A second residency is more than just a backup plan – it’s a smart way to protect your wealth and reduce risks tied to political, economic, or regulatory changes. By securing legal residency in another country, you gain access to stable financial systems, favorable tax regimes, and stronger asset protection. Here’s why it matters:

- Diversify Risks: Spread your assets across multiple jurisdictions to limit exposure to any single government or economy.

- Tax Advantages: Many countries offer lower or zero tax rates on income or foreign-sourced earnings.

- Better Asset Protection: Countries like Switzerland and Singapore provide robust legal frameworks and banking systems.

- Currency Stability: Residency in nations with strong currencies helps safeguard purchasing power against inflation or devaluation.

- Global Mobility: Some programs provide access to better banking and healthcare systems or even a path to citizenship.

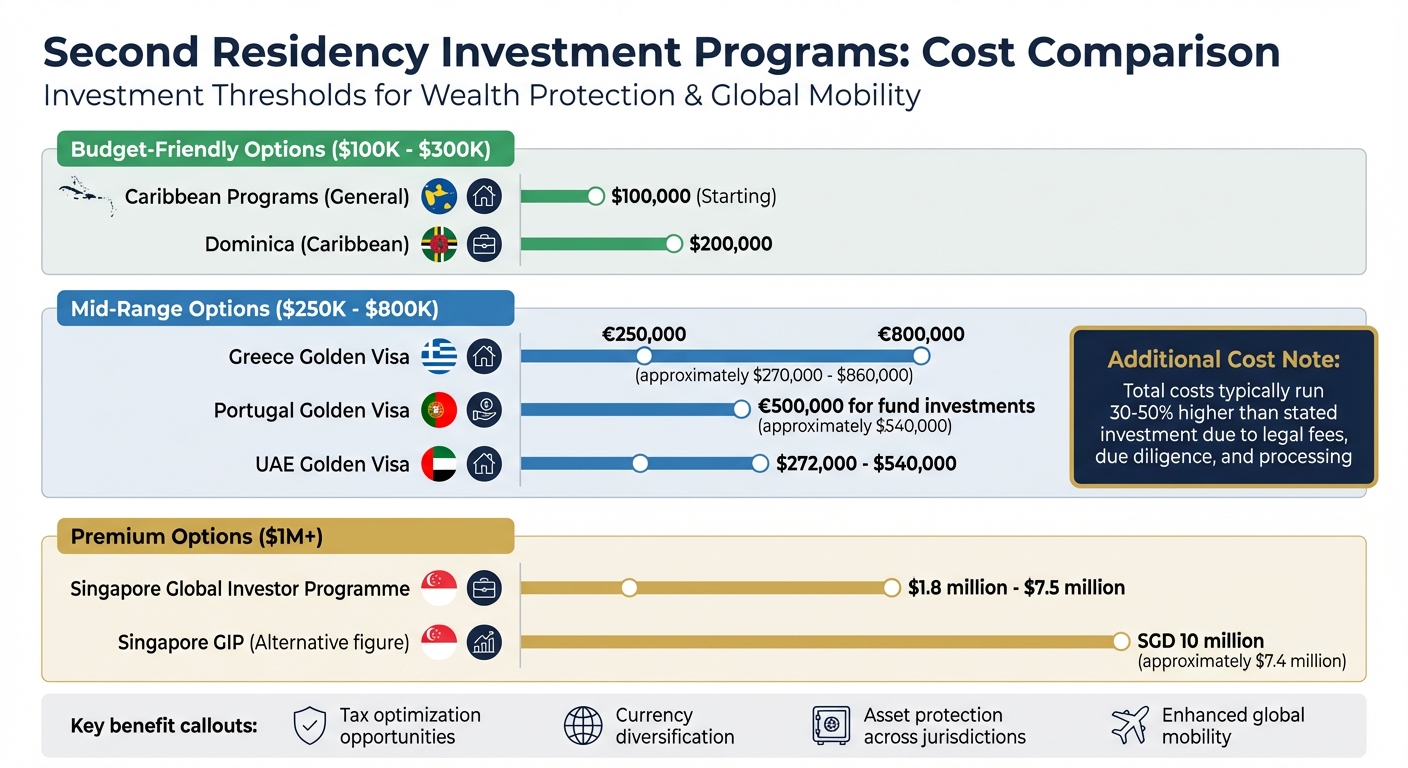

From Caribbean programs starting at $100,000 to high-end options in Singapore requiring over $7.5 million, there’s a program to match every goal. Whether it’s securing privacy, reducing taxes, or creating a financial safety net, a second residency is a practical tool for managing wealth in an unpredictable world.

