July 30, 2015

by Bobby Casey

Stock markets are like riding a roller coaster, drunk and on acid.

Currency markets are wild with the US Dollar showing mystical strength and one of the most stable currencies in the world – Australian Dollar – showing a 21% decline vs. the USD over the past 12 months.

Now we have entire countries narrowly avoiding bankruptcy through sheer corruption and sleight of hand – Greece.

There are even some banks in Europe that are actually paying their customers interest on mortgages due to negative interest rates. Imagine that. Your mortgage balance is credited each month with the interest payment the bank owes you for the privilege of borrowing money from them.

And lets not forget the staggering amount of US public debt standing at about $18T.

Now here’s the funny thing about that $18T. There is a lot of talk in the media about how the US is indebted to China as they are buying up US treasury bonds. The reality is that China actually only owns a bit less than 7% of that debt at $1.2T.

And if you combine all the foreign owned debt in one lump sum, it totals about $6T, or 33%. Hmmmm….who owns the other $12T? Who are we really indebted to?

The answer is YOU!

The US Treasury owes various government agencies, and thus YOU, $12T.

I am lumping in the Federal Reserve into this figure even though they are pseudo-private. I think we all know they are in fact controlled and run by the parasites…er…politicians at large.

The Federal Reserve is the larges holder of US public debt at around $2.5T. That is approximately the same as what China and Japan own combined.

Of course you are asking yourself at this point, “What does this mean for me?” – as well you should consider this important question.

Before we answer that, let’s take a look at some data.

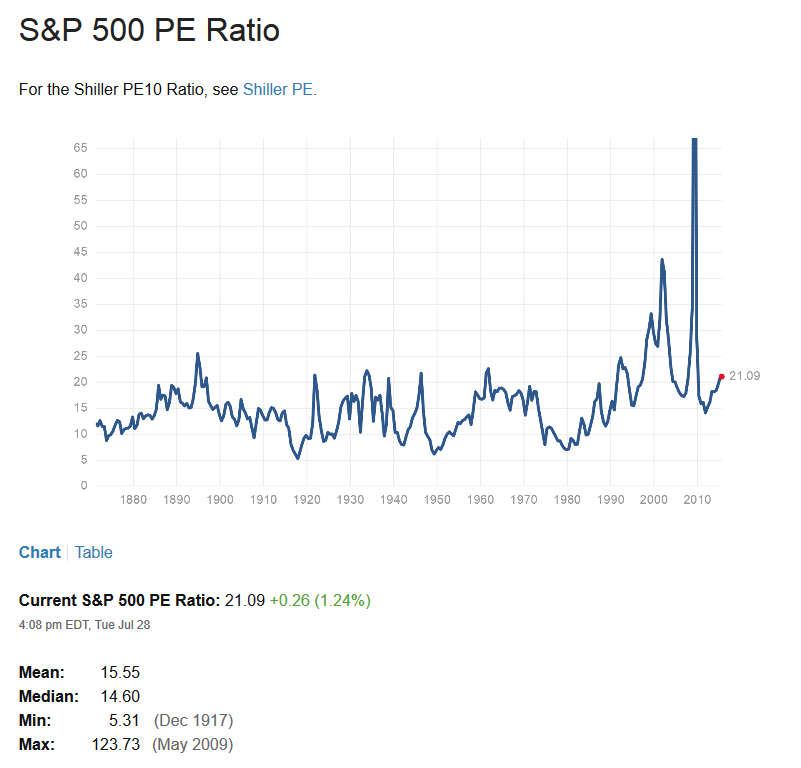

Here is the historical chart of the S&P500 Price to Earnings ratio:

As you can see here, the S&P500 is currently trading at 21X earnings. While not at an all-time high, it is trading about 40% higher than the historical average. Of course this doesn’t necessarily mean that the past will equal the future, but it tells me there is not a lot of room left here for gains.

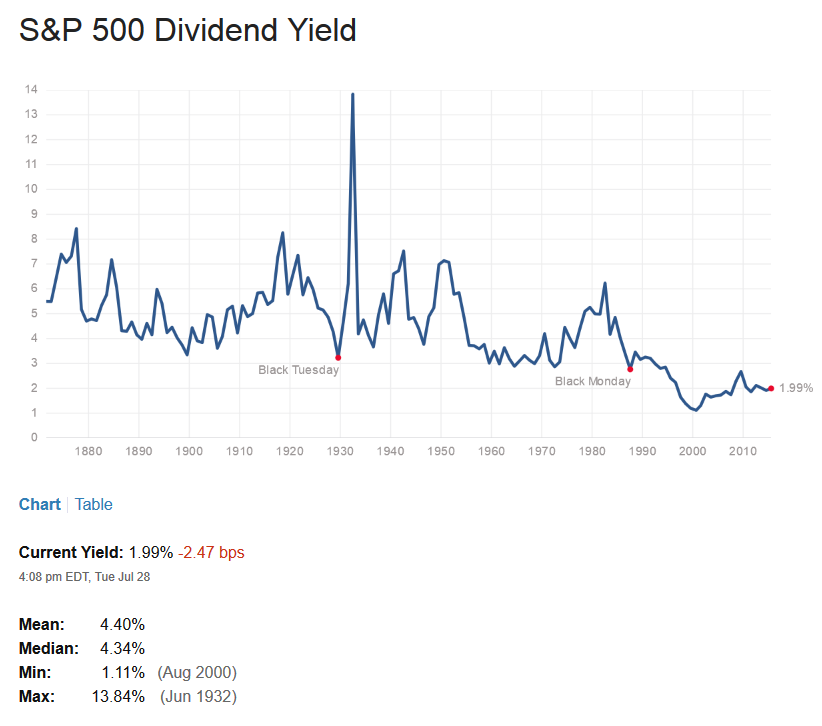

Here is the historical chart of the S&P500 Dividend yield:

