Crypto is volatile, real estate is steady. If you’re looking to reduce risk and stabilize your investments, shifting from cryptocurrencies to real estate might be the move. Here’s why:

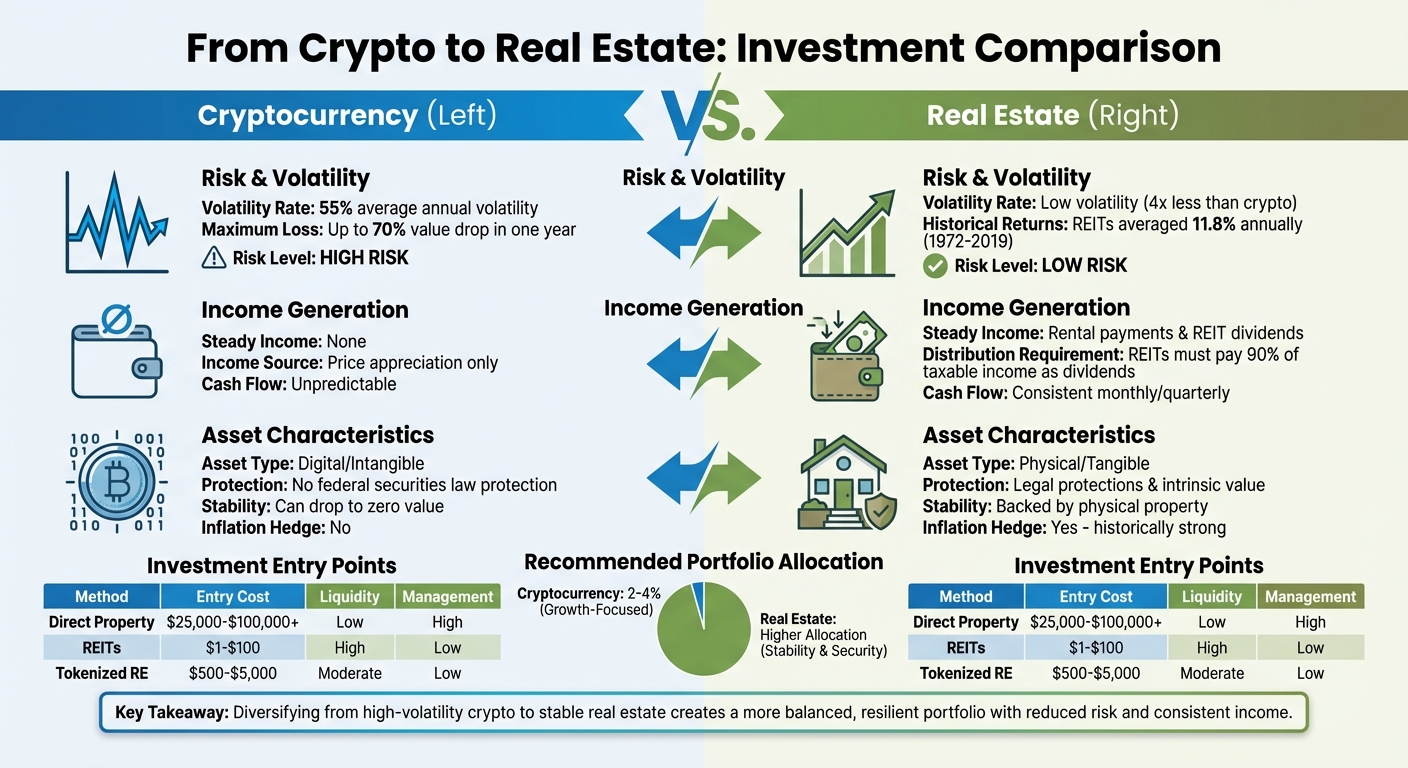

- Crypto’s Risk: With an average volatility of 55%, crypto can lose up to 70% of its value in a year. It offers no steady income and is highly unpredictable.

- Real Estate’s Stability: Real estate provides consistent income through rental payments and dividends (like REITs). Property values grow slowly, making it a safer, long-term investment.

- Portfolio Balance: Experts suggest keeping crypto exposure to 2%-4% for growth-focused portfolios while leaning on real estate for security and inflation protection.

