February 2, 2015

By: Kelly Diamond, Publisher

About three and a half months ago, I wrote of China’s economic rise to prominence (China v the U.S. = Strategy v Tragedy). Sadly, the only real claims the U.S. had in its own defense was that China did not overtake the U.S. in RAW GDP, and the U.S. was still beating China in foreign direct investments (FDI).

About three and a half months ago, I wrote of China’s economic rise to prominence (China v the U.S. = Strategy v Tragedy). Sadly, the only real claims the U.S. had in its own defense was that China did not overtake the U.S. in RAW GDP, and the U.S. was still beating China in foreign direct investments (FDI).

Would it surprise you to learn that the U.S. can no longer claim the latter of the two points? We have not lost this spot in the world economy to China in about a decade. The U.S. maintained its share traditionally through cross-border mergers and acquisitions and new overseas corporate projects.

While this is undeniably big news, it’s not surprising at all. I’ve covered rather closely the goings of the Chinese economy and their activity here at GWP, and without a doubt China is playing the long game. The old adage, “Slow and steady win the race” is proving to be very true for China.

The U.S. lost its ranking to a Verizon (U.S.)/Vodafone (U.K.) deal which, according to Reuters UK, “included a share buyback that reversed $130 billion of foreign investment out of the United States”. Apparently there were enough eggs in that basket to knock the U.S. down two rungs, coming in 3rd to China and Hong Kong respectively.

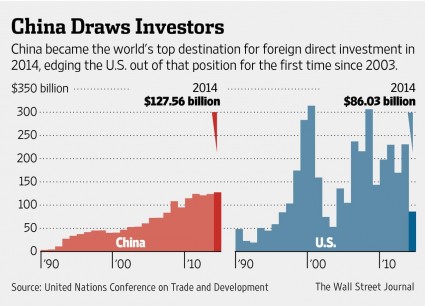

Interestingly enough, this shift is not attributable to China “stealing” business from the U.S. as much as it is the U.S. losing business to others like the U.K. Still, China has seen constant incremental growth here over the years; whereas the U.S. has been rather erratic:

While many still gripe about how China is “stealing American manufacturing jobs”, that is not an accurate bromide. It’s true, that the U.S. is not the manufacturing capital of the world, and hasn’t been for some time. China’s manufacturing industry isn’t exponentially booming either. It’s healthier than the U.S., but where it is really making strides is in service and technology. Their greatest export is tech, while the U.S. greatest export is scrap.

The world economy isn’t expected to make any drastic moves in the near future, given its overall condition. “The fragile world economy, hesitant consumer demand, currency volatility and geopolitical instability could all deter investors, the UNCTAD report said.”

But here are some other numbers that came out from the UN (Sources: Wall Street Journal and Reuters UK):

- China’s share of global FDI crept up to nearly $128 billion last year. Foreign businesses invested $127.6 billion in China, up from $123.9 billion in 2013, while investments in the U.S. fell to $86 billion from $230.8 billion

- Globally, FDI flows fell by 8% last year to $1.26 trillion, the second lowest level since the start of the financial crisis in 2009.

- The European Union, drew $267 billion, up 13% from 2013. However, with the Eurozone economy trapped in a long slump, businesses cut their investments in Germany by $2.1 billion and their investments in France by $6.9 billion. The U.K. saw rapid economic growth, thanks in part to the Verizon/Vodafone deal. Foreign investment rose to $61 billion, making it the largest European destination for foreign investment.

- Flows to Russia fell to about $19 billion, a drop of 70% from 2013 – a year when its FDI was boosted by a single big oil deal. Concerns about the conflict in eastern Ukraine and Western sanctions against Russia contributed to a halving of foreign investment to $45 billion. Foreign businesses cut their investments in Ukraine by $200 million.

- While developing countries as a whole attracted an increased share of total investment, some regions fared better than others. Asia led the way, with a 15% rise in foreign investment to an all-time high of $492 billion. Specifically and quite noteworthy is India, with a 26% surge to $35 billion in FDI.

- Security worries contributed to a slowdown in the Middle East and North Africa overall foreign investment in Africa fell 3% to $55 billion.

- Lower commodity prices helped cut FDI flows to Latin America by 19% to $153 billion, after four years of increase.

What does all this mean for the global economy? If anything, it is a reflection of what is happening politically. OPEC deciding to stick it to Russia in a price war for oil, was a swift kick in the shins for Russia considering how heavily its economy relies on commodities to prop it up.

Russia, the U.S., and the U.K. all lost and gained in a single hand of high stakes market poker. That oil or a singular telecom deal had such influence over their economic standings for foreign direct investment, is telling of their stability or lack thereof.

China is becoming a little more lax (and I mean that by Chinese standards, not ours) in who they let into their country to do business. They had a tightly controlled process that involved evaluation one project at a time. It would seem they are slowing doing away with some of it. Rigid as China can be, they seem to be the only player in all this that can go with the market flow.

I think that has a lot to do with the fact that it has its hands in a variety of things ranging from currency reserves, to real estate, to precious metals, to manufacturing, to tech. It has considerable breadth to its holdings. The chart above shows that the deliberate, incremental actions of China; its diverse interests and investments; and most of all, its patience are paying off.

You know the world has turned straight on its ear when capitalists can take solid investment cues from a self-proclaimed communist country!