Managing wealth as a digital nomad can be tricky. With assets spread across countries, you’re exposed to risks like lawsuits, tax complications, and economic instability. This guide outlines practical steps to safeguard your finances, including:

- Offshore Bank Accounts: Protect funds in stable jurisdictions like Switzerland or Singapore.

- US LLCs: Use private LLCs for liability protection and tax advantages.

- Offshore Companies: Consider Anguilla or Nevis for privacy and asset shielding.

- Trusts and Foundations: Structuring offshore trusts (e.g., Cook Islands) or private foundations for high-level protection.

- Diversify Assets: Spread wealth across currencies and countries to reduce risks.

- Digital Asset Protection: Secure cryptocurrencies and intellectual property with vaults and multi-signature wallets.

- Insurance: Get international health, liability, and equipment coverage.

- Powers of Attorney: Assign trusted individuals to manage your affairs globally.

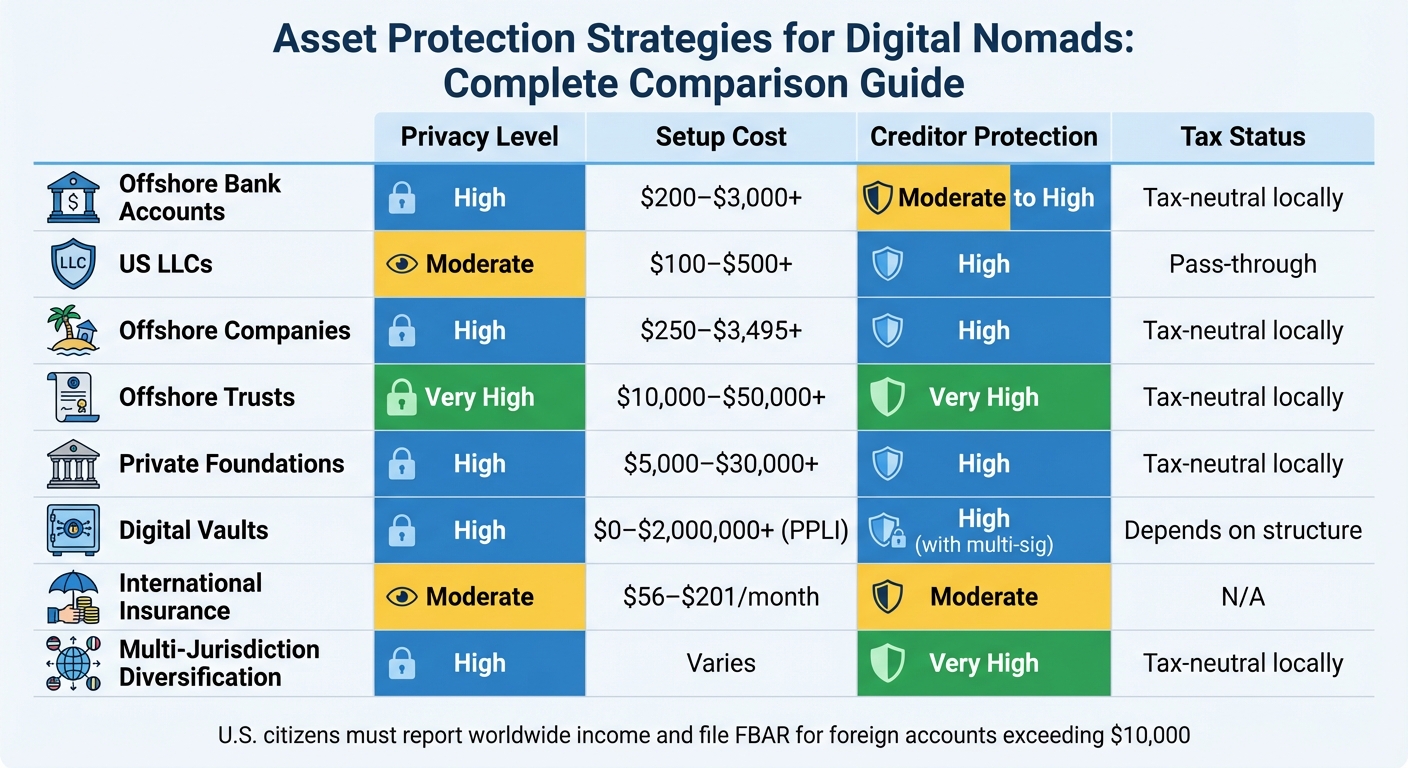

Quick Comparison

| Strategy | Privacy Level | Setup Cost | Creditor Protection Strength | Tax Neutrality |

|---|---|---|---|---|

| Offshore Bank Accounts | High | $200–$3,000+ | Moderate to High | Yes |

| US LLCs | Moderate | $100–$500+ | High | Pass-through |

| Offshore Companies | High | $250–$3,495+ | High | Yes |

| Trusts | Very High | $10,000–$50,000+ | Very High | Yes |

| Digital Vaults | High | Varies | High | Yes |

Protect your wealth before risks arise – early planning is key.

