December 23, 2015

By: Claudio Grass, www.globalgold.ch

Over the course of 2015 we witnessed several events that had, and will have, negative repercussions on our individual freedom. Orwellian totalitarianism is increasingly creeping into our everyday lives. How much more intrusive will the violations of our liberties get and for how long will the establishment get away with it? These are questions that remain unanswered. With regards to the financial system, no real solution was found to issues such as those in the Eurozone. Furthermore, the financial systems as a whole, once again, got deeper into debt. For how much longer can central banks and governments continue kicking the can down the road without any real reform? I will answer these questions and identify trends for 2016 by looking at six key issues that have had an impact this year.

Over the course of 2015 we witnessed several events that had, and will have, negative repercussions on our individual freedom. Orwellian totalitarianism is increasingly creeping into our everyday lives. How much more intrusive will the violations of our liberties get and for how long will the establishment get away with it? These are questions that remain unanswered. With regards to the financial system, no real solution was found to issues such as those in the Eurozone. Furthermore, the financial systems as a whole, once again, got deeper into debt. For how much longer can central banks and governments continue kicking the can down the road without any real reform? I will answer these questions and identify trends for 2016 by looking at six key issues that have had an impact this year.

- Geopolitical developments

We witnessed some troubling geopolitical developments during this past year. From the continuing conflict between Russia and Ukraine, territorial disputes between Japan and China, the escalating proxy war in Syria, the refugee crisis in Europe, the rise of religious tensions all over world to the rise of the Islamic State, the world has become increasingly unstable.Going into the details of these conflicts is definitely beyond the scope of this article, but the fact is that we are witnessing several developments, all of which have the potential for a wide-scale escalation. From the perspective of the West, conflicts and wars in the past decades were for the most part, far away. Only now do we realize that this will change as we have already started to see in 2015. The times of conventional warfare, where two armies meet on the battlefront, is over. Future conflicts and wars will be fought closer to home. We should get ready for a period of increased instability, particularly when it comes to politics and security issues. - Totalitarianism is on the rise

The sudden rise of ISIS and its affiliates is a disturbing development that produced mixed feelings, such as fear, rage and sadness amongst many more. Ultimately, they lead to the same result: States seeking more control by curbing individual liberties. One example we see is how, under the guise of fighting terrorism and illicit activities, Western countries are limiting the use of cash. JP Morgan has placed restrictions on the amount of cash that is allowed to be deposited and several European countries have banned large transactions in cash. Looking to the future, it seems that the current situation will continue to get worse and that we are headed towards an Orwellian state, under which no one is entitled to his financial privacy anymore.Another hot-button issue is gun control. Since it became known that the San Bernardino shooting and the Paris attacks were apparently carried out with legally obtained arms, there have been increased calls for massive restrictions on private gun ownership. Disarming the masses is a necessity to control them and that is exactly what our governments are gradually doing.“The strongest reason for the people to retain the right to keep and bear arms is, as a last resort, to protect themselves against tyranny in Government” – Thomas Jefferson.

On the EU level, a disturbing development is the fact that FRONTEX (the EU agency responsible for border management) has stated that, should the refugee crisis get out of hand, it will intervene to secure the EU borders, even if the respective countries oppose its action. On a global level, the Transatlantic Trade and Investment Partnership (TTIP) says that arbitration courts will have the potential to annul national sovereignty when it comes to jurisprudence. We expect these tendencies of centralization to continue.

- Greece is “saved” and coming to a country near you?

In the beginning of this year, the topic of a potential “Grexit” dominated news cycles over several weeks. It seemed like a realistic possibility that Greece might leave the Eurozone. Instead, after yet another one billion Euro bailout package, Greece was “saved” and a “Grexit” was off the table (for the time being). Once again, political idiocy prevailed over economic rationale. In the end, delaying the inevitable failure of the Greek financial system is all that was achieved.More astonishing than the fact that Greece, a country that represents less than one third of one percent of the world GDP, received another bailout package, was how it all played out. A bank holiday was announced, capital controls were implemented, cash withdrawals were massively restricted, the stock market closed and any assets inside the banking system (even safety deposit boxes) were not accessible by their owners. This is an unprecedented level of infringement on private ownership that has never been seen in a modern Western country. - Fed hikes interest rate