What Second Residency Means for Wealth Protection

What Is Second Residency?

Second residency refers to the legal right to live permanently in a foreign country without becoming a full citizen. Unlike a tourist visa, which typically expires after a few months, second residency is renewable and can often lead to permanent status. Many affluent individuals secure this through Residency by Investment (RBI) programs, often called "golden visas".

These programs allow you to establish legal residence by making a qualifying investment. This could include purchasing real estate, investing in government bonds, or funding business ventures. The required investment amounts can vary significantly depending on the country’s economic goals and the benefits offered.

Residency vs. Citizenship: Understanding the Differences

It’s essential to differentiate second residency from both citizenship and temporary visas. Here’s a quick breakdown:

| Feature | Temporary Visa | Second Residency | Citizenship |

|---|---|---|---|

| Duration | Short-term (e.g., 90 days to 1 year) | Long-term or indefinite (renewable) | Permanent/Lifetime |

| Purpose | Tourism, work, or study | Living, investing, and business growth | Full legal integration |

| Rights | Limited access to services | Right to live and work, plus access to banking and healthcare | Full rights, including voting and a passport |

| Requirements | Activity-specific (e.g., job contract) | Investment, retirement income, or business setup | Naturalization or significant investment |

It’s also worth noting that tax residency is a separate matter. While legal residency allows you to live in a country, tax residency often depends on spending more than 183 days there annually, which could trigger tax obligations on your global income. Understanding this distinction is crucial when planning strategies to protect your wealth.

How Second Residency Protects Your Wealth

Second residency acts as a safeguard against concentrated risk by ensuring that no single government has complete control over your assets. When all your wealth is tied to one jurisdiction, you’re more vulnerable to policy changes, capital controls, or economic instability. By securing residency in another country, you diversify your exposure across multiple legal systems, currencies, and banking networks.

This concept of jurisdictional diversification is key. It reduces the risk of having your entire wealth frozen or seized by one government. For example, during the Russia-Ukraine conflict, over €21.5 billion in private assets were frozen within the EU – a stark reminder of the importance of diversification. Beyond legal protections, second residency also shields your wealth through currency stability and greater financial privacy.

Countries like Switzerland, Singapore, and the UAE are popular for their stable currencies – such as the Swiss franc (CHF), Singapore dollar (SGD), or U.S. dollar (USD). Banking in these currencies can help preserve your purchasing power against inflation or currency devaluation in your home country. Additionally, many of these jurisdictions offer strong financial privacy and legal frameworks for asset protection, including specialized trusts and corporate structures. This layered approach not only guards against government overreach but also supports a broader strategy of risk diversification.

The numbers speak for themselves: in 2025, over 35% of ultra-wealthy individuals surveyed cited investment migration as a top priority for protecting their assets. Furthermore, around 25% of high-net-worth individuals already hold significant assets outside their home country. This highlights how second residency has shifted from being a luxury to becoming a critical tool for managing financial risks.

"In today’s world, a second residency isn’t a luxury – it’s a financial firewall against uncertainty." – Project Black Ledger

sbb-itb-39d39a6

Main Benefits of Second Residency for Wealth Protection

Geographic Diversification and Currency Stability

Having residency in multiple countries allows you to spread financial risks across different economies and currencies. Why does this matter? Because when a currency loses value, it can quickly erode wealth. A second residency gives you access to stable currencies through local banking options, which can be a lifeline during economic upheavals. Take the 2019 Latin American currency crisis, for instance: individuals with assets in Panama’s dollarized economy managed to preserve their wealth, while neighboring countries faced severe devaluations. Fast forward to 2023, and over 75% of global central banks were engaged in quantitative easing, affecting currency values and purchasing power globally. By maintaining accounts in multiple currencies, you create a buffer against inflation and potential monetary instability in your home country.

Real estate investments tied to residency programs can also help diversify currency risks. For example, a Greek Golden Visa investor benefited from a property that not only appreciated in value but also provided steady rental income. This highlights how real estate can act as both a currency hedge and a source of consistent returns. These strategies naturally complement broader asset protection plans, which we’ll explore next.