1. Open Offshore Bank Accounts in Stable Jurisdictions

Opening an offshore bank account can help safeguard your assets from domestic enforcement actions. When your money is held in an offshore account, domestic court orders, such as liens or judgments, don’t automatically apply. Offshore jurisdictions often ignore foreign rulings, meaning creditors must take legal action in the jurisdiction where the account is held – a process that can be both expensive and time-consuming. Let’s dive into some key jurisdictions and what they offer.

Switzerland has long been synonymous with financial privacy and stability, thanks to over 300 years of confidentiality laws. Swiss bankers who breach these laws can face up to six months in prison and fines of up to 50,000 Swiss francs. That said, private banking in Switzerland typically requires deposits ranging from $1,000,000 to $3,000,000. Singapore offers a similar level of institutional security, supported by cutting-edge technology. However, opening an account in Singapore often requires a minimum deposit of $200,000 and an in-person visit.

For those looking for more accessible options, the Isle of Man caters specifically to expats and non-residents, offering lower minimum deposits and the convenience of 100% remote account opening. Georgia has become a popular choice for its speed – accounts can often be opened in just one day. Meanwhile, the Cayman Islands provides a tax-neutral environment with strong confidentiality protections enshrined in its banking laws.

Privacy Level

Offshore accounts also offer a higher degree of privacy. They keep your name out of domestic public records, reducing your visibility to potential litigants. While global initiatives like FATCA and the Common Reporting Standard have chipped away at traditional banking secrecy, offshore accounts still provide significantly more privacy than domestic ones. Switzerland and Singapore lead the way in privacy, while jurisdictions like Germany, though modern, offer only moderate levels of confidentiality.

Setup Costs

To open an offshore account, you’ll need to provide documents such as a passport, proof of residence, and evidence of wealth to comply with anti-money laundering regulations. In Austria, private banking generally requires deposits between $250,000 and $300,000. Some premium banking services, like HSBC Premier, waive monthly fees if specific balance requirements are maintained. Keep in mind that remote account opening may involve additional administrative fees and paperwork compared to opening an account in person.

Creditor Protection Strength

Jurisdictions like Nevis and the Cook Islands are particularly strong when it comes to creditor protection. These regions do not recognize foreign court orders, and creditors must meet a much higher burden of proof – "beyond a reasonable doubt" – as opposed to the lower "preponderance of evidence" standard used in U.S. civil cases. On the other hand, Germany, despite its reputation for safe banking, enforces foreign judgments, making it less suitable for asset protection.

Tax Neutrality

The Cayman Islands is a standout jurisdiction for tax neutrality, offering a financial environment free of income, capital gains, and corporate taxes. However, U.S. citizens are still required to report foreign accounts exceeding $10,000 through the FBAR (FinCEN Form 114) and may need to file IRS Form 8938 for larger balances. Offshore accounts also allow you to hold multiple currencies – like Swiss Francs or Euros – which can act as a hedge against domestic currency fluctuations. For instance, the U.S. dollar saw a decline of over 10% against the DXY in early 2025, marking its worst six-month performance since 1973. This tax-neutral framework makes offshore accounts a powerful tool for protecting and preserving your wealth.

2. Form a Private US LLC for Privacy and Domestic Protection

A private US LLC is a smart way for digital nomads to protect their assets without the complications of offshore setups. By keeping your business and personal finances separate, you create a legal shield that helps safeguard your personal assets from business-related risks. As Jimmy Sexton, LL.M., CEO of Esquire Group, puts it:

"US LLCs offer all the same advantages as traditional offshore companies – limited liability, no tax, etc. – to freelancers and digital nomads at a fraction of the cost."

Here’s a closer look at the privacy, cost, creditor protection, and tax advantages of forming a private US LLC.

