December 9, 2013

By: Kelly Diamond, Publisher

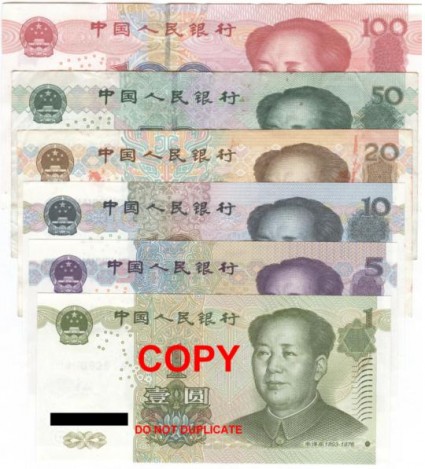

The Yuan has overtaken the Euro in trade finance usage in October, making it the second most used currency in trade finance.

- Chinese currency had 8.66% share in letters of credit and collections, or trade finance, in October. Compare that with Euro’s share in trade finance at 6.64%.

- Top 5 countries using yuan for trade finance in October: China (59%), Hong Kong (21%), Singapore (12%), Germany (2%), and Australia (2%).

- Yuan market share in global payments was 0.84% in Oct. vs. 0.86% in September.

- Yuan payments value rose 1.5% in October vs. 4.6% growth for all currencies.

China essentially stopped stockpiling U.S. Reserves: “The People’s Bank of China said the country does not benefit any more from increases in its foreign-currency holdings.” It has taken a more “noninterventionist” monetary policy, it would seem.

Bloomberg goes on to explain that one of the controls the Chinese central bank has is that it limits the Yuan spot rate’s daily moves to 1% on either side of a fixing it sets every day. They widened the trading band in April 2012, after being expanded from 0.3% in May 2007.

But outside this news… which is big, don’t get me wrong… there are a few other things going on behind the scenes.

First, according to NPR, “China says banks in the country are no longer allowed to trade in Bitcoin, the digital currency whose value has sharply risen this year. Chinese citizens, however, are not forbidden from using the currency.”

As Reuters reports, “Chinese nationals are major participants in the [Bitcoin] market and hold an outsized share of the total number of Bitcoins in circulation. Shanghai-based BTC China has recently become the world’s largest Bitcoin exchange by volume.“

The Chinese government’s concerns are similar to that of the FinCEN of our Department of Treasury: it is unregulated and therefore susceptible to use by unsavory money launderers and terrorists.

Bitcoin took a noticeable hit after that edict was passed down to the Chinese banks.

Second, China’s October Gold Imports Surge to the Second Highest Ever, according to Zerohedge.com. They aren’t just buying gold. They are ushering in gold like it was their own prodigal son! Zerohedge maintains a rightful cynicism toward trade numbers that come out of China. But, we can be certain of the US Reserves China has bought and we can watch what they are doing with the surplus: buy more U.S. debt? NOPE! Buy up gold.

It’s hard to say just how much gold China has since they haven’t updated their numbers accurately in about five years, but the “148 tons of import in the past month was the second highest monthly import ever through Hong Kong, second only to the 224 tons imported in March of 2013”.

Third, China also beat out the United States in importing crude just this September. They are poised to do some real harm to the U.S.:

“China accounts for more global trade than anyone else does, and they also own more of our debt than any other nation does. If China starts dumping our dollars and our debt, much of the rest of the planet would likely follow suit and we would be in for a world of hurt.”

There are cries that China manipulates its currency. But the Washington Post makes an interesting observation:

“What you’re saying when you say you want to put an end to global currency manipulation is that you want a weaker dollar. That’s what currency manipulation is: An effort by other countries to artificially strengthen the dollar in order to make their currency — and thus their exports — comparatively cheaper. But if we want to weaken our dollar, we could just, you know, weaken the dollar.”

I think the cries of foul play by China are a bit gratuitous. Do they tamper and lie by omission? I’ll hear that argument. I’m not saying they don’t. But I would also say that the U.S. made itself vulnerable to being manipulated the day they decided to allow the greenback to be backed by the whims of a market and faith rather than something like gold. Does that make China right? Absolutely not. But does that make China smart? Absolutely.

I don’t really give much credence to the nationalistic nonsense of trade deficits since we all eagerly operate in trade deficits all the time. I’m in a trade deficit with my local grocery. They take all my money, and I only get products. They never buy anything from me for money. Boo-frickin’-hoo. They buy my money with goods… just like China does with the U.S. There is no trade deficit in voluntary acts of commerce.

What do all these various moves amount to? So far, nothing good for the U.S. What is China’s endgame? Winning. And that probably entails a loser in this as well. What does it mean for the U.S.? Well, I’ve heard it said that while China is playing a strategic game of Go, the United States is playing Connect Four with twelve different colors. They bought up copper and stainless steel and changed the monetary landscape through their own purchasing power, for example. The point being, the time to whine about how China plays the game is over. The United States isn’t willing to compete on China’s level as that would be political suicide, but stomping your feet screaming “that’s not fair” at the top of your lungs ain’t movin’ needles either.

As individuals who realize these things, keeping a watchful eye on China makes sense. Doing a regular Google search for obscure coverage of Chinese market plays makes sense. Regardless of personal opinions toward China, its tactics, its policies, or its politics they are indubitably smart. Getting out of the U.S. dollar might make a lot of sense as well because it would seem that the USD is getting painted into a corner.

GWP Insiders discusses real options in internationalizing yourself and your assets. Get your money out of the country and/or into different stores of wealth while there is still value left in your dollar. Click here to find out how!