Keeping Your Wealth Safe in the Digital Age (Cybersecurity for Finances)

Secure your money and identity with MFA, encryption, secure banking habits, backups, and legal asset protections against modern cyber threats.

Secure your money and identity with MFA, encryption, secure banking habits, backups, and legal asset protections against modern cyber threats.

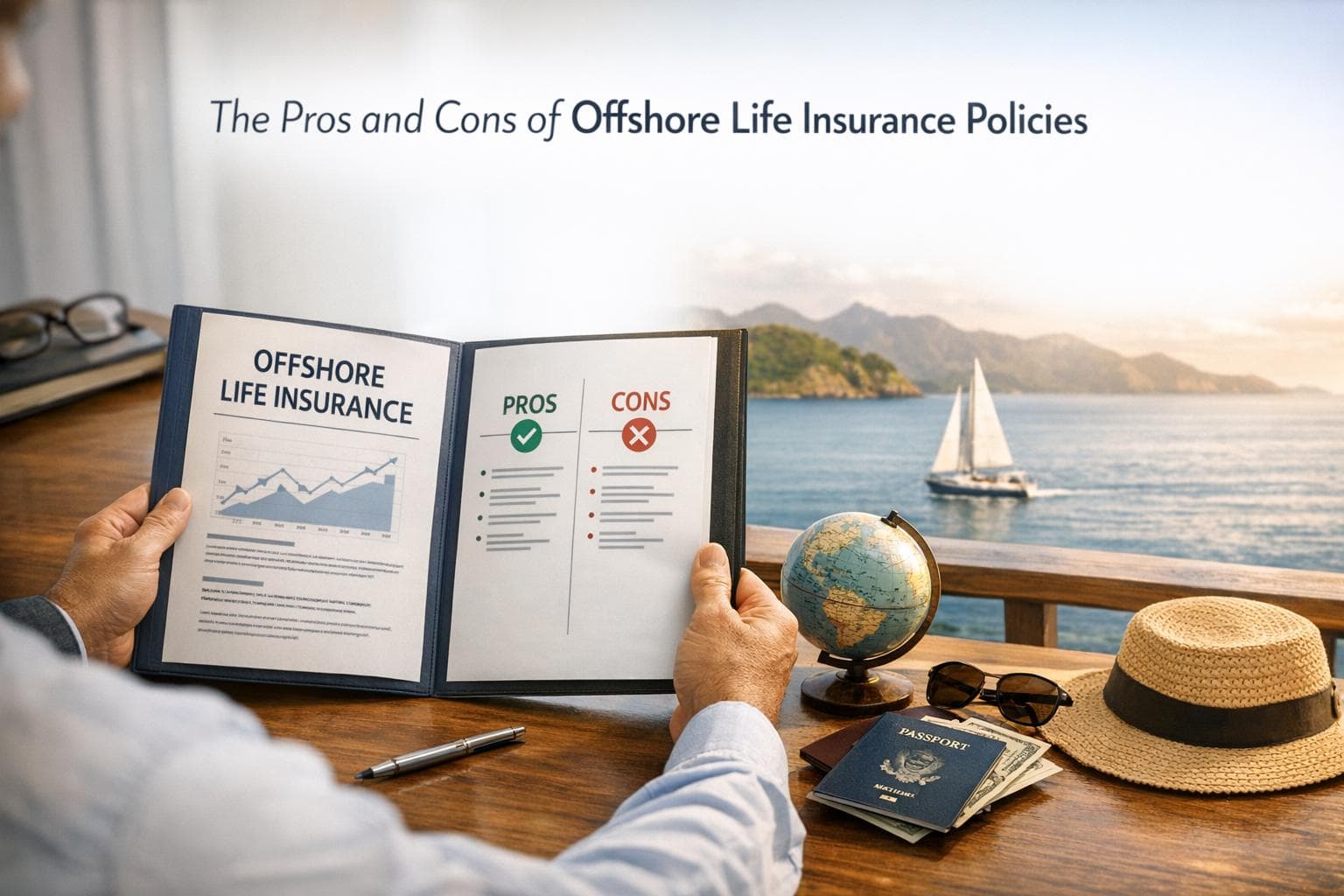

Examines tax, asset-protection, and estate-planning benefits of offshore life insurance – and the regulatory, compliance, and cost risks for wealthy clients.

Compare Anguilla, BVI, Cayman Islands and Panama for taxes, privacy, setup speed and asset protection to choose the best offshore option.

Smart wealth plans blend preservation and growth: align asset allocation with your goals, manage tax and legal risks, and rebalance to secure long-term wealth.

Guidance on taxes, wills, trusts and reporting to avoid double taxation, legal conflicts, and delays when transferring assets across borders.

Use an Anonymous LLC to keep owners off public records and protect assets; compare privacy, costs, and compliance across New Mexico, Wyoming, and Anguilla.

ALMOST THERE! PLEASE COMPLETE THIS FORM TO GAIN INSTANT ACCESS

Privacy Policy: We hate SPAM and promise to keep your email address safe.