Better Asset Protection Across Multiple Jurisdictions

Second residency opens the door to international legal and banking systems designed to protect wealth. Countries like Singapore, Switzerland, and the UAE are known for their private banking services, offering multi-currency accounts and robust asset protection frameworks. Residency can also allow you to establish trusts, foundations, or corporate structures that shield your assets from legal claims in your home country. For instance, Liechtenstein foundations and New Zealand foreign trusts provide strong asset protection options once you secure residency in these jurisdictions.

Consider this: as of 2023, over $80 billion in private assets were frozen within the European Union and by U.S. allies due to geopolitical sanctions. Additionally, many international banks are now "de-risking" by shutting down accounts for entire nationalities from high-risk regions, regardless of whether the individual is personally sanctioned. In such scenarios, having residency in a neutral, stable jurisdiction can safeguard your banking relationships and financial assets, even as geopolitical tensions rise.

Tax Optimization Opportunities

A second residency isn’t just about diversifying currencies or gaining access to better banking – it can also offer significant tax advantages. Many jurisdictions with favorable tax regimes allow residents to lower their tax burdens while simultaneously enhancing asset protection. For example, zero-tax countries like the UAE, Monaco, and the Bahamas impose no personal income tax on residents. Similarly, territorial tax systems in places like Panama, Costa Rica, and Singapore only tax income earned within their borders, leaving foreign-sourced income completely untaxed.

For those looking at European residency, lump-sum tax regimes provide predictability. Italy, for instance, offers a flat $125,000 (about €100,000) annual tax regardless of global earnings, while Anguilla requires a $75,000 annual fee along with a $400,000 home purchase. Malta’s Global Residence Programme sets a 15% flat tax rate on remitted income.

It’s worth noting that tax residency isn’t the same as legal residency. In most countries, spending 183 days or more per year triggers tax obligations on global income. However, there are exceptions. Cyprus, for example, has a "60-day rule" that allows you to qualify for tax residency with far less physical presence. This flexibility makes it easier to strategically manage your time and tax exposure across multiple jurisdictions.

What to Consider When Choosing a Second Residency Program

Country Stability and Economic Environment

When evaluating a second residency program, the first thing to assess is the political and economic stability of the country. The strength of a nation’s currency plays a bigger role than you might expect. For example, even a modest annual currency depreciation of 5–7% can erode the real value of your savings by more than half within a decade. Countries with dollarized economies, like Panama, or those with strong inflation controls, such as Uruguay, tend to offer better wealth preservation.

Geopolitical neutrality is another crucial factor. Consider this: in 2022, the European Union froze over €21.5 billion in Russian private assets following the invasion of Ukraine. Beyond sanctions, many banks began closing accounts based solely on nationality, a practice often referred to as excessive compliance measures. Choosing a politically neutral jurisdiction can help protect you from being caught up in international disputes.

Equally important is the legal framework that safeguards your assets. Look for countries with strong banking secrecy laws, stable regulatory environments, and advanced private banking options that include multi-currency accounts. For instance, Switzerland demonstrated its commitment to financial privacy in September 2025 when lawmakers scaled back proposed anti-money-laundering legislation to maintain the country’s financial competitiveness. A robust legal and financial system provides the foundation for exploring other elements like residency requirements and banking access.

Residency Requirements and Investment Thresholds

Investment thresholds for second residency programs can range widely, depending on your goals. For instance, Caribbean programs like Dominica start at $200,000, while Singapore’s Global Investor Programme requires an investment of over SGD 10 million (approximately $7.4 million). These differences go beyond cost – they reflect strategic priorities. High-threshold programs, such as those in Singapore or the UAE’s Golden Visa (around $540,000), are geared toward business expansion and access to top financial hubs. Meanwhile, lower-cost Caribbean options focus on swift global mobility and providing a "Plan B" for security.

Some programs, like Greece’s Golden Visa or the UAE’s residency options, have minimal physical presence requirements. This means you can maintain legal residency without becoming fully subject to local taxes. For many, this creates a legal "firewall" that protects their wealth.

It’s also vital to budget beyond the stated investment amount. Legal fees, due diligence, and processing costs typically add 40–50% to the initial investment. For example, while Greece’s Golden Visa requires a real estate investment of between €250,000 and €800,000, the total cost often ends up higher once legal and tax-related expenses are factored in.

Banking Access and Financial Privacy

Having access to sophisticated banking services is essential for protecting your assets. Jurisdictions like the Cayman Islands, known for their political stability and strong legal protections, are prime examples of international financial hubs. Similarly, residency in places like Singapore or Switzerland can open doors to exclusive private banking services, which are becoming harder to access for non-residents due to stricter compliance measures.