This one speaks volumes about how your money will be treated on Wall Street now. The current dividend yield is about 2%. Who in their right mind will risk loss of principal in a volatile market for the opportunity to earn 2% on their cash?

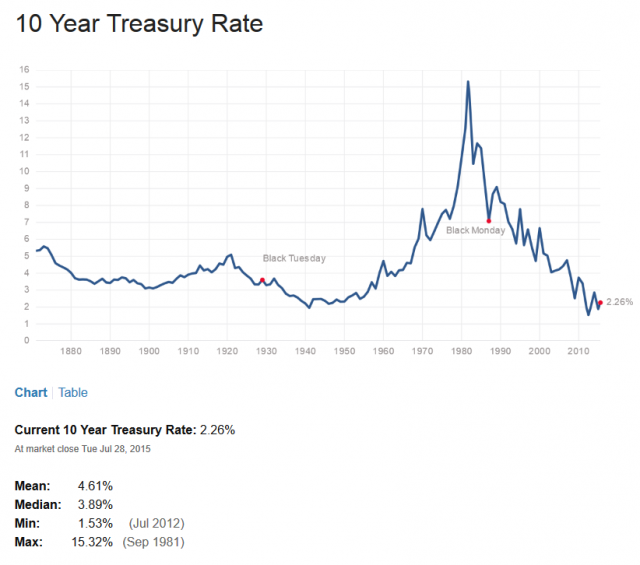

Here is the historical chart for the 10 Year US Treasury Rate:

Anyone notice a trend here? Anyone interested in loaning the least capable minds in the world your hard-earned cash for the privilege of earning 2% per year? ‘Nuff said.

Here is the 1 year chart of the Shanghai index:

I put this here just to show the extreme volatility of the Chinese markets. Considering the vast majority of the big Chinese companies have significant government ownership and control, there is no doubt the Chinese market is heavily manipulated. You have to look no further than the recent policy change in China that allowed the Central Bank to fund 10’s of Billions of dollars for larger brokerage firms to buy shares of publicly listed companies.

At least their corruption is transparent.

Now back to the question, “What does this mean to me?”

The answer is everything.

This craziness in the global economy means the little guy has little or no power to effect change. But it does mean that you can take control of your own personal finances and stop relying on 3rd parties like Wall Street and Central Banks to determine your financial future.

Most people reading this article I imagine have some investable cash. You likely have some significant assets. My guess is that you probably;

- Own a home or 2

- Have a IRA, 401k, or other type of retirement account depending on your residency

- Have a brokerage account

- Own your own business

- Have some cash

I am also guessing most of you reading this are busy with your lives and your businesses.

I would imagine for most of you, the 2 largest assets in your “portfolio” are your home and your retirement accounts.

Every time I think about what is happening in the global economy, I think of Jim Roger’s quote, “I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.”

That means right the stock or the bond markets are not your best bet. There is not a lot of money sitting in the corner when yields are around 2% and stocks are at all-time highs.

Or course stocks CAN go higher, but the rubber band is nearly fully stretched. And what happens when a rubber band is stretched too far? Snap!

So from my perspective, now is the time to be in cash and hard assets.

In 2009 when the US stock market fell through the floor, there was a ton of cash stacked up in the corner. It was easy to just go and pick it up because the rest of the world didn’t want to touch the market.

Many huge companies were trading at “going out of business” prices. But now they are trading at “you’re never going to get your money back” prices.

I don’t like the sound of that, do you?

So today, I would advise primarily cash, real estate and gold.

By cash, I don’t mean digits in your bank account. I mean cold, hard cash sitting in your safe. Do not keep money in a bank safe deposit box – ever. Keep it under your control and watchful eye.

By real estate, I don’t mean speculative deals that “may” work out some day. None of this “no-down payment you will make money when the market goes up bs”. I mean investing in distressed assets that produce cash flow from day one. Don’t invest in a property if you are buying at market price. Have a margin of error by at least 25%. And make sure you can rent it out and earn cash.

By gold, I don’t mean futures contracts or etf’s. I mean coins and bars stored in a private vault or your own safe under your control and watchful eye. I am not a gold bug by any means and don’t advocate 100% gold portfolios, but buying up a coin or 2 with your excess cash every so often is just an insurance policy for the future. Plus they are cool.

If your retirement accounts are held with a traditional custodian, I would highly advise opening a self-managed retirement account. You can read our recent article here. We can help you take control of your retirement accounts by opening a self-managed IRA or 401k that gives you 100% control over the assets you invest in, for example real estate and gold. You can click here to download the details.

Until next time, live well.