What to Do Before You Leave Your Home Country (Financially Speaking)

Don’t move abroad without handling taxes, FBAR/FATCA, banking, investments, retirement, health insurance and possible exit-tax exposure.

Don’t move abroad without handling taxes, FBAR/FATCA, banking, investments, retirement, health insurance and possible exit-tax exposure.

How offshore trusts, multisig blockchain tools and AI-driven compliance are reshaping asset protection amid tighter regulations and rising cyber and litigation risk.

Art, fine wine, rare coins and metals can diversify and protect wealth—understand risks, storage, taxes and offshore strategies for long-term preservation.

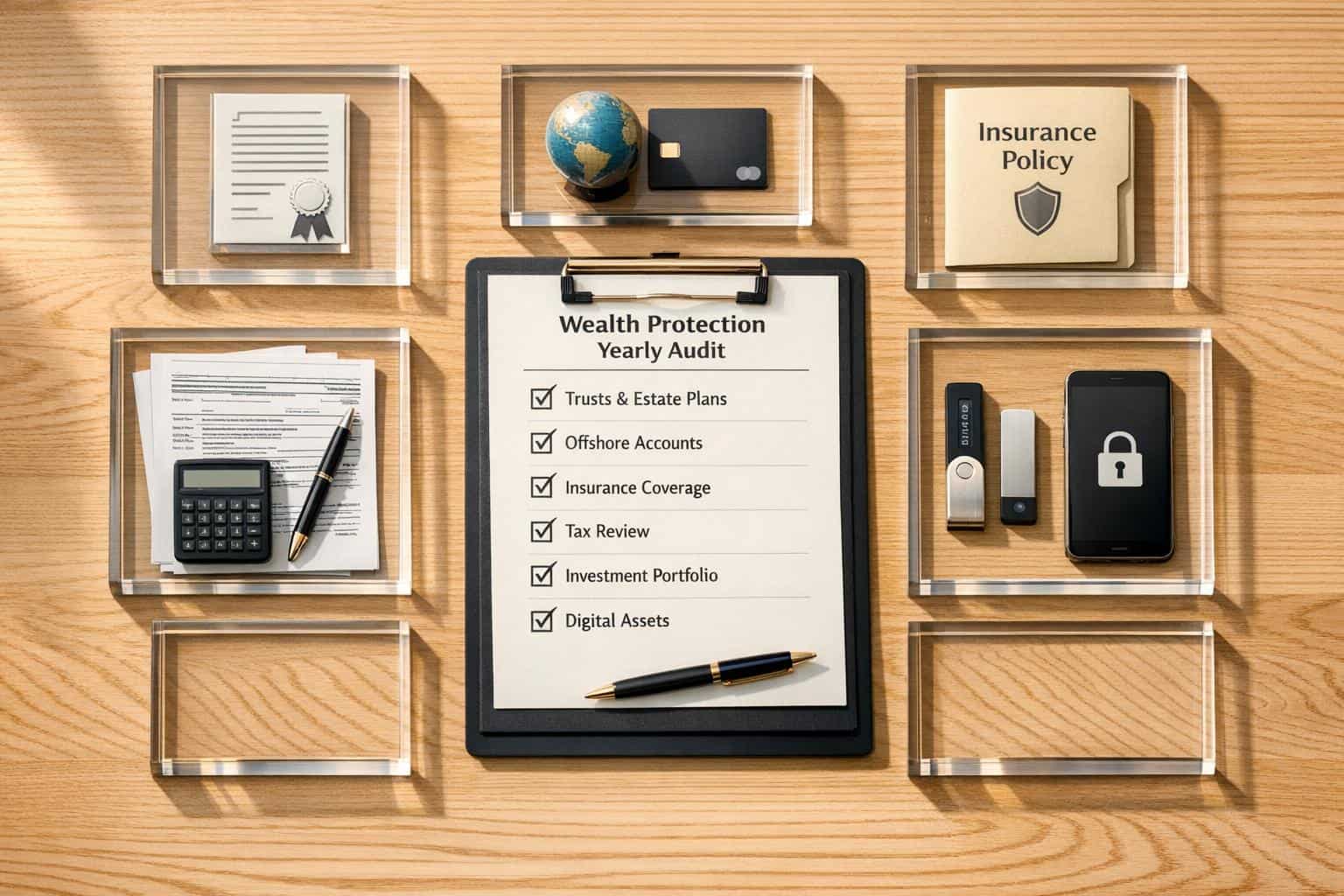

A concise yearly audit guide to review trusts, offshore accounts, insurance, taxes, portfolios and digital assets to maintain compliance and protect wealth.

Protect your retirement savings abroad: manage currency and tax risks, choose stable offshore banking and legal structures, diversify investments, and stay compliant.

Case studies showing how offshore trusts, international LLCs and private foundations legally shield wealthy individuals from creditors, taxes, and divorce.

ALMOST THERE! PLEASE COMPLETE THIS FORM TO GAIN INSTANT ACCESS

Privacy Policy: We hate SPAM and promise to keep your email address safe.