Transitioning requires careful tax planning, choosing the right real estate method (ownership, REITs, or tokenized options), and understanding international opportunities. Real estate offers tangible assets and legal protections that crypto can’t match. Diversifying between these two can create a more balanced, resilient portfolio.

Comparing Risk Levels: Crypto vs. Real Estate

Understanding the key differences between cryptocurrencies and real estate can help you make smarter choices about where to invest your money. While both asset classes can play a role in a diversified portfolio, they come with very different purposes and levels of risk. Let’s break down how these differences shape their overall risk profiles.

Cryptocurrencies: High Risk, High Reward

Cryptocurrencies are known for their extreme volatility and unpredictable price movements. For example, Bitcoin has seen dramatic downturns, with losses of up to 70% in a single year. Unlike traditional investments, crypto doesn’t provide dividends or steady income. Instead, its value depends entirely on price appreciation, which increases the risk of losing your entire investment.

"Crypto assets have experienced higher levels of volatility relative to more traditional investment assets, meaning that price swings – and any investment value – may go up and down dramatically and unpredictably."

– FINRA

The risk of total loss is very real. Even "stablecoins", which are designed to maintain a consistent $1.00 value, can fail to hold their peg and collapse entirely. On top of that, cryptocurrencies lack the protections offered by federal securities laws, leaving them more exposed to fraud and theft.

Real Estate: Stability Backed by Tangible Assets

Real estate, on the other hand, provides a more stable and predictable investment environment. It experiences much lower volatility compared to crypto, with property values generally changing at a slower pace. Between 1972 and 2019, Real Estate Investment Trusts (REITs) delivered an average annual return of 11.8%, slightly higher than the S&P 500’s 10.6%. These returns came with less dramatic fluctuations, making real estate a safer long-term choice, especially when combined with asset protection for the real estate investor.

One of real estate’s biggest advantages is its physical, tangible nature. Properties fulfill essential human needs, like housing and workspace, giving them intrinsic value regardless of market trends. Real estate markets tend to move gradually, influenced by factors like interest rates, inflation, and local economic conditions.

"Over long periods it has historically been a strong hedge against inflation."

– Fidelity

Another benefit of real estate is the steady income it can generate. Rental payments and REIT dividends provide a reliable cash flow that cryptocurrencies simply can’t match. REITs, for instance, are legally required to distribute at least 90% of their taxable income as dividends. Additionally, property values and rents often rise with inflation, helping to preserve purchasing power over time. Financing options, such as mortgages, further enhance real estate’s stability, while trading crypto on margin can amplify risks. Even in tough economic times, owning a physical asset means having something with real utility and value – something cryptocurrencies can’t guarantee if their value drops to zero.

sbb-itb-39d39a6

How to Move from Crypto to Real Estate Investments

Transitioning from cryptocurrency to real estate requires careful planning and a solid grasp of the steps involved. A measured approach can help you navigate risks and manage tax responsibilities effectively.

Reviewing Your Crypto Holdings

Start by assessing your cryptocurrency portfolio. Look for concentration risks, where a large portion of your wealth is tied to just a few digital assets. This evaluation will guide you in deciding which assets to sell first while minimizing tax burdens.

Keep in mind that cryptocurrency transactions are considered taxable events by the IRS, as crypto is classified as property. To reduce capital gains taxes, use specific identification to sell units with the highest cost basis. Additionally, holding crypto for over a year may qualify you for lower long-term capital gains rates instead of higher short-term rates.

Another option is to use your crypto as collateral for real estate loans through fintech platforms. However, be cautious with leverage to avoid margin calls if crypto prices fall.

Once you’ve clarified your crypto position, the next step is choosing the right real estate investment path.

Real Estate Investment Methods

After planning your crypto exit, explore different real estate investment strategies. Each method varies in terms of access, management demands, and liquidity.

Direct ownership gives you complete control but requires significant upfront capital. As of mid-2025, the average U.S. home price exceeded $510,000, with down payments ranging from $25,000 to over $100,000. For international purchases, seek advice from local attorneys and property managers. Some sellers, particularly in places like St. Kitts, even accept cryptocurrency payments directly. However, these transactions may limit financing options and trigger tax liabilities.

