Protecting your assets as an entrepreneur requires more than just insurance or domestic strategies. With rising lawsuits, economic uncertainty, and currency devaluation, global asset protection offers a stronger, multi-layered defense. Here’s what you need to know:

- Why it matters: The U.S. sees 96% of the world’s lawsuits, and entrepreneurs face higher risks. Economic instability, like the 2023 bank failures and a 10% drop in the U.S. dollar by 2025, further highlights the need for diversification.

- Key tools: Offshore trusts, international LLCs, and multi-jurisdictional banking help shield assets from lawsuits, creditors, and economic shocks.

- Compliance is crucial: These strategies are legal and transparent, requiring proper IRS filings like Forms 3520, 8938, and FBAR.

Quick Takeaways:

- Offshore Trusts: Set up in places like the Cook Islands or Nevis, they create barriers against lawsuits. Costs start at $20,000, with annual fees.

- International LLCs: Combine privacy and creditor protection. Nevis, for instance, requires a $100,000 bond to file lawsuits.

- Banking Diversification: Spread funds across stable jurisdictions like Switzerland or Singapore to reduce risks from domestic banking failures.

Timing is critical – set up these structures before facing legal threats. Below, we break down how these strategies work and why they’re essential for safeguarding your wealth.

Offshore Trusts for Asset Protection

An offshore trust operates under foreign laws, where you, as the Settlor, transfer assets to a Trustee based abroad to benefit designated Beneficiaries. Once the assets are transferred, they are no longer legally yours, creating a solid barrier against creditors and lawsuits.

Because these trusts operate outside U.S. jurisdiction, creditors face the daunting task of re-litigating claims in a foreign court, which can be both expensive and complicated. Features like the Event of Distress and Flight Clauses allow trustees to act independently under legal pressure or even move the trust to a safer jurisdiction if needed.

Additionally, offshore trusts provide access to global investments and banking options, while a Trust Protector can oversee the trustee’s actions.

Experts generally recommend setting up an offshore trust only if you have at least $250,000 in assets, given the costs involved. Initial setup fees range from $20,000 to $50,000, with annual maintenance costing several thousand dollars. Importantly, these trusts must be established before any legal claims arise. If done after, courts can reverse the transfer as a fraudulent conveyance.

