If you’re an expat looking to protect your wealth, these 10 countries offer strong legal frameworks, tax advantages, and privacy measures for asset protection. Each jurisdiction has unique benefits, from robust trust laws to favorable tax regimes. Key highlights include:

- Switzerland: Stability, strong banking system, and privacy.

- Singapore: Flexible trust laws and no capital gains or inheritance tax.

- Cayman Islands: STAR trusts and zero-tax policy.

- Cook Islands: Industry-leading creditor protections.

- Nevis: Stringent legal safeguards and short statutes of limitations.

- Belize: Immediate asset protection and low costs.

- Bahamas: Long-term trust options and tax-free environment.

- Luxembourg: European compliance with strong privacy laws.

- UAE: No personal income tax and flexible ownership laws.

- Anguilla: Privacy-focused laws and tax neutrality.

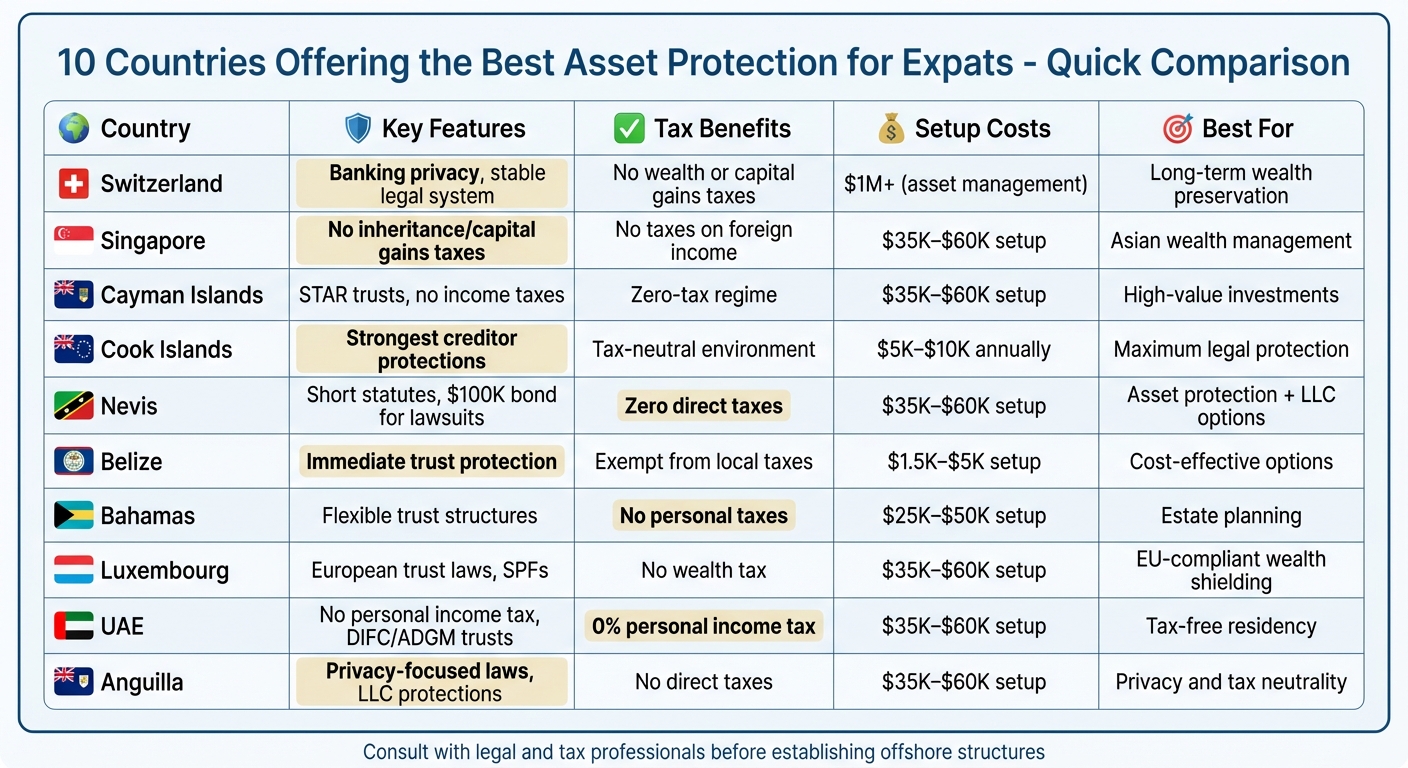

Quick Comparison

| Country | Key Features | Tax Benefits | Setup Costs | Best For |

|---|---|---|---|---|

| Switzerland | Banking privacy, stable legal system | No wealth or capital gains taxes | $1M+ (asset mgmt.) | Long-term wealth preservation |

| Singapore | No inheritance/capital gains taxes | No taxes on foreign income | $35K–$60K setup | Asian wealth management |

| Cayman Islands | STAR trusts, no income taxes | Zero-tax regime | $35K–$60K setup | High-value investments |

| Cook Islands | Strongest creditor protections | Tax-neutral environment | $5K–$10K annually | Maximum legal protection |

| Nevis | Short statutes, $100K bond for lawsuits | Zero direct taxes | $35K–$60K setup | Asset protection + LLC options |

| Belize | Immediate trust protection | Exempt from local taxes | $1.5K–$5K setup | Cost-effective options |

| Bahamas | Flexible trust structures | No personal taxes | $25K–$50K setup | Estate planning |

| Luxembourg | European trust laws, SPFs | No wealth tax | $35K–$60K setup | EU-compliant wealth shielding |

| UAE | No personal income tax, DIFC/ADGM trusts | 0% personal income tax | $35K–$60K setup | Tax-free residency |

| Anguilla | Privacy-focused laws, LLC protections | No direct taxes | $35K–$60K setup | Privacy and tax neutrality |

Choosing the right jurisdiction depends on your specific needs, such as creditor protection, tax efficiency, or privacy. Act early to ensure your asset protection strategy is legally sound and compliant with your home country’s reporting requirements.