Privacy Level

Some states, like Wyoming, offer strong privacy protections for LLC owners. While basic information must be filed during setup, Wyoming’s framework ensures your personal identity remains largely confidential. This makes it a great option for both US-based and international entrepreneurs looking for added discretion. It is often used alongside other tax and residency solutions for digital nomads. Additionally, Wyoming has minimal maintenance requirements, making it an appealing choice for digital nomads.

Setup Costs

Setting up a US LLC is relatively budget-friendly compared to offshore options. Most states charge around $100 for the initial filing, though some, like Massachusetts, charge higher fees – up to $500 for the Certificate of Organization. You’ll also need a registered agent to handle legal documents. While you can act as your own agent in some states, hiring a commercial service typically costs an annual fee. For ongoing costs, Massachusetts requires a $500 annual report fee, whereas other states have much lower fees. The process is straightforward, with online filing options making it quick and easy.

Creditor Protection Strength

US LLCs provide a strong layer of protection for your personal assets against business liabilities. They also limit creditors’ access to the LLC’s assets through charging orders, which allow creditors to collect distributions without gaining control of the LLC itself. States like Wyoming, Nevada, and South Dakota offer even stronger protections, extending these benefits to single-member LLCs. For digital nomads facing international risks, this level of creditor protection is invaluable. Just remember to keep your personal and business finances completely separate to maintain these safeguards.

Tax Neutrality

Single-member LLCs are treated as "disregarded entities" for tax purposes, meaning income passes directly to your personal tax return and avoids double taxation, a key part of digital nomad taxes. For US residents, LLC income is subject to the standard self-employment tax of 15.3%. However, if you’re a non-US resident providing services outside the US, your income generally isn’t classified as US-source income, which means you avoid US income taxes. This pass-through tax structure simplifies the process while still offering the legal protections of an LLC.

3. Set Up an Offshore Company in Anguilla

If you’re exploring offshore strategies, forming a company in Anguilla might be worth considering. As a British Overseas Territory governed by English Common Law, Anguilla offers a blend of privacy, asset protection, and tax advantages. Thanks to its ACORN system, setting up a company can be completed in just 24 hours. Whether you choose an International Business Company (IBC) or a Limited Liability Company (LLC), both structures – discussed earlier for other jurisdictions – can be tailored to suit professionals managing international income streams. This jurisdiction’s efficiency lays the groundwork for its strong privacy measures, which are outlined below.

Privacy Level

One of Anguilla’s standout features is its commitment to privacy. Here, the names of owners, managers, officers, directors, or shareholders are not required to be filed with the Commercial Registry. This ensures that such details remain confidential. Additionally, IBCs in Anguilla are not obligated to publicly disclose financial accounts or records. For those seeking even more anonymity, the jurisdiction allows the use of nominee directors and officers, as well as bearer membership certificates. Offshore Protection highlights this advantage:

"Information about the company’s shareholders and directors is not required to be filed with the Anguilla Commercial Registry. Consequently, their information is not available as part of the public record."

Setup Costs

Establishing an offshore company in Anguilla is relatively affordable. Incorporation fees for an IBC start at around $250, while forming an LLC costs approximately $1,495. Full-service packages, which include incorporation and additional support, are available for about $3,495 in the first year. If you need assistance opening an offshore bank account, expect to pay around $350. For those seeking comprehensive management solutions, packages that include formation, bank account setup, registered agent services, nominee arrangements, and power of attorney services cost about $2,495 annually. Optional services like virtual office support are also offered at competitive rates.

Creditor Protection Strength

Anguilla’s LLC structure is particularly effective for protecting assets from creditors. OffshoreCorporation.com explains:

"Anguilla LLC law offers superior asset protection to corporation or LLC law of other jurisdictions."

Under its charging order regime, creditors are limited to distribution rights. This means they cannot seize company assets or gain voting rights – only a right to distributions. Furthermore, Anguilla courts do not recognize foreign judgments, requiring creditors to file new legal actions within the jurisdiction to pursue claims. For enhanced protection, many high-net-worth individuals pair an Anguilla LLC with a Cook Islands Trust as the owning entity. This combination not only fortifies asset protection but also supports long-term wealth preservation.

Tax Neutrality

Anguilla is a tax haven for offshore entities, imposing no corporate, income, capital gains, estate, profit, or inheritance taxes on foreign-sourced income. Additionally, there are no annual accounting or financial reporting requirements. While this tax-neutral environment ensures your company’s profits are untouched by local taxation, you will still need to meet tax obligations in your country of residence. For digital nomads with diverse international income streams, this setup simplifies wealth management and helps retain more capital for reinvestment or personal use.