Top Jurisdictions for Offshore Trusts

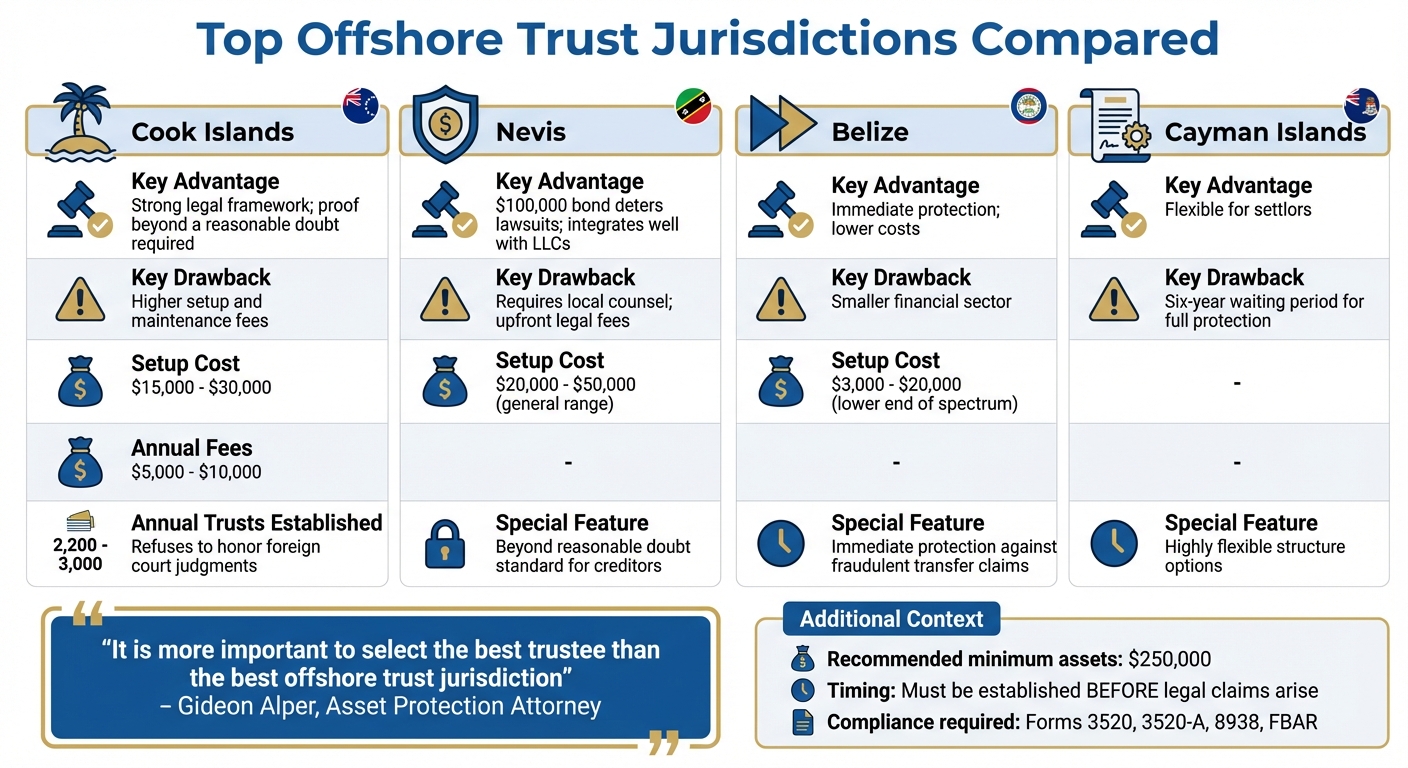

The Cook Islands, Nevis, Belize, and the Cayman Islands are among the most popular jurisdictions for offshore trusts. Each offers distinct advantages, but they also come with specific challenges.

Cook Islands

The Cook Islands is a leading choice due to its strong legal framework and refusal to honor foreign court judgments. Creditors face a high standard of proof – fraudulent intent must be proven "beyond a reasonable doubt", which is much stricter than U.S. civil cases. Between 2,200 and 3,000 trusts are established here annually.

"A Cook Islands Trust… [is] internationally viewed as a respectable trust establishment jurisdiction. This sterling reputation helps make it nearly impossible for lawyers to portray such a trust as anything but legitimate."

– Asset Protection Planners

Nevis

Nevis is known for its aggressive creditor deterrence, requiring a $100,000 bond just to file a lawsuit against a trust. It’s particularly beneficial for entrepreneurs who pair their trust with an offshore LLC, allowing them to maintain control over daily activities until legal threats arise.

Belize

Belize offers immediate protection against fraudulent transfer claims and has lower costs compared to the Cook Islands. However, its financial sector is less developed and smaller in scale.

Cayman Islands

The Cayman Islands is highly flexible for settlors but imposes a six-year waiting period before full asset protection kicks in.

| Jurisdiction | Key Advantage | Key Drawback |

|---|---|---|

| Cook Islands | Strong legal framework; proof beyond a reasonable doubt | Higher setup and maintenance fees |

| Nevis | $100,000 bond deters lawsuits; integrates well with LLCs | Requires local counsel; upfront legal fees |

| Belize | Immediate protection; lower costs | Smaller financial sector |

| Cayman Islands | Flexible for settlors | Six-year waiting period for full protection |

When choosing a jurisdiction, prioritize political stability, effective regulations, and a licensed, bonded trustee.

"It is more important to select the best trustee than the best offshore trust jurisdiction. In fact, trustee selection is the most important part of offshore trust asset protection."

– Gideon Alper, Asset Protection Attorney

Setup costs vary by location, with Cook Islands trusts ranging from $15,000 to $30,000 and annual fees between $5,000 and $10,000. Belize is a lower-cost option, with average setup fees across jurisdictions falling between $3,000 and $20,000.

How Offshore Trusts Function

Offshore trusts revolve around three main roles: the Settlor, the Trustee, and the Beneficiaries. As the Settlor, you transfer assets – such as real estate, business holdings, or investments – to the trust. The Trustee, typically a foreign professional or institution, holds legal ownership and manages the assets according to the trust deed. Beneficiaries, often you or your family, receive distributions as outlined in the trust.

Because the Trustee operates under foreign laws, U.S. court orders are not recognized. Creditors must start a new legal process in the trust’s jurisdiction, often needing to meet strict evidentiary standards like proving claims "beyond a reasonable doubt". This structure provides a strong defense against domestic legal challenges.