How to Choose an Asset Protection Jurisdiction

When it comes to protecting your assets, the jurisdiction you choose plays a critical role. Start by examining the legal system – particularly whether the country enforces foreign court judgments. Some of the most reliable jurisdictions, like the Cook Islands, Nevis, and Belize, do not honor foreign rulings automatically. Instead, they require creditors to prove fraudulent intent, which is a much higher standard than the typical "preponderance of the evidence." This legal difference can make a significant impact on the outcome of asset protection cases.

Political and economic stability is another crucial factor. For example, Switzerland boasts a AAA credit rating, and the Cook Islands maintain a unique political relationship with New Zealand, one of the least corrupt nations globally. Additionally, jurisdictions with strong banking systems, such as Singapore under the Monetary Authority of Singapore (MAS) or Switzerland regulated by FINMA, provide added reassurance for protecting your assets.

Different jurisdictions also offer varying levels of protection and timelines for creditor challenges. The Cook Islands and Nevis, for example, limit creditor claims to one or two years, whereas Belize offers immediate protection once a trust is funded. Nevis even requires creditors to post a bond – often $100,000 or more – before they can proceed with lawsuits against trusts.

For U.S. citizens and residents, compliance with domestic tax laws is non-negotiable. U.S. persons are taxed on worldwide income and must file disclosures like FBAR, FATCA, and IRS Form 8938.

Understanding the intricacies of U.S. tax obligations… is essential, as offshore trusts may still require certain disclosures and tax filings domestically, particularly for U.S. citizens or residents subject to worldwide tax liability.

Selecting a jurisdiction that is tax-neutral – meaning it does not impose local income, capital gains, or inheritance taxes – can simplify your structure and avoid unnecessary tax complications.

Finally, privacy and banking secrecy are key considerations. Effective asset protection relies on robust legal frameworks rather than simply hiding wealth. Switzerland ranks as the second-highest financial secrecy jurisdiction in the world, with Singapore closely following at number three. Jurisdictions that keep trust settlor and beneficiary registries private make it harder for creditors to trace assets, while still allowing you to meet all U.S. reporting requirements.

sbb-itb-39d39a6

1. Switzerland

Legal Framework for Trusts, Foundations, and Companies

Switzerland doesn’t have its own domestic trust law but has recognized foreign trusts since ratifying the Hague Trust Convention in 2007. This means Swiss courts can enforce and apply trusts governed by foreign laws. Under the Convention, trust assets are kept separate from the trustee’s liabilities and are protected from estate claims.

For expats exploring foundation options, Swiss law restricts domestic family foundations to specific purposes like education, health, and welfare. Because of these limitations, many expats turn to foreign family foundations, which are acknowledged by Swiss authorities and offer more flexibility for wealth preservation and structured payouts. Another common strategy is to establish a Swiss family holding company with distinct share classes. This approach allows for shifting growth outside the taxable estate while maintaining control.

It’s worth noting that asset protection measures in Switzerland must be implemented before any potential claims arise. Transfers made within one year of bankruptcy – or within five years if there’s evidence of intent to disadvantage creditors – can be voided under Swiss law. As Tax Partner AG puts it:

The result is a system that changes slowly and predictably.

These legal structures, combined with Switzerland’s broader stability, make it a stronghold for asset protection.

Political and Economic Stability

Switzerland’s reputation for asset protection is closely tied to its political and economic steadiness. The country’s direct democratic system ensures that significant changes to tax or legal frameworks usually require a public referendum, providing a layer of predictability. Additionally, competition among its 26 cantons helps keep tax rates stable.

Switzerland’s economic credentials are equally impressive. It holds a AAA credit rating, manages 25% of global cross-border assets, and ranks 6th on the Global Peace Index. With a GDP per capita (PPP) of $92,980 and a 9.8% GDP trade surplus, the country offers a highly stable environment for international business and wealth management.

Banking and Financial System Strength

Swiss banks, regulated by FINMA, are known for their strong capital reserves and strict client privacy protections. Banking secrecy laws remain a cornerstone of the system, even as Switzerland has adopted global standards like the OECD Common Reporting Standard (CRS) and FATCA to enhance transparency. Despite these changes, Switzerland continues to rank as the world’s second-largest financial secrecy jurisdiction, making it a reliable choice for wealth preservation.

The Swiss franc’s strength and the country’s low inflation rates further contribute to capital preservation. Additionally, foreign judgments against Swiss-based assets typically require a full review by Swiss courts before they can be enforced, adding another layer of protection for asset holders.

Tax Treatment for Nonresidents/Expats

Switzerland’s tax policies for expats are another key advantage. Foreign nationals moving to Switzerland for the first time – or after a 10-year absence – can opt for expenditure-based (lump-sum) taxation. This system calculates taxes based on living costs rather than global income or wealth, with a federal minimum base of CHF 400,000. Securing a written tax ruling from cantonal authorities ensures clarity and predictability.

For resident individuals, private capital gains on movable assets like stocks, bonds, cryptocurrencies, or art are generally not taxed, as long as they are not considered professional traders. A federal withholding tax of 35% applies to Swiss-source dividends and bond interest, but this can often be reclaimed thanks to Switzerland’s network of over 100 double taxation treaties. At the cantonal level, wealth tax rates vary, with top brackets ranging from about 0.1% to 1.1%.

