In uncertain economic times, alternative investments like fine art, collectible wines, and rare coins can help protect your wealth. These assets often maintain or grow in value when traditional markets decline, offering a way to diversify and hedge against inflation. However, they come with challenges like illiquidity, subjective valuations, and higher costs for storage and insurance. Here’s a quick breakdown:

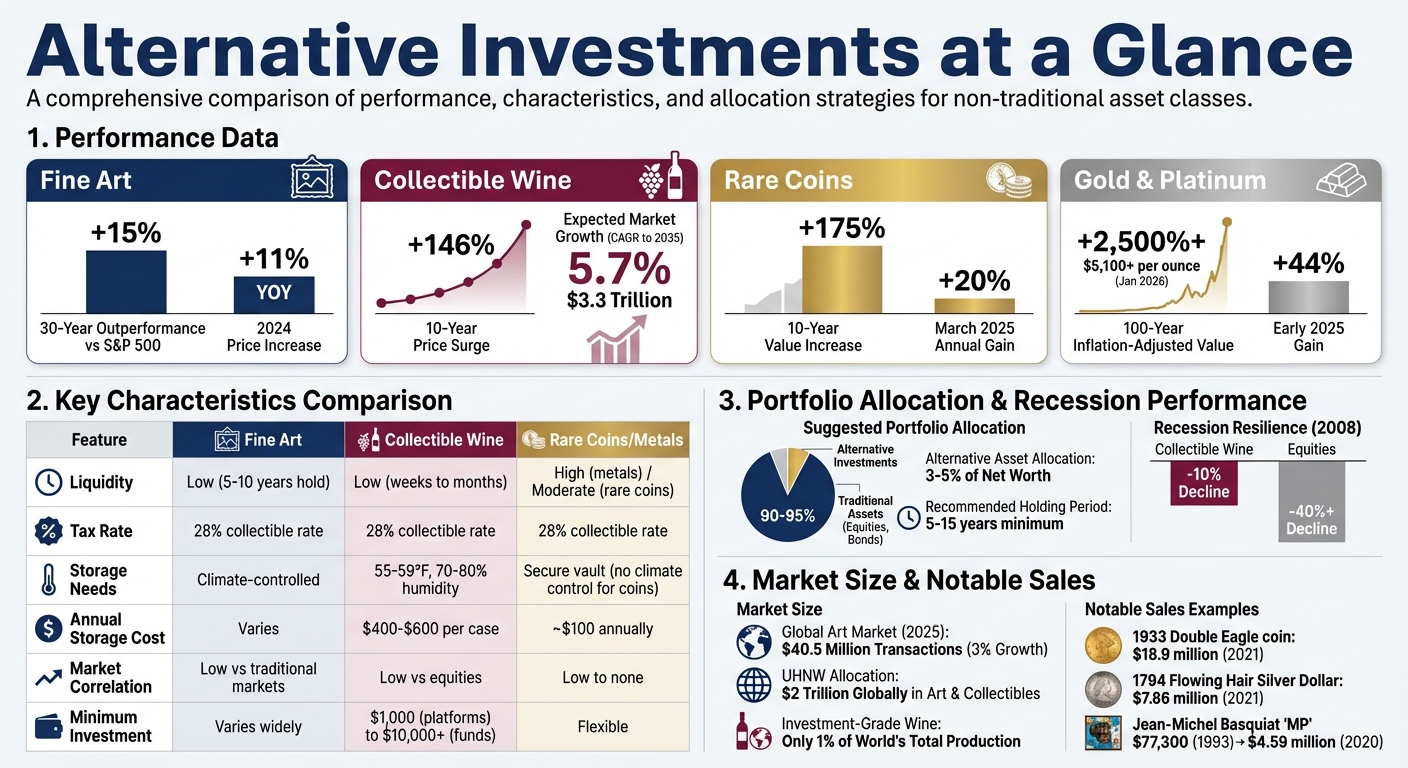

- Fine Art: Art has outpaced the S&P 500 by 15% over 30 years. It’s a long-term option, often requiring 5–10 years of patience. Costs include climate-controlled storage and insurance, and it’s taxed at a 28% rate.

