In today’s volatile financial landscape, protecting your wealth is more important than ever. With rising legal threats, economic instability, and the collapse of major banks like Silicon Valley Bank in 2023, high-net-worth individuals face increasing risks. The U.S. dollar’s 10% drop against the DXY in 2025 and the national debt surpassing $31 trillion further emphasize the need for secure, diversified strategies. This article breaks down how to safeguard assets using international trusts, offshore jurisdictions, and multi-entity structures, while staying compliant with global reporting laws.

Key Takeaways:

- Offshore Trusts: Jurisdictions like the Cook Islands and Nevis offer strong asset protection by not recognizing U.S. court judgments and requiring high burdens of proof for claims.

- Multi-Entity Structures: Combining trusts and LLCs isolates liabilities and protects assets.

- Banking Diversification: Holding funds in stable currencies (e.g., Swiss Francs) and banking systems (e.g., Switzerland) mitigates risks from U.S. economic instability.

- Compliance: Full disclosure through IRS forms like FBAR and FATCA ensures legality while protecting assets.

Offshore Asset Protection: How It Works and Why It Matters

Offshore asset protection creates legal hurdles that make it extremely difficult and costly for creditors to seize your assets. By transferring assets to an irrevocable offshore trust or LLC, you essentially separate ownership, building a legal shield that protects your wealth from being used to satisfy personal judgments against you.

Here’s how it works: jurisdictions like the Cook Islands and Nevis do not recognize U.S. court judgments. So, even if a creditor wins a case in, say, California, they must start over in the foreign jurisdiction. This process involves hiring local attorneys, posting bonds, and re-litigating the case under the foreign country’s laws. Additionally, many offshore jurisdictions have short time limits for challenging asset transfers, making it nearly impossible for creditors to undo a well-planned arrangement. These mechanisms clearly separate legitimate asset protection strategies from illegal activities like tax evasion.

Beyond protecting assets from lawsuits, offshore strategies provide economic and political diversification. Holding wealth in multiple currencies, such as Swiss Francs or Euros, and banking in stable systems like those in Switzerland or Austria, can act as a hedge against U.S. dollar devaluation and domestic banking crises. For instance, this approach proved valuable during the major U.S. bank collapses in 2023. Additionally, placing assets in stable foreign jurisdictions can protect against sudden regulatory changes, political instability, or the introduction of new wealth taxes.

Legal Asset Protection vs. Tax Evasion

It’s important to understand the clear distinction between legal asset protection and illegal tax evasion. Legal asset protection uses foreign laws to safeguard wealth from future, unforeseen creditors. On the other hand, tax evasion involves hiding assets or income to dodge current tax obligations.

For U.S. citizens and residents, worldwide income is taxable, regardless of where assets are held. Moving money offshore doesn’t change this. Legitimate offshore structures must be fully disclosed to the IRS through forms like FBAR (FinCEN Form 114), Form 8938 (FATCA), and Forms 3520/3520-A for foreign trusts. Failing to file these forms can lead to severe penalties or even criminal charges.

Timing is crucial here. Courts can reverse any asset transfer made with the intent to "hinder, delay, or defraud" known creditors – a concept known as fraudulent transfer. This means asset protection measures must be set up well before any legal claims arise. Trying to move assets after a lawsuit is filed, or even after one is threatened, is often too late and could be overturned by a judge.

Main Advantages of Offshore Asset Protection

One of the biggest advantages of offshore asset protection is that it forces creditors to re-litigate claims in foreign jurisdictions. This process is not only time-consuming but also expensive, often discouraging creditors from pursuing claims altogether.

Another key benefit is privacy. Offshore structures make it harder for potential plaintiffs to identify your assets, reducing the likelihood of becoming a target for lawsuits. When your wealth isn’t easily visible, it’s less attractive to those considering costly litigation.

