How to File Form 5471 with Other Tax Forms

Learn how to file Form 5471 with related tax forms to ensure compliance and avoid costly penalties for foreign corporate interests.

5 Countries With Lowest Corporate Tax Rates

Explore five countries with the lowest corporate tax rates and understand the benefits of tax arbitrage for global businesses.

Using Offshore Trusts for Real Estate Tax Benefits

Learn how offshore trusts can provide tax benefits, asset protection, and privacy for real estate investors, while navigating complex regulations.

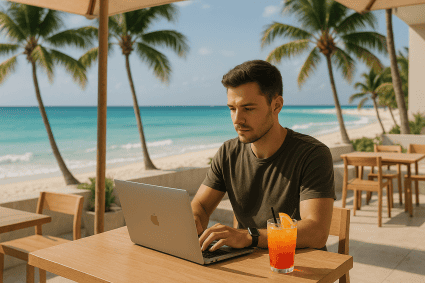

Caribbean Digital Nomad Visas: A Hidden Tax Trap?

Caribbean digital nomad visas promise paradise but come with hidden tax complexities that can lead to double taxation and legal issues.

How to Use the Greek Digital Nomad Visa to Reduce Your Tax Exposure

Explore how the Greek Digital Nomad Visa can help reduce your tax exposure while living and working remotely in Greece.

The Pros and Cons of Spain’s Digital Nomad Visa

Explore the benefits and challenges of Spain’s Digital Nomad Visa, including tax advantages, application requirements, and residency perks.

How to Choose the Right Base as a Digital Nomad: Taxes, Lifestyle, and Risk

Explore essential factors for digital nomads when choosing a base, including tax implications, lifestyle considerations, and risk management.

Is Barcelona a Smart Base for Digital Nomads Concerned About Taxes?

Explore the tax implications of living in Barcelona and compare it with other digital nomad hotspots like Lisbon, Dubai, and Tbilisi.

Why Bansko, Bulgaria Is Becoming Europe’s Remote Work Capital

Explore why Bansko, Bulgaria is becoming a top choice for remote workers with its affordable living, strong community, and vibrant lifestyle.

Playa del Carmen for Digital Nomads: Sun, Safety, and Tax Considerations

Explore Playa del Carmen, a digital nomad paradise offering affordable living, reliable internet, vibrant culture, and important tax considerations.