For added flexibility, many entrepreneurs use a "bridge" structure. For instance, a Cook Islands trust might own a Nevis LLC, which you manage for daily operations. If a legal threat arises, the Trustee can remove you as the LLC manager, cutting off creditor access. This setup balances operational control with asset security.

Protective clauses in the trust deed further enhance its resilience. The Event of Distress Clause allows the Trustee to ignore your instructions if you’re under legal pressure to repatriate funds. Meanwhile, the Flight Clause lets the Trustee relocate the trust to another jurisdiction if the current one becomes unstable. A Trust Protector can also provide oversight for added security.

Legal and Tax Requirements

For U.S. citizens, offshore trusts don’t offer tax advantages. The IRS taxes U.S. persons on their worldwide income, regardless of where the trust is located. If the trust has a U.S. beneficiary, the Settlor remains responsible for taxes on the trust’s income. This means the real value of an offshore trust lies in protecting assets, not in reducing taxes.

To comply with U.S. law, several forms must be filed annually:

- Form 3520: For creating a foreign trust, transferring property, or receiving distributions (due April 15).

- Form 3520-A: An annual information return for the trust (due March 15).

- Form 8938 (FATCA): For reporting foreign financial assets if thresholds are exceeded.

- FinCEN Form 114 (FBAR): Required if the total value of all foreign accounts exceeds $10,000 at any time during the year.

Failing to file these forms can result in severe penalties, extended audit windows, or even criminal charges for willful violations. Using an Employer Identification Number (EIN) for the trust, rather than a personal SSN or ITIN, is recommended for filing Form 3520-A.

Timing is critical: establish your offshore trust before any legal claims arise. Transfers made with the intent to hinder or defraud creditors can be reversed by courts in both the U.S. and abroad.

Next, we’ll explore how combining offshore trusts with international LLCs can further strengthen your asset protection strategy.

sbb-itb-39d39a6

Using International LLCs for Business and Personal Protection

Expanding on offshore trust strategies, international LLCs offer a powerful way to enhance asset protection by combining operational control with strong legal safeguards against creditors.

International LLCs provide limited liability and privacy, creating a solid defense against creditor claims. You maintain control over daily operations while operating under foreign laws that often do not recognize U.S. court judgments. This means creditors would need to re-litigate their claims in the LLC’s jurisdiction – a costly and time-consuming process that often discourages lawsuits.

While offshore trusts are effective for isolating assets, international LLCs add an operational dimension, creating a more comprehensive plan for global asset protection. Structuring an international LLC under an offshore trust further separates asset ownership from day-to-day management, making it even harder for creditors to gain access.

Benefits of International LLCs

One of the standout features of international LLCs is charging order protection. In jurisdictions like Nevis and the Cook Islands, a charging order is typically the only remedy available to creditors. This means creditors may only claim distributions if they are made but cannot vote, force liquidation, or interfere with management decisions.

Nevis, for example, requires creditors to post a $100,000 bond before filing a lawsuit, which acts as a deterrent. Additionally, creditors must prove fraudulent intent beyond a reasonable doubt – an evidentiary standard much stricter than the "preponderance of evidence" used in U.S. civil courts.

"The Nevis LLC uniquely combines the most protective features of the international trust, limited partnership, and Nevada corporation into one remarkably protective entity."

– The Presser Law Firm, P.A.

Privacy is another key advantage. Many offshore jurisdictions exclude the names of members and managers from public registries, making it harder for potential litigants to identify and target your assets. This isn’t about hiding assets – it’s about reducing the likelihood of becoming a litigation target.

International LLCs also allow for multi-currency operations and unrestricted capital movement. Popular jurisdictions like Nevis, Belize, and the British Virgin Islands impose no local taxes on foreign-sourced income (though U.S. citizens are still taxed on worldwide income).

Costs for forming an international LLC generally range from $1,000 to $3,000, with annual fees between $850 and $1,200 for government renewals and registered agent services. For instance, in Nevis, the government filing fee is $450, and the annual renewal fee is $350.

