Protecting your wealth legally and avoiding trouble with the IRS comes down to understanding the difference between asset protection and tax evasion. Here’s the key distinction:

- Asset protection is lawful. It involves using tools like trusts or LLCs to shield assets from lawsuits or creditors without hiding income or breaking tax laws.

- Tax evasion is illegal. It includes actions like underreporting income, hiding assets, or falsifying records to avoid paying taxes.

The IRS scrutinizes transactions for economic substance and transparency. Misusing asset protection tools to hide income or control assets secretly can lead to severe penalties, including prison time. Examples like the 2023 Mark Anthony Gyetvay case – where he concealed $93 million – show how high the stakes can be.

To stay compliant:

- Set up legal structures before lawsuits or claims arise.

- Fully disclose foreign accounts and trusts (e.g., via FBAR or Form 3520).

- Avoid retaining personal control over transferred assets.

The article explores how to use legitimate strategies, like offshore trusts or LLCs, while avoiding red flags that could trigger IRS scrutiny. By following the rules and working with qualified professionals, you can protect your assets while staying on the right side of the law.

What Is Asset Protection?

Definition and Purpose

Asset protection is a legal strategy designed to safeguard your wealth from creditors, lawsuits, and other financial risks. The goal isn’t to hide money or evade taxes but to use legitimate structures – like trusts and limited liability companies (LLCs) – to shield your assets from civil judgments and claims. Importantly, this process operates within the boundaries of the law, steering clear of perjury or tax evasion practices.

This approach is distinct from managing business liability or navigating bankruptcy. It’s particularly relevant for individuals with substantial wealth. A 2003 report revealed that 60% of U.S. millionaires have considered asset protection planning. Why? High-net-worth individuals – such as doctors, business owners, and real estate investors – face a heightened risk of lawsuits and creditor claims.

Core Principles of Legal Asset Protection

For asset protection to remain lawful and ethical, timing is everything. Legal structures must be set up before any claim or lawsuit emerges. Transferring assets to shield them from a known creditor is classified as a fraudulent transfer or conveyance, which courts can reverse[10, 12].

As White and Bright, LLP puts it:

"It is unlawful to move assets in order to hide them from a known creditor; however, while you have no pending legal claims, you are permitted to set up your estate in any manner you wish."

Transparency also plays a key role. Laws like the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) ensure financial institutions share information with tax authorities. For instance, if you hold more than $10,000 in offshore accounts, you must disclose them on FinCEN Form 114 (FBAR). Similarly, offshore trusts and foundations must be reported on IRS Form 3520.

Another essential aspect is independent control. For asset protection structures to be valid, a trustee must hold legal title and exercise genuine authority over the assets.

Lastly, asset protection is not a tool for tax reduction. Any income generated remains fully taxable, whether to the trust, the grantor, or the beneficiary[4, 14]. Many effective asset protection setups, like offshore trusts, need to be irrevocable. This means you relinquish direct control permanently to ensure the assets are protected.

Next, we’ll look at practices that cross the line into illegality.

What Is Tax Evasion?

Definition and Common Methods

Tax evasion happens when someone deliberately avoids paying taxes by using methods like fraud, misrepresentation, or hiding income. Unlike lawful tax planning, which works within the rules, tax evasion involves breaking them on purpose.

To prove tax evasion, the IRS must establish "willfulness", meaning the person knowingly and intentionally violated a legal obligation. As attorney Sam Brotman explains:

"the difference between tax avoidance and tax evasion is sometimes quoted as the difference between them being the thickness of a prison wall."

Some common tactics include underreporting income, falsifying financial records, exaggerating deductions, hiding assets in offshore accounts, or using shell companies to obscure ownership. Another red flag for the IRS is structuring cash transactions to avoid reporting thresholds, such as keeping deposits under $10,000 to bypass scrutiny.

These actions contribute to a massive tax gap – estimated at $688 billion for 2020-2021 alone. Interestingly, over half of unpaid taxes come from the wealthiest 5% of earners. While these schemes might seem tempting, they come with severe legal and financial risks.