- Collectible Wines: Wine prices surged 146% over the last decade. Its value increases with scarcity as bottles are consumed, but storage and insurance costs can reduce returns.

- Rare Coins & Precious Metals: Coins combine historical significance with intrinsic metal value, while gold and silver hedge against inflation. These assets are highly liquid but require secure storage.

To maximize benefits, allocate 5–10% of your portfolio to these assets, plan for long-term holding, and consider offshore structures for added protection and tax advantages. Proper research, expert advice, structuring offshore trusts, and regular appraisals are essential for success in this space.

Fine Art as a Wealth Preservation Asset

In 2024, fine art led the luxury investment market, with prices climbing 11% year-over-year. Its ability to maintain value independently of traditional markets makes it a resilient choice during economic uncertainty. As part of a well-rounded alternative investment strategy, art offers distinct advantages for preserving wealth.

Benefits of Art Investments

Art’s financial appeal is backed by decades of performance data. Over the past 30 years, high-value art has outpaced the S&P 500 by 15%, proving its strength as a long-term asset. Unlike stocks, which can face abrupt downturns, art’s value is shaped by factors like collector interest, historical importance, and rarity – not quarterly financial results.

Art also serves as a hedge against inflation. When currency values decline, tangible assets like paintings often retain their purchasing power. For example, the global art market saw $40.5 million in transactions in 2025, reflecting a 3% growth. Ultra-high-net-worth individuals have allocated over $2 trillion globally to art and collectibles, and younger generations are following suit – 98% of millennial and Gen Z collectors now view art as a formal investment.

Beyond financial returns, art offers cultural capital. Owning historically significant or visually stunning pieces brings prestige and enjoyment. Its portability, privacy, and ability to be passed down across generations make it particularly appealing to global investors focused on discretion and legacy planning.

What to Know Before Buying Art

Investing in art demands more than an eye for aesthetics – it requires careful research and preparation. One key step is verifying provenance, or the ownership history of a piece. Without a clear and documented chain of ownership, even authentic works can lose value if their history is questioned. Keep all receipts, certificates, and appraisal documents securely stored.

Focus on quality. Established "blue-chip" artists like Banksy or Salvador Dalí provide stability, while emerging artists may offer higher growth potential. For prints, rarity matters – a limited edition piece (e.g., 10 out of 100) is generally more valuable than widely available reproductions.

"The art world is fairly opaque with valuations and transactions, so having someone who understands the process of acquiring and caring for your collection can make it much easier."

– Liz Jacovino, Wealth Strategist, RBC Wealth Management

Be mindful of ongoing costs. Climate-controlled storage, specialized insurance, and regular appraisals can impact your overall returns. Additionally, the IRS classifies art as a "collectible", with long-term capital gains taxed at rates up to 28% – higher than the 20% rate for stocks.

Finally, consider working with independent art advisors or trusted gallerists. Auction houses often charge buyer’s premiums of up to 20%, which can eat into profits. Tracking indices like Sotheby’s Mei Moses or Artnet can also help evaluate the resale potential of similar works.

Examples of Profitable Art Investments

Real-world cases highlight the potential of strategic art investments. Take Jean-Michel Basquiat’s painting MP, which sold for $4.59 million at Christie’s in October 2020. Originally purchased in 1993 for just $77,300, the piece appreciated dramatically over 27 years. This example shows how established contemporary artists can yield impressive returns for those willing to hold their investments.

Another example is Joan Mitchell. A work purchased for $100 in 2000 reached an average valuation of $2,479 by December 2020. While the initial investment was modest, the percentage increase demonstrates how even lower-cost acquisitions can grow significantly as an artist gains recognition.

These examples emphasize a key principle: art investments require patience. Holding pieces for at least five to ten years allows time for market cycles and compound appreciation. With major auctions typically happening only twice a year, a long-term approach, paired with expert guidance, is essential. This strategy not only enhances the potential for financial growth but also lays the groundwork for exploring other tangible assets to diversify and safeguard wealth.

sbb-itb-39d39a6

Collectible Wines for Portfolio Diversification

Fine wine has proven itself as a solid addition to diversified portfolios, offering low correlation with traditional markets. Over the past decade, ending in Q4 2023, fine wine prices surged by 146%, outperforming other luxury assets like art, watches, and cars. With the market expected to grow at a 5.7% CAGR and potentially hit $3.3 trillion by 2035, interest from both institutional and private investors continues to rise.

