March 25, 2013

By: Kelly Diamond, Editor

It’s no coincidence that as European Banks continue to falter and require subsequent bailouts, European citizens lose faith in government currency and seek out an alternative which is safeguarded from politics and manipulation such as BitCoin (a virtual currency).

The resulting and rather abrupt rally in BitCoin value has the United States Treasury Department imposing regulations on points of exchange for virtual currencies under the guise of preventing criminal activity like money laundering and tax evasion.

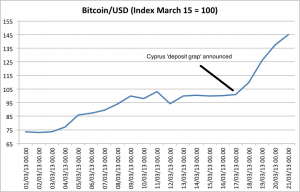

With the growing number of members in the E.U. seeking bailouts for their failing banks, and with the recent money-grab perpetrated upon account holders in Cypriot Banks, Europeans are in desperate search for an asset safe-haven. Despite feeble attempts to keep up appearances, and repeated reassurances from the politicians, Spaniards see the writing on the wall and are buying up BitCoin! They do not trust centrally planned fiat currency, and want to rescue what value remains in their assets. Even outside Europe, where inflation is brutal, individuals are seeking a hedge against their government-issue monetary unit.

BitCoin’s recent rally, however, is attributable to the Euro and the European response to the questionable monetary policies or “solutions” of the E.U. During the last week of February, BitCoin hovered around the mid-thirty dollar range. It closed at about $70 not even a month later!

People turned to metals like silver and gold because it was a tangible thing that held real value. Argentina, for example, has become incredibly bullish toward gold. Unfortunately, metals are not immune to central bank manipulations… or “trading techniques”. BitCoin is a fiat currency just like most government currencies. It isn’t backed by anything. It doesn’t even have a physical manifestation! It’s basically a number in a computer. HOWEVER, it is regulated by an intricate algorithm rather than a central bank or government. It is precisely this attribute that make it valuable – especially to those rightly cynical of governments and banks.

Now the U.S. Department of Treasury wants to regulate BitCoin at every point of exchange. If you have a website that accepts BitCoin, you are subject to these regulations. If you offer a “wallet”, you are subject to these regulations. Regulations run from bookkeeping reforms to reporting transactions over a certain amount. The particular arm of the DoT that leads this charge is FinCEN, Financial Crimes Enforcement Network, also known as: the guys who go after money launderers.

Gauntlet is Thrown

Much like every other “moral war” our country wages, there is the propaganda leading up to and justifying the “war”. The War on Virtual Currency seems to be following the exact same steps. The European Central Bank (ECU) put out a piece on the potential economic maladies tied to virtual currency “schemes”. Yes. They are “schemes” of a Ponzi-esque nature according to the ECU. And if there is one establishment that can speak expertly to the machinations of a Ponzi Scheme, its centralized governments.

So far, they have defined the “problem” as Virtual Currency. A “problem” they created through the mismanagement of their own currencies, and by virtue of defining it as a problem simply because it threatens their monopoly. Truth be told, it’s not a problem: it’s a market demand. Then they weave in assuaging verbiage like “scheme”. There is no discernable difference in government currency and virtual currency other than the latter isn’t beholden to the former. But, nonetheless, the seed is planted that virtual currency is not on the up-and-up. Then they release a statement elaborating upon the disruptions a competing currency like BitCoin could impose upon the workings of a central bank and the interest rates. Since no one really knows the rhyme or reason behind the inner workings of any central bank – although it is reasonable to assume they have NOTHING to do with real or natural market forces – other than the few who run them, they can pretty much take full poetic license here.

The United States Department of Treasury took it a step further than the EU – since banks, central or otherwise, are not high on anyone’s sympathy list – and they tied it to existing crimes: money laundering and tax evasion. While I don’t deny this can be done – and most certainly is a plausible application of virtual currency – it can be and is done with ANY currency, so for now it’s just a hybrid of conjecture and red herring. If someone wanted to launder money, it can just as easily be done through goods and services: anything that is legitimately and openly traded, can be a conduit for money laundering. Nevertheless, bad guys will use it.

This sounds like all the other inanimate stuff government tries to regulate. Guns, drugs, banking, driving, etc.: all of them COULD be used to harm people… but they can also be helpful or benign. And since the criminal application of these things is hardly curbed by the state’s preemptive measures, one can only assume, the frenzy surrounding BitCoin is like those other things: a play for power and/or money.

For most statists, if something goes unregulated, images of twisted steal and carnage, along with a coast full of dead baby seals, and children starving in the street race through their minds. They are well-conditioned to believe anything unregulated is a disaster in the making. So you say, “There is an unregulated currency called BitCoin, completely unattached to any government” and the monetary and economic hardships enumerated in the ECU’s statement are not a hard sell at all. Likewise, presumptions about criminal elements being drawn to it are equally palatable.