Real Estate Investment Trusts (REITs) offer a more accessible entry point. You can start with as little as $1 through brokers that provide fractional shares. REITs are traded like stocks, providing high liquidity and professional management. By law, they must invest at least 75% of their assets in real estate and distribute at least 90% of taxable income as dividends. This makes them a convenient option for generating steady income without the hassle of managing properties.

Tokenized real estate bridges the gap between direct ownership and REITs. Blockchain platforms enable fractional property ownership with lower entry costs and moderate liquidity. As HoneyBricks explains:

"The tokenization of real estate provides the typical benefits of blockchain technology – efficiency, transparency, and security – onto fractionalized real estate investing"

– HoneyBricks

However, it’s essential to evaluate the platform’s reliability and the security of its smart contracts.

| Investment Method | Entry Cost | Management Required | Liquidity | Key Advantage |

|---|---|---|---|---|

| Direct Ownership | $25,000–$100,000+ | High (Active landlord) | Low (Months to sell) | Full control |

| REITs | $1–$100 | Low (Professional) | High (Daily trading) | Easy diversification |

| Tokenized Real Estate | $500–$5,000 | Low (Passive) | Moderate (Secondary markets) | Fractional ownership |

| Crowdfunding | $500–$25,000 | Low (Passive) | Low (Lock-up periods) | Access to specific deals |

Transition Timing and Gradual Strategies

Once you’ve chosen an investment method, plan your transition to balance market risks and tax considerations. Instead of converting all your crypto at once, consider a phased strategy to spread out tax liabilities and market exposure. Portfolio rebalancing is a proven tactic – selling assets that exceed your target allocation (such as during a bull market) can free up funds for real estate.

Research from Morgan Stanley‘s Global Investment Committee shows that a 6% crypto allocation doubles portfolio volatility. They recommend keeping crypto exposure between 2% and 4%. The U.S. Securities and Exchange Commission emphasizes the benefits of rebalancing:

"By cutting back on the current ‘winners’ and adding more of the current so-called ‘losers,’ rebalancing forces you to buy low and sell high"

– U.S. Securities and Exchange Commission

Rebalance your portfolio every six to twelve months. You can also set threshold-based triggers, such as reallocating funds when crypto exceeds a specific percentage of your portfolio. This disciplined approach helps remove emotional decision-making and allows you to systematically capitalize on crypto gains.

Stay informed about economic factors that influence real estate values, including interest rates, inflation, and currency exchange rates. Lower interest rates make financing more appealing, while high inflation highlights real estate’s historical role as a hedge against rising prices.

Finally, consult tax professionals experienced in both cryptocurrency and real estate to ensure a smooth and efficient transition.

International and Offshore Real Estate Opportunities

Investing in international real estate can be a smart way to diversify your portfolio and reduce exposure to local economic, political, and currency risks.

In 2023, the global commercial real estate market was valued at $19.5 trillion. Cross-regional investments saw a 31% increase in the second half of 2024, reaching $37 billion, while Asia-Pacific inflows surged by an impressive 221%. However, currency fluctuations played a significant role – USD investors holding non-dollar assets experienced a 12.2-point reduction in returns due to exchange rate shifts. On the flip side, international properties can generate income in foreign currencies, which might act as a hedge if your home currency weakens. For example, in 2023, non-USD investors gained a 9.7 percentage point advantage from their U.S. real estate holdings.

Factors to Consider for International Real Estate

When exploring international markets, start by assessing the region’s economic and political stability. Unstable areas can complicate property management and make it harder to sell your investment when needed. Additionally, research local property laws thoroughly – some countries impose restrictions on foreign ownership or require specific legal arrangements, such as bank trusts or joint ventures.

Tax considerations are equally important. Look into local property taxes, capital gains rules, and obligations related to rental income. U.S. investors should also be aware of reporting requirements like FBAR and Form 5471, as these might lead to tax liabilities in multiple countries unless double taxation treaties are in place.

For long-term value and liquidity, focus on transparent markets and prime locations, such as capital cities or well-established areas. For instance, in 2023, Kuala Lumpur’s property costs were nearly half those in Bangkok due to a temporary oversupply. However, properties aimed exclusively at foreign buyers often come with a hefty premium – ranging from 10% to 40%. Andrew Henderson, founder of Nomad Capitalist, cautions:

"The shinier it looks, or the more it seems to be geared towards foreigners, the faster you should run."

