June 16, 2014

By: Kelly Diamond, Publisher

The E.U. still has its struggles, and it seems every country it “helps” can’t manage to get out of the dire circumstances the Troyka ostensibly bailed them out of in the first place. I imagine a man drowning. Someone comes up with the brilliant idea that we splash the water away from the drowning man. So we do that for a bit, the water moves away so that he can actually catch his breath, and then the ones splashing the water away see this and say, “Okay, he’s got this!” and walk away.

The E.U. still has its struggles, and it seems every country it “helps” can’t manage to get out of the dire circumstances the Troyka ostensibly bailed them out of in the first place. I imagine a man drowning. Someone comes up with the brilliant idea that we splash the water away from the drowning man. So we do that for a bit, the water moves away so that he can actually catch his breath, and then the ones splashing the water away see this and say, “Okay, he’s got this!” and walk away.

The reason why I chose this example is because the amount of energy and effort it takes to get such a tiny result is the same. The EU dumped some serious cash into Portugal’s bailout for a tiny shift in the needle from desperately in the red, to just outside the red for a few minutes.

Well, now Portugal is back in the red. From an ethical standpoint, bailouts are criminal. They require theft. From a political and economic standpoint, bailouts are not sustainable. They are sold as solutions, but in reality they are temporary bandages for a select few.

Why is Portugal even important to Americans? Consider it a glimpse into our not-too-distant future. Portugal has a hard case of stagflation. Investopdeia defines stagflation as: “A condition of slow economic growth and relatively high unemployment – a time of stagnation – accompanied by a rise in prices, or inflation.”

And that’s exactly what’s happening. So much was put into giving Portugal one more breath and otherwise preserving the status quo, there’s nothing left to actually change the course of the ship itself.

Zerohedge had an analysis of the situation in Portugal. The bottom line is that the REMAINING producers there are being pulled in two directions: paying down the debts and making the necessary investments to produce and turn the profits necessary to stay in business.

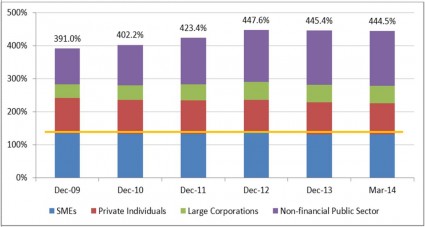

If you look closely at the above chart (and you can enlarge it by clicking on it), you see a few things at play: Small to Mid-Sized businesses are stagnated at their levels of indebtedness. Private sector indebtedness has decreased. Public sector indebtedness is up.

The Small to Mid-Sized Businesses are barely treading water right now because of the lack of liquidity in the market. The banks aren’t lending and the books are being cooked by the Troyka. The private sector consumers are just dropping off. They are losing their jobs, getting their wages cut, enduring the higher tax burdens, or they are just leaving altogether. And can you blame them? While the EU is a beast of burden, to say the very least, it does also lend some flexibility to its members to move where the opportunities might be a little better.

Then there is the government or public sector portion. Despite all the surface level “austerity measures”, in the end, the government as a whole is not really spending less. It is spending just as much if not more and assuming considerable levels encumbrances. On what? I don’t know, but it’s not being pumped back into the economy, that’s for sure.

Again, take a look at the future of the United States! So while Portugal and other struggling countries are desperately trying to retain their tax base, places like Estonia are fast-tracking their growth! This is a real measure that is being taken under serious advisement if not well on its way to becoming law.

“Estonia has great potential to attract entrepreneurs needing an investment account in the European Union, bringing more customers to Estonian companies and capital into the country’s economy. Future e-residents could be charmed by the opportunity to create a company and bank account in the European Union in just one day, the country’s fully online tax system, and its highly developed internet banking infrastructure. Also, any profit reinvested in Estonia is tax-free.”

This paragraph in particular got my attention. I remember writing an open letter to South America asking that they open their borders up to the disenfranchised Americans out there. That the lazy would be too inert to cross your borders, the rich are already there, but the industrious middle class and young entrepreneurs are the ones who would go en masse to seek out more affordable, and less regulated, opportunities… if only they would fast track the process. Well, Estonia has apparently been on it for the past several years, but it is expected that by year’s end there will be some sort of streamline process in place, and by 2015 sometime, it will be as easy as going to the local Estonian Consulate’s office and otherwise doing all your Estonian business online.

They want your business. They want to entice business to go there. And I believe it will work… to the detriment of all the countries who don’t get on board with this supreme idea. Opening up your borders is the simplest solution to economic struggles, and Estonia is going to lead that charge.

I will be interested to see what happens to the Silicone Valley and all the other e-businesses out there.

I don’t think the US is even remotely prepared for the enormity of the rug that is about to be pulled out from under it. Look at what the brain-trust in the Keynesian camp are saying about the US economy:

“Counterintuitive though it may sound, the greater peacefulness of the world may make the attainment of higher rates of economic growth less urgent and thus less likely.”

That’s right. He blames PEACE, of all things, for the current state of economic stasis. I mean, we could have 4% growth in GDP, but people kinda have to die n’ stuff. You really need to read the article to get the full sour taste in your mouth. But Tyler Cowen over at the New York Times rolls out in full Keynesian flare, not necessarily advocating war… but more calling the economic slowdown the cost for peace. It’s chilling, really.

In any case, if the US is of the mindset that the business of killing and dying is the way back to economic recovery, then don’t expect us to be much different than Portugal in a few years or sooner.

Time after time, we are seeing people expatriate as a solution to the burden of their respective governments trying to “solve” economic problems. This was a solution for some in Cyprus, for a business in Italy, and for many manufacturers in America. England and the US are seeing higher rates of expatriation than ever before, so this is not new or news. It’s just that the time to act is becoming more pressing and urgent as the economy continues on this self-destructive course.

Keep your options open and learn more about them. There is no collective effort to spare your property or your wealth. There’s just YOUR willingness to take the necessary measures to protect your assets.