U.S. citizens who might seek to renounce citizenship will find it harder and more costly to do so including higher fees and onerous taxes before they show themselves out.

That said, some U.S. citizens ultimately decide that the best move they can make is to renounce their citizenship and completely remove the IRS from their lives.

Some of the primary reasons to expatriate and renounce U.S. citizenship include (but aren’t limited to):

- FACTA if you invest offshore.

- The IRS and its ever-increasing dragnet.

- The worsening U.S. political situation

Any of these reasons could be enough to make you want to renounce.

So let’s say you decide you don’t want your U.S. citizenship anymore. You just renounce it and move on, right? Wrong. Like a bad divorce, the actual process of renouncing U.S. citizenship is both complicated and costly.

In fact, due in part to the increasing number of people renouncing their citizenship annually, the U.S. has recently made it more challenging than ever to renounce citizenship.

How? By quintupling the renunciation fee you must pay when renouncing your citizenship.

According to Investopedia: “Because of the increase in the number of U.S. citizens seeking renunciation, the U.S. Department of State raised the fee for renunciation from $450 to $2,350.”

For context, this fee to expatriate from the United States is currently…

More Than 20x The Cost of Other Wealthy Nations!

This “exit fee” is now 5X what it used to be. If I didn’t know any better, I’d think the U.S. was intentionally trying to discourage people from leaving the country. Oh, wait, that’s exactly what they’re trying to do.

Keep in mind, the renunciation fee is just one part of the “breakup” process. The IRS also imposes additional taxes and penalties before letting you go your way. And if you make too much money – or if your net worth is more than $2 million – the IRS collects a complex series of “expatriation taxes”. Fun times!

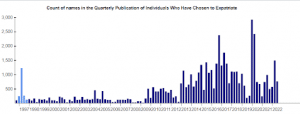

Up-to-date information is challenging to source, but according to the quarterly report published at the Treasury Department, some 750 more people have renounced their citizenship during the third quarter of 2022 alone.

That might not seem like much, but the chart below reveals that since 2009, a massive tidal wave of people have decided their U.S. citizenship was becoming too costly and cumbersome:

These folks are completing the renunciation process despite the enormous number of obstacles the U.S. Government has put in place. I have to think these numbers would be much higher if the “exit” taxes and fees weren’t so onerous.

As you know, the IRS loves paperwork and fines, so there are extra penalties if you don’t properly file your paperwork…

IRS Says: “$10,000 Penalty Where Appropriate”

Once you file for expatriation, the IRS reaches into your pocket one more time to grab as much of your cash as it can.

It does that by making you file Form 8854 to account for income, net worth, and other assets to determine how much tax you owe one last time.

If you fail to file this form on time, the IRS can impose a $10,000 penalty on top of interest and fees it may charge.

This is just another in a litany of reasons to abolish the IRS altogether.

But until that happens, you do have one other helpful option you can consider…

Your “Expatriation Plan” Can Start With One Phone Call

Look, the U.S. is making it tougher to renounce your citizenship and leave. That’s why I want to help you successfully mitigate as much of the process as possible.

Become a GWP Insider, and you can schedule unlimited 1-hour consultations with me to help you reduce your tax burden, lower your costs, and implement any other business and wealth internationalization strategies that make sense for you.

In just one call, we could put together an exit plan to help you escape higher taxes, fees, or expensive penalties when expatriating from the U.S. (or any other country).

People from all walks of life become GWP Insiders, like:

- A Canadian ecomm entrepreneur living in Portugal making 6-7 figures net. He needs to know where to register his company and how to get out of the Canadian tax system without owing much (or anything) in Portugal.

- A German SaaS company owner living in Thailand.

- A Brit who is nomadic with a digital marketing agency.

- An American with a digital products business living in Mexico.

Even though my clientele is diverse, they’re all facing similar challenges.

They all want to create the right business structure and optimize it for a low-tax multi-jurisdictional approach in different parts of the world (to stay free).

And I’m the one guy they come to for help!

So if you’d like to exploit every possible tax loophole, while avoiding the #1 most common business structure mistake (plus others unique to your situation)…

Then you should join us inside GWP Insiders.

Once you join, you’ll immediately get to schedule your first 1-hour consultation with me. This can be used to discuss your business structure, expatriation planning, or to make professional introductions for your specific needs.

One consultation would normally cost $445 to $4,000 depending on your situation, but GWP Insiders get unlimited consultations at no charge.

You’ll also gain access to the private membership area, which includes a variety of business, life, and wealth internationalization strategies that give you shortcuts to success with the following:

- Offshore companies,

- Trust planning,

- Tax planning,

- Real estate,

- 2nd passports,

- Discounts on offshore structures

- And so much more.

As a bonus, the insiders-only content includes the 2022 edition of my Offshore Banking Report where you’ll discover more helpful information:

- The 9 best licensed offshore banks for 2022, plus my commentary on each.

- How to start banking in the US without visiting a single branch.

- How to leverage “Fintech” institutions like the wealthy elite do.

- How FATCA could “trap” you even if you aren’t a U.S. Citizen.

- The Top 5 Traditional U.S. Banks that accept non-residents.

Look, I’ve made joining GWP Insiders and scheduling your first 1-hour consultation with me as easy as taking a walk in the park.

But for a limited time, I have one more surprise for you…

If you go to this special page and sign up you’ll also receive an 80% discount.

To live freely is divine,

Bobby Casey

Location Independent Entrepreneur

P.S. As time goes on, renouncing your U.S. citizenship could get really expensive with higher taxes, fees, and penalties (on top of the paperwork). That’s why I strongly encourage you to become a GWP Insider right now.

When you do, bring me your toughest questions about setting up your digital nomad “expatriation plan” to get away from it all.

I bet I can answer all of them during our first call. Massive financial and personal security for the right person. Hurry, and go to this link to save 80% right now.