July 29, 2013

By: Bobby Casey, Managing Director GWP

I am not telling you this to say that if the third little pig chose to work with me, she would be ok; only that she needed to do SOMETHING in order to protect herself. I will focus on the facts relevant to their situation, for the sake of illustrating my point.

Let the story begin…

“Harry”, “Tom”, and “Sue” were all partners in a real estate project. None of them had a very high net worth and all lived normal lives that most would consider upper middle class.

Harry worked a corporate job, earning a decent low six figure salary. Tom was semi-retired and owned a few residential rental properties – some multi-family, some single-family. Sue was also semi-retired, working a part-time job, and living off the cash flow from her stable of rental houses.

What brought Harry, Tom and Sue together was a commercial office complex they bought a few years earlier. They found a bank-owned property selling at a discount to its intrinsic value and it was generating substantial cash flow. Going forward, we will refer to this property as “The Albatross”.

Each one of them came to me to develop their own asset protection plan. They all recognized their need to change something in the structure of their investments. You see, they all made the HUGE classic mistake of owning their investments in their PERSONAL names!

They each originally thought they did not need to place their investments into the proper structures because THEY were not high risk individuals, nor were they very wealthy. Sure, they controlled several properties — including The Albatross — but they were highly leveraged, and the cash flow was paying their bills.

Each of them hired me as a consultant to develop their own customized asset protection plan. Each one realized they were potentially exposed to risk with their investment assets held in their own name.

Harry’s Story.

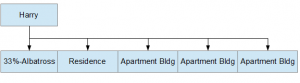

In Harry’s case, he owned several pieces of real estate, his residence, and his partnership interest in The Albatross. As previously stated, each asset was in Harry’s own name.

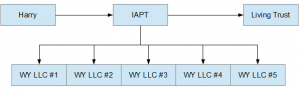

His restructuring was relatively simple. We placed each of his investments in the name of a Private Wyoming LLC – five (5) in total. We then created an Integrated Asset Protection Trust (or IAPT) as the 100% member of each Wyoming LLC. Harry is the manager of each Wyoming LLC. Additionally, we drafted a Living Trust as beneficiary of his Integrated Asset Protection Trust in order to simplify his estate planning needs.

This structure provides a layer of anonymity with his assets since they are no longer in Harry’s name. Each asset is owned by the Private Wyoming LLC. The IAPT is the 100% member of each Wyoming LLC with Harry as the trust grantor and his living trust as beneficiary.

By virtue of using the Integrated Asset Protection Trust, it also removed Harry from legal ownership and thus removed any litigation risk he may encounter in the future. Finally, he wrapped up his estate planning needs so he would not have any hefty estate tax issues down the road.

Tom’s Story.

Tom was in a similar situation except he had fewer assets. Tom owned his primary residence, one other rental property, and his interest in The Albatross.

Like Harry, Tom owned everything in his personal name. For restructuring, we did the same thing as with Harry, utilizing the Integrated Asset Protection Trust to own his 33% interest in The Albatross Wyoming LLC, as well as his membership interest in the other Private Wyoming LLCs.

Sue’s Story.

Sue, however, was the pig that got eaten. After consulting with Sue, she chose to forgo any asset protection planning, as she felt the cost was not worth the benefit and, ultimately, she was not a litigation target… or so she thought.

You see, asset protection planning is a bit like health insurance. No one ever pays their insurance premiums hoping to get cancer or have a heart attack in order for it to make financial sense. You don’t want to deal with a major lawsuit, but if and when it happens, you will be very glad you developed your asset protection plan.

In the United States, there is a new lawsuit filed in federal court every 17 seconds. You read correctly, every 17 seconds. Feel free to visit the American Bar Association website and look up the stats. It is shocking.

The Albatross

After owning The Albatross for a couple years, Harry, Tom and Sue became one of those statistics.

The Albatross was found to have black mold, which condemned the property making it uninhabitable until repaired. It seems the inspector who signed off on the property just a couple of years prior completely missed it. Certainly he holds some liability in the matter, but he doesn’t have a multi-million dollar mortgage outstanding without the cash flow to support it.

Harry, Tom and Sue, however, did have that mortgage; and they could not pay it without the cash flow from the property, so they were forced into foreclosure. As you may imagine, the property just became significantly less valuable with the new-found black mold.

This left the 3 little pigs with a relatively HUGE default on their hands of approximately $3M. In this particular case, the bank was uninterested in negotiating a settlement and pursued the full value of the default. If you understand the way judgments work, you will know that each partner was jointly and considerably liable for the full $3M!!!

Ouch.

Luckily for Harry and Tom, they put their asset protection plan in place before the black mold debacle unfolded. Once the bank’s attorneys started searching for assets to attach in the judgment, they realized that in fact, Harry and Tom owned nothing.

Recall from their asset protection plan, they moved all of their assets into an Integrated Asset Protection Trust thus removing themselves from the ownership.

As John D Rockefeller stated, “Own nothing and control everything.”

Harry and Tom were living proof. They owned nothing, but had control over their assets through the asset protection structures previously put in place.

So while they did have the outstanding judgment against them for $3M each, the bank was unable to attach any of their assets beyond The Albatross itself, leaving them financially intact.

Unfortunately for Sue, it didn’t work out so well. Because Sue had her home and other properties in her own name as well as her cash savings. The bank got a lien on all of her properties and virtually cleaned out her cash balance. She was FLAT BROKE!

This little pig got eaten!

Ironically, when talking to each of them in the initial consults, not one of them considered themselves to be at risk for litigation.

But the problem with unforeseen risk it just that – it’s unforeseen. They had no idea The Albatross was filled with black mold. They trusted their inspector at the time of purchase – as well they should.

Luckily for Harry and Tom, they put the ‘peace of mind’ insurance in place with their asset protection plan. Unfortunately, Sue didn’t have the cautionary foresight of her partners.

Contact us today if you would like to schedule your asset protection consultation.