Geographic diversification also plays a critical role in protecting against systemic risks. With the U.S. national debt surpassing $31 trillion and the U.S. dollar losing over 10% against the DXY in 2025 – the worst six-month decline since 1973 – spreading wealth across multiple stable jurisdictions ensures no single economic event or government action can jeopardize your entire portfolio. For example, Swiss private banks typically require $1 million to $5 million to open an account, while Austrian banks have lower minimums, ranging from $250,000 to $300,000.

| Feature | Legitimate Asset Protection | Illegal Tax Evasion |

|---|---|---|

| Primary Goal | Shielding assets from future creditors | Hiding assets to avoid paying taxes |

| IRS Status | Fully disclosed and tax-neutral | Hidden from authorities; non-reporting |

| Legal Basis | Based on foreign trust and corporate laws | Violates tax codes through deception |

| Timing | Proactive; set up before claims exist | Reactive; often done after debts arise |

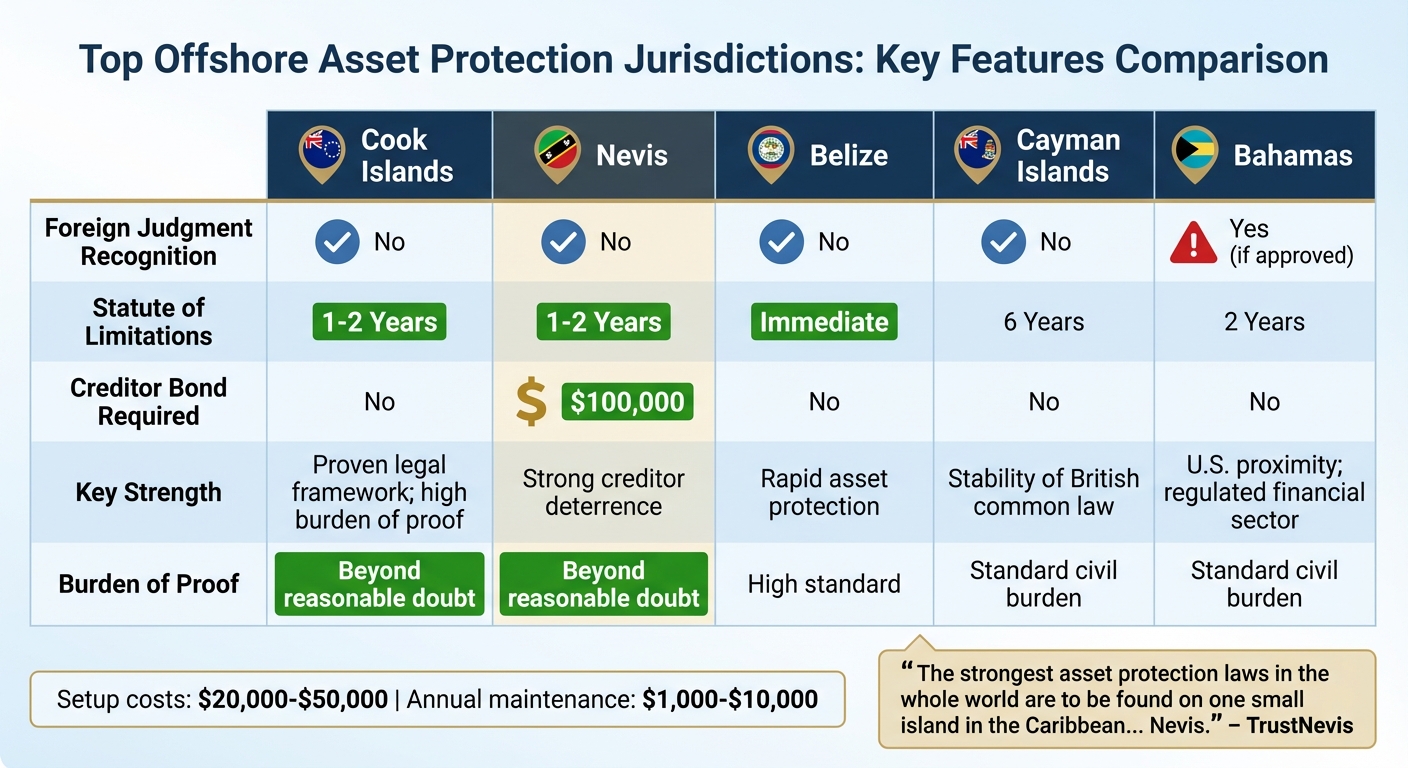

Setting up an offshore protection structure typically costs between $20,000 and $50,000, with annual maintenance fees in the thousands. While this may seem steep, the protection it offers against multi-million-dollar lawsuits can be a worthwhile investment for high-net-worth individuals facing significant litigation risks.