The Fed hikes interest rates for the first time since the financial crisis of 2008. For the past 7 years we have had an interest rate band between 0-0.25%, which essentially is “money for nothing”. With its decision, the Fed became the first large (and the leading) central bank to effectively hike interest rates. Meanwhile, on the other side of the Atlantic, the ECB cut its deposit rate (slightly) deeper into negative territory and prolonged its QE program that is now expected to continue until March 2017. Since last summer, the media continuously speculated about a rate hike and its timing. So, will interest rates start to normalize after the long-awaited change in monetary policy? We don’t think so! We believe that the main reason the Fed decided to hike rates was to regain some of its lost credibility. For the past seven years the monetary floodgates have been open with no clear positive effect on the real economy. A continuation of zero interest rate policy (ZIRP) would have been an admittance of failure. With this slight rate hike of 25bps, the Fed is trying to show the world that its policy during the financial crisis worked.We all know that the economy in the US is not as healthy as the Fed would like us to believe. When we throw in the potential explosive impact the failing shale industry could have on the economy and the strong dollar, that is likely to increase due to this interest rate move, we doubt that this move by the Fed is the turning point and that the Fed will continue hiking rates as it has done previously in such cycles. The Fed raised interest rates because it had to, but don’t expect the monetary shenanigans to be over. There is a lot more to come! - Defaults surge as global debt explodes

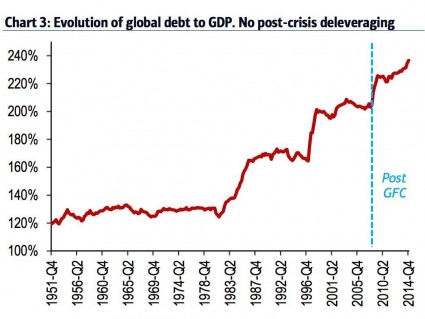

2015 has seen the greatest number of corporate defaults since the financial crisis. Many of the companies that are defaulting are from the energy and materials sector. Why? It is the logical outcome of the excessive borrowing by corporations who were misled by close-to-zero interest rates. And, of course, we cannot forget the boom in the shale industry. With a barrel of oil costing over USD100, shale oil was a very interesting investment. Now with oil hitting rock bottom, some oil producers are operating at a loss and only continue operations to be able to make their interest payments. Standard & Poor’s rating of junk or speculative corporate bonds has gone up to 50% from a previous 40%. Unfortunately, the world did not learn its lesson after the financial crisis and instead of deleveraging, it has accumulated more and more debt, as seen in the chart below. Of course, it’s not only the corporations; governments have not learned their lesson either.

Source: Bank of America Merrill Lynch

Source: Bank of America Merrill Lynch

The issue of debt will continue to follow us for some time to come; the house of cards will eventually collapse, but we think that politicians and central bankers have the will to “do whatever it takes” to prolong its eventual demise. What we will likely see in 2016, however, is a massive increase in defaults. Yields for high-yield issuers are already at alarming levels. What exactly will be responsible for the next crisis is hard to foresee. It might come from the possible collapse of the shale industry, the strengthening dollar that will make it very hard for emerging market countries to repay their debts, or a completely unexpected sector (who knew what subprime was back in 2006?).

- Oil price collapse

Crude oil prices fell to their lowest levels in nearly 11 years, as crude oil nearly reached USD35 per barrel. The price of oil has been on a continuous downward trend and has declined nearly 70% since the summer of 2014. From our perspective, the main factor that led to this decline is the US shale oil “revolution”. It was truly a revolution when one considers that the boom in shale oil production allowed the US to surpass Saudi Arabia, the world’s largest oil producer. Meanwhile, OPEC hasn’t changed its stance as it insists on maintaining its strategy to increase market share, even if this comes at the expense of oil prices plunging.I am not an expert on oil and therefore it’s not my place to provide predictions regarding where the oil price is heading, but I would rather want to discuss the impact of the oil price movement. First, a collapse of the oil price, the commodity that is widely used in the industry, has historically always been a herald of recessionary tendencies. In my view, the oil price clearly signals that the economy is not as healthy as is portrayed by the mainstream media. Second, the continued failure of companies in the shale industry has the potential to bring on a crisis that would dwarf the previous financial crisis. Last, but definitely not least, is the question of how oil exporters, such as Saudi Arabia, will finance their budgets when oil revenues massively decrease and they are no longer able to “buy” their population’s silence with gifts.

So how can we position ourselves in such an environment?

The outlook for the future looks bleak: continuously growing debt, looming defaults on a major scale and geopolitical tensions. So, how can we best position ourselves?

In times like these, where it is almost impossible to predict even the near future, we seek security. Holding precious metals like gold and silver is a claim to wealth and value. It gives their owner independence and protection from the whims of governments. Given recent events in Greece, we learn that gold and silver are only a safe investment as long as you have full control over it and can access it at any time. Holding gold outside the banking system is therefore, in my view, essential.

Those who know me know that I am Swiss and rather biased towards my home country. To me, Switzerland strikes the perfect balance between international neutrality with a history of a safe and stable political landscape, and an environment that encourages investment and guarantees private ownership rights.

Subscribe for future updates at www.globalgold.ch

About the author: Claudio Grass is a passionate advocate of free-market thinking and libertarian philosophy. Following the teachings of the Austrian School of Economics he is convinced that sound money and human freedom are inextricably linked to each other.