4. Create an Offshore Trust for High-Net-Worth Protection

If you’re a digital nomad with considerable assets, an offshore trust can offer one of the most robust forms of legal protection. By transferring the legal ownership of your assets to a foreign trustee, you can shield your wealth from domestic courts. Countries like the Cook Islands, Nevis, and Belize are particularly appealing for this purpose because they do not recognize foreign court judgments. These trusts add another layer of defense to your wealth protection strategy.

As Nomad Capitalist puts it:

"If you are looking for the strongest possible level of asset protection, an offshore trust is the only way to go."

This setup makes it significantly harder for creditors to pursue claims. They would need to restart their legal efforts in the offshore jurisdiction, which is often expensive and unlikely to succeed. The process of refiling a case in these jurisdictions can be both time-consuming and cost-prohibitive for creditors.

Privacy Level

Offshore trusts also provide a high degree of privacy. Jurisdictions like Nevis and the Cook Islands have minimal reporting requirements, which can help protect your financial information. However, U.S. citizens are still required to comply with IRS regulations. This means filing forms like FBAR, FATCA, and IRS Form 3520 every year.

Setup Costs

Setting up an offshore trust is not cheap. Initial legal fees can range from $10,000 to $50,000, depending on the jurisdiction. For example, a Cook Islands trust, often considered the most secure option, costs around $29,000 to establish[8,37]. There are also ongoing expenses, such as trustee services, registered agent fees, and compliance costs. Nevis offers comparable protection at a lower cost, but creditors attempting to file a claim there must first post a $100,000 bond with the Ministry of Finance.

Creditor Protection Strength

Offshore trusts are particularly effective at protecting assets from lawsuits. With 55% of U.S. businesses facing more than five lawsuits annually and only 18% avoiding lawsuits altogether, this kind of protection is crucial. In Nevis, for example, creditors must meet the very high standard of proving their case "beyond a reasonable doubt", which is typically reserved for criminal cases rather than civil disputes. In addition, these jurisdictions impose short statutes of limitations – often just one to two years – for fraudulent transfer claims. This means legal avenues for creditors may close before domestic lawsuits even conclude.

As Nomad Capitalist vividly describes:

"Offshore trusts are the legal equivalent of a brightly-coloured jungle creature bristling with large venomous spines. Litigators see them and immediately back away."

A common strategy is to pair an offshore trust with a Nevis LLC. In this arrangement, the trust owns the LLC, while you retain control over its day-to-day operations.

Tax Neutrality

While asset protection is the primary goal, tax implications are also important to consider. Offshore trusts are typically tax-neutral in their home jurisdictions, meaning they aren’t subject to local income, capital gains, or inheritance taxes. However, U.S. citizens are still taxed on their worldwide income, regardless of where the trust is located. It’s important to note that these trusts are designed for legal asset protection and privacy – not for avoiding taxes. To ensure the trust is effective, establish it well in advance of any legal threats. Transfers made after litigation begins could be reversed as fraudulent conveyances. For the best results, work with a non-U.S. trustee to keep the trust outside the reach of U.S. courts.

5. Use Private Interest Foundations for Added Privacy

A private interest foundation functions much like a trust, offering a way to legally separate yourself from your assets. For digital nomads, these foundations act as a protective layer, keeping assets out of direct reach from creditors. They’re particularly useful for transferring cash, investments, and property to foreign jurisdictions where they can be safeguarded against domestic lawsuits or political uncertainty.

By placing assets in multiple countries, foundations help reduce geopolitical risks. This makes them an effective tool for international estate planning and ensuring business continuity.

Privacy Level

Foundations provide a strong degree of privacy by holding assets under their name instead of yours, making it more challenging for creditors to trace ownership. However, global regulations like FATCA and CRS require disclosure to tax authorities. While they shield assets from public scrutiny and creditors, they don’t offer complete anonymity from the IRS.

Setup Costs

Setting up a foundation comes with considerable expenses. You’ll face one-time costs for legal services, trustee arrangements, and registered agent fees. Offshore foundations tend to be pricier due to stricter privacy protocols. Additionally, there are ongoing costs for trustee services, legal support, and compliance.

Creditor Protection Strength

Foundations can effectively block creditors by requiring them to pursue claims in the foundation’s local jurisdiction. This process is both costly and time-consuming. However, it’s crucial to establish the foundation well before any legal threats arise. Late setups could be challenged as fraudulent conveyances.