Top Offshore Jurisdictions for Asset Protection

Jurisdiction Comparison: Nevis, Belize, Cook Islands, and Others

When it comes to offshore asset protection, choosing the right jurisdiction is all about understanding their unique legal systems, creditor barriers, and political stability. These factors play a huge role in determining how effective your asset protection strategy will be.

The Cook Islands is often considered the gold standard in offshore asset protection. Why? For starters, it doesn’t recognize foreign court judgments, meaning creditors must re-litigate their case in local courts. Add to that a short statute of limitations – usually 1–2 years – and the need for creditors to prove fraudulent intent beyond a reasonable doubt (a standard typically reserved for criminal cases), and you’ve got a system designed to protect assets. Its track record of favorable case law only adds to its appeal.

Nevis takes things a step further. It not only matches the Cook Islands in protection but also requires creditors to post a $100,000 bond before filing a lawsuit against a trust. Like the Cook Islands, Nevis enforces the same high burden of proof and short statute of limitations, making it a formidable choice for asset protection.

"The strongest asset protection laws in the whole world are to be found on one small island in the Caribbean… Nevis." – TrustNevis

Belize offers a different kind of advantage: speed. Its statute of limitations on fraudulent conveyance is effectively immediate. However, Belize’s reputation can sometimes be a drawback due to concerns about crime and corruption, which may impact banking relationships.

The Cayman Islands brings the stability of British common law to the table. While this is a major plus, its six-year statute of limitations on fraudulent transfer claims makes it less ideal for those seeking immediate protection. Similarly, The Bahamas offers proximity to the U.S. and a well-regulated financial sector, but foreign rulings can be enforced if approved by local judges, which weakens its protective edge.

| Jurisdiction | Foreign Judgment Recognition | Statute of Limitations | Creditor Bond Required | Key Strength |

|---|---|---|---|---|

| Cook Islands | No | 1–2 Years | No | Proven legal framework; high burden of proof |

| Nevis | No | 1–2 Years | $100,000 | Strong creditor deterrence |

| Belize | No | Immediate | No | Rapid asset protection |

| Cayman Islands | No | 6 Years | No | Stability of British common law |

| Bahamas | Yes (if approved) | 2 Years | No | U.S. proximity; regulated financial sector |

For those more focused on banking stability and currency diversification, Switzerland and Austria are popular options. Swiss private banks typically require a minimum deposit of $1 million, while Austrian banks usually ask for $250,000 to $300,000. While these countries are known for their strong banking systems, they don’t offer the same statutory protections against creditors as jurisdictions like the Cook Islands or Nevis.

Each jurisdiction has its strengths and weaknesses, making it essential to understand how they align with your asset protection goals.

How to Choose the Right Jurisdiction

Selecting the best jurisdiction for asset protection is a strategic decision that depends on your specific needs and circumstances. Political and economic stability should be at the top of your list. Jurisdictions with a strong rule of law and independent judiciaries provide the most reliable protection.

Timing is another key factor. If you’re planning ahead and want to establish protection long before any potential legal claims, the Cook Islands offers a stellar track record backed by extensive case law. On the other hand, if you’re facing more immediate risks, Belize’s near-instant protection against fraudulent transfer claims might be a better fit. Keep in mind that any transfers made after legal action is initiated – or even threatened – can be reversed as fraudulent conveyances.

Creditor deterrence is also critical. Nevis’s $100,000 bond requirement creates a significant financial obstacle for creditors, discouraging many from pursuing claims. Additionally, the jurisdiction’s international reputation matters. While Belize’s asset protection laws are strong, it doesn’t always carry the same level of trust as the Cook Islands or Nevis. Jurisdictions that comply with global standards like the Common Reporting Standard (CRS) and FATCA enhance their credibility by operating transparently within international norms.

For maximum protection, many high-net-worth individuals use layered structures. For example, combining a Nevis LLC with a Cook Islands Trust allows you to retain control through the LLC while benefiting from the Cook Islands’ robust legal shield.

Costs for setting up offshore trusts typically range from $3,000 to $20,000, with annual maintenance fees between $1,000 and $10,000. In Nevis, setting up an International Exempt Trust includes a $300 registration fee and a $300 annual renewal. Balancing these costs against the level of protection and compliance you need is an important part of the decision-making process.

For U.S. persons, transparency is key. Offshore structures must be reported through FBAR and Form 8938. Choosing jurisdictions that align with CRS and FATCA frameworks ensures compliance while maintaining the integrity of your asset protection strategy.

