Wealth Protection for High-Net-Worth Individuals: Best Practices

Practical asset-protection best practices for high-net-worth individuals: insurance, domestic and offshore structures, diversification, and FATCA/CRS compliance.

Practical asset-protection best practices for high-net-worth individuals: insurance, domestic and offshore structures, diversification, and FATCA/CRS compliance.

How international life insurance and PPLI protect assets, reduce taxes, and enable efficient cross-border estate planning for high-net-worth individuals.

Use charitable trusts, donor-advised funds, offshore foundations, and gifting strategies to lower taxes, shield assets from creditors, and sustain philanthropy.

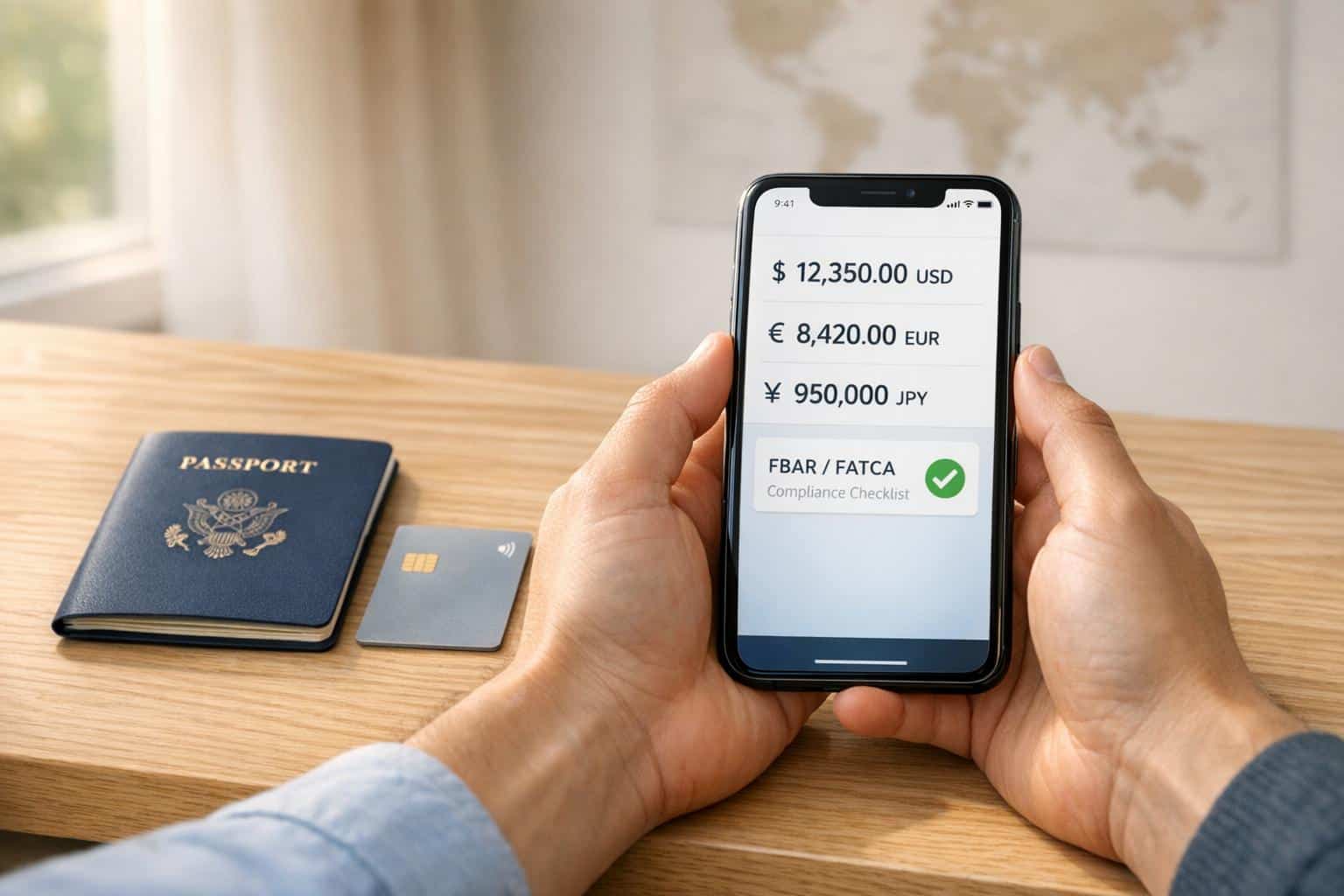

Learn how legal asset protection differs from illegal tax evasion, common IRS red flags, required reporting (FBAR, Form 3520), and steps to stay compliant.

How tax shifts, regulation and geopolitics can erode or boost your assets, plus practical steps to diversify, protect, and grow wealth across borders.

Avoid hidden fees and compliance traps abroad by using multi-currency accounts, expat-friendly banks, and strict FBAR/FATCA reporting.

ALMOST THERE! PLEASE COMPLETE THIS FORM TO GAIN INSTANT ACCESS

Privacy Policy: We hate SPAM and promise to keep your email address safe.