Cryptocurrencies are no longer just speculative investments – they’re becoming essential tools for protecting and growing wealth. With a market value of $4 trillion, digital assets like Bitcoin and Ethereum are gaining traction among investors for their potential to hedge against inflation, offer financial privacy, and diversify portfolios. Here’s what you need to know:

- Bitcoin’s Scarcity: Fixed supply of 21 million coins makes it a hedge against fiat currency devaluation.

- 24/7 Liquidity: Crypto markets operate round-the-clock, offering flexibility unmatched by traditional assets.

- Portfolio Benefits: Adding 2-5% crypto to a portfolio can improve risk-adjusted returns due to low correlation with stocks and bonds.

- Security First: Use cold wallets for long-term storage and hot wallets for active trading, and always safeguard private keys.

- Tax and Regulation: Every crypto transaction is taxable; keep detailed records and stay updated on IRS requirements.

Want to protect your digital wealth? Focus on secure storage, diversify your holdings, and leverage strategies like dollar-cost averaging, multi-signature wallets, and offshore trusts for added security. Cryptocurrency is reshaping wealth management – are you ready to integrate it into your portfolio?

Secure Storage Solutions for Digital Assets

When it comes to safeguarding your digital assets, the security of your storage method is everything. Unlike traditional bank deposits that come with insurance, protecting digital assets depends entirely on how you handle them. A single misstep – like misplacing a password, exposing a device, or losing a seed phrase – can result in permanent loss of access to your funds. Take the case of programmer Stefan Thomas, who lost access to 7,002 Bitcoins in 2021, valued at around $203 million at the time. Or the story of James Howells, who accidentally threw away a hard drive containing 8,000 Bitcoins, which had ballooned to nearly $1 billion by 2026.

The key decision for digital asset storage boils down to hot wallets versus cold wallets. Hot wallets are software tools – available as mobile apps, desktop software, or browser extensions – that remain connected to the internet, offering quick access. On the other hand, cold wallets are offline solutions, such as physical devices or paper, that store private keys away from online threats.

Hardware Wallets and Cold Storage

Hardware wallets are physical devices, often resembling USB drives, designed to keep your private keys offline. When you need to make a transaction, the wallet signs it internally, ensuring the private key never connects to the internet. This makes hardware wallets highly resistant to malware, keyloggers, and remote hacking attempts. Many models even require a physical button press to authorize transactions, adding an extra safeguard against unauthorized use, even if your computer is compromised.

These devices generate a 12-to-24-word seed phrase, which acts as a master backup. If your wallet is lost, stolen, or damaged, this phrase allows you to recover your funds on a new device. However, safeguarding this seed phrase is just as vital as securing the wallet itself. Write it down on paper or engrave it on a metal plate, and store it in a fireproof safe or a bank safe-deposit box. Avoid storing it digitally – whether in cloud storage, email, or as a photo. Hardware wallets typically cost between $50 and $200, and it’s crucial to purchase directly from trusted manufacturers like Ledger or Trezor to avoid the risk of tampered devices.

For those managing substantial crypto holdings, multi-signature (multi-sig) wallets provide an added layer of security. These wallets require multiple independent approvals – such as 3 out of 5 keys – to complete a transaction. This setup eliminates a single point of failure and is increasingly favored by institutions handling large volumes of digital assets.

While cold storage is unmatched for security, it’s not ideal for situations requiring frequent access. That’s where hot wallets come into play.

Hot Wallets for Active Trading

If you’re making frequent transactions, you’ll need a more accessible solution. Hot wallets are convenient but come with higher security risks. Numerous breaches have highlighted the vulnerabilities associated with these wallets.

As Johnny Gabriele, Head Analyst of Blockchain Economics and AI Integration at The Lifted Initiative, advises:

"I always tell people to treat their hot wallet like they would their actual wallet – never store more than you’d be okay losing".

The most effective approach is a hybrid strategy: keep only the amount you need for active trading in a hot wallet, while transferring the majority of your holdings to cold storage.

Fei Chen, Founder and CEO of Intellectia, offers a helpful analogy:

"Think of hot wallets like your checking account – easy to use but riskier. Cold wallets are your safety deposit box – harder to access but more secure".

When using hot wallets, enhance security by enabling hardware-based two-factor authentication (like Yubikey) instead of SMS-based 2FA, which is vulnerable to SIM swapping attacks. And before making any large transactions, always start with a small test transfer to ensure everything works as expected.