2. Singapore

Legal Framework for Trusts, Foundations, and Companies

Singapore offers a well-structured legal framework for trusts and corporate entities, making it a strong choice for asset protection. The Trustees Act 1967 supports various types of trusts, including "living trusts", which can safeguard assets during your lifetime and protect them from creditors in cases of bankruptcy. Notably, Section 90 of the Act provides a "firewall" against foreign forced heirship rules. This means that as long as a trust is created under Singapore’s laws, foreign inheritance laws cannot override it.

For families, Private Trust Companies (PTCs) and Single Family Offices (SFOs) provide efficient ways to manage trusts with minimal regulatory hurdles. Additionally, Variable Capital Companies (VCCs) offer a flexible structure for handling investment funds effectively.

Political and Economic Stability

Singapore’s stable governance and strong regulatory systems make it a magnet for expatriates and high-net-worth individuals. Its consistent wealth management policies have earned it the #2 spot in Deloitte‘s 2024 rankings of International Wealth Management Centers. Private banking client assets in Singapore saw a notable 19% growth in 2024. Moreover, Singapore ranks as the world’s #3 financial secrecy jurisdiction, ensuring robust client data protection under the Banking Act.

Tax Treatment for Nonresidents/Expats

Singapore’s tax policies are another key reason it appeals to expats seeking to protect their wealth. The country imposes no capital gains, inheritance, estate, or gift taxes, allowing tax-free transfers of wealth and investment profits. Corporate taxes are set at a flat 17%, and dividends from Singapore-based companies are exempt from further taxation under its one-tier tax system.

For nonresidents, taxation is limited to income sourced from Singapore, while foreign-sourced income is generally exempt unless it is earned through a partnership. Employment income for nonresidents is taxed at a flat rate of 15%. Singapore has also signed 98 comprehensive tax treaties to prevent double taxation. Expats can access these treaty benefits by obtaining a Certificate of Residence from the Inland Revenue Authority of Singapore.

However, foreigners should note that a 60% Additional Buyer’s Stamp Duty applies to residential property purchases. Nationals from the USA, Iceland, Liechtenstein, Norway, and Switzerland may qualify for preferential rates.

These tax policies, combined with Singapore’s legal and economic stability, solidify its reputation as a leading destination for safeguarding and managing wealth.

3. Cayman Islands

Legal Framework for Trusts, Foundations, and Companies

The Cayman Islands operates under the Trusts Act (2021 Revision), which blends English common law with local statutes. This creates a reliable framework for individuals looking to safeguard their wealth by structuring offshore trusts and other legal entities.

One standout option is the STAR Trust (Special Trusts Alternative Regime). Unlike traditional trusts, STAR trusts can be created for specific purposes rather than solely for beneficiaries. They are particularly useful for managing high-risk assets like cryptocurrencies, yachts, or aircraft. These trusts can exist indefinitely and allow for restrictions on beneficiaries’ access to information and court involvement.

Another option is the Foundation Company, introduced in 2017. These hybrid entities have a separate legal personality but no shareholders or members. They work well for purposes like philanthropy, holding assets, or serving as private trust companies, all while maintaining privacy.

The Cayman Islands also offers strong firewall provisions under Section 90 of the Trusts Act. These provisions ensure that foreign laws, such as forced heirship claims or divorce settlements, cannot override a Cayman trust. All legal matters are governed exclusively by Cayman law. Creditors face a tough hurdle – proving fraudulent intent beyond a reasonable doubt within a 6-year statute of limitations, which is a stricter standard than in most jurisdictions.

These legal structures provide a solid foundation for wealth protection, as explored further in the political and economic stability section.

Political and Economic Stability

The Cayman Islands builds on its robust legal framework with the stability of being a British Overseas Territory, ensuring a mature and reliable financial system. The Grand Court’s Financial Services Division specializes in handling trust-related cases, offering expert management of complex wealth structures.

"The longstanding stability of the Cayman Islands and its well-regulated private wealth industry continue to provide wealth creators with a viable, stable and effective jurisdiction in which to establish their private wealth structures." – Collas Crill

The jurisdiction also allows full testamentary freedom, meaning there are no forced heirship rules dictating how estates must be divided. Recent amendments, such as the Perpetuities Amendment Act, 2024, allow ordinary Cayman trusts to last indefinitely if the trust deed explicitly removes perpetuity restrictions.

Tax Treatment for Nonresidents/Expats

The Cayman Islands is known for its zero-tax policy on income, capital gains, wealth, estate, gifts, and withholding. This tax-neutral environment extends to offshore entities, making it a popular choice for preserving wealth. Additionally, exempted trusts come with a 50-year tax-free guarantee, ensuring trust assets remain untouched by local taxes for half a century.

However, stamp duty applies to real estate transactions. The standard rate is 7.5% of the market value, but for properties priced at $2 million or more, the rate increases to 10%, effective January 1, 2026. Imported goods are also subject to duties averaging 22%, with rates ranging from 5% to 42%.

For U.S. citizens, compliance with reporting requirements is essential. This includes filing FBAR and Form 3520 for foreign accounts and trusts, as the Cayman Islands participates in FATCA and the Common Reporting Standard (CRS). Setting up an offshore trust in the Cayman Islands typically costs between $15,000 and $30,000, with annual fees ranging from $4,000 to $8,000.

Although the Cayman Islands lacks double taxation treaties, it’s crucial to understand your home country’s tax obligations before establishing structures here. While setup costs may be higher than in some other jurisdictions, the combination of strong legal protections, tax neutrality, and creditor safeguards makes the Cayman Islands a top choice for serious asset protection.