Tax Neutrality

Most foundations operate as tax-neutral entities in their home jurisdictions, meaning they don’t incur local income, capital gains, or inheritance taxes. That said, U.S. citizens are still required to report worldwide income and comply with FBAR, FATCA, and other reporting obligations. Foundations are designed to protect assets, not dodge taxes, so it’s essential to consult local estate attorneys to ensure your strategy aligns with regional laws.

Up next, we’ll explore ways to secure and manage your digital portfolio efficiently.

6. Spread Assets Across Multiple Jurisdictions and Currencies

Expanding on strategies like offshore banking and legal entities, distributing your assets across multiple jurisdictions adds another layer of financial protection. Concentrating all your wealth in a single country exposes you to greater risks. For digital nomads, jurisdictional diversification acts as a legal shield, making it far more challenging for creditors to access your assets. To pursue claims, creditors would need to initiate legal actions in each jurisdiction separately, which significantly drives up their costs and delays the process. This approach not only complicates creditor claims but also protects your wealth from country-specific financial crises.

Diversifying also guards against institutional failures. The collapses of Silicon Valley Bank and Signature Bank in 2023, along with a dramatic >10% drop in the US dollar against the DXY index in early 2025, highlight how even robust financial systems can stumble. Holding assets in multiple currencies – such as Swiss francs, euros, or even gold – can help safeguard your wealth from the impact of any single currency’s devaluation.

"By placing assets in foreign locations with favorable laws, you make it much harder for others to get to your money." – The Nestmann Group

Many offshore banks now offer multi-currency accounts, giving you the ability to shift your holdings as market conditions change. This flexibility becomes critical when one currency weakens while others gain strength. Additionally, if one account faces issues – like being frozen due to regulatory scrutiny – you still retain access to funds elsewhere. Beyond currency risk management, this diversification further complicates efforts by creditors to seize your assets.

Creditor Protection Strength

Using multiple jurisdictions creates formidable legal barriers, as shown by the numbers. In 2023 alone, approximately 5 million lawsuits were filed in the United States, with 55% of US businesses reporting more than five legal cases against them within a single year. For creditors, pursuing assets in jurisdictions such as Nevis or the Cook Islands is notoriously difficult. These countries do not recognize US court judgments, requiring plaintiffs to re-litigate their cases locally under stricter legal standards. The increased costs and complexity of navigating different legal systems often discourage creditors from proceeding at all.

Tax Neutrality

It’s important to note that spreading assets internationally doesn’t eliminate your tax obligations, especially if you’re a US citizen. The US taxes worldwide income, no matter where your assets are held. If your foreign accounts exceed $10,000 at any point during the year, you’re required to file FBAR (FinCEN Form 114), and you must also report foreign holdings on IRS Form 8938. The goal here isn’t tax avoidance – it’s about creating legal separation between you and your assets while staying fully compliant. To ensure these structures hold up, set them up well in advance of any legal troubles. Transfers made during or after a lawsuit can be reversed as fraudulent conveyances.

sbb-itb-39d39a6

7. Protect Digital Assets with Inventory and Digital Vaults

Think of digital vaults as the digital equivalent of offshore bank accounts or LLCs – they safeguard your intangible wealth. For digital nomads, wealth often takes non-physical forms like cryptocurrencies, NFTs, domain names, monetized blogs, and loyalty points. Without proper documentation, these assets can be lost in cases of incapacity or death. The first step to protecting them is creating a thorough inventory. Organize your digital, business, personal, and social assets into clear categories. This inventory becomes the backbone of a broader strategy that includes advanced digital vaults.

"Many people don’t fully appreciate that digital assets are different animals from traditional assets such as bank accounts."

– Colin Korzec, Head of Trust and Estate Settlement Services, Bank of America Private Bank

Once your inventory is in place, secure these assets using digital vaults with strong protection features. For example, non-custodial wallets like Guarda or Exodus offer multi-signature support, which lets you maintain control over your private keys. Multi-signature security splits signing authority among multiple parties – such as yourself, an offshore trustee, and a third-party vault provider. This setup ensures that even if you’re forced to surrender your keys, you can demonstrate that control is shared.

For high-value assets, cold storage (offline storage) is a must. It protects against hacking and other cyber threats. Avoid keeping substantial holdings on U.S.-based exchanges, as they are vulnerable to domestic subpoenas and court-ordered freezes. Instead, consider cold storage managed by an independent legal entity. Keep your asset inventory and access credentials stored separately for added security.