Diversification Strategies for Crypto Portfolios

Once you’ve ensured secure storage for your digital assets, the next step is crafting a portfolio that balances potential growth with manageable risk. Cryptocurrency is known for its volatility – since early 2017, a market-cap–weighted index of investable digital assets has shown annualized volatility of 95%, compared to just 16% for the S&P 500.

According to Grayscale Research, adding around 5% of crypto to your portfolio can improve risk-adjusted returns due to its low correlation with traditional investments. As Grayscale Research puts it:

"Lower correlations are the ‘secret sauce’ of portfolio diversification, and why data-driven approaches to portfolio optimization will typically see a role for incorporating the crypto asset class."

Allocating Across Bitcoin, Ethereum, and Altcoins

Bitcoin is often considered digital gold and a hedge against inflation, while Ethereum powers decentralized applications and smart contracts. Beyond these two giants, altcoins offer a diverse range of use cases, from lending platforms like Aave to AI-focused projects like Bittensor.

A practical approach is to follow the 80/20 rule: allocate 80% of your crypto portfolio to large-cap coins like Bitcoin and Ethereum, and the remaining 20% to promising altcoins. However, altcoins come with higher risks – they tend to have smaller market caps and greater price volatility compared to Bitcoin. As Mark Cuban advises:

"Anyone planning to invest in crypto, particularly in altcoins that may be less established, must do their research before investing."