The resilience of fine wine as an asset was evident during the 2008 recession when the Liv-ex Fine Wine 100 Index dipped by only 10%, compared to the over 40% drop in equities. This stability stems from wine’s finite supply – bottles consumed over time create scarcity, which, combined with aging potential and collector demand, drives value. Let’s break down how the wine market operates to sustain these trends.

How the Wine Market Works

One unique aspect of fine wine is its fixed supply. Once a vintage is bottled, no more can be produced, and as bottles are consumed, availability shrinks further. Unlike stocks that can issue additional shares, investment-grade wine makes up just 1% of the world’s total wine production, ensuring natural scarcity that supports price growth.

Demand, on the other hand, depends on factors like expert ratings, provenance, and aging potential. Influential outlets such as Wine Spectator and Decanter significantly shape market trends through their scoring systems. Bottles with verified ownership and proper storage – especially in bond – often fetch premium prices, as they guarantee authenticity and ideal preservation.

While Bordeaux and Burgundy have long been the benchmarks, regions like Tuscany (Super Tuscans), Napa Valley, and Champagne are gaining traction among investors. A notable example is the 45.1% price jump for Domaine Armand Rousseau Chambertin Grand Cru 2013 in August 2025, highlighting how specific vintages can deliver exceptional returns.

How to Invest in Fine Wines

Proper storage is crucial for maintaining a wine’s value. Wine should be kept at 55–59°F (13–15°C) with 70–80% humidity, shielded from light and vibration. Many investors opt for professional bonded warehouses, which cost around $400 to $600 annually for a standard 12-bottle case. These facilities not only preserve quality but also defer taxes until the wine is withdrawn.

"If your wine isn’t stored in bond, in controlled conditions, with verified records, it can be very challenging to find an interested buyer."

– Jason Hartman, President, Sommelier Company

For those new to wine investing, digital platforms like Vinovest allow entry with as little as $1,000, while specialized wine funds typically require $10,000 to $50,000. However, liquidity can be a challenge, as most auction platforms prefer selling wine in sets – cases of 3, 6, or 12 bottles – making single-bottle purchases less practical.

Focus on well-established producers to minimize risk. Names like Château Lafite, Domaine de la Romanée-Conti (DRC), and Penfolds Grange are highly sought after. For instance, a 2012 DRC bottle, with a limited production of fewer than 4,500 bottles annually, often sells for more than $13,000. As Clifford Korn, Managing Director of Sales at Acker Merrall & Condit, advises:

"If you like Pinot Noir, don’t invest solely in Cabernet because it’s popular. If the market shifts and you are stuck with a cellar full of wine you had planned to sell, you should ideally be able to enjoy drinking some of it."

– Clifford Korn

A long-term approach is key. Plan to hold wine for 6 to 10 years or more, allowing vintages to reach their peak drinking windows and for secondary markets to recognize their value. With these steps in mind, it’s easier to weigh the benefits and challenges of wine as an investment.

Wine Investment Pros and Cons

Investing in wine comes with its own set of advantages and challenges. Knowing both is essential for making informed decisions and setting realistic expectations.

| Feature | Fine Wine Investment | Traditional Stocks |

|---|---|---|

| Liquidity | Low (weeks to months to sell) | High (instant) |

| Volatility | Historically low | Moderate to high |

| Market Correlation | Low correlation to equities | High correlation to economy |

| Storage Requirements | Needs climate control | Digital/brokerage |

| U.S. Tax Rate | 28% (collectible rate) | 15–20% (capital gains) |

| Intrinsic Value | Physical/consumable | Paper/digital claim |

One of wine’s biggest drawbacks is its liquidity – or lack thereof. As Robert Johnson, CEO of Economic Index Associates, notes:

"No pun intended, the biggest drawback of wine is a lack of liquidity. Like most alternative assets, it often cannot be converted into cash quickly without a significant decrease in value."