Some LLCs also include a "poison pill" feature, imposing tax liabilities on creditors to discourage prolonged litigation and encourage settlements.

| Feature | International LLC | International IBC (Corporation) |

|---|---|---|

| Ownership | Membership interests (protected by charging orders) | Transferable shares (can be seized by court order) |

| Best Use Case | Asset protection and holding personal wealth | Multi-investor ventures and traditional trading |

| Management | Flexible; can be member or manager-managed | Rigid; requires directors, officers, and board resolutions |

| Taxation | Pass-through entity (taxed at member level) | Separate taxable entity (unless elected otherwise) |

Selecting the Right Jurisdiction for Your LLC

Choosing the best jurisdiction depends on your goals, but Nevis is often considered the gold standard for asset protection. Its $100,000 bond requirement and strict evidentiary standards make it difficult for creditors to pursue claims. Nevis also enforces a short statute of limitations, requiring creditors to file within two years of the asset transfer or one year from discovery – whichever comes first.

The Cook Islands is another top choice, especially for those holding cryptocurrency or liquid assets. It does not recognize foreign judgments and enforces a short statute of limitations (one to two years) on fraudulent transfer claims. Setting up an LLC in the Cook Islands typically costs around $1,500.

Belize offers quick formation and flexibility, often used in layered structures that combine LLCs with offshore trusts. The British Virgin Islands (BVI) is highly regarded for its global recognition and high volume of incorporations, with around 31,200 new companies registered in the year leading up to September 2022. The BVI is particularly suited for international trading and joint ventures due to its flexible framework.

The Cayman Islands, known for institutional credibility, hosts approximately 85% of the world’s hedge funds. It provides a politically stable environment and imposes no direct taxes on income or capital gains.

"Nevis incorporation is not a magic shield, nor is it a tax evasion scheme. It’s a sophisticated legal structure that… offers unparalleled protection for legitimate business assets."

– Privacy Solutions

When selecting a jurisdiction, those based on English Common Law – such as Nevis, the Cook Islands, or the BVI – are often the most reliable for LLCs. Securing a banking relationship before finalizing incorporation is also crucial. Global de-risking has made it harder to open accounts for Caribbean entities, often requiring the help of specialized introducers. This process can take two to six months and may cost between $2,000 and $5,000.

For U.S. tax purposes, offshore LLCs are automatically classified as corporations unless you elect pass-through taxation within 75 days of formation. U.S. citizens must file Form 5471, Form 8938, and FinCEN Form 114 (FBAR) if foreign accounts exceed $10,000. Expect to budget an additional $3,000 to $5,000 annually for specialized tax preparation to ensure compliance.

Timing is essential: establish your LLC well before any legal claims arise. Transfers made after a lawsuit is filed or threatened may be reversed as fraudulent conveyances.

These jurisdictional options provide a foundation for diversifying financial risk through multi-jurisdictional banking.

Multi-Jurisdictional Banking: Spreading Your Financial Risk

Once you’ve set up your international LLC, it’s smart to diversify where you bank. Multi-jurisdictional banking means keeping accounts in multiple countries rather than putting all your financial eggs in one basket. This approach helps protect your assets from economic instability, currency devaluation, and potential banking failures.

The past few years have highlighted the risks of relying on a single banking system. U.S. bank failures, such as Silicon Valley Bank and Signature Bank, along with a steep 10% drop in the U.S. dollar during the first half of 2025, make a strong case for spreading out your funds.

"In a world where currencies fluctuate, political environments shift, and banking rules can change overnight, having part of your financial life offshore isn’t extreme – it’s practical." – Build Smarter

This principle underpins the effectiveness of multi-jurisdictional banking.

Why Multi-Jurisdictional Banking Works

The main advantage of this strategy is reducing geopolitical risk. By spreading your assets across different countries, you’re less exposed to the financial or political instability of any one nation. For instance, with the U.S. national debt surpassing $31 trillion by 2025, many entrepreneurs are hedging against potential dollar weakness by holding wealth in more stable currencies.

Holding multiple currencies also protects against domestic currency devaluation. For businesses, this can be especially useful – receiving euros for European transactions or pounds for UK imports can help avoid costly currency conversion losses.

Another benefit is reducing the impact of banking system failures. The U.S. banking crises of 2023 showed how having accounts in multiple stable jurisdictions can ensure uninterrupted access to funds. Additionally, placing assets in jurisdictions with favorable legal frameworks can create barriers that make it harder for creditors to seize your funds.

For entrepreneurs, multi-jurisdictional banking also simplifies international operations. It allows for smoother local-currency transactions and opens doors to global markets, making day-to-day business more efficient.

Choosing Banking Jurisdictions

Picking the right banking jurisdictions is key to maximizing these benefits. You’ll want to balance stability, accessibility, and legal protections when deciding where to open accounts. Here are some popular options:

- Switzerland: Known for political stability and top-notch wealth management, Swiss banks often require a minimum deposit of around $1 million for asset management accounts.