The UAE has also gained attention as a banking-friendly jurisdiction. Ranked 2nd globally in the 2025 Digital Nomad Visa Index, the UAE offers a well-developed financial infrastructure with relatively low barriers to entry. For example, its Virtual Work Visa requires just $3,500 in monthly income. On the other hand, Andorra increased its passive residency investment threshold from €600,000 to €800,000 in 2025 to meet growing demand for its secure European banking services.

"Mobility is no longer a luxury but a necessity for HNWIs seeking to safeguard their assets and access opportunities worldwide." – Global Citizen Solutions

Financial privacy is another key consideration. While some countries, like Switzerland, maintain a balance between global compliance and privacy protections, others have leaned toward more transparent reporting standards. The goal is to identify jurisdictions with strong data protection laws that still provide access to international banking networks. Strong financial privacy doesn’t just enhance banking options – it also strengthens your overall asset protection strategy. Notably, 17.2% of high-net-worth individuals, or about 8.6 million people, live in countries with weak passports or geopolitical restrictions, driving demand for second residencies that improve banking access and asset security. These factors are critical as you finalize your residency plans. For personalized guidance, you can schedule private consultations to tailor a strategy to your specific needs.

How to Obtain a Second Residency for Wealth Protection

Assess Your Current Wealth and Risk Exposure

Before diving into any residency program, it’s crucial to understand what you’re trying to protect and why. Start with a quick tax risk assessment – this can help you spot vulnerabilities, especially if you’re a U.S. citizen dealing with FBAR or FATCA regulations. Take a deep dive into your financial records and business structures over a couple of months. This includes reviewing your investment portfolios, equity compensation like RSUs, real estate holdings, and offshore accounts. The goal? Identify which assets are most at risk due to political instability, currency depreciation, or changing regulations in your home country.

Here’s an eye-opener: between 2021 and 2024, there was a 67% jump in wealthy Americans exploring international residency options. Many of them only discovered their financial weak spots after conducting a thorough risk review. For instance, if you hold significant unvested equity or face potential exit taxes, you’ll need a solid plan before changing your tax domicile. Otherwise, you could trigger immediate taxation on capital gains.

Select the Best Jurisdiction Based on Your Goals

Your choice of residency program should align with your financial needs and lifestyle priorities. For example, tech executives with equity compensation often turn to Singapore’s Global Investor Programme. While it requires an investment of $1.8 million to $7.5 million, it offers sophisticated tax benefits for RSUs. On the other hand, business owners looking for tax-friendly holding company setups might prefer the UAE Golden Visa, which costs around $272,000 and offers 0% personal income tax.

When selecting a jurisdiction, focus on three key factors: the taxation system, physical presence requirements, and the path to citizenship. If you want minimal physical presence, options like the UAE Golden Visa or Greece’s Golden Visa (€250,000–€800,000) allow you to maintain residency without becoming fully subject to local taxes. But if your goal is to secure a second passport, Portugal’s Golden Visa (€500,000 for fund investments) offers citizenship after five years. In contrast, Thailand’s Elite Visa ($15,000–$60,000) doesn’t provide a path to citizenship.

Take this real-world example: In 2025, a Silicon Valley tech executive with $3.5 million in unvested RSUs used Singapore’s Global Investor Programme to establish residency. By restructuring her role to include regional responsibilities in Asia and setting up a local office, she met the program’s business substance requirements. This move reduced her equity income tax rate from 37% to about 22%, saving her over $500,000 in just the first year.

To prepare for relocation, start building banking relationships 6–12 months in advance. Once you’ve aligned your goals and chosen a jurisdiction, the next step is to work with experts to navigate the application process.

Work with Professionals for Residency Applications

Professional guidance is invaluable when applying for residency. Without it, you risk unexpected costs – total expenses for residency can run 30% to 50% higher than the advertised investment due to legal fees, due diligence, and government processing. Professionals can help you budget effectively and avoid hidden fees.

These experts also craft a compelling application narrative, showcasing your meaningful economic contributions. It’s no longer enough to meet the minimum requirements – modern residency programs favor applicants who demonstrate economic substance, like hiring locally or establishing an office. For example, Singapore’s Global Investor Programme and the UAE Golden Visa both prioritize applicants with legitimate business operations or regional roles.

