Since January 25th, I have had a nearly uncontrollable urge to write about the one hour sitcom I watched that same night at around 9 pm EST. This was one of the funniest shows I have seen in a long time.

Of course I am talking about Barry O’s State of the Destruction Address. On a superficial level, it made us all feel really good. That is unless we are thinking humans and realize that he was promoting bigger government and explaining to us all how it has created everything good in life.

It sounds really nice when he says he is putting a 5 year freeze on all discretionary government spending. Of course it loses a bit of its luster when you consider this has the impact of 1/10 of 1% of all government spending. It also sounds nice when he talks about lowering corporate tax rates and simplifying the tax code, until you realize the White House is in gridlock mode with Republicans controlling the house and Democrats controlling the Senate and White House.

Ok, ok, I said I wouldn’t overburden you with my musings of fictional TV. I want to do my best to offer you something of value since we know nothing of value is going to come from Washington.

Over the past 2 weeks, I have had a several interesting calls from various real estate investors. Currently we are drafting asset protection plans for a couple of them. With such an uptick in calls from real estate investors, I thought I would discuss some tactics available to minimize your investment and personal risk.

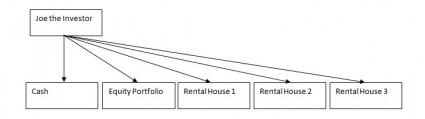

Take the following simple scenario:

Joe runs a pretty basic business. He owns three rental houses and self-manages them. He accumulates profits that sit in his cash account and his equity investment portfolio. Do you see any problems here? I do.

1. Never own significant assets in your own name

2. Never group significant assets under the same ownership structure

Why is this a problem? Imagine if the tenant in rental house 2 is injured at the property and is permanently disabled. This person’s attorney can easily determine your assets and will likely be willing to take the case on a contingency basis. Once the attorney easily defeats you in court he can execute a judgment and seize some or all of your assets leaving you penniless.

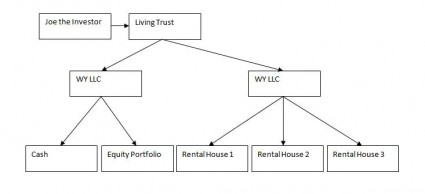

Let’s restructure Joe’s assets to minimize his risk:

With this structure in place, Joe has taken several steps to minimize his risk:

1. Joe no longer personally owns anything, making it difficult to verify asset ownership

2. Joe has segregated his real estate holdings from his liquid assets

3. Joe has implemented an estate planning tool by having the living trust own the LLC’s

Please keep in mind; this is a very basic structure for a very basic asset picture. By implementing this simple strategy, Joe has created ‘sleep at night’ insurance.

Joe could also further improve the asset protection plan by forming 3 separate LLC’s – one for each rental house. He could also put each rental house in a land trust and name his LLC as the beneficiary. As you can see, there are a multitude of options for creating an effective asset protection plan for the investor.

Some items to make special note of: By having no assets titled in Joe’s name, many plaintiff attorneys will come up empty handed when doing an asset search. Most attorneys will not take a contingency case and will require the plaintiff to provide a significant retainer. This is deterrent enough in many cases.

Even if the case is pursued beyond the insurance payout, the plaintiff will only be able to attach the property and the assets of the LLC itself which shields the remainder of Joe’s assets. This means Joe gets to live to fight another day.

As Joe’s real estate portfolio grows, he would want to add more LLC’s for property ownership and likely would want to form an S-corporation for the property management business, further segregating the assets and minimizing the risk.

If you are a real estate investor and would like to investigate your asset protection options, call today for your free 30 minute consultation. Until next week, live well.