Costs like storage and insurance can also cut into returns. Eric Croak, CFP and President of Croak Capital, explains:

"A 12-bottle case of Bordeaux purchased for $6,000 may double in value to $12,000 over 8 years, but at $400 per year in storage fees and $200 per year in insurance, the effective yield is much lower."

Additional risks include counterfeit bottles and shifting consumer trends. For instance, the percentage of Americans consuming alcohol fell to 54% in 2025, down from 67% in 2022. While this hasn’t significantly impacted high-end wines, it’s a trend investors should monitor.

Many advisors recommend treating wine as a "satellite" investment, allocating around 3% to 5% of total net worth or 5% to 10% of an alternative asset portfolio. This approach balances wine’s diversification benefits with its illiquidity and ongoing costs.

Rare Coins and Precious Metals for Asset Protection

For centuries, rare coins and precious metals have been a cornerstone of wealth preservation, maintaining their value even during economic upheavals. Unlike paper assets, these tangible holdings hold steady, immune to government policies or market crashes. A striking example: in the 100 years following the Federal Reserve’s creation, the U.S. dollar’s purchasing power plummeted by 95%, while gold’s inflation-adjusted value soared by more than 2,500%. This stark contrast explains why many investors turn to these assets when traditional markets falter.

But the appeal isn’t just historical. Precious metals often show little to no correlation with stocks and bonds, making them a smart choice for portfolio diversification. For instance, during the 2008 financial crisis, gold proved its status as a "crisis commodity." Fast forward to October 2025, gold prices surged past $4,000 per troy ounce, marking a yearly increase of over 50%. By late January 2026, gold hit record highs above $5,100 per ounce, and silver climbed past $100 per ounce. These numbers reflect growing demand from investors seeking stability amid geopolitical tensions and currency concerns.

Why Precious Metals Hold Value

Gold’s durability is unmatched. It doesn’t rust, corrode, or degrade, making it an ideal asset for long-term wealth transfers. Unlike fiat currencies, which governments can print at will, the global gold supply grows by only about 1% annually. This scarcity helps maintain its value.

Gold also acts as a hedge against hyperinflation and currency devaluation. During economic crises, it’s often the first asset people turn to for preserving purchasing power. Central banks understand this well. As of August 2024, the U.S. held the largest gold reserves globally, totaling 8,133.5 tons. Emerging markets have also been increasing their gold reserves to shield themselves from economic instability. Interestingly, since the mid-2020s, gold began defying its traditional inverse relationship with real interest rates and the U.S. dollar, rising even as rates stayed high.

Other metals bring their own advantages. Platinum, for instance, is much rarer than gold, with lower annual mining output, leading to greater price swings. In early 2025, as gold prices peaked, platinum gained 44%. Palladium, essential for catalytic converters, sees roughly 80% of its global supply used for this purpose. Meanwhile, rhodium, priced at about $14,000 per ounce in June 2022, remains one of the rarest metals with specialized industrial applications.

| Metal | Primary Value Driver | Considerations |

|---|---|---|

| Gold | Safe-haven demand, inflation hedge | Low volatility, high liquidity, storage costs |

| Silver | Industrial demand (electronics, solar) | Higher volatility, dual industrial role |

| Platinum | Automotive catalysts, rarity, jewelry | Geopolitical mining concentration |

| Palladium | Catalytic converters, electronics | Industrial demand shifts, supply concentration |

Rare Coins as Investments

Rare coins combine the intrinsic value of precious metals with historical significance, offering a dual layer of asset protection. Unlike bullion, which is valued solely by weight and purity, rare coins carry premiums based on their rarity, condition, and historical importance. This sets them apart as both collectibles and investments.

Recent data highlights their strong performance. Over the last decade, rare coins have seen a 175% increase in value. In March 2025, the rare coin market reported a 20% annual gain – double the 10% rise in gold bullion over the same period. These returns reflect growing interest from wealthy investors seeking diversification and privacy through private sales. Rare coins offer resilience by blending precious metal value with collectible appeal.