Portfolio Weighting Guidelines

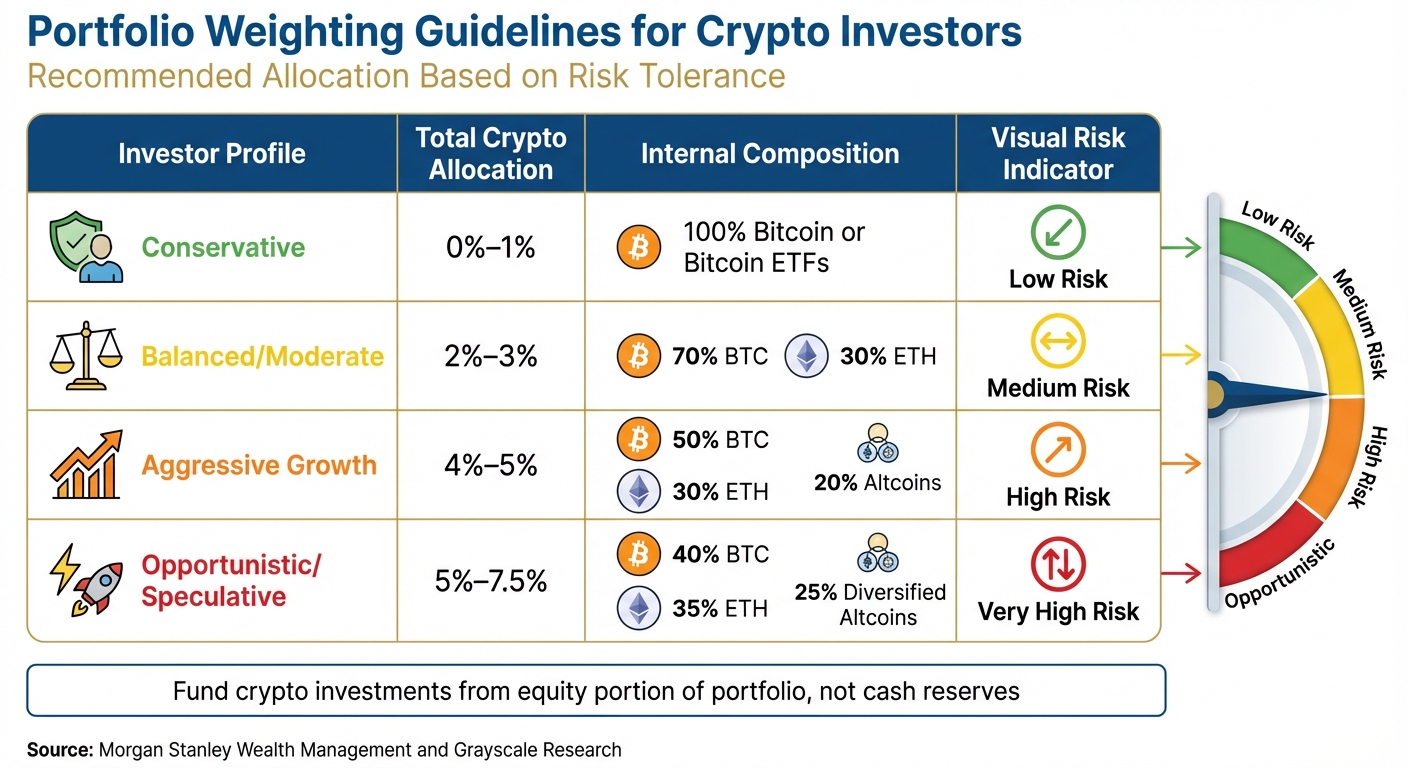

The amount of crypto in your portfolio should align with your risk tolerance and financial objectives. Morgan Stanley Wealth Management suggests the following guidelines for crypto allocation based on investor profiles:

| Investor Profile | Total Crypto Allocation | Internal Composition |

|---|---|---|

| Conservative | 0%–1% | 100% Bitcoin or Bitcoin ETFs |

| Balanced / Moderate | 2%–3% | 70% BTC, 30% ETH |

| Aggressive Growth | 4%–5% | 50% BTC, 30% ETH, 20% Altcoins |

| Opportunistic / Speculative | 5%–7.5% | 40% BTC, 35% ETH, 25% Diversified Altcoins |

Source: Morgan Stanley Wealth Management and Grayscale Research

Experts recommend funding your crypto investments from the "risky asset" section of your portfolio, typically the equity portion, rather than dipping into cash or stable income reserves. Given the extreme volatility of crypto markets, regular rebalancing is critical to keep your portfolio aligned with your risk preferences, especially during bull runs.

Risk Mitigation Techniques

The extreme volatility of cryptocurrency markets makes disciplined risk management an absolute must. To put this into perspective, the Morgan Stanley Global Investment Committee reports that crypto’s annualized volatility is around 55% – roughly four times higher than the S&P 500 Index. Since 2010, the Bloomberg Bitcoin Galaxy Index has faced drawdowns of at least 10% in every rolling six-month period, with 30% drops in half of those periods and 50% declines in 30% of them. These dramatic swings highlight the need for deliberate investment strategies like systematic averaging and rebalancing.

Dollar-Cost Averaging and Rebalancing

One effective way to manage crypto’s volatility is through dollar-cost averaging. This method involves investing a fixed amount, such as $500, at regular intervals, regardless of market conditions. By doing so, you avoid emotional decision-making. When prices dip, your fixed investment buys more coins; when prices rise, you acquire fewer. This consistent approach helps smooth out the market’s ups and downs and reduces the risks associated with timing your investments.

Another key strategy is rebalancing, which adjusts your portfolio back to its target allocation after market fluctuations cause imbalances. The U.S. Securities and Exchange Commission explains it this way: "By cutting back on the current ‘winners’ and adding more of the current so-called ‘losers,’ rebalancing forces you to buy low and sell high." In crypto investing, rebalancing is particularly important during market surges when one asset might grow disproportionately. Instead of selling appreciated positions, you can allocate new funds to underweighted assets to restore balance.

Cybersecurity Best Practices

Strong cybersecurity measures are just as important as financial strategies when managing your crypto portfolio. Protecting your digital assets requires a layered approach, covering network, application, and physical security. At the heart of this is safeguarding your private keys – the alphanumeric codes that authorize transactions. Losing your private keys means losing access to your crypto forever. As the SEC Office of Investor Education warns, "If you lose your private key, you permanently lose access to the crypto assets in your wallet." To prevent this, store backup copies of your keys in secure, offline locations like a fireproof safe.

Two-factor authentication (2FA) is another essential security measure. Use 2FA on all exchange accounts, preferably with biometric methods like fingerprints or facial recognition rather than SMS codes, which can be intercepted. For added security, consider setting up a dedicated email address for crypto trading to keep it separate from personal accounts. Always verify recipient addresses with a small test transfer before sending larger amounts. Additionally, ensure your wallet software and device operating systems are always updated, and avoid accessing crypto accounts over public Wi-Fi unless using a VPN.