Offshore digital vaults offer an extra layer of privacy by keeping asset details out of public records and beyond the reach of domestic court subpoenas. When combined with entity ownership, they provide even greater protection. While many software wallets are free to download, setting up protective legal structures often requires professional help. For instance, Private Placement Life Insurance (PPLI) typically requires a minimum investment of $2 million, making it a choice for ultra-high-net-worth individuals. Pairing multi-signature wallets with offshore trusts creates a legal barrier that creditors find almost impossible to breach. In jurisdictions like the Cook Islands or Nevis, U.S. judgments are not recognized, forcing creditors to re-litigate under stricter local standards.

It’s important to note that while digital vaults can shield assets from creditors, they don’t protect against the IRS. U.S. citizens are required to report worldwide income, no matter where their digital assets are stored. If your foreign accounts, including digital wallets held through offshore entities, exceed $10,000 at any point during the year, you must file an FBAR (FinCEN Form 114) and report holdings on IRS Form 8938. Also, moving digital assets into protective structures after a lawsuit has been filed can be undone as a fraudulent conveyance.

8. Get International Insurance Coverage

Insurance is a crucial piece of the puzzle when it comes to protecting your assets internationally. While legal and banking strategies are essential, they often leave gaps that insurance can fill. For digital nomads, domestic policies usually fall short. Depending on your needs, you might opt for travel medical insurance to handle short-term emergencies or international health insurance for ongoing care.

For example, SafetyWing offers two plans tailored to travelers. Their Essential plan costs about $56 every four weeks for individuals aged 18–39, covering over 180 countries with a $250,000 medical limit and $100,000 for evacuation expenses. If you need more comprehensive coverage, their Complete plan includes wellness visits and mental health services, priced at around $162 per month. Another option, World Nomads, provides a Standard Plan for approximately $549, covering a 180-day trip for a 30-year-old. This plan also includes coverage for over 150–300 adventure sports that typical policies often exclude. Additionally, AXA Global Healthcare reported that between January and November 2024, they processed 82.1% of eligible claims submitted online within two days.

"Travel insurance won’t pay for everyday or preventative care… It’s for medical emergencies."

– World Nomads

If you’re a digital nomad, you also need to think about protecting your tech and equipment. World Nomads, for instance, covers personal items like laptops and cameras against theft or transit damage, though the payout per item is usually capped at $500–$1,000, depending on your plan. However, equipment owned by a business entity is typically excluded, so it’s important to check the fine print. To streamline claims, keep scanned receipts stored securely in a digital vault. Some plans, such as those offered by Heymondo, also include personal liability insurance, which can protect you if you accidentally injure someone or damage property while abroad. Combining these types of coverage ensures you’re prepared for emergencies and asset-specific risks.

Setup Costs

If you’re looking for affordable options, travel medical insurance starts at around $56 every four weeks with SafetyWing (excluding U.S. coverage). For more comprehensive international health plans, IMG Global’s Bronze Plan costs about $201 per month for a 30-year-old. Genki offers subscription-based plans starting at €48.30 per month. For individuals with significant assets, Private Placement Life Insurance (PPLI) can provide liquidity for estate planning, covering foreign probate fees and inheritance taxes without requiring asset sales. However, PPLI typically requires a minimum investment of $2,000,000.

Creditor Protection Strength

Insurance isn’t just about health or travel – it can also serve as a shield against lawsuits. Umbrella liability policies, for instance, offer additional coverage beyond standard limits and can even help cover international attorneys’ fees. PPLI, when set up in advance, can provide robust creditor protections, but it must be established proactively to avoid any legal complications related to fraudulent transfers.

9. Prepare International Powers of Attorney

For digital nomads juggling assets in multiple countries, having a power of attorney (POA) is a smart move. A POA gives a trusted individual the authority to handle your financial, legal, or health-related matters when you’re not physically present. If you’re managing assets across borders, a durable POA is particularly important, as it ensures your agent can act on your behalf even if you become incapacitated. Without it, you could face legal hurdles like court-appointed guardianship, which the Consumer Financial Protection Bureau describes as "lengthy, expensive, and very public."

To make things easier, consider appointing an agent located near your primary assets, especially for tasks that require in-person attention. If you own significant assets in different countries, separate POAs tailored to each jurisdiction might be necessary, as a single document may not be valid everywhere.

"A power of attorney allows you to choose who will act for you and defines his or her authority and its limits, if any."