Then we have the misguided Libertarians who cheer over BitCoin gaining some government recognition and therefore gaining legitimacy. Government doesn’t make currency legitimate. It makes it illegitimate. It literally bastardizes money. The free and open market legitimizes money. BitCoin is legitimate BECAUSE people assign value to it and voluntarily agree to trade with it. For now, just a bunch of new paperwork for those who deal in BitCoin, but it won’t be long before we declare it on the ole tax forms… and it joins the ranks of the USD.

The run-down of rules

You might be wondering why the lack of specifics when it comes to what these regulations are exactly? Well, it’s because there really aren’t any!

“Creating clear-cut rules for virtual currencies is difficult. A FinCen official said that anti-money-laundering rules would apply depending on the ‘factors and circumstances’ of each business. The rules don’t apply to individuals who simply use virtual currencies to purchase real or virtual goods.”

Factors and circumstances? That’s right! They are keeping it vague, just in case. The rules depend on things we cannot define with any certainty; but we will recognize it when it happens and let you know you were wrong as we’re cuffing and/or fining you.

“The new guidance ‘clarifies definitions and expectations to ensure that businesses…are aware of their regulatory responsibilities,’ said Jennifer Shasky Calvery, FinCen director.

The new “guidance”! Are they seriously expecting anyone with a minimum of two marbles rolling around in their head to accept that this is a mere “guidance”? We have an entire arm of the Department of Treasury, apparently, whose job it is to “guide” matters of currency? With what? Their parameters are as vague as a newspaper horoscope!

And businesses are to be aware of their regulatory responsibilities. So evidently, they have very clear items pertaining to what they expect from every BitCoin point of exchange to do. Figures.

What gives with money laundering and tax evasion?

Why would someone WANT to launder money? They want to conceal the source from which they get their money, presumably because it’s an illegal source. Perhaps the sale of illegal drugs? Guns? Gambling?

So government criminalizes all these things. A black market emerges for these things as well as a new market for different ways to hide those transactions. What if all of that was just legal? You wouldn’t have money laundering! Moreover, you wouldn’t need task forces, or “guidance”, or regulations to monitor any of it either.

And tax evasion? You mean protecting your own wealth from the thieves in Washington? What’s the difference between tax evasion and inflation hedging? Inflation is the most insidious tax ever: and it results from central bankers, politicians and their collectively irresponsible whims to print money at the first signs of economic hardship. Lecherous parasites that they are, they want a taste of your investment. Don’t expect BitCoin to rally much once the government gets its hands on it.

The War on Virtual Currency is no different than the War on Drugs: the more they try to regulate and restrict it, the more creative folks will get to circumvent those regulations and restrictions. You ban one, a different variety with a different name comes out. They ban that, and yet another surfaces.

OR look at Google’s search analytics. Businesses tried to figure out its algorithm to gain rank in search engine results. Google wants their search results to be authentic, not contrived, so they are constantly optimizing their search algorithms to produce a qualitative search for its users.

Inevitably, the feds will track BitCoin starting with the points of exchange; some clause in the Patriot Act will naturally lead to monitoring users of BitCoin; it will get taxed if not banned, etc. etc. etc. BUT, people want to engage in commerce, damn it! And they want to protect the wealth they earn and save! So, while BitCoin might get tracked, it could also roll out an upgraded algorithm. And much like the drug war, the feds will never win, they’ll always be a step or two behind, and they’ll waste an obscene amount of money chasing down individuals and businesses that are not even remotely a danger to society. This will result in an overall rally in all alternative currencies, including virtual ones like BitCoin.

However I hope that you’ve learned some very useful tips

that you can immediately put into action and incorporate into your hypothyroidism food plan immediately to start seeing some outcomes.

I don’t know whether to laugh or cry at this, but I will ask, “Why?”

There would be no need for people to seek alternatives to the government monopolies on currencies if said governments would do a better job of managing them. The problem is, they don’t. In the United States, these boobs should recognize that they yammer on about “living in the freest country in the world,” yet they always dream up new schemes to separate us from those same freedoms they profess to support.

No one should consider her/himself to be free if they are restricted in any way from any activity they choose to do.

I don’t mean to sound alarmist about this, but no one in the United States has been free since 1913 at the latest.

Freedom, as it turns out, is an individual pursuit much like happiness. It is incumbent upon each individual to seek out a freer way of life. A country, by definition, isn’t free. Having a bigger yard or a longer leash doesn’t make a dog any freer from his owner. Individuals are inherently free: and I encourage individuals to globalize themselves, and maximize their freedoms.