However, one subscriber had a very different perspective. Actually he went so far as to threaten me and then insinuate my promotion of illegal and immoral acts. Below you can read his initial response to the above mentioned article:

“What you seem to be proposing is illegal and is likely to generate an irs audit. Does the irs know what you are up to?”

Maybe you think I took his response the wrong way, but when I did a little homework on the reader (pretty easy to do since his reply included his website), I realized ‘Stan’ is a Federal Tax Attorney. He works with clients that hold offshore assets helping them reach and/or maintain full compliance with the draconian US laws regarding offshore investments, financial accounts, etc.

My response to ‘Stan’ was;

“I’m not really sure how to take this email. I don’t propose anything illegal. Actually I work with a couple of firms like yours where I recommend them to my clients for tax planning for their offshore businesses and assets. However I don’t appreciate your subtle IRS threats – it’s really quite unprofessional. I wonder if your clients are aware of your business practices.”

‘Stan’s’ abbreviated response was;

“…I must say when you talk about two passports, offshore banking, asset protection and data privacy the uneducated reads, “here’s how you can hide your money from the IRS.” …“Two passports”? What purpose would that serve but to hide the fact that someone is an American? Also, criminalizing cash is a ridiculous statement. It is not illegal to use cash, it is only illegal to use cash when it is part of a money laundering scheme, attempt to circumvent the FBAR rules, avoid CTR’s etc…”

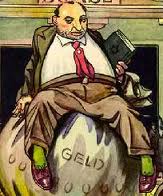

My initial thoughts when I read this were, “There are Idiots Among Us”. Upon further reflection and research into ‘Stan’, I realized the reality; he is just a money-grubbing bureaucrat. When trolling around on his website, I found the following statement;

“He began his career in 1970 as a tax law specialist with the IRS Office of the Chief Counsel in Washington, D.C. He was an IRS trial attorney and then a special assistant to the IRS deputy chief counsel, where he helped administer an office with 5,000 counsel and appeals staff.

After 15 years as chief legal counsel for the IRS Sacramento District, ‘Stan’ entered private practice. He is not licensed to practice law in California; his practice focuses exclusively on federal tax law.

Helping offshore investors voluntarily comply with IRS rules is central to the practice — and it’s lucrative. “With clients like this, there’s not an issue of getting paid,” ‘Stan’ said. The IRS is not going after people without money.”

I have several issues with this parasite.

Issue number 1 – He threatened me.Like any other red-blooded testosterone filled male, I don’t take too kindly to being threatened. I’m really not sure why he would even subscribe to my asset protection newsletter unless he is just a spook looking for someone to go after so he can justify his miserable existence.

It goes a bit deeper though. He threatened me because he knows putting knowledge about asset protection, 2nd passports, offshore banking, and offshore companies into the hands of intelligent, productive people like you is dangerous – at least dangerous to him. He is like the engineer who designs with intentional flaws to ensure his job security. This type of person is dangerous to your liberty.

Issue number 2 – Narrowly-focused statist mindset. His comment that having a 2nd passport is either stupid, or just ignorant. Either way, the lack of intelligent thought is dangerous. There are numerous reasons an American would want to have an 2nd passport.

For example;

- The wife of one of my best friend’s holds both an American and an Irish passport. Her parents were born there and wanted her to retain their heritage.

- A Russian client of mine has a St. Kitts passport. Russians have difficulty getting travel visas and with his business he frequently needs to take short notice trips. This is very difficult with only a Russian passport.

- A friend of mine was born in Denmark, but has lived most of his life in the US. He holds both passports. The Danish passport allows him freedom to travel to many South American countries visa-free as well as work, own property, and bank in the EU uninhibited.

- An American client of mine is a commercial real estate investor in South America and Europe. His Italian passport allows him much more freedom of travel as well as ability to transact business in the EU.

Honestly the list can go on and on. The list of reasons for wanting a 2nd passport are innumerable. But this parasite of the people believes the only reason you would want one is to defraud the US government and deprive people like him of his wealth.

Issue number 3 – He is stupid and lazy. I have no tolerance for either of those traits. Maybe I’m just not a nice person, but life is short and I prefer to spend time with intelligent and productive people. ‘Stan’ is neither.

He makes the comment, “criminalizing cash is a ridiculous statement.” In this case he is exhibiting stupidity or laziness, or maybe both. The article in question discusses 3 countries that have recently criminalized cash transactions over a certain threshold. It doesn’t take a genius to do a quick Google search and confirm the facts in my article are true.

Italy, Argentina and Spain have all recently made cash transactions over a certain amount illegal. Maybe the US is next. Maybe not. Who knows, but the reality is this guy claims to be an expert on offshore compliance matters and he couldn’t be bothered with the facts. He only wants to refute them.

Lastly, the statement found from his website shows me he is just the money-grubbing bureaucrat I perceived him to be. He clearly states his mission is to go after wealthy offshore investors and charge them fees to get compliant with big brother’s statist agenda. Keep in mind this guy was on big brother’s payroll; now he is one of the anointed ones tasked with bringing your hard-earned dollars back into the coffers of the ruling class.

Just to be clear, I highly recommend that each one of you that have offshore investments, offshore companies, andoffshore trusts comply with all reporting requirements. The penalties for non-compliance are too high and can make your life quite hellish. But ‘Stan’ has devoted his entire life to ensuring the longevity of the empire, and frankly – he disgusts me.

For those of you interested in learning from the world’s top experts in asset protection, 2nd passports, offshore banking, offshore investments, data privacy and more; visit our website, “Global Escape Hatch” to get on the early notification list. This is the official site for our offshore conference in Panama coming this fall – September 19-23.

This event will be like nothing else you have ever experienced. You will have the ability to listen to the world’s top experts on these topics as well as meet them and ask your questions face-to-face in a unique, tropical island setting. Hopefully parasites like ‘Stan’ will be too busy leeching off his wealthy American clients to attend.

I look forward to meeting many of you there.