Recent high-profile cyberattacks illustrate the importance of robust security. In August 2021, hackers stole over $610 million from Poly Network, and in mid-2022, Horizon Bridge suffered a $100 million breach. A particularly tragic case occurred in 2018 when the CEO of QuadrigaCX, Canada’s largest crypto exchange, passed away as the sole holder of the cold wallet passwords, leaving customers locked out of their investments permanently. These incidents emphasize the value of multi-signature wallets, which require multiple approvals for transactions. This extra layer of security protects against both external theft and single points of failure.

Integrating Cryptocurrencies with International Asset Protection

Savvy investors are increasingly incorporating cryptocurrencies into international legal frameworks to shield their digital assets. These strategies add layers of protection against creditors, lawsuits, and regulatory challenges, building on previously discussed risk management techniques.

Using Offshore Trusts for Crypto Holdings

Offshore trusts are a powerful tool for safeguarding digital assets. By transferring ownership to a trustee in a jurisdiction with strong asset protection laws, such as the Cook Islands or Wyoming, you create formidable barriers for potential litigants. These jurisdictions offer strict confidentiality, making it difficult for anyone to access trust details. Once assets are transferred, they are effectively out of reach for U.S.-based creditors or claimants.

A common approach is to establish a Crypto LLC to hold your digital assets and then have an offshore trust own the LLC. This setup creates a legal buffer, making it financially and legally challenging for frivolous claims to proceed. Costs for setting up a Foreign Asset Protection Trust typically range from $20,000 to $50,000, with annual maintenance fees between $2,000 and $5,000, plus about 1% of the asset value.

"A firm Asset Protection Trust can eliminate that aspect by transferring the ownership of your assets and/or property to a Trust that’s wholly controlled by a named Trustee." – Craig Parker, Assistant General Counsel, Trust & Will

However, handling sensitive information like private keys requires caution. Never include private keys in the trust documents themselves. Instead, use a separate "Credential Memorandum" or "Letter of Instruction" to keep this information secure and out of legal discovery. Additionally, ensure the trust document exempts the trustee from the Prudent Investor Rule, which typically restricts speculative investments. Without this exemption, holding volatile cryptocurrencies could violate fiduciary duties.

Private US LLCs for Digital Asset Privacy

For those seeking privacy, a private U.S. LLC is a practical choice. By using a registered agent during formation, you can keep your name off public state records, making it harder for anyone to trace your crypto holdings.

"If someone was to set up an LLC through an agent, it’s possible to not have their name tied to their LLC in a state’s public database. This can provide valuable privacy that is highly sought-after by crypto participants." – CoinLedger

Wyoming is a standout jurisdiction for setting up crypto LLCs. The state offers zero state income tax, a dedicated DAO LLC statute, and clear regulations for digital asset custody. Wyoming was also the first to legally recognize Decentralized Autonomous Organizations (DAOs) under Wyoming Statutes §17-31-101 et seq.. Beyond privacy, LLCs provide legal separation, safeguarding personal assets from business liabilities. Ownership interests can be transferred by updating internal agreements rather than executing on-chain transactions, which helps avoid public blockchain exposure and may defer taxable events.

To preserve these protections, it’s critical to maintain a clear separation between personal and LLC finances. Commingling funds could "pierce the corporate veil", nullifying liability protections. Your LLC’s operating agreement should specifically address issues like digital asset management, private key custody, and succession planning in the event of death or incapacity.

Global Wealth Protection‘s Offshore Company Formation Solutions

Expanding on domestic strategies, Global Wealth Protection offers tailored offshore solutions for cryptocurrency investors. Their services leverage jurisdictions like Anguilla to provide enhanced privacy, asset protection, and tax advantages.

For high-net-worth individuals, the firm provides offshore trusts and private interest foundations designed to integrate seamlessly with cryptocurrency portfolios. Their comprehensive service packages include all necessary filings, certifications, trust administration, and introductions to international banking partners. Membership in the GWP Insiders program grants access to ongoing consultations, jurisdictional guidance, and strategies to adapt to evolving crypto regulations.

Through one-on-one consultations, Global Wealth Protection offers step-by-step guidance for structuring crypto holdings within international frameworks. Whether safeguarding a modest portfolio or managing substantial digital wealth, their expertise ensures your assets are protected across borders while optimizing for tax efficiency and legal compliance.

sbb-itb-39d39a6

Regulatory and Tax Considerations in 2026

Navigating IRS rules and staying ahead of shifting crypto regulations are critical for investors in 2026. With reporting requirements becoming more stringent, understanding how to document and report your crypto transactions has never been more important.