4. Cook Islands

Legal Framework for Trusts, Foundations, and Companies

The Cook Islands operates under the International Trusts Act 1984, later amended in 1989, and has earned a reputation as a premier jurisdiction for asset protection. One of its standout features is that Cook Islands courts do not recognize foreign court judgments. This means creditors are required to re-litigate their claims entirely within the Cook Islands, adhering to local laws.

The legal hurdles for creditors are steep. To challenge an asset transfer, they must prove – beyond a reasonable doubt – that the trust was established fraudulently. Additionally, claims must be filed within strict time limits: within one year of the asset transfer or within two years of the cause of action.

"The Cook Islands trust is often referred to as the gold standard in asset protection."

– Alicia Adamczyk, Senior Writer, Fortune

Another layer of protection is the "impossibility to act" defense. If a foreign court orders the repatriation of assets, Cook Islands trustees are legally barred from complying if the request is made under duress. Privacy is also a key feature – there’s no public registry for trust deeds, and disclosing trust ownership or values is illegal.

Experts often suggest incorporating an LLC into the trust structure. This allows the individual to manage the LLC during normal circumstances, while control can be shifted in the event of legal threats. These robust legal protections lay the groundwork for understanding how the Cook Islands’ political and economic stability complements its asset protection advantages.

Political and Economic Stability

Since becoming self-governing in 1965 and entering into a free association agreement with New Zealand, the Cook Islands has enjoyed a stable political environment. Its judiciary operates independently and is rooted in British Common Law principles. Additionally, Cook Islands citizens hold New Zealand citizenship, offering another layer of legal and political security.

The jurisdiction is closely tied to New Zealand, which ranks #1 out of 180 countries on the Transparency International Global Corruption Perceptions Index. With over four decades of experience in wealth management, the Cook Islands has developed a strong body of case law, providing greater clarity and reliability for asset owners. Financial services, the second-largest sector after tourism, are tightly regulated by the Financial Supervisory Commission (FSC). Non-residents are required to work with government-approved trustee companies, and the absence of bankruptcy law further restricts creditors’ ability to seize assets. These legal and political safeguards, combined with a favorable tax environment, make the Cook Islands an attractive option for asset protection.

Tax Treatment for Nonresidents/Expats

The Cook Islands offers a tax-neutral environment for nonresidents. There are no local income, capital gains, or inheritance taxes on assets held within international trusts or LLCs. Additionally, the absence of double taxation treaties can provide an extra layer of privacy for certain asset structures.

That said, U.S. citizens must comply with IRS requirements. This includes filing Forms 3520 and 3520-A annually to report foreign trusts. Starting in 2026, the reporting threshold for gifts from foreign corporations or partnerships will be $19,570.

In terms of costs, establishing a trust typically runs between $20,000 and $35,000, although more complex setups can cost as much as $60,000. Annual maintenance fees range from $3,000 to $10,000, and U.S. attorney fees for drafting and setup generally add around $15,000.

5. Nevis

Legal Framework for Trusts, Foundations, and Companies

For those seeking strong legal safeguards, Nevis is a standout option thanks to its stringent asset protection laws. Governed by the Nevis International Exempt Trust Ordinance (NIETO) of 1994, the jurisdiction offers some of the most robust creditor protections available. One key feature is that Nevis courts do not recognize foreign judgments. This means creditors must start fresh legal proceedings in Nevis if they want to access assets held in a Nevis trust. To initiate such action, creditors are required to post a $100,000 bond. Additionally, they must prove – beyond a reasonable doubt – that the trust was created with fraudulent intentions. This must be done within short time limits: typically within one year of the asset transfer or two years following the cause of action.

"The strongest asset protection laws in the whole world are to be found on one small island in the Caribbean… that island, of course, is Nevis."

– TrustNevis.com

Experts often recommend pairing a Nevis Trust with a Nevis LLC for optimal protection. In this setup, the trust fully owns the LLC. Under Nevis law, creditors can only pursue a charging order against an LLC member. This limits their remedy to receiving distributions – if any are made – without gaining control over the LLC’s assets or management. Furthermore, this structure can lead to a situation where creditors may owe taxes on the LLC’s income, even if they don’t receive any distributions.

These legal advantages are further reinforced by Nevis’s stable political and economic landscape.

Political and Economic Stability

Nevis, part of the Federation of Saint Kitts and Nevis, has been an independent nation since 1983. As a sovereign state with full control over its financial services sector, Nevis operates under English Common Law and remains a member of the British Commonwealth. Its legal and financial systems are stable and reliable. Additionally, the jurisdiction imposes no exchange controls, allowing profits and capital to move freely. Nevis is known for its well-regulated financial environment and boasts a literacy rate of 96%, one of the highest in the Western Hemisphere, which supports a skilled professional workforce.

"No creditor has ever penetrated a Nevis trust in a local court."

– The Nestmann Group

Between 2010 and 2020, the number of new international trusts formed in Nevis grew by 40%, reflecting widespread confidence in its legal and financial systems.

Tax Treatment for Nonresidents/Expats

Nevis complements its legal and economic strengths with a highly attractive tax regime for nonresidents. International trusts and LLCs in Nevis benefit from zero direct taxation – there are no income, capital gains, inheritance, estate, or wealth taxes – as long as the settlor, beneficiaries, and members are nonresidents and the entity does not hold local real estate. Privacy is another cornerstone of Nevis’s financial system. Under the Confidential Relationships Act, unauthorized disclosure of financial information is a criminal offense. Additionally, Nevis’s inheritance laws ensure that assets are distributed strictly according to the trust deed.