Legal and Financial Consequences

The penalties for tax evasion are serious. Under Section 7201 of the Internal Revenue Code, it’s classified as a Class E felony. Convictions can lead to up to 5 years in prison, fines of up to $100,000 for individuals (or $250,000 under certain laws), and up to $500,000 for corporations. On top of that, offenders are still responsible for paying the owed taxes, interest, and the costs of prosecution.

For example, in June 2023, Canada’s tax authority wrapped up the "Collecteur Project", which resulted in a taxpayer receiving a 5-year prison sentence and an $850,000 fine for evading taxes. This case highlights how determined tax agencies are to prosecute offenders.

But the consequences don’t stop at financial penalties. A felony conviction can leave a permanent mark on your criminal record, harm your professional reputation, and limit future job opportunities. The IRS Criminal Investigation Division actively tracks down cases, using tools like third-party data from W-2s and 1099s to identify discrepancies – even if someone skips filing a return.

Understanding these risks is critical when examining the line between legitimate asset protection and illegal tax evasion.

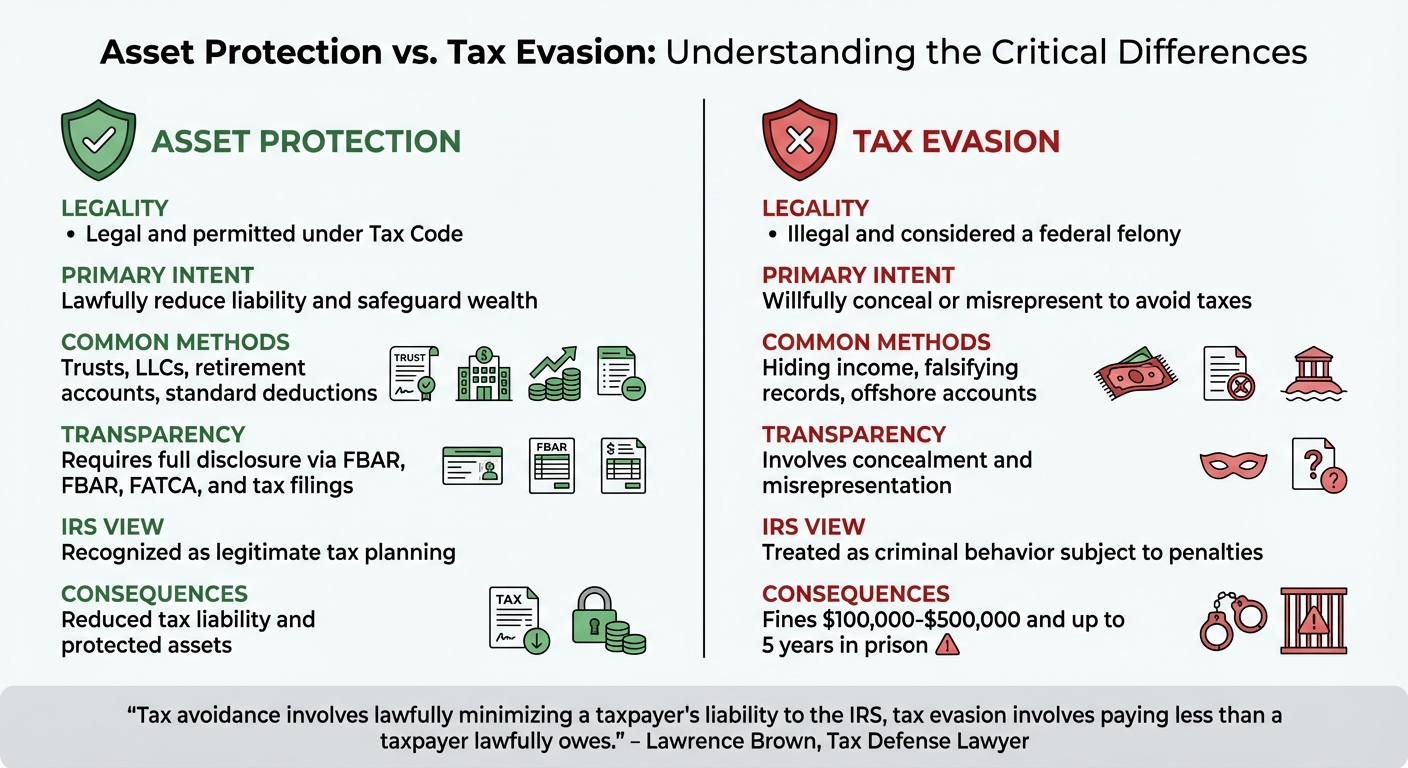

Asset Protection vs. Tax Evasion: Main Differences

Let’s break down the key distinctions between asset protection and tax evasion. While both deal with taxes and wealth, the approaches couldn’t be more different. Asset protection involves legally reducing liability and preserving wealth, while tax evasion is an illegal act of hiding or misrepresenting income to avoid paying taxes.