- Singapore: A hub for international trade and multi-currency accounts, Singapore combines strict compliance with high levels of stability.

- Austria: A straightforward European choice, where private banks generally require deposits between $250,000 and $300,000.

- Nevis and Belize: These jurisdictions offer low or no minimum deposit requirements for certain accounts, making them more accessible. They also have strong legal frameworks for LLCs and structuring offshore trusts, though their services may not match the sophistication of Switzerland or Singapore.

- UAE (Dubai): A modern banking destination with quick account opening, no personal income tax, and seamless integration with global business operations.

When evaluating jurisdictions, focus on political and economic stability, strong banking regulations, and a solid track record of protecting depositors’ rights. It’s also wise to choose countries that participate in global reporting standards like the Common Reporting Standard.

| Jurisdiction | Primary Strength | Typical Requirement |

|---|---|---|

| Switzerland | Stability; world-class wealth management | High minimums (around $1M) |

| Singapore | Great for trade; multi-currency options | Strict compliance standards |

| Austria | Simple European private banking | $250,000–$300,000 deposit |

| UAE (Dubai) | Quick setup; no income tax | Modern global services |

| Nevis | Strong legal protections | Lower fees and minimums |

It’s crucial to set up your multi-jurisdictional banking structure before facing legal or financial challenges. Moving assets after a lawsuit is filed or threatened could trigger claims of fraudulent conveyance, potentially invalidating your transfers. Treat diversification as a proactive strategy, while keeping enough liquid capital in domestic accounts for immediate needs.

Meeting AML and KYC Requirements

While diversifying your banking can protect your assets, it also requires strict compliance with international regulations. Opening accounts in foreign jurisdictions means navigating Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. Preparing for these requirements upfront can save time and prevent application rejections.

Banks will typically ask for government-issued ID (like a passport) and proof of residence, such as a recent utility bill or bank statement. In many cases, these documents must be notarized.

You’ll also need to verify the source of your funds. This could include pay stubs, investment statements, inheritance records, or sale contracts. For business accounts, expect to provide corporate documents like articles of incorporation, resolutions, and proof of authorized signatories. If you’re using a trust or LLC to hold the account, banks will require details about the ultimate beneficial owners to comply with FATF standards and local laws.

For U.S. citizens, tax reporting is non-negotiable. If the total value of your foreign accounts exceeds $10,000 at any point in the year, you must file an FBAR (FinCEN Form 114). Additionally, foreign financial assets above certain thresholds must be reported on IRS Form 8938, with penalties exceeding $10,000 for non-compliance.

Global initiatives like the OECD’s Common Reporting Standard and FATCA have largely ended traditional banking secrecy. Most foreign banks now automatically report U.S. account holder information to the IRS. Transparency is the new normal for offshore banking.

To stay compliant, work with tax professionals experienced in international filings, such as Forms 5471, 3520, and 8938. Their expertise can help you navigate these complex requirements and avoid costly mistakes.

Combining Global Strategies with Legal Compliance

Crafting an international asset protection plan means more than just choosing the right jurisdictions – it’s about ensuring every step aligns with legal requirements. For U.S. citizens, this is particularly critical since they are taxed on their worldwide income, no matter where their assets are held. The goal is to establish legal frameworks that safeguard your wealth while staying fully transparent with tax authorities.

With regulations like FATCA and the Common Reporting Standard in place, the days of hidden offshore accounts are over. Today, over 100 countries automatically share financial information with the IRS. This shift has made transparency and strategic planning the cornerstones of effective asset protection.

"Offshore asset protection is still viable, but it’s no longer a ‘hidden vault.’ Today, it’s most effective as part of a transparent, legally compliant, and professionally structured estate and asset plan."

– James G. Bohm, Partner, Bohm Wildish & Matsen, LLP

Timing is another critical factor. Creating offshore structures after a lawsuit has been filed can lead to accusations of fraudulent conveyance, potentially allowing courts to dismantle your protections and seize assets. The most effective strategies are proactive, with clear documentation showing legitimate business purposes for all transfers.

Staying Compliant with U.S. Tax Laws

While global legal structures are essential, strict adherence to U.S. tax laws is equally important. For example, if your foreign accounts exceed $10,000 at any point during the year, you must file FinCEN Form 114 (FBAR) by April 15, with an automatic extension available until October 15.

