UK debt no longer identifies as debt as a work around for acquiring more… you guessed it… debt!

October 28, 2024

By: Bobby Casey, Managing Director GWP

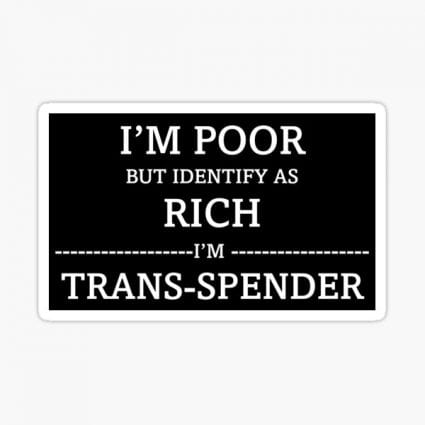

A friend of mine found a few older dictionaries at a thrift store, and decided to buy them. She said it was to keep some official record of what words meant since words are getting butchered beyond recognition today. Words mean whatever you want them to!

It’s like a person with aphasia was put in charge of the lexicon because it’s getting wild. Here are some examples just swirling in the ethers of social media:

Free Speech isn’t the same as Hate Speech. It isn’t? That’s news to me.

Words are literal violence. Wait. Wut?!

Work is wage slavery. So you’re saying if you have to work to survive, that’s slavery? How else are we meant to live? Is someone supposed to bring you food and give you air-conditioning? Wouldn’t that make them slaves?

Everything I need to live is a positive human right. How do you get those things? Where do they come from if not yourself or the paid services of someone else? How does this work definitionally?

Don’t get me started on the definition of a felony! Certainly there are plenty of words and terms that are defined by whatever people want them to mean.

But the whole purpose behind redefining things is to push a larger agenda. If words keep their meaning, people will see that something isn’t right. But if identify out of that definition, the problem goes away, right? That’s why UK debt no longer identifies as debt.

The unenviable economic situation in UK

So this happened two years ago:

The UK government’s “mini-budget” announcement on September 23, 2022 sent yields on UK government bonds soaring at a daily rate not seen since November 1988, brought the value of the pound to all-time lows, lead some mortgage providers to suspend lending, and dropped the UK pension system to a liquidity crisis.

Between the 2020 pandemic, and this, the UK finds itself seeking — if not needing — a new “infrastructure investment” to keep the assets propped up. They plan to pay for all that by borrowing £70 billion.

Much like the US, the UK has an unsustainable dependence on a debt based economy, which means it’s up to its eyeballs in debt.

UK’s Chancellor of the Exchequer must believe that you can in fact have your cake and eat it too, because she is setting out to do the following:

[Rachel] Reeves is trying to strike a balance between fiscal prudence to keep financial markets on side while increasing investment in roads, schools and other public infrastructure, to drive up economic growth and tax revenues while also ending austerity in public services.

She is further looking to mitigate the need for tax hikes by leaning into as much debt as possible first, as the Prime Minister, Keir Starmer, vowed to avoid tax hikes on working people in a recent meeting.

The reality is, the only economic solution is to cut spending drastically to pay off the debts and encourage more economic growth in the private sector. It may shock you to know, that is not an option being entertained by anyone at this time.

So we turn to the linguistic solution instead: UK debt no longer identifies as debt!

How can the UK pretend to fix the debt problem?

You read that correctly: UK debt no longer identifies as debt! That’s the play!

Debt used to be that you borrowed $10, so you owed $10. That $10 was considered debt until it was paid off.

NOW, if you borrow $10, but you bought a $10 sweater, it’s not actually debt anymore because you have an asset of that value.

How did we land on that?

First we start with a couple of rule changes:

- They must pay for day-to-day spending out of taxes. All in, that will require £40 billion from either tax revenue, austerity, or both.

- Debt must be falling in the fifth year of the official forecast.

The second bullet point leads to the second phase where the definition of debt comes into play. It will likely be:

“…public sector net financial liabilities,” which captures the value of assets created alongside the cost of any investment, effectively removing the debt from the books.

You see! It’s just that simple. Debt isn’t about what you borrowed and still owe. Debt is only money owed that doesn’t have a corresponding asset as collateral. UK debt no longer identifies as debt anymore! This allows them to work around their debt ceiling to borrow more money.

Bonus Round: How will the UK avoid raising taxes on working people?

You guessed it! We’ll just change what it means to be a working person! According to Keir Starmer :

People who own assets are not “working people”, he said, adding that the type of person he intended to protect was someone who “goes out and earns their living, usually paid in a sort of monthly check” but who does not have the ability to “write a check to get out of difficulties.” One measure being weighed by Reeves is increasing the capital gains tax levied on entrepreneurs when they sell their businesses, according to people familiar with the matter.

Also floated was the possibility of employers paying more national insurance and raising capital gains and inheritance taxes.

The most predictable outcome is capital flight. That’s what happened in Norway only last year. They took off to Switzerland because their center-left government decided the rich should foot the bill for their expansion of the tax regime by hiking their wealth tax to 1.1%.

You might not be able to vote your way out of economic problems, but you can identify out of them! Or at least that’s the latest smoke and mirror scheme to push more debt and inflation on everyone. So for now, UK debt no longer identifies as debt, and we’ll see how far that can sustain them.

Click here to get a copy of our offshore banking report, or here to become a member of our Insider program, where you are eligible for free consultations, deep discounts on corporate and trust services, plus a host of information about internationalizing your business, wealth and life.