Enlisting the help of local experts can make a big difference. Independent attorneys and property managers familiar with the market can guide you through complexities that agencies targeting foreign buyers might overlook – or even intentionally hide. Always confirm title laws and conduct thorough due diligence on property ownership history, as unclear systems in some markets can lead to future issues.

Taking these factors into account is essential, especially if you plan to use offshore structures for additional asset protection.

Offshore Property for Privacy and Protection

Investing in offshore real estate offers more than just geographic diversification – it can also provide enhanced privacy and legal safeguards for your assets. While real estate is a physical and immovable asset, holding it through legal entities creates an extra layer of protection.

Structures like offshore companies, trusts, and foundations can help shield your identity, making it harder for creditors or legal claims to target your holdings. Setting up these arrangements proactively – before any legal challenges arise – can be a wise move. Options include forming limited partnerships, LLCs, or using non-U.S. corporation "blockers", each offering unique tax and protection advantages.

Some countries even offer residency or citizenship benefits to property investors. Programs like Portugal’s and Spain’s "Golden Visa" initiatives grant residency rights, which can serve as a backup plan in times of political or economic uncertainty at home.

However, enhanced privacy doesn’t eliminate tax obligations. U.S. investors are still required to report foreign assets and income under FATCA and CRS regulations. The goal is to ensure lawful asset protection and diversification – not to evade taxes. Working with experienced tax advisors who understand both domestic and international regulations is key to staying compliant while maximizing the benefits of offshore investments.

Tax and Legal Considerations

When shifting from cryptocurrency to real estate, you’ll encounter some notable tax and legal hurdles. Successfully managing these challenges is essential for preserving your wealth while diversifying your portfolio. Below, we’ll explore strategies to handle tax obligations and safeguard your assets through legal structures.

Managing Taxes on Crypto Sales and Real Estate

The IRS categorizes cryptocurrency as property, so selling digital assets to purchase real estate triggers a taxable event, resulting in either capital gains or losses. If you’ve held the crypto for one year or less, it’s taxed as ordinary income, with rates ranging from 10% to 37% in 2025. For assets held longer, long-term capital gains rates apply – 0%, 15%, or 20%, depending on your income bracket.

For instance, in 2025, single filers earning up to $48,350 or married couples filing jointly with incomes up to $96,700 will pay 0% on long-term capital gains. Timing your crypto sale carefully can help you avoid capital gains tax altogether. To calculate your gain, subtract your adjusted basis (original purchase price plus fees) from the net sale price.

Starting in 2025, brokers must report digital asset sales on Form 1099-DA. Additionally, for property transactions closing on or after January 1, 2026, real estate professionals will need to report the fair market value of any digital assets used in the purchase.

To reduce your tax liability, consider strategies like specific identification (choosing which crypto units to sell) or tax-loss harvesting (selling assets at a loss to offset gains). Donating cryptocurrency to a qualified 501(c)(3) organization can also eliminate capital gains tax while allowing you to deduct the fair market value of the donation.

While crypto sales create immediate tax obligations, real estate offers ongoing tax advantages. Property ownership allows you to claim depreciation deductions – 27.5 years for residential properties and 39 years for commercial ones. If you rent out the property for more than 15 days a year, you may also deduct mortgage interest and related expenses.

| Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly (Taxable Income) |

|---|---|---|

| 0% | Up to $48,350 | Up to $96,700 |

| 15% | $48,356 to $533,400 | $96,701 to $600,050 |

| 20% | Over $533,400 | Over $600,050 |

Setting Up Legal Entities for Asset Protection

Establishing the right legal structures is key to protecting your real estate investments. One popular option is a Limited Liability Company (LLC), which separates your personal assets from your investment. This structure shields you from personal liability in the event of lawsuits or creditor claims.

For added security, Domestic Asset Protection Trusts (DAPTs) can safeguard your assets while still allowing you to benefit from them. These irrevocable trusts must be set up proactively to be effective.

If you’re looking for maximum protection, especially with international real estate, offshore trusts like those in the Cook Islands are worth considering. These trusts don’t recognize foreign judgments and enforce a two-year statute of limitations on creditor claims.

