The government imposes regulations on individuals through private corporations, relying on them to enforce rules people would never otherwise approve of.

May 13, 2024

By: Bobby Casey, Managing Director

A part of me thinks that was deliberate.

When people got upset, others would bark back, “They’re just a clerk trying to keep their job!”

So then people got mad at the stores, and others would bark back, “They are a private company and they have the right to enforce whatever rules they wish! If you don’t like it, don’t go there!”

The same happened with social media and its censorship.

Something similar was already happening with banks and their SARs (Suspicious Activity Reports):

The financial institution has the responsibility to file a report within 30 days regarding any account activity they deem to be suspicious or out of the ordinary… The institution does not need proof that a crime has occurred. The client is not notified that a SAR has been filed regarding their account.

These are just some examples by which the government is regulating people and essentially deputizing private corporations as enforcers. This is the work-around of choice to avoid political consequences with the voting public. They impose the regulations on the businesses, for whom there’s much less sympathy, and they do the political dirty work.

None of these things were rules the businesses or industries conjured themselves. Why would they? It’s extra work that upsets their customer base, causing all sorts of strain on customer service and reputation management. Which makes sense right? A business wants to make it as easy as possible to do business with them. That’s how you get free shipping, loyalty programs, and same-day pick-up.

It’s rather ingenious, if you think about it. Stir up a bunch of division and ire for corporations. Then impose a series of regulations on them, totally unopposed — if not cheered on — by the public. Then subsequently regulate the public through these corporate regulations. It’s not new though. It’s boilerplate fascism.

The censorship with all social platforms during the pandemic, the push to ban TikTok in the US, and the continued effort in Australia to have platforms like X sanitize their feeds to prevent bad news (not fake news, BAD news) from being delivered, are all government regulating businesses to indirectly regulate individuals.

Even the controlled goods such as guns and alcohol. That’s enforced at the proprietor level. The bartender and clerks have to check ID and enforce the age restrictions.

No one is talking much about this anymore, but it’s still very normal for doctors to ask patients if they own firearms. For what purpose, who can be sure. But there was a struggle in Florida to outlaw such interrogations, that ultimately failed because it would infringe upon the free speech rights of the doctor.

The proposed but failed Florida law provided the following:

Under the legislation, physicians who asked patients about gun ownership without justification, entered unnecessary information about such ownership in medical records or discriminated against gun-owning patients faced possible sanctions by the state medical board.

Imagine a doctor asking about what you have in your home, and then when you tell them they note it in your medical record. As if owning any particular thing was indicative of a medical condition. And then to discriminate against gun-owners in some way, according them differently than those who reportedly don’t own them? It seems some doctors are shifting from Hippocratic to Hypocritical oath.

Doctors were urged to push the COVID vaccines, and financially incentivized to order people onto respirators as well. They were also told to discourage the use of Ivermectin. All of this is being backtracked, but the retraction is much quieter than the initial push.

This shows no sign of slowing down either. The bank SARs have ensnared many innocent people. Banks have heightened their SARs, and innocent people are now losing their accounts:

“[M]ost of the time the customers are probably innocent. A 2018 study from the Bank Policy Institute found that a median of just 4 percent of 640,000 suspicious activity reports from a sample of large banks warranted a follow-up from law enforcement, according to the research, which examined 16 million alerts.”

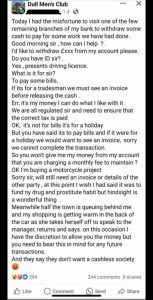

In the UK, it’s called “Banking Protocol”:

The Banking Protocol is a UK-wide piece of legislation which means that staff in financial institutions may ask you questions when you move your money. This might be when you are paying it in, withdrawing it, or paying someone. They must ask these questions by law and sometimes they have to record your response.

A teller is allowed to ask why you’re withdrawing money, and it would appear there are plenty who are glad these protocols are in place. They’re of course worried about grannies who would withdraw their entire savings for a scam, only to later blame the bank for allowing them to do so.

But a bank asking the reason for the withdrawal, and how you plan to spend your money is a bit much. It’s understandable that a bank might need notice to withdraw large sums of cash just to have it on hand. It’s another to ask why. It does reach into the same zone as a doctor asking about gun ownership. I understand the “safety” argument, but I also it’s not my doctor’s or bank’s job to be paternal.

There are moral hazards to come from this:

The UK banks were “de-banking” nearly 1,000 accounts per business day less than a year ago. New regulations to mitigate this were introduced a few months later. But at some point, if you make it impossible to work with a bank, people won’t use one. If you want people to use banks, stop making it impossible to use banks. But if you’re kicking them out faster than they can find another account, and no matter where they go they are getting interrogated and reported on, you go from de-banking to de-personing very quickly.

And even if the welfare of the account holders was irrelevant, the banks themselves are uninterested in becoming extensions of the police department:

Don’t turn us into social security cops, banks tell UK government.

All the more reason to absolutely denounce and reject Central Bank Digital Currency. Check out this post, which was pulled down from Facebook:

The government is paranoid about how you are using your money and what sort of news you’re consuming. At some point the two will converge where if you consume the wrong news, your funds are frozen. It’s not the leap you might think it is considering plenty of politically motivated actions have been taken against Wrongthinkers.

Whatever your position on tax evasion and money laundering might be, neither are so nefarious that it warrants the level of scrutiny and tattling people are getting from the corporate gestapo.

Click here to get a copy of our offshore banking report, or here to become a member of our Insider program, where you are eligible for free consultations, deep discounts on corporate and trust services, plus a host of information about internationalizing your business, wealth and life.