Scarcity plays a big role in driving premiums. For example, in June 2021, a 1933 Double Eagle gold coin sold for $18.9 million at Sotheby’s, setting a record. Most of these coins were melted down after the Gold Reserve Act of 1934. Similarly, a 1794 Flowing Hair Silver Dollar, considered the first silver dollar minted in the U.S., fetched $7.86 million in 2021, with only 120–130 examples surviving from the original 1,758 minted. Another standout: a 1913 Liberty Head Nickel, one of just five known, sold for $4.2 million in 2022.

Professional grading is key in this market. Coins are evaluated on a 1 to 70 scale, with higher grades – like "Mint State" (MS70) – commanding higher prices. Trusted third-party grading services, such as the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Company (NGC), authenticate coins and protect against counterfeits.

Mint marks, such as "W" for West Point or "D" for Denver, also influence rarity and value. To maintain their value, it’s important to keep sales receipts, original packaging, and certificates of authenticity separate from the coins themselves. Rare coins, unlike many other collectibles, don’t require climate-controlled storage, though careful handling is crucial.

Storing Precious Metals and Coins Securely

Proper storage is as important as the assets themselves. High-value collections often require specialized insurance beyond standard homeowner policies. Precious metals, in particular, need independent insurance since they fall outside traditional investor protections.

Storage options include home safes and third-party depositories. While home storage offers immediate access, it demands robust security systems. Professional depositories, on the other hand, charge fees – typically around $100 annually. For precious metal IRAs, management fees range from $75 for accounts under $100,000 to $125 for larger accounts, with some firms requiring a minimum purchase of $10,000.

Professional vaults provide added security but come with their own considerations. For instance, FINRA cautions:

"Storage charges, price fluctuations and the use of investor loans to finance the purchase of metal bars, bullion or coins are just a few of the risks associated with an investment in physical precious metals".

Morgan Stanley also notes:

"Physical precious metals are non-regulated products… SIPC insurance does not apply to precious metals or other commodities".

Maintaining a clear chain of custody is critical for resale. Removing bullion from recognized vault systems, such as those accredited by the LBMA, can require costly re-assaying before it can re-enter the professional market. Some refiners, like Argor-Heraeus, use holographic technology on kinebars to deter counterfeiting. However, even large gold bars face forgery risks from tungsten-filled cavities due to tungsten’s nearly identical density to gold.

Annual appraisals ensure insurance coverage matches the current market value. Using discreet smart tags on collectibles can help track them in case of theft. It’s also wise to obtain a written risk disclosure statement and verify the credentials of any salesperson before making purchases. Lastly, avoid financing physical metals on margin, as such loans carry interest and the risk of margin calls if values drop. Factoring in costs like insurance, storage, and potential re-assaying fees is essential for accurately calculating your break-even point.

Combining Alternative Investments with Offshore Asset Protection

Pairing alternative investments like art, wine, and rare coins with offshore structures adds a layer of legal protection. These setups aren’t just about moving assets internationally – they create barriers that shield wealth from creditors, lawsuits, and unwanted attention. When done correctly, they safeguard physical assets and enhance privacy.

Timing is everything. As White and Bright, LLP emphasizes:

"Asset protection trusts must be set up and funded before litigation is on the horizon".

Attempting to move assets after legal trouble arises could lead to fraudulent transfer claims, jeopardizing the entire strategy. That’s why proactive planning is critical for those with valuable alternative investments. Let’s explore how offshore structures work in tandem with these assets to provide robust protection.

Using Offshore Structures for Alternative Assets

Offshore trusts and entities offer specific advantages for holding physical assets. For example, irrevocable offshore trusts in debtor-friendly jurisdictions transfer legal ownership, shielding assets from U.S. judgments and creditor claims. These trusts often remain private, avoiding public records and bypassing probate, which helps keep high-value collections confidential.

Freeports – specialized storage facilities at shipping ports – provide another layer of protection. By storing art or wine in freeports, these assets remain outside the tax jurisdiction of any single country. Abigail Bogli, Associate at Quarles, explains:

"Freeports (storage facilities at specific shipping ports), resulting in art remaining outside of any country’s tax jurisdiction, meaning the investor would avoid taxes associated with the art, such as capital gains, sales tax or import duties".

