January 12, 2015

By: Kelly Diamond, Publisher

Well, this week, the news came to me! I usually have to root around the financial corners of the internet to find something to write about, but this one just dropped in my lap. I was scrolling through Facebook, and this one self-proclaimed liberal Democrat posts this article Fed pays record $98.7 bn in profits to US Treasury along with the commentary: “The Stimulus Plan worked!!!”. (Sadly, she’s serious.)

Well, this week, the news came to me! I usually have to root around the financial corners of the internet to find something to write about, but this one just dropped in my lap. I was scrolling through Facebook, and this one self-proclaimed liberal Democrat posts this article Fed pays record $98.7 bn in profits to US Treasury along with the commentary: “The Stimulus Plan worked!!!”. (Sadly, she’s serious.)

If she was sarcastic, I would have left it alone. But then other liberals chime in with their actual sarcasm making statements like: “Oooooooooooh the Fed is stealing our money! End the Fed…” The past several years have seen some very large profits. Two things have consistently led the charge in those profits: US Treasury Securities and Mortgage Backed Securities. Another component, that is often neglected by many AP writers because they don’t know any better, is the multiple rounds of “Quantitative Easing” (or maybe that’s what they mean when they say “stimulus”?).

I’ve said this before, I’m no economist. I’m as average as they come. But “average” to me means, on a scale of 0 to 100 being somewhere in the 50 to 70 range. There are some things I might not know, but I’m at least half conscious of what is happening and I know enough to know when things are turning sour. And that’s how most of us get through life. We know what sick feels like, even if we aren’t medical doctors; we know when milk’s gone bad even if we can’t explain the scientific transformation that took place.

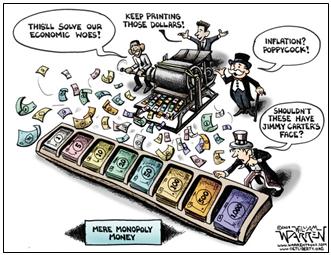

Basically, the US Treasury is making money off debt by printing money out of thin air.

If you were to look at your own portfolio, how much of it, would you say, is occupied by government debt? I should hope not a lot. If the only hope you have is on debtors making good on their debts it seems a risky business. The US has been aggressively monetizing its own debt for the past few years.

The way monetization of debt typically works is that the government issues this debt that needs to be financed so it can go spend it on government things. The Central Bank purchases that debt until it come due, but in the interim has printed the money leaving the government with nothing to pay off. Debt monetization is the magical process known as printing money out of thin air.

Contrast this with outside parties buying these debts, whereby requiring that the government actually make good on it. Imagine if you could issue your own line of credit, and you spoke into the universe, “I need a million dollars!”. You could then respond to yourself and say, “Hey, I got your back!” Only it’s not an actual million dollars you have in a savings account. Instead, you take a fraction out of every dollar that is in circulation and get your money that way. You leave the physical dollars alone, but just skim the value and purchasing power of them such that no one really sees or feels it… at least not immediately.

The only ones who really get any value out of debt monetization is the initial user of the money. What the rest of us are left with are a greater monetary supply and a debased dollar.

As of October 2014, the Fed has stopped buying treasuries. Is it fair to assume that another round of QE is on the table? Absolutely. Here’s the other question to ask: who is going to buy all the US Treasuries in circulation now?

Last year, many countries sold off their US Treasuries. Ireland, Luxembourg, Russia, and China all sold of noticeable amounts of their US Treasuries holding, while there was a mysterious bump in Belgium’s purchase of them. I’m not 100% clear on what happened there, but I am wondering if there is some merit to China selling off some of its US Treasuries to Euroclear. It wouldn’t be the first time China has manipulated the markets in its favor.

Take that piece and juxtapose it with this: Germany and China had a conversation about how they can make some bilateral arrangements which circumvent the US dollar. It wasn’t just Russia talking to China after all, as I originally thought. Certainly that had more sinister implications.

But with the Eurozone now in talks with working around the US Dollar, and all these heavy hitters selling off US Treasuries, I think people need to reconsider the “positive” effects perceived by these “record profits”.

I’ve come to realize that the critical question of any economic event is: “what does it mean?” What does $98.7 Billion in “profit” mean when put into the context of the Federal Reserve and the US Treasury?

One quick place to get one of many answers to that question is here: The US Inflation Calculator.

So what does $98.7 billion dollars mean in say 1913 terms? It means about $4 billion. Ouch. And that’s me rounding up!

What does it mean when set in the context of countries selling off US Treasuries, and finding ways to work around the US, while the Fed held its finger on the zero button for several years printing as fast as those zeros would show up?

It means Japan. That’s what it means. Japan is in a worse state than Greece was when it collapsed and it’s not getting any better through Abenomics. It means the US is heading down the same tragic path. It means the US thinks it is above the laws of economics, but that hubris will crush our economy faster than it will turn it around.

It’s a lot of money no matter how you slice it. But that money is not in production, real value, or investments in maturity. It’s in debt. Over-valued debt, I might add. Debt from which the world is slowly turn away as it is tired of the US monopoly on reserve currency.

The world is FULL of valuable enduring assets… and the US Dollars is hardly among them. I’m no financial planner, and I’m in no position to offer you specific advice. But it would seem that the US dollar’s value to the world is what fairies are to a 4 year old little girl: she will out-grow it, she will realize they’re imaginary, and she will move on.