"Residency applications aren’t just paperwork – they’re a strategic blueprint. The difference between approval and long-term success lies in early banking relationships, business substance, and a well-crafted presence." – Project Black Ledger

Additionally, professionals ensure compliance with international standards like AML, FATCA, and FBAR, protecting you from account closures or regulatory penalties. They’ll guide you through a phased approach: 2–3 months for planning, 3–4 months for implementation, and ongoing optimization. This timeline allows you to establish essential legal frameworks – such as holding companies, trusts, or foundations – to protect your assets before finalizing your residency.

Finally, expert advisors help you navigate "exit tax traps" that could result in immediate taxation on unvested equity or capital gains when relocating. With the right guidance, you can avoid unexpected tax bills and ensure the benefits of your new residency outweigh the costs.

Conclusion

A second residency isn’t just a convenient travel benefit – it’s a safeguard against the uncertainties of today’s global economy. Whether it’s shielding assets from political unrest, tapping into reliable banking systems, or improving your tax efficiency, a well-thought-out residency strategy provides a level of geographic diversification that traditional investments simply can’t match. This trend highlights a growing shift in how wealth is managed and protected on an international scale.

The numbers speak for themselves – over 35% of ultra-wealthy individuals now consider investment migration a key tool for securing their assets. This isn’t about escaping challenges; it’s about creating a solid foundation for your wealth, your business, and your family. Jurisdictions like Singapore, with its advanced banking systems, or the UAE, with its zero-tax policies, exemplify how the right location can redefine asset protection and growth. Success in this arena requires thoughtful planning and early action.

"In today’s world, a second residency isn’t a luxury – it’s a financial firewall against uncertainty." – Project Black Ledger

To turn these insights into action, start by planning strategically and early. Evaluate your risks, choose jurisdictions that align with your goals, and collaborate with experienced professionals to build a framework that shields your wealth from unexpected disruptions and regulatory shifts.

Your financial future shouldn’t hinge on the stability of a single country. By creating a diversified, resilient strategy – complete with robust banking and legal structures – you can secure your legacy and protect your assets for generations to come.

FAQs

What are the key advantages of getting a second residency for protecting your wealth?

Obtaining a second residency comes with some clear benefits when it comes to safeguarding your wealth. For one, it can help protect your assets from the uncertainties of political or economic turmoil in your home country. It also provides access to jurisdictions with more favorable tax policies and enhances financial privacy. These advantages can act as a safety net, helping you secure your financial future in a world that’s often unpredictable.

On top of that, a second residency boosts your global mobility, offering the freedom to live, work, or invest across multiple countries. This added flexibility not only spreads out risk but also opens doors to new opportunities – whether for personal aspirations or financial ventures.

What’s the difference between second residency, citizenship, and tax residency?

A second residency lets you legally live in another country, often through programs tied to investment, work, or retirement. However, it doesn’t come with the full rights of citizenship – like voting or holding a passport from that country. What it does offer is access to local services and legal recognition without granting the broader privileges of being a citizen.

Citizenship, in contrast, is a more permanent status. It includes key rights such as voting, obtaining a passport, and often access to social benefits. Securing citizenship usually involves a more detailed legal process and stricter requirements.

Tax residency is a separate concept altogether. It determines where you’re required to pay taxes, which is often based on where you live or maintain economic ties, regardless of your legal residency or citizenship. Many seek second residencies as a way to diversify their financial and legal options, safeguarding their wealth without necessarily altering their citizenship or tax obligations.

What should I consider when selecting a second residency for wealth protection?

When selecting a second residency, a few important factors should guide your decision to ensure it aligns with both your financial plans and personal aspirations. Start by looking into the legal framework and compliance rules of the program. This will help you confirm that the residency option is legitimate and built for long-term stability.

Next, take a close look at the costs involved, which can include investment requirements, application fees, and any ongoing commitments. These costs can differ significantly depending on the country, so it’s worth doing a detailed comparison.

Tax advantages are also worth examining. Certain countries provide tax-friendly systems that can help you manage your finances more effectively and safeguard your assets. Additionally, consider whether the program includes family members and offers perks like visa-free travel, which can expand your global mobility.

Finally, evaluate the country’s geopolitical stability, financial privacy protections, and reputation for safeguarding assets. These elements can play a big role in ensuring your wealth stays secure.

By taking these factors into account, you’ll be better equipped to choose a second residency program that supports your financial goals and enhances your global opportunities.