn’t be an issue if the state of California never got involved in the first place.

California proudly boasts of its solar energy initiatives, offering rebates and various other incentives for property owners to install solar panels such as rebates and energy credits. $3.3 billion dollars was set aside for this, but if you go to the website, you will find that this program is closed down because the rebates have been exhausted for residential customers. Obviously, quite a few people bought in.

The low income single family and multi-family programs were extended with $54 million each in January 2015.

The way the energy credits work is that people with panels are still connected to the grid and their solar energy feeds back into the main grid. There is a monthly bill that tries to assess credits and debits month to month but an annual statement that offers the full picture. If in fact you are square with the house and it all evened out correctly month to month, then you owe nothing. If you used more than you produced and were billed for, then you pay the balance. If, however, you used less than you produced, you get a credit.

Sounds simple enough, right? This is all structured upon Assembly Bills 327 and 920. What’s the catch? People who don’t have solar panels are being saddled with the maintenance bills of keeping the solar customers on the grid. Solar customers do still use regular coal based electricity, just not as much. They still require the same maintenance as non-solar customers. But the pay structure doesn’t account for that, so the utility companies want to reform the Net Energy Metering guidelines in AB327 to have solar customers toss in for grid maintenance. Their electric bills would still be significantly less than those without solar panels, but it would be an added charge nonetheless.

While the people with solar panels are upset at the prospect of this new fee and insist that it’s the utility companies trying to line their pockets with the energy their panels are generating, the utility companies contend that the costs of doing business are what they are, and if they are denied their initiative to spread the cost of maintenance evenly across all customers, then non-solar customers will bear that burden. They are getting their money one way or another and that’s the bottom line.

It would seem the state of California went a little too far with the program and created a sense of entitlement. Or should I say created ANOTHER sense of entitlement, because after all this is California?

Rebates have all but dried up, but there are still federal tax credits, some regional credits, and for now Net Energy Metering. What happens when the kickbacks go away? It’s funny that the same individuals who condemn corporations for enlisting in every known subsidy and kickback, have no compunction to do the same when it’s their wallet on the line.

Time will tell if this is a sustainable program for the very broken state of California, or if something will ultimately have to give on the Net Energy Metering. The government can’t manipulate the markets forever. What will become of the Solar Industry if the incentives start to disappear?

As for education, it appears a blind squirrel might’ve found a nut! Representative Peter Roskam (R-IL) asked if perhaps government programs might have something to do with the rising prices of universities. A hearing in the House Ways and Means Oversight Committee heard evidence and findings showing a correlation – if not an outright causal relationship – with dramatic tuition hikes and tax breaks for college administrator salaries and endowments, affects seen from increases in federal financial aid and tax credits for students.

The high salaries of some university presidents and sports coaches was also discussed, however given the small percentage of colleges that pay dearly to their presidents and coaches, it didn’t seem to be the large or pervasive factor initially believed.

Richard Vedder, an economics professor at Ohio University and director of the university’s Center for College Affordability testified, “There is no statistically significant relationship between endowment size and tuition fees. There are exceptions. Second, endowments are used some to provide scholarships, effectively lowering the actual or net tuition fee paid by students. However, assuming a 4 or 5 percent payout rate, the evidence suggests typically that less than 20 cents out of every dollar of endowment income goes for this purpose. Making college more affordable is not the dominant use of endowed resources.”

David Lucca, a research officer at the Federal Reserve Bank of New York, researched whether federal aid was linked to tuition increases and found a connection. “Our main empirical finding is that changes in subsidized loan amounts have been associated with sizable increases in posted tuition. Our estimates suggest that an additional dollar of per-student credit led to a 70-cent increase in posted tuition. We find smaller effects on tuition for additional Pell Grants and unsubsidized loans of about 55 cents and 30 cents on the dollar, respectively. Overall, these results are consistent with the so-called Bennett Hypothesis, according to which an increase in student aid can result in a higher cost of education.”

I’m for all tax cuts of any sort. Period. But it’s become fairly obvious to not just Americans but countries around the world that our universities are painfully overpriced. While I don’t think tax credits encourage price gouging, I do think a broken faucet that pours endless funds out of it does. To blame tax free endowments, or tax free interest accrued on endowments is dancing around the edges. It’s the manipulation resulting from this bottomless pit of loans that signs the permission slips for price hikes of 180% to 300% over the past 20 years.

We are back to the entitlement issue. Politicians have sold many people on the idea that a college education is necessary… regardless of the nature of the degree! Because a degree in engineering is obviously as valuable as a degree in Women’s Studies right? As the sense of entitlement grew, loan applications increased. University loans are basically blank checks for universities to fill in the amount.

Again, the government cannot sustainably manipulate the market forever. At some point it will correct itself. I can appreciate the stated purpose or intent of these programs, but they rarely achieve those lofty goals. They actually create new problems.