FATCA adds another layer of reporting. Depending on your residency and filing status, you must report foreign financial assets on IRS Form 8938 if their value exceeds thresholds ranging from $50,000 to $400,000. This form covers more than just bank accounts, extending to foreign stocks, interests in foreign entities, and other financial instruments.

Failing to comply with these requirements can lead to hefty penalties. For example, neglecting to file Form 8938 could result in an initial $10,000 fine, which can rise to $50,000 if the IRS sends follow-up notices. For willful FBAR violations, penalties can reach the greater of $100,000 or 50% of the account balance. Additionally, if you fail to report more than $5,000 of income from foreign assets, the statute of limitations for audits extends from three to six years.

If you own or transfer assets to a foreign trust, additional forms are required. The trust must file Form 3520-A annually, while you must report any transactions or distributions on Form 3520.

| Compliance Requirement | Key Forms | Filing Threshold | Penalty for Non-Compliance |

|---|---|---|---|

| Foreign Bank Accounts | FinCEN Form 114 (FBAR) | Aggregate value > $10,000 | Up to $100,000 or 50% of balance (willful) |

| Foreign Financial Assets | IRS Form 8938 | $50,000–$400,000+ (varies by status) | $10,000–$50,000 |

| Foreign Trust Ownership | Forms 3520 & 3520-A | Any ownership or transaction | Substantial penalties |

Foreign financial institutions also face consequences. They are subject to a 30% withholding tax on certain U.S.-source payments if they fail to comply with FATCA reporting requirements.

Reducing Risks with Professional Help

Navigating the complexities of U.S. tax law alongside the legal systems of other countries isn’t something you should tackle alone. Professional guidance is essential to avoid costly missteps.

"Failure to comply with these legal requirements for offshore asset protection trusts risks steep fines and other potential penalties."

– Blake Harris, Founding Principal, Blake Harris Law

A dual-counsel approach – involving attorneys from both the U.S. and your chosen offshore jurisdiction – is often the best way to ensure compliance with local laws while meeting U.S. tax obligations. This approach minimizes the risk of legal challenges or regulatory penalties.

Experts can also help you navigate complex rules like those governing Controlled Foreign Corporations (CFCs) and Passive Foreign Investment Companies (PFICs), which can create unexpected tax liabilities if your international LLC or trust isn’t structured properly.

Thorough documentation is another must. Keeping detailed records that demonstrate the legitimate business purpose behind every asset transfer is crucial, especially if your structure is ever challenged as a fraudulent conveyance.

Firms like Global Wealth Protection specialize in these matters. They assist with everything from offshore company formation to trust administration, ensuring your plan remains effective and compliant. Regular audits of your structure can help you adapt to evolving global laws.

For added flexibility, consider hybrid structures that combine U.S. operational ease with international asset protection. For instance, a domestic LLC owned by an offshore trust can simplify day-to-day management while placing ultimate ownership in a jurisdiction that doesn’t recognize U.S. court judgments. These setups, however, require careful planning to avoid unfavorable tax consequences, making expert advice indispensable.

Finally, remember that compliance isn’t a one-and-done task. Tax laws, reporting thresholds, and international agreements are constantly changing. Regular reviews with your legal and tax advisors ensure your plan remains up-to-date and effective. By integrating compliance measures into your offshore strategy, you create a well-rounded approach to protecting your wealth.

Building Your Global Asset Protection Plan

You’ve learned about the tools – offshore trusts, international LLCs, multi-jurisdictional banking, and compliance frameworks. Now, it’s time to bring these elements together into a practical plan that protects your hard-earned wealth as an entrepreneur.

Summary of Key Strategies

The best global asset protection plans rely on a layered defense strategy. Start with insurance as your first layer – policies like professional liability and umbrella insurance can help resolve disputes or deter claims before they escalate. Next, move beyond operating as a sole proprietor by forming entities like LLCs or S-Corporations. These structures create a legal barrier between your personal assets and business liabilities.

A strong plan often combines multiple layers of protection. This might include insurance, structured entities, offshore trusts in jurisdictions such as the Cook Islands or Nevis, and multi-jurisdictional banking. These measures not only separate personal and business assets but also discourage creditor claims. Many entrepreneurs opt for a hybrid approach: using a domestic LLC for daily operations that’s owned by an offshore trust. This setup balances U.S. compliance with international safeguards.