Asset protection uses legitimate strategies like trusts, LLCs, or retirement accounts to reduce tax liability. On the flip side, tax evasion requires deliberate misconduct, such as underreporting income or falsifying records. As tax defense lawyer Lawrence Brown explains:

"Tax avoidance involves lawfully minimizing a taxpayer’s liability to the IRS, tax evasion involves paying less than a taxpayer lawfully owes."

Another key difference lies in transparency. Asset protection requires full disclosure to the IRS through forms like FBAR and Form 8938. Tax evasion, however, relies on concealment – such as hiding assets, misrepresenting one’s status, or using nominees to disguise ownership. These distinctions highlight how legal strategies differ from criminal acts.

Comparison Table

Here’s a quick comparison of asset protection and tax evasion:

| Feature | Asset Protection (Tax Avoidance) | Tax Evasion |

|---|---|---|

| Legality | Legal and permitted under the Tax Code | Illegal and considered a federal felony |

| Primary Intent | Lawfully reduce liability and safeguard wealth | Willfully conceal or misrepresent to avoid taxes |

| Common Methods | Trusts, LLCs, retirement accounts, standard deductions | Hiding income, falsifying records, offshore accounts |

| Transparency | Requires full disclosure via FBAR, FATCA, and tax filings | Involves concealment and misrepresentation |

| IRS View | Recognized as legitimate tax planning | Treated as criminal behavior subject to penalties |

| Consequences | Reduced tax liability and protected assets | Fines ranging from $100,000–$500,000 and up to 5 years in prison |

The IRS also applies the "substance over form" doctrine to ensure that asset protection strategies aren’t used as a cover for tax evasion. If a trust or entity lacks genuine economic purpose and is designed solely to evade taxes, it is deemed abusive and illegal. To stay compliant, keep detailed records and seek guidance from board-certified tax law experts.

sbb-itb-39d39a6

Legal Methods for Protecting Assets

Now that we’ve clarified the distinction between legal asset protection and tax evasion, let’s explore specific strategies to safeguard your wealth while adhering to U.S. tax laws.

Offshore Trusts

An offshore asset protection trust involves transferring assets to a trustee located in another country to benefit designated beneficiaries. The main advantage? Foreign trustees are not bound by U.S. law, meaning they don’t have to comply with domestic court orders. This forces creditors to pursue claims under foreign legal systems, which often have stricter limitations and shorter timeframes.

Some of the most common jurisdictions for offshore trusts include the Cook Islands, Nevis, the Cayman Islands, Bermuda, and the British Virgin Islands. Timing is everything when setting up these trusts. As White and Bright, LLP emphasizes:

"Asset protection trusts must be set up and funded before litigation is on the horizon. It is unlawful to move assets in order to hide them from a known creditor".

While offshore trusts provide robust protection, they’re considered "tax neutral" for U.S. citizens. This means you’re still responsible for paying taxes on any income generated by the trust. U.S. taxpayers must also report offshore trusts and any related foreign financial accounts according to IRS and FinCEN rules. If the trust itself fails to file, you’ll need to submit a substitute Form 3520-A with your own tax return to avoid penalties.

Offshore LLCs offer another option for safeguarding assets, often complementing the use of trusts.

Offshore LLCs

An offshore LLC combines flexibility, privacy, and limited liability protection. Unlike a trust, an LLC allows for more direct control over your assets while still separating ownership. High-net-worth individuals often pair offshore LLCs with offshore trusts to balance control with protection.

Anguilla is a favored location for forming offshore LLCs due to its strong privacy safeguards and business-friendly regulations. However, transparency with the IRS is critical. If you’re classified as the owner under grantor trust rules (IRC sections 671–679), you’ll need to report the LLC’s income on your personal tax return [20, 14].