– American Bar Association

Your chosen agent can handle a variety of responsibilities, including paying bills, managing bank accounts, negotiating with creditors, and even filing taxes. For U.S. tax purposes, you’ll need to submit IRS Form 2848 to grant your agent specific authorization. Make sure copies of your POA are on file with relevant banks and institutions, and keep your agent’s contact details easily accessible in case of emergencies.

Setup Costs

Setting up a POA is relatively affordable and much simpler than dealing with court-appointed guardianship. According to the Consumer Financial Protection Bureau, legal assistance for drafting a POA is inexpensive. Online platforms offer basic POA documents for one-time fees ranging from $99 to $199, while premium packages that include attorney support can cost up to $549. Some services also provide annual memberships for $19 to $39, which cover updates to your documents. Without a POA, however, the cost of court proceedings for guardianship can quickly drain your resources.

10. Join GWP Insiders Membership for Continued Support

For digital nomads, staying on top of international tax compliance and reforms can feel like navigating a maze. That’s where the GWP Insiders Membership steps in, connecting you with experts in CRS (Common Reporting Standard) and FATCA (Foreign Account Tax Compliance Act). This network becomes even more valuable as upcoming reforms in 2026, like those affecting Pillar Two and Net CFC-Tested Income, bring changes to offshore structures.

Members gain access to actionable strategies for establishing tax residency in jurisdictions known for their favorable tax policies, such as Panama, Cyprus, or certain parts of Eastern Europe. Additionally, the membership explores territorial taxation regimes in countries like Singapore and Malaysia, where foreign-earned income remains untaxed. Bobby Casey, Managing Director at GWP, highlights the program’s benefits:

"GWP Insiders offers strategies for international living and asset protection".

The membership also focuses on helping you document economic substance – things like hiring local employees, leasing office space, and making management decisions locally. This documentation is key for shielding offshore companies from audits or unexpected taxes. Jurisdictions like the Cook Islands, Nevis, and Belize often require such measures. By addressing these challenges, the membership ensures ongoing compliance while supporting long-term strategic planning.

Setup Costs

The GWP Insiders Membership runs on a subscription basis, with pricing available upon request. The real value lies in avoiding costly mistakes – errors in tax filings or failure to properly establish residency can lead to hefty penalties and legal troubles. As Bobby Casey puts it:

"GWP Insiders is designed to help and connect you with professionals who know how to navigate these waters".

Tax Neutrality

The support doesn’t stop at compliance. Membership advisors also dive into tax strategies, helping members identify jurisdictions with favorable tax benefits. For U.S. citizens, this includes guidance on using the Foreign Earned Income Exclusion (FEIE) to reduce federal tax liabilities. Advisors also assist in conducting preliminary Effective Tax Rate (ETR) calculations for different jurisdictions, helping you spot potential tax risks ahead of the 2026 tax changes.

Jurisdiction Comparison Table

Here’s a breakdown of privacy levels, setup costs, creditor protection, and tax neutrality across key jurisdictions:

| Jurisdiction | Privacy Level | Setup Cost | Creditor Protection Strength | Tax Neutrality |

|---|---|---|---|---|

| Cook Islands | High | $15,000 (Trust) | Very High (Gold standard) | Fully Neutral (0%) |

| Nevis | Very High (No public register) | $1,470 (LLC) / $8,000 (Trust) | Very High (requires a creditor bond) | Fully Neutral (0%) |

| Belize | High (Court order required) | $990 (LLC) / $8,000 (Trust) | High (strong on paper) | Fully Neutral (0%) |

| Anguilla | High (Non-public records) | $890 (IBC) | High (rising star) | Fully Neutral (0%) |

| Cayman Islands | High (strict banking laws) | $2,900 (Exempt Co) | High (institutional grade) | Fully Neutral (0%) |

| BVI | High | $1,500 (BC) | High (global benchmark) | Fully Neutral (0%) |

| Seychelles | High (private agent filing) | $595 (IBC) | Moderate to High (affordable) | Fully Neutral (0%) |

Nevis is particularly noteworthy for its robust protection mechanisms. Its refusal to recognize foreign judgments and the requirement for creditors to post a bond before filing claims make it a standout choice. As Sofia Meier, Head of Private Clients at CitizenX, highlights:

"the gold standard of asset protection trusts… a financial fortress that’s withstood 30+ years of legal challenges."