Setting up a Nevis International Trust typically costs around $9,000, with annual maintenance fees averaging $5,000. Establishing a Nevis LLC is slightly more affordable, with setup costs of about $4,000 and annual fees of $3,000. Registration fees for both initial and annual filings are $300.

6. Belize

Legal Framework for Trusts, Foundations, and Companies

Belize stands out for offering immediate asset protection with no waiting period, shielding assets from fraudulent conveyance claims as long as the transfer isn’t tied to criminal activity. Under the Trusts Act (1992, with updates in 2000 and 2007), assets transferred to a Belizean trust are instantly protected. This is a significant advantage for expats facing legal challenges, as many other jurisdictions impose a one- to two-year statute of limitations before protections take effect. This legal immediacy positions Belize as a unique option for asset protection.

"Belize is the only jurisdiction in the world offering immediate asset protection without a statute of limitations – even if a lawsuit is already pending."

– Enzo Caputo, Asset Protection Lawyer

Belizean courts do not recognize foreign judgments, requiring creditors to re-litigate claims and prove fraudulent intent locally. Since the current legal framework was established, no Belize asset protection trust has been successfully challenged. Many expats combine a Belize trust with an International Business Company (IBC) or Limited Duration Company (LDC). In this setup, the trust owns the company entirely, while the settlor manages operations, creating a robust layer of asset protection. IBCs operate under the IBC Act, with no minimum capital requirements and confidentiality ensured, as beneficial ownership details are not publicly disclosed.

Political and Economic Stability

Complementing its legal advantages, Belize enjoys a stable parliamentary democracy and a legal system rooted in English common law. As a member of the Commonwealth, its judiciary operates independently of the executive branch, with the Caribbean Court of Justice serving as the highest appellate court. Economically, Belize recorded a 4.1% growth in 2023, driven by tourism and construction. The government also made significant progress in reducing public debt, cutting it from 132% of GDP in 2020 to 66.3% in 2022. By January 2025, Belize reached a major milestone in regulatory compliance, being rated "Fully Compliant" with 38 out of 40 FATF Recommendations. Additionally, the fixed exchange rate of 2 BZ$ to 1 US$ provides currency stability, which is particularly appealing to American expats.

However, Belize’s economy does face challenges, including vulnerability to climate-related disasters and external economic shocks. Issues with bureaucracy and corruption remain areas of concern.

Tax Treatment for Nonresidents/Expats

Belize offers a favorable tax environment for international trusts and IBCs, provided the settlor and beneficiaries are non-residents and the trust does not hold local real estate. Offshore structures are exempt from income, capital gains, estate, inheritance, and stamp duty taxes. Additionally, assets held within a Belizean trust are free from wealth-related taxes. Offshore trusts and IBCs are not subject to local exchange controls, allowing unrestricted movement of funds in any currency. Privacy is also a key feature, as the Registrar of International Trusts does not require public disclosure of settlors or beneficiaries, and trust deeds remain non-public.

Setting up a Belize trust typically costs between US$1,500 and US$5,000, with annual fees ranging from US$800 to US$3,000. An IBC, on the other hand, costs around US$400 to establish and has annual fees of approximately US$500. Additionally, the government imposes a yearly license fee of US$1,250 and a flat tax of US$850 to maintain a trust’s good standing. While the legal structure is established in Belize, experts often advise holding liquid assets in more stable financial centers like Switzerland or Luxembourg to further insulate them from local court jurisdictions.

7. Bahamas

Legal Framework for Trusts, Foundations, and Companies

The Bahamas has built a strong reputation for asset protection, thanks to forward-thinking laws like the Trustee Act 1998, the Trusts (Choice of Governing Law) Act 1989, and the Fraudulent Dispositions Act 1991. These laws require creditors to prove "intent to defraud" beyond a reasonable doubt, giving added security to asset holders. Creditors only have a two-year window to challenge asset transfers, and once that period ends, the assets are nearly untouchable. Since December 30, 2011, the Bahamas has removed the rule against perpetuities, allowing trusts to last indefinitely – making them ideal for long-term dynasty planning. Additionally, Bahamian courts do not enforce foreign forced-heirship or matrimonial claims against trusts governed by Bahamian law, providing a robust legal "firewall".

"Three decades of progressive legislation have made The Bahamas a first-call jurisdiction for families who want iron-clad protection without sacrificing control."

– SCGIBC

The Bahamas also offers unique structures beyond traditional trusts. Families seeking more direct control can use Private Trust Companies (PTCs), while the 2004 Foundations Act caters to individuals from civil-law jurisdictions. Segregated Account Companies (SACs) are another option, providing legal separation of assets within a single entity. The jurisdiction’s expertise is further highlighted by hosting the 6th largest branch of the Society of Trust and Estate Practitioners (STEP) worldwide. Together, these elements create a stable and sophisticated environment for wealth management.

Political and Economic Stability

The Bahamas combines its strong legal framework with a stable political and economic system. As a former British colony, it operates under a parliamentary democracy and an English Common Law system, which is familiar to expats from the U.S., UK, and Canada. All trust companies are regulated by the Central Bank of the Bahamas, which enforces strict confidentiality laws. To shed its "tax haven" label, the Bahamas has adopted the Common Reporting Standard (CRS) and maintains a beneficial ownership register accessible only to the Attorney General.

"In a world of financial turbulence, The Bahamas stands out as a competent, internationally minded jurisdiction. It offers not just tools, but clarity, stability, and the foundation for generational success."

– Bahamas Financial Services Board

Tax Treatment for Nonresidents/Expats

The Bahamas offers a tax-free environment for individuals, with no taxes on personal income, capital gains, wealth, inheritance, or gifts. Nonresident trusts and their beneficiaries are also exempt from local taxes on trust property and income. Instead, the government relies on indirect taxes like a 10% Value Added Tax (VAT), customs duties, and real property taxes for revenue.