This approach can defer or even eliminate certain taxes while preserving the asset’s provenance. For those wanting to display their art at home, leaseback provisions offer a creative workaround. By transferring art to an irrevocable trust and paying fair market lease payments, owners can keep the art on display while removing it from their taxable estate.

Family limited liability companies (LLCs) or limited partnerships are also valuable tools. These entities allow centralized management of various assets – art, wine, coins – under one structure, which an offshore trust can then own for added security.

Here’s a breakdown of how offshore structures benefit different asset classes and the risks they address:

| Asset Class | Offshore Structure Benefit | Primary Risk Mitigated |

|---|---|---|

| Fine Art | Freeports and irrevocable trusts | Import duties, sales tax, public probate |

| Fine Wine | Bonded storage and LLC ownership | Tax liability and provenance issues |

| Rare Coins | Private vaulting within offshore trusts | Creditor seizure and public disclosure |

| Collectibles | Family limited partnerships | Estate tax exposure and fractional disputes |

However, challenges exist. Many corporate trustees are hesitant to hold illiquid assets like art or wine because these don’t align with Modern Portfolio Theory’s emphasis on liquidity and diversification. Matthew F. Erskine, Managing Partner at Erskine & Erskine, notes:

"Holding an illiquid asset like art will not meet all of [Modern Portfolio Theory] criteria, so requires drafting in specific exemptions to this fiduciary duty".

Trust documents must explicitly allow trustees to hold such assets without violating fiduciary responsibilities.

Steps to Add Alternatives to Your Portfolio

Incorporating these strategies into your wealth plan strengthens your portfolio against market volatility. Here’s a practical guide:

- Set up the offshore structure first. Choose a jurisdiction with strong asset protection laws, such as the Cook Islands or the Cayman Islands, and establish an irrevocable trust or offshore LLC before any legal claims arise to avoid fraudulent transfer issues.

- Conduct thorough due diligence. Verify the "title, recognition, and liquidity" of any asset before purchase. For art, confirm authenticity and provenance through experts. For wine, ensure proper storage in bonded facilities. For coins, use third-party grading services like PCGS or NGC.

- Transfer ownership to the structure. Once the offshore entity is set up and the asset vetted, transfer legal ownership. Store physical assets in freeports or bonded warehouses, and keep detailed records like sales receipts and certificates of authenticity for insurance and future transactions.

- Secure appropriate storage. Freeports offer tax advantages but may limit immediate access. Bonded facilities ensure proper climate control for wine, while professional vaulting protects rare coins from seizure.

- Get regular appraisals. The IRS requires appraisals for art or collectibles valued over $3,000 for estate purposes and over $5,000 for charitable donations. For art worth more than $20,000, photo documentation is also necessary. Regular appraisals ensure accurate insurance coverage and tax compliance.

- Diversify within the asset class. Spread your investments across different artists, wine regions, or coin types to reduce the impact of market downturns on your collection.

- Plan for illiquidity. These investments are long-term by nature. Allocate only funds you won’t need in the short term.

- Address tax considerations. In the U.S., collectibles are taxed at a higher long-term capital gains rate of 28%, compared to 20% for securities. Freeports and bonded storage can help defer taxes, but careful planning is crucial. Eric Croak, CFP and President of Croak Capital, advises:

"Taxes and regulations are the fine print where most people get burned".

Working with Professional Advisors

Navigating the complexities of alternative investments and offshore structures requires expert guidance. Tax laws, fiduciary duties, and asset-specific risks demand advisors who understand both the asset class and offshore legal frameworks.

Work with professionals who specialize in the tax treatment of collectibles and offshore trust law. Qualified IRS appraisers can ensure your documentation meets regulatory standards. Additionally, trust documents should include specific exemptions allowing trustees to hold illiquid assets without breaching fiduciary responsibilities.

Conclusion: Building a Wealth Preservation Strategy

Key Takeaways

Alternative investments can serve as effective safeguards against market swings and economic instability. For instance, art has shown impressive long-term performance, while fine wine prices surged by 146% over the decade ending in Q4 2023. These types of assets generally have a low correlation with traditional stocks and bonds, making them a solid option for diversifying and protecting wealth during uncertain times.

