May 30, 2013

By: Bobby Casey, Managing Director

The satisfaction many find in tales of fiction is, no matter how terrifying or calamitous, in the end, it’s understood that none of it was true.

In the case of what we are experiencing now, not only are we proving countless political and economic prophets right, no fiction writer could make this stuff up!

Recycling debt from one country to another, and some how generating “money” from it sounds fictitious because it makes no economic sense, BUT…

Low and behold, Blackholeistan is running massive budget deficits and has run up an outstanding public debt of nearly 100% of GDP. Blackholeistan is not even an energy producer so it imports approximately 90% of all oil, gas and electricity.

One day the President of Blackholeistan calls up his buddy, the President of Empireland and asks for a loan. The President of Empireland tells him, “I’ve got a better idea. Let’s do this: You sell $2B worth of bonds and Empireland will guarantee your bonds, giving the unsuspecting investors the idea they are getting a good yield with no risk. When you default on this loan in 2-3 years, as you inevitably will, I will have my Central Bank Magician print the cash to pay off your debts. The $2B will be paid off using freshly printed dollars – we will just dupe the citizens of Empireland into thinking it is a humanitarian project. They always fall for that.

“In return, I just ask that we be allowed to build military bases in Blackholeistan and use your country as a central location for our other economic operations in the region.”

The problem with this story is it is not a fable at all.

This week, Jordan announced plans to sell $2B in government bonds to shore up its massive budget deficits. Luckily big brother Amerika stepped in and offered to guarantee 100% of that debt.

When – not if – Jordan defaults, the US Treasury will sell $2B of US bonds and use that cash to pay off the investors from the Jordanian debt issue. Of course the Federal Reserve will be the buyer of those $2B of US Treasury bonds meaning we just printed an extra $2B in Monopoly money.

… And no one is the wiser…

The first question you should be asking yourself is, “Why would the US government do this? What’s in it for them?”

That is really quite simple: money, power and political favors – the imperialistic trifecta of Amerika.

Take a look at the rebuilding of Iraq. Who received 10’s of billions of government contracts rebuilding Iraq’s infrastructure? You guessed it, Dick Cheney’s company, Haliburton. And no, those contracts weren’t up for bid.

Do you find it ironic that those contracts were awarded without bidding to the new VP’s old company? Me neither.

The same will happen in Jordan. Jordan will likely default. The US will receive its favors in the form of Jordanian assets which will then be assigned to select US companies for various projects. And the US taxpayer pays the bill through the hidden tax called inflation.

Is this exactly how it will play out? Historically, I have no reason to believe otherwise. It has happened countless times in the past. Iraq, as I mentioned, is a perfect modern example. What about Russia post-WWI? Or Germany post-WWII? I don’t want to go into the minutia of too many examples, as it is beyond the scope of this article, but I would highly encourage you to pick up a copy of, “The Creature From Jekyll Island” by G. Edward Griffin. I think you will find it hugely enlightening.

The second question you should be asking yourself is, “How does this affect me and what should I do about it?”

This is a much deeper question requiring some analysis of your personal situation to determine your own game plan and proper response to this type of political action and monetary policy.

The situation with Jordan is but a fraction the problem. This type of financial sleight-of-hand has been going on for 100 years – since the birth of the Federal Reserve.

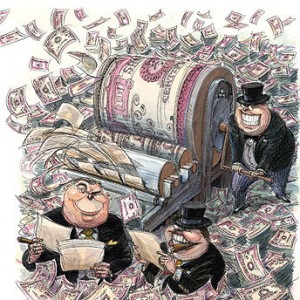

In truth, the Federal Reserve was created for exactly these types of shenanigans. Understand the Federal Reserve is owned by the world’s largest banks from New York, London, Paris and more. These bankers created the Federal Reserve in order to maintain a monopoly on the money supply and the banking sector as a whole. Our ignorance of this fact only facilitates their ability to earn unlimited profits.

In simple terms they print the money out of thin air, loan it to us, and charge us interest for the benefit of using funny money. Funny huh?

Even worse, they print the money to pay their own bills and in a case like Jordan, they print the money to bail out smaller, weaker countries so they can take control of them. It is subtle empire building at its finest.

In order to protect yourself, you must understand what you are fighting. That’s step one. Once you know the beast, you can understand how to fight it. Dragon-slaying has become the fantastic metaphor for the surreal events unfolding in our time: the beast is real, but it all seems so unbelievable! Mythical dragon-slayers never went to battle until they knew the weak spots of the dragon… and neither should you!

Armed with the knowledge that the monetary slave-masters are printing away your wealth, means two things: 1. you want to be as close to the printing press as possible (i.e. if you can’t beat them, join them); and 2. own real assets.

Personally, I am invested in businesses that are able to take advantage of the money printing. I am buying hard assets and keeping savings in precious metals. I am running businesses internationally not beholden to any one government. I am globally diversified. If you really are asking what you should do, I would suggest seriously considering a similar globalized strategy.

In the next 30 days we are launching our premium membership site: GWP Insiders. With GWP Insiders you will learn about asset protection, offshore planning, international investment and business opportunities, and have direct access to our own panel of experts.

To learn more, get on our early notification list by clicking here.

Until next time,

Live well.