Guidance for 2023 taxes was released by the IRS, and it’s time to strategize how to keep as much of your earnings and gains as possible.

I despise both income and property taxes because they are a form of theft. Nevertheless, this theft is sanctioned by the U.S. government and enforced at the national level by the IRS.

Every single U.S. citizen gets caught up in the IRS dragnet, but not everybody is impacted to the same degree. Some pay more, some pay less.

Obviously, if you can reduce your tax liability you should. In fact, I consider it a duty to pay as little tax as possible, and I suspect you feel the same.

With that in mind, one of the primary ways the IRS tightens their dragnet to capture as much tax revenue as possible boils down to three words: “Tax code changes.”

I can’t cover every one of the thousands of annual code changes in this article. But I did want to highlight a few changes that are expensive to ignore, starting with this one…

The Annual “Tax Bracket Creep”

The U.S. tax code changes every single year. Sometimes the changes are minor, and sometimes they are major. But all of these annual changes represent creative ways to steal more income from American citizens.

No one reads thousands of pages of tax code every year, except maybe tax preparers. So I’ll highlight some key changes in the 2023 tax brackets, to give you a small taste of how much more income you could be forking over.

GOBankingRates revealed the projected tax brackets for 2023, and if you’re not careful, you’re going to get robbed. The upcoming ones are below…

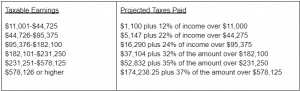

For individual taxpayers and married separate filers:

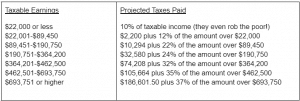

For married taxpayers filing jointly and surviving spouses, it isn’t any better:

Keep in mind, the average taxpayer rarely pays much attention to these tax brackets. And once they’ve been raised they rarely come down again. Which is why the IRS loves to manipulate these brackets to extract more of your hard-earned income every year.

Even when you invest in stocks you can get robbed, if you aren’t paying attention. That’s because the IRS also likes to manipulate the capital gains tax, which applies to any profits generated from the sale of assets like stocks or cryptocurrencies.

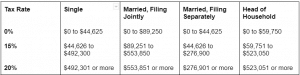

For 2023, the capital gains tax rates on taxable gains are projected as follows:

Please keep in mind that everything I’ve outlined so far are simple examples of the tax code that changes every single year.

In addition to the constantly changing tax code, the IRS also loves to bury the American taxpayer under even more tax laws at a furious pace…

Next Year’s IRS Tax Grab Gets Even “Grabbier”

Income that you earn from working at a job or through investments is one thing. But now the busybodies at the IRS want to reach even deeper into your pockets.

Introducing Form 1099-K, which you might receive soon. Especially if you use Paypal or Venmo (among others) to receive small payments.

In years past, you would only receive one of these income tracking forms if you “had over 200 commercial transactions per year that exceeded $20,000 in total value, the IRS said.”

Unless you’re already a digital nomad, you probably weren’t producing the number of transactions that put you on the IRS radar.

But that’s all changing. Now all it takes is $600 in annual income from any one of these payment apps like Venmo, Paypal, or CashApp. Then the IRS will expect you to account for that paltry amount of income too, and pay taxes on it (!!).

Remember the new battalion of IRS agents that Biden is going to fund? This is what they enforce. That means the next logical step is to figure out how to avoid paying as much as you can.

Your “IRS Escape Plan” Starts With One Phone Call

On top of the most up-to-date information on the best locations for digital nomads to escape the United States, most of my GWP Insiders also save 50-100% on their taxes after working with me.

That means they also need to structure their businesses to take advantage of every single IRS loophole available.

I help them with that, too.

Become a GWP Insider, and you can schedule unlimited 1-hour consultations with me to help you put this or any other life, business, or wealth internationalization strategies to use.

That call could include putting together an exit plan to escape the tax “dragnet” in the U.S. or any other country.

People from all walks of life become GWP Insiders, like:

- A Canadian ecomm entrepreneur living in Portugal making 6-7 figures net. He needs to know where to register his company and how to get out of the Canadian tax system without owing much (or anything) in Portugal.

- A German SaaS company owner living in Thailand.

- A Brit who is nomadic with a digital marketing agency.

- An American with a digital products business living in Mexico.

Even though my clientele is diverse, they’re all facing similar challenges.

They all want to create the right business structure and optimize it for a low-tax multi-jurisdictional approach in different parts of the world (to stay free).

And I’m the one guy they come to for help!

So if you’d like to exploit every possible tax loophole, while avoiding the #1 most common business structure mistake (plus others unique to your situation)…

Then you should join us inside GWP Insiders.

Once you join, you’ll immediately get to schedule your first 1-hour consultation with me. This can be used to discuss your business structure, residency, tax planning, or to make professional introductions for your specific needs.

One consultation would normally cost $445 to $4,000 depending on your situation, but GWP Insiders get unlimited consultations at no charge.

You’ll also gain access to the private membership area, which includes a variety of business, life, and wealth internationalization strategies that give you shortcuts to success with the following:

- Offshore companies,

- Trust planning,

- Tax planning,

- Real estate,

- 2nd passports,

- Discounts on offshore structures

- And so much more.

As a bonus, the insiders-only content includes the 2022 edition of my Offshore Banking Report where you’ll discover:

- The 9 best licensed offshore banks for 2022, plus my commentary on each.

- How to start banking in the US without visiting a single branch.

- How to leverage “Fintech” institutions like the wealthy elite do.

- How FATCA could “trap” you even if you aren’t a U.S. Citizen.

- The Top 5 Traditional U.S. Banks that accept non-residents.

Look, I’ve made joining GWP Insiders and scheduling your first 1-hour consultation with me as easy as taking a walk in the park.

But for a limited time, I have one more surprise for you…

If you go to this special page and sign up you’ll also receive an 80% discount.

To live freely is divine,

Bobby Casey

Location Independent Entrepreneur

P.S. The busybodies at the IRS are always cooking up new ways to collect more taxes from earned income, real estate, and investments. That’s why I strongly encourage you to become a GWP Insider right now.

When you do, bring me your toughest questions about setting up your digital nomad business to legally avoid paying as much in taxes as possible.

I bet I can answer all of them during our first call. Massive financial and personal security for the right person. Hurry, and go to this link to save 80% right now.