Offshore Trusts: Structure, Setup, and Benefits

How Offshore Trusts Function

Offshore trusts are a powerful tool for protecting wealth, offering a legal framework to shield assets from potential threats. In simple terms, an offshore trust involves transferring ownership of assets to a trustee in a foreign jurisdiction, who then manages those assets for your designated beneficiaries. The key players here include the settlor (you, the one creating the trust), the trustee (a non-U.S. citizen or foreign entity with no U.S. ties), and the beneficiaries (those who will benefit from the trust). Additionally, a trust protector can be appointed to oversee the trustee, with the authority to intervene or replace them if necessary.

What makes offshore trusts especially effective are their protective clauses. For instance, a duress clause ensures the trustee ignores instructions given under coercion, while a flight clause allows the trust to relocate to another jurisdiction if needed.

"Properly established offshore trusts are tools that effectively protect your money from creditors and aggressive lawyers." – Asset Protection Planners

For U.S. citizens, offshore trusts are considered tax-neutral. This means that any income generated by the trust must be reported on your personal tax filings. It’s critical to ensure full compliance with IRS reporting requirements to avoid legal complications.

Now, let’s break down the steps involved in creating an offshore trust.

How to Set Up an Offshore Trust

Setting up an offshore trust requires careful planning and attention to detail. The first step is choosing the right jurisdiction. Look for a location with stable governance and strong laws that favor asset protection – some of the most popular options are the Cook Islands and Nevis. Once the jurisdiction is selected, decide on the trust structure. Most offshore trusts used for asset protection are irrevocable and discretionary. This means that once you transfer assets into the trust, you relinquish control over them, leaving the trustee with significant discretion over distributions.

A key part of the process is appointing a professional foreign trustee. This individual or entity must operate under the laws of the chosen jurisdiction and cannot have ties to the U.S. Some people opt for a bridge trust, which combines an offshore trust with a domestic LLC. In this setup, the domestic LLC handles asset management until a legal threat arises, at which point the foreign trustee takes over.

You’ll also need to prepare a thorough KYC (Know Your Customer) package and provide solvency documentation. Once the trust deed is finalized and signed, you can transfer the ownership of your assets – whether they are real estate, LLC interests, or liquid funds – into the trust.

The costs for setting up an offshore trust typically range between $20,000 and $50,000, with annual maintenance fees in the thousands. Timing is critical here. If you transfer assets after a legal claim has been filed, those transfers may be challenged as fraudulent. Working with specialized brokers can sometimes help reduce costs compared to traditional U.S. attorney fees.

When structured correctly, offshore trusts offer unmatched protection for your assets.

Why Offshore Trusts Work for Asset Protection

The strength of offshore trusts lies in their ability to create legal and jurisdictional barriers that are incredibly difficult for domestic creditors to overcome. This strategy complements broader asset protection plans by placing your wealth beyond the reach of U.S. courts. Once your assets are held by a foreign trustee under the laws of another country, creditors must pursue their claims in that jurisdiction, which is both costly and complex. In some cases, legal expenses for creditors can climb as high as $150,000.

For example, in the Cook Islands, creditors face an uphill battle. They must prove a fraudulent transfer beyond a reasonable doubt, and they have only a two-year statute of limitations to do so. These stringent requirements make it exceptionally challenging to succeed in legal claims.

"The Cook Islands trust law is considered the gold standard in asset protection law, and other jurisdictions have copied it." – White and Bright, LLP

Timing is everything when it comes to offshore trusts. Establishing the trust well before any legal trouble arises is crucial, as any transfers made after litigation begins could be deemed fraudulent. By transferring legal ownership of your assets to a foreign trustee, offshore trusts effectively shield your wealth from domestic legal threats, while still allowing you to benefit through structured distributions.

Multi-Entity Structures for Maximum Protection

Using Holding Companies and LLCs Together

When it comes to safeguarding your assets, multi-entity structures can be a powerful addition to strategies like offshore trusts and private interest foundations or jurisdictional planning. These structures work by layering legal entities to create multiple barriers between your assets and potential creditors. A common method involves using a trust or holding company that owns multiple LLCs, with each LLC holding a distinct asset.

Take real estate investors as an example. They might set up a parent holding company – either domestic or offshore – that owns several LLCs. Each LLC would then hold a separate property. If a tenant sues over an injury at one property, the lawsuit is limited to the assets within that specific LLC, effectively containing the legal risk.

