July 20, 2015

By: Kelly Diamond, Publisher

So by now you probably know that Greece is on sale. It is quite literally the world’s largest estate sale. They are selling off their land, their ancient artifacts, and anything else that can fetch a price to pay off their debt.

So by now you probably know that Greece is on sale. It is quite literally the world’s largest estate sale. They are selling off their land, their ancient artifacts, and anything else that can fetch a price to pay off their debt.

This is what people and businesses do all the time. People have yard sales and pawn their stuff off to liquidate their assets when they hit hard times. Greece should’ve done this years ago, but the fact remains the behavior is par for this course. I think about the big brands that were there throughout my childhood, and how they faded away into the great market nothing. Yes, I was sad to see Sam Goody what shrinking and virtually going away was like having a Christmas Wish Outlet disappear! Sharper Image, Circuit City, and Borders all went under, and I could hardly believe it considering how much I enjoyed their stores.

But them’s the breaks. While there might be this gap between the top percentage of earners and everyone else, the truth is, it’s not always the same people occupying the bottom and top. There is fluidity in the ranks. That is the market deciding who deserves to be where.

If we look at countries as nothing more than (poorly run) businesses, then it’s clear Greece was insolvent from early on. The citizens are nothing more than employees (albeit more like indentured servants). What will become of them? Well, when a company fails, the employees are free to seek out another job. When a country fails, are its citizens free to seek out alternative residency? I don’t know. If the EU is offering some sort of refuge or amnesty for individual Greeks to relocate to a more solvent geography then perhaps that is an option.

In the meantime, Greece is liquidating its assets and timidly reopening its banks.

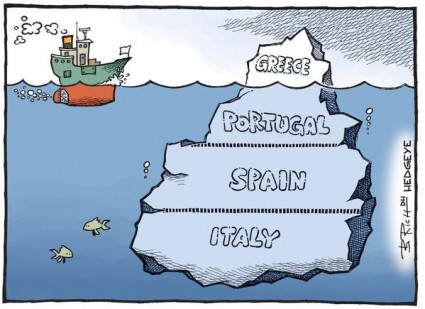

But while Greece continues to sort its business, other countries in the EU are flickering red warning signs of their impending collapse. I have to wonder if in fact it will be Portugal, Spain, and then Italy in that order as the main image suggests.Portugal and Spain lead that list. We touched on both Spain and Portugal before (“Portugal: A Glimpse into America’s Future”, “Spain Raids Social Security Fund; Is Portugal Next?”, and “A Tale of Two Bailouts”.)

No question, Portugal is taking FAR more austerity measures than Greece even considered. But is that enough? The short answer is no.

When Obama cut the deficit, people who paid attention in high school economics class knew that wasn’t the same as cutting our sovereign debt. It meant we weren’t bleeding AS MUCH money as we were. If I bring in $1000 per month, and I was spending $3000 per month, then I cut back to $2500 per month, that doesn’t make me a hero considering the debt I mounted during my $3000 per month spending period and the still unaffordable $2500 per month spending I have now along with its respective mounting debt.

Portugal implemented austerity measures, but the numbers don’t indicate they are enough to keep up with even their interest much less any dent in principle. Here are some rather simple calculations laid out by Erico Matias Tavares via Zerohedge:

“As of March 2015, non-financial public sector debt stood at €288 billion, or 166% of GDP.

- We start by dividing €288 billion by 166% to find out what nominal GDP the BdP used in its calculation: about €174 billion;

- Next, let’s assume that the cost of debt on all that government debt is only 1%. In this case, the annual interest expense for the government should be 1% x €288 billion, or €2.88 billion. We know that this is very low as the actual interest expense in 2014 was almost €7 billion (and likely not all of it, but government accounts can get quite murky);

- Then we assume that Portugal’s nominal GDP grows at 1%, which is not stellar but certainly better than recent years – from December 2011 to December 2014, the average nominal growth rate was actually -0.6% (BdP figures). So that’s 1% x €174 billion, or €1.74 billion;

- Finally, we compare the assumed interest costs with the nominal GDP growth: €2.88 billion vs €1.74 billion.”

If these are the optimistic numbers of Portugal, then what are the realistic ones? Worse, what are the pessimistic ones? The best laid plans of mice and men often – if not always – go awry. If they can’t even service the interest, what happens?

Spain, on the other hand, has two things going for it: its austerity measures and its economic growth. It is one of the larger EU economies. Its situation isn’t nearly as precarious as Portugal’s since it is seeing more growth. It’s debt to GDP isn’t as high as Portugal’s either.

Can Spain out-grow its debts? As one of the larger economies in the EU, you want to say YES! But there is a slight snag in their workforce. They have a good number of people who are unskilled and uneducated who decided to drop out of school to take advantage of their construction boom back in the 90’s. They have a staggering number of people who literally can barely function at the level of cashier. What will become of that generation of people?

Moreover, every time Spain decides to tax its citizens and businesses more, they are in fact taking point blank aim at their own foot. Taxing people on such paltry things as sunshine and Google links? I mean, come on… It’s not the austerity that hurts as much as the taxation.

Again it comes down to the difference between slowing the bleeding and stopping the bleeding. Slowing the bleeding could either be a path to eventually stopping it or just bleeding out more slowly.

There is also a difference in debts. There are those debts which are productive and those which aren’t. The former are debts used to invest in that which ostensibly would result in an ROI. The latter are debts which produce no return on investment. So a small business could go in debt to invest in better machines, which produce more and keep up with a demand that will result in a return on investment. So now they are making more money which can service the debt comfortably. Or, the company could go into debt to repair an existing machine. That isn’t going to have an ROI, it’s going to at best return them to their baseline and stop the bleeding caused by their broken machine.

There is no productive debt here. The EU is on some shaky ground. It needs to get its house in order. Its member countries need to get their respective acts together.