When venturing into international real estate, it’s essential to work with experienced legal advisors familiar with both U.S. and foreign property laws. While these structures can enhance privacy, they don’t exempt you from tax obligations. U.S. taxpayers must report foreign assets under FATCA regulations, and starting in 2026, real estate transactions involving digital assets will face tighter scrutiny. To stay compliant, maintain detailed records of each transaction’s U.S. dollar fair market value for at least three years.

Conclusion

Shifting from cryptocurrency to real estate can create a well-rounded portfolio, balancing growth potential with reduced risk. With crypto’s annualized volatility hovering around 55% – about four times that of the S&P 500 – it’s clear that relying solely on digital assets can be a risky move for long-term financial security. Real estate, on the other hand, provides tangible stability, steady rental income, and a track record of protecting against inflation – advantages that digital assets simply don’t offer.

However, making this transition requires thoughtful planning. Timing your crypto sales to minimize tax liabilities is crucial, as is selecting the right type of real estate investment to align with your financial goals. Exploring international markets can also add diversification and asset protection to your strategy. Keep in mind that selling cryptocurrency often triggers capital gains taxes, while real estate offers ongoing benefits like depreciation deductions and mortgage interest write-offs. A tax-conscious approach like this can strengthen your portfolio’s durability over time.

"Being disciplined as an investor isn’t always easy, but over time it has demonstrated the ability to generate wealth, while market timing has proven to be a costly exercise for many investors."

– Ann Dowd, CFP®, Vice President, Fidelity Investments

To navigate the complexities of tax laws, legal requirements, and real estate strategies, it’s essential to consult with experienced professionals in these fields.

While diversification into real estate doesn’t eliminate risk entirely, it does reduce volatility by pairing the high-growth potential of digital assets with the stability of physical property. This balance between digital innovation and tangible security can provide a solid foundation for long-term wealth preservation, even in uncertain markets.

FAQs

What are some strategies to reduce tax liabilities when moving from cryptocurrency to real estate investments?

To manage tax obligations when transitioning from cryptocurrency to real estate, smart tax planning is essential. One useful method is the 1031 like-kind exchange, which lets you defer capital gains taxes. By reinvesting the proceeds from selling one investment property into another qualifying property within a set time frame, you can retain more capital for future ventures.

Understanding how the IRS classifies cryptocurrencies is equally important since they are treated as taxable assets. Keeping thorough records of all transactions – like purchase costs and sale prices – can help you determine accurate gains and uncover potential deductions or offsets. Working with a tax professional who specializes in both digital assets and real estate can ensure you stay compliant while taking advantage of strategies to reduce your tax liability.

What are the advantages of investing in tokenized real estate?

Investing in tokenized real estate brings a fresh approach to property investment, blending the perks of traditional ownership with the efficiency of blockchain technology.

One standout benefit is liquidity. Unlike conventional real estate transactions, which can drag on for weeks or even months, tokenized real estate allows ownership stakes to be traded in a matter of minutes. This makes it far easier to adjust your portfolio or react to market shifts without the usual delays.

Another key advantage is fractional ownership, which significantly lowers the cost of entry. Through tokenization, you can buy smaller shares of properties, enabling you to spread your investments across various locations and property types without needing a large amount of capital. For instance, you could allocate funds to properties in different states or even countries, diversifying your portfolio and reducing risk while tapping into multiple markets.

Blockchain technology also adds an extra layer of transparency and security. Ownership records are stored on an unchangeable ledger, minimizing the risk of fraud and offering clear, real-time insights into transactions and ownership details.

In short, tokenized real estate provides a modern way to access liquidity, diversify investments, and ensure security, making it an attractive option for those aiming for long-term financial growth.

How can investing in international real estate reduce local economic risks?

Investing in international real estate offers a smart way to balance your financial risks by spreading your assets across various countries and markets. This approach helps shield you from potential challenges like economic slowdowns, political unrest, or abrupt regulatory shifts in any single location.

Owning properties in multiple regions allows you to build a more stable portfolio, one that’s less vulnerable to local market fluctuations. Beyond protecting your wealth, this strategy opens doors to tap into growth opportunities in both emerging and established international markets, setting the stage for long-term financial stability.