This setup allows you to retain operational control. While the trust or holding company holds legal ownership, you can still manage the LLCs, oversee investments, operate bank accounts, and make day-to-day decisions. The legal ownership remains protected, offering a strong shield against potential claims.

"Offshore trusts can be used in conjunction with companies, including partnerships and LLCs, in order to allow you to maintain control of the assets".

Adding to this, many jurisdictions provide additional legal protections for LLCs. For instance, if a creditor wins a judgment against you personally, their remedy may be limited to a charging order. This allows them to collect distributions when the LLC makes them but prevents them from seizing the LLC’s assets or taking over its management. When multiple entities are involved, these protections apply separately to each one, often making creditors more inclined to settle than pursue lengthy litigation across numerous legal barriers.

Benefits of Using Multiple Entities

Multi-entity structures offer more than just protection – they provide flexibility, privacy, and strategic advantages. Here are some key benefits:

- Liability Isolation: Claims against one entity won’t jeopardize assets held by others. This is especially valuable for professionals in high-risk fields like medicine, law, or real estate development.

- Operational Flexibility: A holding company can manage multiple subsidiaries, raise capital, and provide guarantees, all while maintaining liability boundaries for each subsidiary. For example, intellectual property like patents or trademarks can be held in a separate entity, while high-risk assets like yachts or aircraft can be isolated in their own LLCs to limit liability exposure.

- Enhanced Privacy: Jurisdictions such as Nevis and the British Virgin Islands do not make shareholder and director information public. This allows families to manage their wealth discreetly, reducing exposure to security risks and unwanted attention.

- Simplified Estate Planning: When LLC membership interests are held by a trust, they bypass probate entirely. This ensures a smooth and private transfer of assets to heirs without court delays or public records.

"By transferring your LLC membership interests to a trust, you can potentially shield those interests from personal creditors and lawsuits".

The key is to design a structure that aligns with your specific risk profile and asset types. Overcomplicating the setup by creating unnecessary entities can be counterproductive. A well-thought-out, rational structure offers both protection and practicality, ensuring your financial fortress is as strong as it needs to be.

sbb-itb-39d39a6

Compliance Requirements and International Reporting

FATCA, CRS, and Other Reporting Requirements

Offshore asset protection comes with a critical requirement: full regulatory transparency. Global regulations now enforce automatic information sharing between tax authorities, primarily through two key frameworks: the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). FATCA, introduced by the U.S. Congress in 2010, mandates that foreign financial institutions report accounts held by U.S. taxpayers directly to the IRS. Meanwhile, over 100 jurisdictions have adopted the CRS framework, facilitating the automatic exchange of financial account information between participating countries. For example, if you hold an account in a CRS-participating jurisdiction like the Cook Islands or Nevis, your account details will be shared with your home country’s tax authority.

"Offshore asset protection trusts are tax-neutral structures – they are not meant to dodge taxes or hide assets from the IRS." – White & Bright, LLP

U.S. persons must navigate specific reporting requirements. If you have foreign accounts exceeding $10,000 at any point, you’re required to file FinCEN Form 114 (FBAR) electronically by April 15. For foreign financial assets exceeding certain thresholds, Form 8938 is necessary. For U.S. residents, the threshold starts at $50,000 at year-end or $75,000 at any time during the year, while for those filing jointly and living abroad, it can go up to $600,000.

Additional forms may apply in other cases. For example, transactions involving foreign trusts or receiving large foreign gifts require Form 3520, while the trust itself must submit Form 3520-A annually. Form 3520-A is due on March 15, whereas Forms 3520 and 8938 are typically due alongside your annual income tax return on April 15.

Non-compliance carries serious consequences. Failing to file Form 8938 can result in an initial $10,000 penalty, escalating to $50,000 after IRS notifications, plus a 40% penalty on understated taxes related to undisclosed assets. For FBAR violations, penalties can reach up to $10,000 for non-willful failures, while willful violations may incur penalties equal to the greater of $100,000 or 50% of the account balance. These rules set the groundwork for the compliance steps outlined below.