Compliance is key when using offshore LLCs. The IRS scrutinizes the "economic substance" of these arrangements. If you retain full control over the assets or continue to use property transferred to the LLC, the structure may be disregarded, leaving those assets vulnerable to seizure.

Avoid advisors who promote schemes involving multiple layers of entities to obscure ownership or claim tax-free income [1, 20]. Instead, work closely with qualified tax and legal professionals, both in the U.S. and in your chosen jurisdiction, to ensure accurate reporting and compliance. When implemented correctly, offshore trusts and LLCs can serve as effective tools for legally protecting your assets.

IRS Scrutiny and Legal Cases

Asset protection strategies must walk a fine line between safeguarding wealth and staying compliant with tax laws. The IRS keeps a close eye on these strategies, ensuring they don’t drift into tax evasion. To understand where things go wrong, it’s helpful to examine real-life cases where taxpayers crossed the line.

Court Cases: When Asset Protection Becomes Tax Evasion

Some legal battles highlight how asset protection can veer into unlawful territory. For instance, in the case of United States v. Douglas Edelman (December 2024), Edelman was accused of hiding over $350 million in earnings from defense contracts through fraudulent schemes. To sidestep a 2010 Congressional investigation, he falsely claimed his wife, a French national, owned the firm. Things worsened when he violated "no contact" orders by using Signal and WhatsApp to influence trust assets. His pretrial release was revoked, and the case remains under prosecution.

Another example, Kruse v. Repp (2020-2021), shows the risks of trying to shield assets from creditors. After a car accident, the defendant transferred assets into LLCs to avoid compensating the injured party. The court allowed a federal civil RICO action to proceed, noting misrepresentation of asset titles and values to lenders. As ACTEC Fellow George Karibjanian succinctly put it:

"Any sound asset attorney who practices in asset protection knows you cannot avoid a past or present creditor. Not going to happen."

The case ultimately settled in 2021.

Here’s a quick look at these and other cases:

| Case Name | Strategy Used | Court Ruling | Penalty/Outcome |

|---|---|---|---|

| United States v. Douglas Edelman (2024) | Concealed $350M+ in earnings through global entities and a discretionary trust; false ownership claims | Charged with tax evasion; pretrial release revoked | Criminal charges; ongoing prosecution |

| Kruse v. Repp (2020-2021) | Transferred assets to LLCs to avoid creditor claims | RICO action allowed to proceed | Settled in 2021; highlighted illegality of shielding from creditors |

| Markosian v. Commissioner | Transferred property to trust without material change in control | Trust ruled a "sham" | IRS ignored trust for tax purposes |

| Zmuda v. Commissioner | Layered assets through businesses, equipment, and foreign trusts | Assets deemed directly owned by the individual | Trust entities disregarded for tax purposes |

Even historical cases underline the harsh consequences of tax evasion. Al Capone, the infamous gangster, serves as a cautionary tale. While authorities couldn’t convict him on other charges, they secured an 11-year prison sentence for five counts of income tax evasion.

How to Avoid IRS Red Flags

To stay on the right side of the law, asset protection strategies need to have genuine economic substance. The IRS scrutinizes structures that give the appearance of compliance but allow individuals to retain control over assets. A key warning sign? Maintaining personal control over assets after transferring them. For example, if you can override foreign trustees or continue managing transferred assets, the IRS will likely disregard the structure.

The Supreme Court has made it clear:

"The substance rather than the form of a transaction is controlling for tax purposes."

If you transfer your home to a trust but continue living there as before, without any real change, expect IRS scrutiny. The relationship between you and the assets must genuinely shift.

Other red flags include circular transactions, artificial deductions, and attempts to classify personal expenses as business costs. Complex layering of multiple trusts to obscure ownership is another tactic that raises alarms. Beware of promoters selling "trust packages" for $5,000 to $70,000, claiming they can eliminate taxes entirely. These schemes are actively investigated by the IRS.