Setting up a Bahamian trust typically costs between $25,000 and $50,000, with annual maintenance fees ranging from $5,000 to $15,000. A one-time trust duty of $50 is also required at the time of creation. The Bahamas allows settlors to retain control through "reserved powers", enabling them to direct investments, change beneficiaries, or even remove trustees – all without invalidating the trust structure. However, U.S. citizens must still report their global income to the IRS, even in this tax-neutral jurisdiction. With its tax advantages and flexible trust structures, the Bahamas remains a top choice for expats seeking asset protection and wealth management.

8. Luxembourg

Legal Framework for Trusts, Foundations, and Companies

Luxembourg’s Trust Law, enacted on July 27, 2003, allows foreign nationals to participate as settlors, beneficiaries, and trustees. This legal structure provides expatriates with a respected European option for managing wealth, sidestepping the negative connotations often associated with "offshore" jurisdictions while maintaining robust privacy protections. Additionally, Luxembourg recognizes foreign trusts under the Hague Convention of July 1, 1985, simplifying cross-border estate planning.

In addition to traditional trusts, Luxembourg offers fiducies, which are civil law contracts where assets are transferred to a fiduciary. For those focused on wealth management, the Private Wealth Management Company (SPF) is a standout option tailored for managing private fortunes. SPFs benefit from exemptions on Corporate Income Tax, Municipal Business Tax, and Net Wealth Tax, paying only an annual subscription tax of 0.25%, capped at $135,000. The jurisdiction also provides various investment fund structures, such as SICAVs, which can be integrated into trusts for tax-efficient management.

Trust assets in Luxembourg are legally segregated from the personal estates of both the settlor and trustee, offering protection from personal creditors. However, the 2020 RFT Law mandates that trust details be registered in the Fiduciary and Trust Register (LTR) for a fixed fee of $13. While this information is not publicly accessible, it ensures compliance with regulatory requirements. Expats should also be aware of Luxembourg’s forced heirship rules, which reserve between 50% and 75% of an estate for children. However, these provisions can be managed by drafting a will that applies the law of the individual’s home country. These legal instruments form a key part of Luxembourg’s financial landscape.

Banking and Financial System Strength

Luxembourg’s strong legal foundation is complemented by its position as Europe’s largest investment fund hub and the world’s second-largest, trailing only the United States. As the leading private banking center in the Eurozone, it excels in wealth management and cross-border fund distribution. The country’s financial stability is underscored by its "AAA" credit rating from all major agencies and a remarkably low debt-to-GDP ratio of 24% as of late 2022 – far below the EU average of 86.4%.

To stay ahead in financial innovation, Luxembourg has embraced blockchain-friendly legislation, attracting both fintech companies and global institutions. Although the Tax Justice Network’s Financial Secrecy Index ranks Luxembourg 5th out of 144 countries, its regulatory framework strikes a balance between privacy and compliance. Furthermore, the statute of limitations for challenging fraudulent transfers to trusts is five years, providing reasonable safeguards against creditor claims.

Tax Treatment for Nonresidents/Expats

Luxembourg’s tax policies are designed to complement its asset protection offerings, making it a prime choice for expatriates. The country abolished its net wealth tax for individuals in 2006 and has no plans to reinstate it. For non-resident beneficiaries, trust assets located outside Luxembourg are generally exempt from local taxes. Direct-line descendants and spouses enjoy a 0% inheritance tax, while other heirs face rates ranging from 2.5% to 15%.

In 2025, Luxembourg introduced the Inpatriate Tax Regime, offering highly skilled foreign workers a 50% tax exemption on gross annual remuneration (including benefits), capped at $435,000, for up to eight years. Capital gains on shareholdings of 10% or less are completely tax-exempt if held for more than six months, and dividend income from qualifying companies receives a 50% exemption.

The personal income tax system features progressive rates across 23 brackets, with the top marginal rate reaching 45.78% in 2026. The standard VAT rate is set at 17%. While U.S. expatriates must still report their global income to the IRS, Luxembourg’s tax treaties and specialized financial structures offer valuable opportunities for wealth protection and efficient tax planning.

9. United Arab Emirates

Legal Framework for Trusts, Foundations, and Companies

The UAE’s legal landscape for trusts took a major step forward with Federal Decree-Law No. 19 of 2020, which introduced a trust framework granting trusts their own legal personality and financial independence. This law complements the offshore systems in the DIFC (Dubai International Financial Centre) and ADGM (Abu Dhabi Global Market), each operating with independent courts, laws, and registries. Expats now have the flexibility to choose between onshore (Arabic-based) and offshore (English-based) legal systems.

Since 2021, the UAE has allowed 100% foreign ownership of onshore companies, removing the need for a local partner. Trusts must be registered with the electronic Trust Register, managed by the Emirates Integrated Registries Company. Both discretionary and fixed trusts are available, catering to different asset distribution needs. Additionally, Dubai and ADGM foundations function as separate legal entities, providing effective options for holding assets and ensuring smooth succession planning.

The introduction of Federal Decree-Law No. 37 of 2022 has further enhanced family business continuity by incorporating targeted dispute resolution measures. However, UAE law includes claw-back provisions on transactions made up to two years before bankruptcy. It’s also essential to check free zone regulations for trust-based shareholding arrangements. These legal structures make the UAE a reliable hub for asset protection.

Political and Economic Stability

The UAE continues to attract high-net-worth individuals (HNWIs) at an impressive rate. In 2022, approximately 5,000 HNWIs relocated to the country, and projections for 2024 suggest this number will exceed 6,700. Dubai’s wealth management sector alone has grown by 62% in the first half of 2024.