How to Stay Compliant Across Multiple Countries

Staying compliant with international reporting requirements means understanding the nuances of each mandate. Start by monitoring your offshore asset values throughout the year, as FBAR and Form 8938 have different thresholds and timing rules.

| Feature | Form 8938 (FATCA) | FinCEN Form 114 (FBAR) |

|---|---|---|

| Reporting Agency | Internal Revenue Service (IRS) | Financial Crimes Enforcement Network (FinCEN) |

| Threshold (Single/US) | $50,000 at year-end / $75,000 peak | $10,000 at any time |

| Filing Method | Attached to annual income tax return | Filed electronically via BSA E-Filing System |

| Assets Covered | Specified foreign financial assets | Financial accounts (e.g., bank, brokerage, mutual funds) |

Maintain accurate records and self-certification documentation for at least five years. Financial institutions will require you to certify your tax residency, and thorough documentation can help safeguard you during audits. If you’ve established a foreign trust, ensure it has an Employer Identification Number (EIN) for IRS processes, rather than using a Social Security Number.

If you miss a filing deadline, the IRS offers streamlined compliance procedures that may help you avoid severe penalties. You can also avoid penalties for Form 8938 if you can demonstrate reasonable cause for failing to disclose. However, failure to report foreign assets can extend the statute of limitations for your entire tax return – three years from when the information is provided, or six years if more than $5,000 of income is omitted.

The bottom line? Offshore asset protection structures are designed to safeguard assets from creditors and litigation – not to evade taxes or conceal them from authorities. While jurisdictions like the Cook Islands provide strong privacy protections, adhering to compliance rules ensures your asset protection strategy remains effective and legally sound.

US-Based Asset Protection and Combined Strategies

US Trusts and LLCs for Asset Protection

Domestic Asset Protection Trusts (DAPTs) and Limited Liability Companies (LLCs) provide practical and effective ways to safeguard high-risk assets while keeping tax compliance manageable. By 2024, at least 20 states in the U.S. allow DAPTs – self-settled trusts where you can act as both the grantor and a beneficiary, offering protection against creditors. Alaska pioneered this concept in 1997, and states like Nevada, South Dakota, Delaware, and Utah have since followed with debtor-friendly regulations.

LLCs, on the other hand, are designed to isolate liabilities. For example, placing each rental property into its own LLC ensures that any liability remains confined to that specific property. Derek Thain, Vice President of Fidelity‘s Advanced Planning team, highlights the importance of layering protections:

"Liability insurance is always the first line of defense".

After liability insurance, domestic LLCs and limited partnerships can add additional layers of security, with irrevocable trusts serving as the final safeguard.

One major advantage of domestic structures is that they avoid the complexities tied to international reporting. Additionally, some states offer income tax benefits. For instance, setting up a DAPT in a state with no income tax can reduce your state tax obligations while also protecting your assets from creditors. However, it’s worth noting that domestic trusts are still subject to U.S. court rulings and federal bankruptcy laws. This means that determined creditors with valid judgments could potentially access those assets.

While domestic strategies are effective on their own, combining them with offshore solutions can create an even stronger defense.

Combining Offshore and Domestic Solutions

Pairing domestic asset protection strategies with offshore structures can offer a dual-layered approach to safeguarding assets. Offshore trusts, as mentioned earlier, are ideal for shielding against foreign claims, while domestic LLCs and DAPTs protect against local liabilities. A popular setup involves an offshore trust – commonly established in jurisdictions like the Cook Islands or Nevis – that owns 100% of a U.S.-based LLC. You retain control of the LLC for day-to-day management, but in the event of a U.S. court repatriation order, the offshore trustee steps in to protect the assets.

Adam Frank, Managing Director and Head of Wealth Planning and Advice at J.P. Morgan, explains the value of this approach:

"If you create an entity, transfer assets to the entity and then contribute the entity to an asset protection trust, you can give yourself two layers of protection – even if a creditor can somehow ‘break through’ the asset protection trust, your assets are still protected in an entity."

This dual-layer strategy addresses a key weakness: domestic tools alone fall under U.S. court jurisdiction, while relying solely on offshore solutions can be costly and overly complex for active management. A balanced approach involves keeping operational assets in domestic LLCs while transferring long-term holdings to offshore trusts. This ensures accessibility for daily needs while maximizing protection for larger, long-term assets.

To avoid complications, asset protection strategies should be implemented well in advance. Transfers made after a claim arises can be reversed as fraudulent conveyances. It’s also essential to maintain enough liquid capital in U.S. accounts to cover immediate legal and defense expenses. Additionally, every structure should have a clear business purpose, with separate books and records to support its legitimacy.

