December 7, 2015

By: Bobby Casey, Managing Director GWP

A new chapter to the global economy story has officially started, with the IMF declaring China’s renminbi a reserve currency:

A new chapter to the global economy story has officially started, with the IMF declaring China’s renminbi a reserve currency:

“On Oct. 1, 2016, the yuan will officially be added to the IMF’s Special Drawing Rights (SDR) basket of currencies, which previously included only the dollar, euro, yen, and pound sterling.” (Source: Washington Post)

“The IMF staff recommendation was based on increasing international use and trading of the yuan, policy reforms that allow the yuan to be used smoothly in SDR operations, and steps by China to step up data disclosure, the fund said.” (Source: Bloomberg)

In order, the current Q2 2015 allocated reserves of each of those currencies is: USD: 64%, Euro: 21.5%, Yen: 4%, Pound Sterling: 5%. (Source: IMF)

Now the yuan has joined their ranks. This should be interesting considering the economic landscape of the existing players. The EU has some struggling nations in bailout mode or heading that way to contend with. The USD is marching toward a $20 Trillion debt and her credit standing has slipped (and so has her popularity). Japan is all but lost with their debt to GDP being the highest in the world and seemingly endless quantitative easing. Britain has taken a hawkish approach to international policy it can’t afford. No one is doing too hot. China has had an economically tumultuous year, without a doubt. But it is another choice at the end of the day!

Obviously this is not enough for the yuan to surpass the USD… and perhaps it may never surpass the USD. The yuan happens to have some geopolitical clout on its side right now, which is crucial. It’s greatest selling point? It’s NOT the USD. Sounds trite, but it’s true. Many countries around the world have already made significant strides to avoid engaging the dollar by adding the renminbi to their reserves.

It’s because of this that the decision was anticipated by the global markets. To be sure, this decision by the IMF is big news, but not surprising news. China has come a long way over the past decade, and has more work to do over the next decade.

Given China’s expansion in exports and production, I think it will likewise start to grow in its consumption from outside its borders. They have to open up their financial markets which will require more transparency on China’s part, a point with which they still struggle. And while old habits die hard, other changes have been relatively easier to implement, such as getting other countries to use the renminbi. One of her advocates is Russia. Their trade agreements involve large volumes of fuel and yuan.

That sort of diversity and popularity bodes well for China:

“A relatively stable exchange rate also enhances a reserve currency’s economic attractiveness. Similarly, the more the yuan is used in trade settlement and debt markets, the more likely central banks are to increase their holdings of the currency.” (Source: Washington Post)

It’s not until you look at a bigger timeline of China’s economic journey to reserve currency status that the story becomes a little more inspiring from a free market perspective. We’re talking about a country that was once so protectionist, the renminbi was only used by the Chinese… foreigners used state issued foreign exchange certificates. Those certificates were around until the mid-90’s!

They’ve since allowed foreign banks to set up in Beijing, unpegged itself from the dollar, and broadened the allowable Qualified Foreign Institutional Investors. And the freer their markets are allowed to be, the better off they and the world has become for it.

We’ve indicated before that their central bankers and planners are timid when it comes to opening up some aspects of their markets, but there is a demand for an alternative to Japan and the West when it comes to reserve currencies.

We now have another reserve currency in the basket. We have the second largest economy that was once decidedly protectionist, communist, and exclusionary now participating in open markets with the rest of the world. The world has benefited from their production, and soon it will benefit from its consumption.

Transparency is where things will get sticky. One of their major secrets has been their exact holdings in gold. There’s more guessing than knowing when it comes to the real answer. Some traders and speculators suggest just over 13,000 metric tons, but China recently ‘officially’ disclosed their holdings closer to 1,658 metric tons. No one believes the latter… and that’s a problem when it comes to their credibility and transparency.

What if China had enough to back its currency with gold? What if it was just CLOSE to doing so? I think that would change the dynamics drastically. A gold backed yuan… or even a ruble… could have some devastating implications for the USD. I’m sure every leading reserve currency throughout history has thought they were invincible… that a new currency would NEVER surpass them.

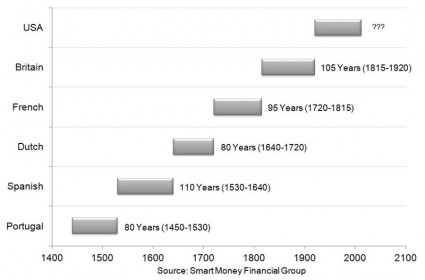

Let’s hope US monetary hubris doesn’t “jinx” itself. The average life span for largest reserve currency in the world is about 94 years. The US is right about there. Thinking that the USD will maintain its standing forever is like believing back in 2004 that housing prices would continue to exponentially rise: it’s naïve. And given the present conditions of the global economy, I wouldn’t be surprised if the US had another decade at most before they get knocked down a peg.