"The UAE is one of the most politically stable and secure countries in the region and consequently is regarded as a safe haven for investment." – Amjad Ali Khan, Partner, Afridi & Angell

The country’s removal from the FATF ‘grey list’ in February 2024 has bolstered trust in its financial and banking systems. On top of that, the UAE has signed double taxation avoidance treaties with over 70 jurisdictions, including Singapore, Switzerland, and Japan. The 10-year Golden Visa program, which requires a property investment of at least $540,000, has also enhanced its appeal by separating residency from employer sponsorship, making it particularly attractive to HNWIs.

Tax Treatment for Nonresidents/Expats

The UAE offers a highly favorable tax environment, with 0% personal income tax, no withholding taxes, and no exchange controls. Corporate tax is set at 9% for profits exceeding $102,000 (AED 375,000). Starting January 2025, a 15% Domestic Minimum Top-up Tax will apply to large multinational companies.

"One of the UAE’s most significant attractions is the absence of taxation and the ease of remitting money into and out of the country." – Amjad Ali Khan, Partner, Afridi & Angell

For non-Muslim expats, the DIFC Wills and Probate Registry (registration fee of approximately $2,700) ensures that assets are distributed according to their wishes, bypassing default Shariah inheritance laws. Additionally, holding real estate through corporate entities or DIFC foundations can help avoid the direct application of Shariah-based rules. To maintain UAE residency for tax purposes, expats must visit the country at least once every six months.

10. Anguilla

Anguilla has carved out a reputation as an offshore haven, offering strong legal protections, privacy, and a tax-neutral environment that appeals to expats and investors alike.

Legal Framework for Trusts, Foundations, and Companies

As a British Overseas Territory governed by English Common Law, Anguilla provides a solid legal foundation for trusts, foundations, and companies. The Anguilla Trust Act allows trusts to exist indefinitely, bypassing the "Rule against Perpetuities." This flexibility supports various structures, including asset protection trusts, charitable trusts, and spendthrift trusts.

The Limited Liability Company Act ensures that creditors can only claim distributions in lawsuits against members, safeguarding company assets and management rights. For those prioritizing privacy, the International Business Companies (IBC) Act allows for the creation of tax-neutral entities without requiring the disclosure of directors or shareholders.

"The Anguilla LLC act possesses some of the strongest asset protection and privacy regulations of any offshore haven on the planet." – OffshoreCorporation.com

Anguilla’s Fraudulent Dispositions Ordinance adds another layer of protection. Creditors must prove insolvency at the time of asset transfers into trusts, and challenges are limited to a three-year window from the transfer date. Additionally, Anguilla courts do not enforce foreign judgments related to divorce, inheritance, or tax claims against valid Anguilla trusts. Oversight by the Anguilla Financial Services Commission (FSC) ensures confidentiality while maintaining regulatory compliance. The island’s streamlined company registration system, ACORN, enables businesses to register within 24 hours.

Political and Economic Stability

With a population of around 13,500, Anguilla operates as a stable democracy under the British Monarch. The economy thrives on luxury tourism, offshore banking, and fishing, with an annual per capita income of approximately $8,600.

"Anguilla is a politically stable, democratic country… a peaceful, law-abiding base for our clients seeking privacy and asset protection." – President of OffshoreCorporation.com

The island’s low crime rate is another draw, with some high-end resorts even forgoing room keys. Government officials remain committed to maintaining financial privacy and asset protection laws, ensuring long-term reliability for investors. Modern fiber optic telecommunications infrastructure supports remote business operations, making Anguilla an attractive destination for expats managing global ventures.

Tax Treatment for Nonresidents/Expats

Anguilla’s tax policies are a standout feature. There are no direct taxes on income, capital gains, estates, profits, wealth, or gifts for individuals or corporations. The territory operates on a territorial tax basis, meaning foreign-sourced income is entirely exempt.

"There are no income, capital gains, estate, profit or other forms of direct taxation on either individuals or corporations, whether resident in Anguilla or not." – Geneva Trust

Cryptocurrency investors and businesses also benefit from 0% capital gains and corporate taxes. Courts in Anguilla explicitly refuse to recognize foreign tax claims against trusts. For U.S. expats, Anguilla LLCs employ a "poison pill" strategy, creating tax liabilities for creditors on earnings they haven’t received.

Residency options are available for expats willing to invest. A $150,000 donation (plus $50,000 per additional dependent) or a $400,000 real estate purchase can secure residency. However, foreigners face a 12.5% stamp duty on property purchases compared to 5% for locals. U.S. citizens must still report worldwide income and file IRS Forms 3520 and 3520-A to remain compliant with American tax laws.

With its combination of robust legal protections, a stable political environment, and favorable tax policies, Anguilla has become a prime destination for expats seeking asset protection and financial privacy.