Conclusion: Taking Action to Protect Your Financial Future

Asset protection isn’t something you can slap together at the last minute. Courts can undo transfers made after a legal threat has surfaced, so planning ahead is key. Think of it as building a shield – one that needs to be in place long before any trouble arises.

Start by conducting a thorough risk assessment. Take stock of all your assets – bank accounts, real estate, business interests – along with their locations, ownership details, and any key identifiers. This inventory lays the groundwork for deciding which assets need protection within the U.S. and which might benefit from offshore strategies.

From there, assemble a team of experts. Collaborate with estate attorneys, local foreign counsel, and tax advisors who understand the ins and outs of FBAR and FATCA regulations. Together, they can create a multi-layered strategy that blends domestic safeguards with offshore options. Tailoring this approach to your specific situation ensures it’s both effective and manageable. Avoid cookie-cutter plans – they rarely address individual risks effectively.

In today’s complex financial landscape, proactive planning isn’t just smart – it’s necessary. Legitimate asset protection is all about transparency. The goal is to establish legal barriers that make it much harder and more expensive for creditors to reach your assets.

The bottom line? The best time to start securing your financial future was years ago. The next best time is right now, before you actually need it.

FAQs

What’s the difference between legal asset protection and tax evasion?

Legal asset protection and tax evasion are two entirely different concepts, each with distinct purposes, legal standing, and methods of implementation.

Asset protection refers to using legitimate strategies – such as trusts, LLCs, or other financial structures – to shield your wealth from potential risks like lawsuits, creditors, or political uncertainties. These methods are designed to comply fully with tax laws and maintain transparency with authorities. On the other hand, tax evasion is an illegal act where individuals or entities deliberately avoid paying taxes. This can involve tactics like underreporting income, hiding assets, or falsifying financial records, all of which carry serious legal consequences.

Here’s how they differ:

- Purpose: Asset protection focuses on preserving and safeguarding wealth from external threats. Tax evasion, however, is solely about illegally reducing or avoiding tax obligations.

- Legality: Asset protection strategies operate within the bounds of the law and require full disclosure to the IRS. Tax evasion, by contrast, directly breaks U.S. tax laws.

- Consequences: When done correctly, asset protection has no legal repercussions. Tax evasion, however, can lead to hefty fines, accrued interest, or even criminal charges, including imprisonment.

By understanding these key differences, you can take steps to secure your financial future in a way that remains aligned with the law.

How can offshore trusts help protect my assets from creditors?

Offshore trusts protect your assets by transferring their ownership to an independent trustee in a foreign country with strong asset protection laws. Once you set up and fund the trust – whether with cash, investments, or property – it becomes irrevocable. This means you no longer legally own the assets, creating a barrier that makes it incredibly challenging for creditors to access them.

These trusts often come with features like spendthrift provisions, which block creditors from seizing assets distributed to beneficiaries, and flight clauses, allowing trustees to relocate assets to another jurisdiction if necessary. Many foreign jurisdictions also refuse to recognize U.S. court judgments, forcing creditors to pursue legal action locally. This process is not only expensive but also time-intensive, often discouraging lawsuits altogether.

Although offshore trusts are not a tool for avoiding taxes, they provide a strong layer of protection against lawsuits, judgments, and collection efforts, ensuring your wealth remains secure even in uncertain times.

Why is it important to comply with international reporting standards when using offshore asset protection strategies?

Compliance with international reporting standards is crucial to keeping your offshore asset protection strategies within legal bounds. For U.S. citizens, this means correctly reporting foreign accounts, trusts, or other assets using forms like Form 8938 and the FBAR. Skipping these requirements can lead to hefty penalties – fines can reach up to $10,000 per violation. In severe cases, non-compliance might even result in criminal charges. Accurate reporting also highlights that these tools are being used for lawful purposes, such as estate planning or financial diversification, rather than for tax evasion.

On a broader scale, following global standards like the FATF’s Beneficial Ownership Transparency Recommendations ensures your offshore structures steer clear of links to unlawful activities like money laundering or terrorist financing. By providing complete and timely disclosures, you reduce the risk of asset freezes or heightened scrutiny from authorities. This transparency allows your offshore strategies to work as intended – safeguarding your wealth and managing risks effectively.