For those prioritizing affordability, Seychelles offers the lowest entry cost at just $595. Anguilla, on the other hand, combines reasonable fees with the reliability of a UK-based legal framework.

All jurisdictions listed maintain a 0% local tax rate on foreign-earned income. However, U.S. citizens must still report worldwide income and file an FBAR if foreign accounts exceed $10,000.

Belize has recently updated its IBC tax laws, but non-residents still enjoy a 0% capital gains tax. Setup costs vary widely – while the Cayman Islands are on the pricier side, jurisdictions like Nevis and Belize offer more budget-friendly options. Additionally, annual maintenance fees range between $590 and $2,610, with trusts incurring an extra $2,000 to $5,000 annually.

This table highlights the diverse benefits and costs of each jurisdiction, helping you craft a tailored, resilient, and cost-conscious offshore strategy.

Conclusion

For digital nomads navigating complex legal and tax systems, safeguarding your assets isn’t just a good idea – it’s essential. Protecting your wealth requires careful, proactive planning because waiting too long can leave you vulnerable.

Looking at the strategies outlined earlier, one thing becomes clear: a one-size-fits-all approach won’t cut it. Building a strong financial defense means layering strategies that are tailored to your specific needs. Your circumstances are unique, and generic solutions often crumble when tested under legal scrutiny.

Operating across multiple jurisdictions brings its own set of challenges, from compliance headaches to the risk of steep penalties. This is where expert advice becomes indispensable. Bobby Casey, Managing Director at Global Wealth Protection, emphasizes:

"Unless you prove you are tax compliant in another country, in which you have an agreement with their tax authorities, banks default to you being taxable in your country of citizenship".

Global Wealth Protection offers customized solutions to help secure your international assets. Whether you’re setting up a private US LLC, forming an offshore company in Anguilla, creating an international trust, or simply seeking clarity through a private consultation, having professional guidance ensures your protection strategies are effective – not just on paper, but in the real world.

Don’t wait – take action today to secure your financial future.

FAQs

What are the benefits of having an offshore bank account as a digital nomad?

Offshore bank accounts give digital nomads a convenient and secure way to handle their finances across borders. These accounts let you hold and transact in multiple currencies, making it simpler to receive payments, cover expenses, and transfer money without the steep fees or delays that often come with currency conversions through domestic banks.

But the benefits go beyond just convenience. Offshore accounts offer increased privacy and asset protection. By keeping your funds in a jurisdiction outside your home country, you can safeguard your wealth from potential risks like lawsuits, political upheaval, or issues within local banking systems. Plus, spreading your banking across different locations helps minimize exposure to sudden regulatory changes or currency fluctuations in any one country.

When properly established with professional advice, offshore accounts can also make tax reporting easier for digital nomads. They provide detailed records of foreign income and expenses, which can support claims for benefits such as the Foreign Earned Income Exclusion or foreign tax credits. This helps you stay compliant while enjoying greater financial flexibility.

What are the tax and asset protection benefits of setting up a private U.S. LLC as a digital nomad?

Setting up a private U.S. LLC can be a smart move for digital nomads, offering key tax benefits and operational advantages. As a "pass-through" entity, the LLC itself doesn’t pay federal income tax. Instead, profits and losses flow through to your personal tax return. This setup allows you to deduct common business expenses – like coworking space fees, travel-related internet costs, and equipment – directly from the LLC’s income. If you choose S-corporation status, only your salary is subject to self-employment tax, while remaining profits are taxed as ordinary income, potentially saving you a significant amount in taxes.

In addition to tax perks, a U.S. LLC provides personal asset protection by keeping your business liabilities separate from your personal finances. It also simplifies global operations by enabling you to invoice clients in U.S. dollars and receive payments through a U.S. bank account – eliminating the need to set up a foreign corporation. This structure can also help you avoid double taxation and make compliance with U.S. reporting requirements more straightforward, making it an appealing option for digital nomads navigating international work.

Why should digital nomads spread their assets across different countries?

Diversifying your assets across different countries is a smart move for digital nomads looking to reduce risks and strengthen their financial security. By spreading your wealth internationally, you can shield yourself from issues like economic instability, sudden changes in tax laws, or legal disputes that might arise in a single country.

This approach also boosts your privacy and adds an extra layer of protection for your assets, making it harder for creditors or other parties to access your funds. Plus, it helps ensure that your financial portfolio stays strong and adaptable, even if unexpected challenges crop up in one location. Diversification is a practical way to safeguard your financial well-being while living and working across borders.