Transparency is critical. If you’re using offshore entities, comply with Foreign Bank Account Reporting (FBAR) requirements. Don’t fall for false claims that foreign trusts with foreign trustees don’t require U.S. filings. Ensure that trustees operate independently and document legitimate business or estate planning reasons for asset transfers. And remember – never use asset protection strategies to dodge creditors or claims that already exist.

The IRS estimates that the wealthiest 1% of Americans evade up to $163 billion in taxes annually. To avoid becoming part of this statistic, work with qualified tax and legal professionals who focus on compliance rather than aggressive tax avoidance schemes.

Conclusion

Protecting your assets legally requires genuine economic activity and full transparency – it’s a completely different game from tax evasion. George Dimov, President & Managing Owner of Dimov Tax, puts it clearly:

"Tax haven compliance means understanding the bright line separating legal international tax planning from illegal tax evasion. That line is economic substance combined with full disclosure."

At its core, legitimate asset protection hinges on creating real economic value, not just cutting tax bills. If an offshore trust or entity exists solely to dodge taxes without serving a valid business purpose, it risks being invalidated under the substance-over-form doctrine. Plus, maintaining control through nominee directors is a major red flag that could invite IRS scrutiny.

Even if your offshore setup is above board, full reporting is non-negotiable. This includes filing the FBAR, Form 8938, and other IRS forms. Missing these filings isn’t just a slap on the wrist – civil penalties start at $10,000 per form, per year. For willful violations, the stakes rise to fines of up to $250,000 and possible imprisonment. And with FATCA agreements in place, the IRS now gets automatic access to foreign financial data, making hidden offshore assets a thing of the past.

Hiring qualified tax professionals is essential. Yes, their services can cost thousands, but it’s a wise investment compared to the financial and legal fallout from non-compliance. Beware of promoters selling "tax elimination" or "judgment-proof" schemes for $5,000 to $70,000 – these are under active IRS investigation. Professional guidance ensures your strategies stay within legal boundaries and avoid the pitfalls that have tripped up others in the past.

The key to protecting your wealth lies in thorough documentation, legitimate business-driven structures, and complete transparency. These practices not only safeguard your assets but also keep you on the right side of the law.

FAQs

How can I make sure my asset protection strategies are legal and compliant?

To ensure your asset protection strategies remain within the bounds of the law, it’s essential to use legitimate methods and adhere to all tax and reporting requirements. Tools like offshore trusts and LLCs can be effective for safeguarding assets, but they must be correctly structured and fully disclosed to meet federal regulations. For instance, the IRS mandates the reporting of foreign accounts and trusts, often requiring forms like the FBAR. Failing to disclose these or attempting to hide assets can lead to severe penalties.

Legitimate approaches might involve taking advantage of deductions, credits, or properly established offshore entities for purposes such as estate planning or diversifying holdings. However, transparency is non-negotiable – hiding income or providing false information veers into tax evasion, which is illegal. Working with knowledgeable legal and tax professionals can help you protect your wealth responsibly while staying compliant with U.S. laws.

What activities could raise a red flag with the IRS?

Certain activities can draw the attention of the IRS, especially if they hint at possible tax evasion. For example, using abusive trust schemes that falsely promise tax benefits is a major red flag. Similarly, failing to report income or assets held in offshore accounts can trigger scrutiny, particularly when those accounts exceed reporting thresholds. The IRS keeps a close eye on unreported foreign accounts, as noncompliance can lead to hefty penalties.

Other behaviors likely to raise suspicion include underreporting income, claiming deductions that aren’t legitimate, or transferring assets to hide ownership. Be wary of any schemes that advertise unrealistic tax savings or refunds – they’re often designed to evade taxes and could result in audits, penalties, or even criminal charges. Following tax laws carefully is the best way to avoid these pitfalls.

Why should you establish asset protection structures before facing legal issues?

Setting up asset protection structures ahead of time is crucial because it safeguards your wealth before legal issues or disputes arise. Once a claim is filed, any unprotected assets could be at risk, leaving you with fewer options to shield them effectively.

By establishing structures like offshore trusts or LLCs early, you not only strengthen your legal standing but also ensure you’re operating within the law. Waiting until a claim is made can lead to complications – last-minute moves might be viewed as attempts to hide assets, raising potential legal red flags. Planning ahead allows you to protect your assets responsibly and maintain compliance with legal requirements.