The trend toward alternative investments is gaining traction, especially among institutional investors – 86% of them now include alternative strategies in their portfolios. This growing acceptance underscores the role of tangible assets as practical financial tools.

Experts suggest allocating 3% to 10% of your portfolio to these assets, treating them as "satellite" holdings that complement rather than replace traditional investments. However, because these assets are often illiquid, a holding period of 5 to 15 years is recommended to ride out market cycles effectively. It’s also important to factor in costs like storage, insurance, and the 28% U.S. tax rate on collectibles, as these can eat into your returns if not managed carefully.

For added protection and tax advantages, pairing these assets with offshore structures can be a smart move. Tools like irrevocable trusts can help shield collections from creditors and defer certain taxes. But due diligence is critical – ensure you verify provenance, maintain thorough documentation, and account for all related costs. As Tricia Heuring, Curator at RBC Wealth Management, notes:

"Art can be an asset that appreciates over time, diversifies a portfolio and serves as a tangible store of value. However, its real power goes beyond financial returns".

These strategies provide a strong foundation for taking meaningful steps toward preserving your wealth.

Next Steps

Wealth preservation is a complex process that requires expert advice on tax, legal, and fiduciary matters. Reach out to Global Wealth Protection for personalized consultations and tailored solutions. Whether you’re looking into offshore trusts, private U.S. LLCs, or broader internationalization strategies through the GWP Insiders membership program, their advisors can help ensure your approach stays compliant and effective. Regular annual reviews are crucial to keeping your strategy aligned with evolving market conditions and personal goals. With the right plan in place, your wealth can be positioned for steady growth, no matter what economic challenges arise.

FAQs

What tax considerations should I know about when investing in alternative assets like art and wine?

Investing in assets like art and wine brings some unique tax rules that you’ll want to keep in mind. For starters, profits from selling these items are usually hit with capital gains taxes, and the rate you pay depends on how long you’ve held the asset. If you’ve owned it for more than a year, you might qualify for long-term capital gains rates, which are often lower. But here’s the catch: art and wine fall under the collectibles category, which can come with a higher maximum tax rate than other types of investments.

On top of that, costs tied to these investments – like insurance, storage fees, or commissions – can influence your taxable gains. In some situations, especially if the assets are part of a business activity, these expenses might even be deductible. Given how tricky these tax rules can get, working with a tax professional is a smart move. They can help you navigate IRS regulations and fine-tune your tax strategy for investments like these.

How do offshore structures help protect alternative investments like art and wine?

Offshore structures, like trusts and accounts, offer an added layer of legal and financial protection for alternative investments. These setups are often created in jurisdictions with laws that favor asset protection, making it harder for creditors or legal claims to reach the assets they hold. On top of that, they provide greater privacy by keeping ownership details out of public records.

For example, offshore trusts can help investors shield assets such as fine art, rare wines, and other valuables from risks like economic turbulence, legal challenges, or market instability. Many of these trusts are designed to be irrevocable, which further restricts creditor access. Popular locations for these trusts – like the Cook Islands or the Cayman Islands – are well-known for their strong asset protection laws.

For high-net-worth individuals, these offshore structures are a strategic approach to preserving wealth, maintaining confidentiality, and safeguarding investments for future generations.

What should I consider when storing and insuring rare coins and precious metals?

When it comes to storing and insuring rare coins and precious metals, security and proper documentation should top your priority list. For storage, consider specialized safes, vaults, or professional depositories. These options provide strong protection against theft, damage, or loss, ensuring your assets remain safe and retain their value over time.

Equally important is insurance. Partner with insurers who have experience in rare coins and precious metals to get the right coverage. Factors like appraised value, condition, and authenticity play a big role in determining your policy. Accurate appraisals and thorough documentation are essential – not just for insurance but also for future resale opportunities.

Finally, maintain detailed records of your purchases, appraisals, and insurance policies. These records simplify asset management and ensure you’re ready for any transactions down the line. By focusing on these steps, you can safeguard your investments and ensure their longevity.