Another key element is strict asset segregation – keeping your personal and business finances completely separate. This reduces the risk of courts "piercing the corporate veil" to access your personal wealth. Together, these strategies create a comprehensive protection plan, ready for action.

Action Steps for Entrepreneurs

Now that you have the foundation, it’s time to put your asset protection plan into motion. Timing is critical. As Presti & Naegele emphasize:

"Asset protection is about proactive planning, not reactive scrambling. Once a lawsuit is filed or a judgment is in motion, it’s usually too late."

Transfers made after legal claims arise can be deemed fraudulent conveyances, leaving you exposed to further penalties. To avoid this, implement your strategy well before any threats emerge.

Work with U.S. and offshore legal experts to align your plan with domestic tax laws and international protections. This isn’t a task for a DIY approach – the complexities of KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements demand professional guidance. Tailor your plan to your specific needs by considering factors like asset value, industry risks, and your business structure. Don’t overlook retirement accounts like 401(k)s, which provide significant federal protection against civil judgments and serve as a valuable diversification tool.

To maintain the integrity of your plan, follow strict formalities. Use separate business accounts and credit cards, keep detailed company records, and avoid commingling funds – using a business card for personal expenses even once could jeopardize your LLC’s liability protection. Regularly review your plan with your advisors to ensure it evolves with tax law changes, business growth, or family needs.

Specialized firms like Global Wealth Protection can assist with implementing these strategies, from forming offshore companies to managing trusts, ensuring your asset protection plan stays effective and compliant over time.

FAQs

What are the key advantages of using offshore trusts for asset protection?

Offshore trusts offer a robust way for entrepreneurs to safeguard their assets by leveraging legal systems in jurisdictions that often resist recognizing or enforcing U.S. court rulings. This creates a significant hurdle for creditors, making it both more challenging and costly for them to pursue your wealth.

These trusts also come with the advantage of greater privacy, thanks to strict confidentiality laws in popular locations like the Cook Islands, Nevis, and Belize. On top of that, an independent foreign trustee manages distributions, adding another layer of protection against lawsuits or bankruptcy claims.

One of the standout benefits is the ability to compartmentalize and protect various types of assets – such as business interests, real estate, or personal wealth – across different jurisdictions. This approach not only spreads risk but also shields your estate from the impact of political or economic upheaval in any single country. Altogether, offshore trusts serve as a powerful strategy for securing global assets and ensuring long-term financial stability.

How can international LLCs help entrepreneurs protect their assets?

International LLCs offer a robust safeguard by keeping an entrepreneur’s personal assets separate from their business liabilities. Since an LLC functions as its own legal entity, creditors are generally limited to pursuing the company’s assets, leaving personal property protected from claims. Moreover, setting up an LLC in regions with strict privacy laws can obscure ownership details, making it more challenging for potential litigants to identify and seize assets.

Expanding operations across different countries adds an extra layer of security. Any claims made in one country would need to navigate the legal system of the LLC’s home jurisdiction, which often has laws favorable to protecting assets. That said, U.S. entrepreneurs must adhere to reporting requirements such as FATCA, FBAR, and the Corporate Transparency Act to ensure the structure remains compliant. By choosing a reputable jurisdiction and following U.S. regulations, entrepreneurs can take full advantage of the asset protection offered by international LLCs while steering clear of legal complications.

What do U.S. citizens need to know about compliance when using global asset protection strategies?

U.S. citizens using offshore trusts, international LLCs, or foreign bank accounts face strict federal reporting and tax rules. When it comes to foreign trusts, U.S. individuals are required to file Form 3520 to report trust transactions and Form 3520-A, which serves as the annual information return for the trust. These forms must be submitted along with your tax return, and failing to do so can lead to hefty penalties. Additionally, any income generated by the trust is typically taxable and should be reported on your Form 1040.

If you have foreign financial accounts with a combined value exceeding $10,000 at any point during the year, you’re obligated to file FinCEN Form 114 (FBAR). Further, specified foreign assets must be reported on Form 8938 (FATCA). Missing these filings can result in civil penalties of up to $10,000 per violation, with even steeper consequences for willful non-compliance. Additionally, any transfers to offshore structures must align with U.S. fraudulent-transfer laws, ensuring they serve legitimate purposes.

To avoid issues, keep detailed records of your offshore entities and their financial activities. Consulting a qualified tax professional can help ensure your filings are accurate and on time. Staying compliant not only helps you avoid penalties but also safeguards your assets while adhering to U.S. regulations.