November 4, 2013

By: Kelly Diamond, Publisher

I don’t fault people for not knowing about BitCoin. It’s normal for people to not know things.

I do however condemn those who don’t know anything about BitCoin, but feel confident enough in their ignorance to attempt at any substantive claim for or against it.

Well, I spent this weekend in the virtual rabbit hole known as the internet. Sometimes I find some pretty cool stuff… this was NOT one of those times. I found a preponderance of ridiculousness that has yet to be matched outside the political arena.

Here’s how it went:

First, there was this article: Founder of Digital Currency Service, Liberty Reserve, Admits Guilt and Faces 75 Years in Prison. What’s he actually guilty of? Receiving child pornography, marriage fraud, and money laundering.

My blood immediately began to boil as the headline’s spin on this is to affiliate virtual currency with this sort of trash. First off, child porn and marriage fraud have jack to do with virtual currency. Long before there were computers, there was marriage fraud and child porn. And the same goes for money laundering, to be honest. That we now have new technological means to carry out the same old, tired crimes is really not news. BUT it is when you’re desperately trying to build some strawman narrative against virtual currency and depict it as some wretched thing only employed by the underbelly of our society.

Seriously? PHONES are also often used in the carrying out crimes. Shall we outlaw that too?

These are the exact same scare tactics used on guns: MASS KILLINGS! Really? More people die from car accidents. And cars are already regulated, registered, licensed, with goons patrolling the streets for the slightest infraction. Cars are also used by criminals… so that’s a double whammy!

Logic no-showed on that one, but that didn’t stop them from publishing this nonsense just the same.

So then, I find this “related article” along their sidebar: FBI Proves Seizing BitCoin isn’t the Same as Owning Them.

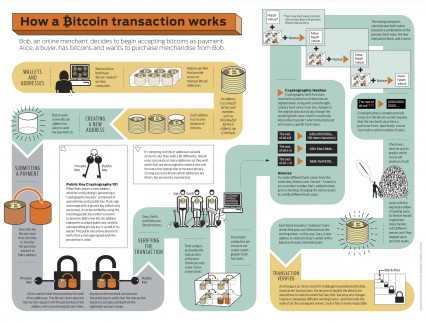

You have to wonder if the person who wrote this has any freakin’ clue what the hell BitCoin is or how it works. (For those who honestly don’t, here’s an infographic that might help you or others you know.)

I’m not by any stretch of the imagination a tech guru. Hell, I’m that person that calls Tech Support when my computer doesn’t work because I never turned it on. But even I know that passwords and encryption can amount to a wall made of quicksand or butter for would-be hackers.

Still, I thought perhaps such a “revelation” (late as it is) would amount to some praise for the security of this currency. Yeah, that would be a no. Take a read from this economic protectionist crony fraud:

“Taking down Silk Road was an important step in helping legitimize and bring bitcoin into the mainstream. Liquidity is a big problem right now that impedes bitcoin’s growth, hopefully this 5% stash can be recovered and reinserted into circulation to get more people and businesses using BTC,” said Travis Skweres, CEO of bitcoin exchange CoinMKT.

“Legitimize” BitCoin? By taking down a black marketeer? Silk Road sold goods and services people wanted. PERIOD. As far as I’m concerned that’s legit. But here’s this fascistic shyster, calling for the THEFT of Ross Ulbricht’s property! Please, out of respect for virtual currency in general, and in the name of libertarian principle, I ask that you NOT patron CoinMKT. If he is willing to sell out that quickly on the property right of Ulbricht, your privacy and your wallet aren’t far behind.

This guy here is even worse! Evidently the algorithm that restricts the mining of BTC is a little inconvenient for him, so he wants what’s already been mined, but happens to also be OWNED by someone else, circulated back into the market:

“I’ll be glad to see these bitcoins transitioned to the wider community,” says Jaron Lukasiewicz, the founder of Coinsetter, a high-performance bitcoin exchange designed for traders. Yeah, just not YOUR BitCoins, right? Hypocrite.

And finally this: Banking Innovation Depends on BitCoin.

This guy thinks that banks should get into BitCoin. See, we are getting into that age where the brick and mortar bank buildings are becoming obsolete. It’s already for the most part a 1’s and 0’s game. When the only distinguishing factor is the person on the other end of the 800 number and the easy navigation of your website, what will be left to set one bank apart from another?

BitCoin is the next big thing for banks who want to appeal to the younger generations, he claims. It’s the bee’s knees! And it’s such a natural fit for banks too! *rolling my eyes*

“Banks own the trust game and it is their game to lose.

“For better or worse, a majority of people still prefer banks over trusting Apple, Google, or PayPal with sensitive data. Security at banks and financial institutions usually represents the strongest in the world among private businesses.

“For those individuals desiring a third-party safe keeper for their bitcoin balances, banks could provide several obvious advantages,” writes the author.

In what alter-universe do banks own the trust game? Not MINE! In MY reality, banks have betrayed every level of trust imaginable. If the bail OUTS in the US were not enough, certainly the bail INS in Cyprus would seal that deal.

And how did this become some weird choice between Apple, Google or PayPal and the banks? Does this author have any idea how transactions are carried out with BitCoin? I guess if you’re trading… you would need a fluid means of transference, but still… couldn’t you just as easily get an app? Aren’t there already intermediaries that deal in this sort of thing? (Ideally NOT people like Jaron Lukasiewicz, above.)

He writes this: “…bitcoin doesn’t even claim to represent anything similar to legal tender,” which has me wondering how he reconciles that with this: “Shifting the monetary unit of account to cryptographic money supported by market-based legitimacy rather than regulatory-based legitimacy is allowing innovation on an entirely new level.” I can’t even pretend to understand where this guy’s head is at. One second it’s not even close to similar to legal tender… but it is a monetary unit of account that has market-based legitimacy.

Let’s go a little further: BTC is not illegal anywhere in the world. In fact, Germany recognizes BTC as legal tender. Sadly, the man who wrote this advocacy for BTC to be part of the banking business model wrote his article on October 31st, 2013. And he writes as if he is being cutting edge and innovative.

I want to tell him that many people who are using BTC want NOTHING to do with banks. I wrote a blog about this back in April, “Casualties of Plunder: Condemning an Ethic into Exile”, where I site a Cypriot business owner who lost hundreds of thousands of dollars in the “bail-in” of the Cypriot banks. They stole his money. His response? Moving his business offshore and dealing in BitCoin.

Virtual currency is the market giving fascistic banks the big angry finger. It’s not an invitation to a new game. I WISH banks were still competing in currencies! But that’s not what this would be. It would be just another government toady monitoring your financial goings. And remember how the DHS likes confiscating stuff out of people’s safe deposit boxes, courtesy of the Patriot Act? To have a BTC account with a bank all but raises the red flag for the DHS to ride in and confiscate your virtual holdings as well. I mean, you can’t honestly think that BTC accounts with a bank will be as iron clad as the wallets we have from private companies now, do you?

Keep educating yourself and others about virtual currencies. Demystify the hype, replace it with some simple truths, and just say not to fiat currencies when you can.