Country Comparison Table

When selecting a jurisdiction for asset protection, it’s essential to evaluate legal frameworks, economic stability, costs, and the specific advantages each country offers. Below is a detailed comparison to help weigh your options.

| Country | Primary Legal Structures | Stability Rating | Statute of Limitations (Fraudulent Transfer) | Recognition of Foreign Judgments | Estimated Setup & Annual Costs |

|---|---|---|---|---|---|

| Switzerland | Foundations, Private Banking | AAA (Very High) | Varies | Yes | $1,000,000+ minimum for asset management |

| Singapore | Trusts, VCC, Family Offices | AA (Very High) | Varies | Yes | $35,000–$60,000 setup |

| Cayman Islands | STAR Trusts, PTCs, Foundation Companies | High (UK Territory) | 6 Years | No (6-year lookback applies) | $35,000–$60,000 setup |

| Cook Islands | International Trusts, LLCs | High (Stable) | 1–2 Years | No | $5,000–$10,000 annual maintenance |

| Nevis | International Exempt Trusts, LLCs | High (Stable) | 1–2 Years | No ($100,000 bond required) | $35,000–$60,000 setup |

| Belize | International Trusts | Moderate (Corruption risk) | Immediate (0 Years) | No | $35,000–$60,000 setup |

| Bahamas | Asset Protection Trusts, Foundations | High (Stable) | 2 Years | Yes (under specific conditions) | $35,000–$60,000 setup |

| Luxembourg | Private Foundations, SOPARFI | AAA (Very High) | Varies | Yes | $35,000–$60,000 setup |

| United Arab Emirates | DIFC/ADGM Foundations | High (Stable) | Varies | Varies by free zone | $35,000–$60,000 setup |

| Anguilla | Trusts, LLCs, IBCs | High (Stable) | 3 Years | No (foreign tax/divorce claims rejected) | $35,000–$60,000 setup |

Conclusion

Different jurisdictions bring various legal and tax advantages to the table, each designed to help safeguard your assets from potential threats. For instance, the Cook Islands are renowned for their strong creditor protection, Switzerland is synonymous with a stable banking infrastructure, and the UAE stands out for its favorable tax environment. The right choice for asset protection hinges on your specific risks, the nature of your assets, and your long-term goals. This highlights the importance of seeking expert guidance to create a plan tailored to your individual needs.

Taking action early is critical. Setting up protection structures long before legal disputes arise ensures that asset transfers won’t be classified as fraudulent. As The Nestmann Group explains:

The best plan is to set up protection years before any trouble. This way, no one can say you were trying to dodge a specific person who’s after your money.

If you wait until legal action has already begun, courts may reverse asset transfers.

To navigate the complexities of international laws and reporting requirements – like FBAR and Form 3520 – collaborating with experienced attorneys and CPAs is essential. Blake Harris, Founding Principal at Blake Harris Law, underscores this point:

Offshore asset protection trusts are not a device to reduce or avoid taxation in your home country.

Staying compliant with all reporting obligations is non-negotiable. Partnering with professionals ensures that your structure remains legally sound and withstands scrutiny. Asset protection isn’t about secrecy; it’s about building legitimate legal safeguards for your wealth.

Ultimately, effective asset protection combines well-structured legal frameworks with timely, expert advice. By planning ahead and working with knowledgeable professionals, you can secure your financial future and protect your wealth over the long term.

FAQs

What should I look for when selecting a country for asset protection?

Choosing the right country for asset protection plays a critical role in shielding your wealth from threats like lawsuits, creditors, or political upheaval. The ideal jurisdictions provide a combination of strong legal safeguards, financial confidentiality, and a stable economy, ensuring your assets stay secure and accessible.

When evaluating options, start with the legal framework. Look for countries that have well-established asset protection laws and limit the enforcement of foreign judgments. Financial privacy is another key factor – jurisdictions with strict confidentiality rules can help keep your personal and financial information out of the hands of third parties. Stability is equally important; countries with political and economic consistency are less likely to impose sudden regulations or restrict capital flows.

You might also want to think about tax benefits, such as jurisdictions that impose little to no taxes on foreign income. Some countries even offer residency or citizenship programs, giving you added flexibility and options. Lastly, weigh the costs and administrative requirements to make sure they align with your financial objectives and lifestyle. By carefully considering these aspects, you can select a jurisdiction that best meets your needs for security, privacy, and ease of management.

What are the tax responsibilities for U.S. citizens using offshore asset protection strategies?

U.S. citizens are required to pay taxes on all income earned worldwide, even if their assets are tucked away in offshore trusts, companies, or bank accounts. This means that no matter where your assets are located, you must report any foreign income and accounts to the IRS.

Here are some key forms to know about when meeting these reporting requirements:

- Form 1040: Includes Schedule B to report foreign interest or dividends.

- Form 8938: Required under FATCA for specified foreign financial assets.

- FBAR (FinCEN Form 114): Must be filed if foreign accounts exceed a combined total of $10,000 during the year.

- Form 3520: Needed when creating or transferring assets to offshore trusts.

- Form 3520-A: Used for the annual reporting of foreign trusts.

While offshore structures might offer protection against creditors or political risks, they don’t reduce your U.S. tax obligations. In fact, they come with additional compliance responsibilities. Ignoring these requirements can lead to hefty penalties, so it’s crucial to align any offshore strategies with U.S. tax laws to steer clear of trouble.

What are the potential risks of setting up an offshore asset protection trust?

Setting up an offshore asset protection trust can be a powerful way to safeguard your wealth, but it does come with its own set of challenges. One of the biggest concerns is cost. Establishing such a trust in jurisdictions like the Cook Islands or Cayman Islands can be expensive, with legal and trustee fees adding up quickly. On top of that, annual maintenance costs can easily reach thousands of dollars. For U.S. taxpayers, the process also involves navigating strict IRS reporting requirements, including filing Forms 3520 and 3520-A to avoid penalties.

Beyond the financial aspect, there are legal and operational risks to consider. Transfers into the trust may come under scrutiny, and if deemed fraudulent, creditors could potentially access the assets. Additionally, political or regulatory shifts – such as the introduction of new anti-money-laundering measures – might impact the trust’s stability. Beneficiaries could also face hurdles, like delays in accessing funds or difficulties enforcing trust terms in foreign courts. While offshore trusts can provide strong asset protection, it’s crucial to weigh these risks carefully before moving forward.