Tax Obligations for Crypto Investors

In the U.S., the IRS classifies digital assets – such as cryptocurrencies, stablecoins, and NFTs – as property rather than currency. This means that every single crypto transaction you make is a taxable event. Whether you’re selling Bitcoin for dollars, swapping Ethereum for another altcoin, or using crypto to pay for goods, you’ll need to report capital gains or losses on Form 8949 and Schedule D.

Starting January 1, 2026, brokers will also be required to report the cost basis of digital assets on Form 1099-DA. Real estate professionals acting as brokers will need to report the fair market value of digital assets used in property transactions for deals closing on or after that date.

Here’s how holding periods affect your tax rates:

- Short-term (≤1 year): Taxed at ordinary income rates.

- Long-term (>1 year): Eligible for lower long-term capital gains rates.

Income from staking rewards, mining, or receiving crypto as payment for services is treated as ordinary income. The IRS taxes these earnings based on the fair market value of the asset at the time you receive it.

To reduce your tax burden, consider using specific identification when selling crypto. By keeping detailed records – like private keys, transaction logs, and purchase dates – you can sell units with the highest cost basis first, minimizing your taxable gains. If you don’t have this documentation, the IRS will default to the First-In, First-Out (FIFO) method. Don’t forget to include gas fees and transaction costs in your calculations; these can either increase your asset’s basis or reduce the proceeds from a sale.

| Transaction Type | Tax Treatment | Reporting Form |

|---|---|---|

| Sale for USD | Capital Gain/Loss | Form 8949, Schedule D |

| Crypto-to-Crypto Exchange | Capital Gain/Loss | Form 8949, Schedule D |

| Staking/Mining Rewards | Ordinary Income | Schedule 1 or Schedule C |

| Payment for Services | Wages/Ordinary Income | Form 1040 (Line 1a) |

| Charitable Donation | Non-taxable; possible deduction | Form 8283 (if >$500) |

Keeping accurate records and planning your taxes carefully are essential as these changes take effect.

Staying Compliant with Evolving Crypto Regulations

Beyond taxes, staying compliant with new crypto regulations is equally important. The IRS now requires all taxpayers to answer the digital asset question on the first page of their tax returns – whether or not they had any transactions during the year. This applies to individuals, estates, trusts, partnerships, and corporations, signaling the agency’s push for greater transparency.

Meanwhile, the U.S. Senate is debating a sweeping crypto market structure bill. This legislation aims to increase oversight of decentralized finance (DeFi) and introduces the concept of "ancillary assets".

"the most significant law considered by the Committee this century." – Senators Jack Reed, Tina Smith, and Chris Van Hollen

These changes will significantly impact how DeFi projects and developers operate, making it crucial to stay informed.

To stay compliant:

- Record the date, time, U.S. dollar value, and costs of each transaction.

- Keep these records for at least three years.

- If you hold digital assets on foreign exchanges or platforms, ensure you meet FBAR (Report of Foreign Bank and Financial Accounts) requirements.

The IRS has offered temporary relief for brokers regarding backup withholding and reporting for 2025 transactions, provided they make a "good faith effort" to comply. However, full compliance will be required by 2026. Consulting a tax professional familiar with crypto regulations can help you optimize your tax strategy and meet these requirements.

Case Studies and Applications

Let’s dive into some real-world scenarios that highlight how secure storage, diversified portfolios, and strategic legal tools come together to protect and grow cryptocurrency assets.

Case Study: Diversifying a Crypto Portfolio for Asset Protection

A tech entrepreneur decided to tackle the unpredictable nature of Bitcoin by restructuring his crypto holdings. With guidance from his financial advisor, he allocated 5% of his overall investment portfolio to cryptocurrency. To strike a balance between growth and stability, he diversified his assets across Bitcoin, Ethereum, utility tokens, and stablecoins.

To safeguard these assets, he distributed them across multiple cold storage devices, reducing the risk of a single point of failure. For added protection, he set up an Asset Protection Trust (APT), which legally separated him from his holdings, shielding them from potential creditor claims. His trust documents even included an exception to the "prudent investor rule", allowing for more flexible crypto management strategies.

"Many holders of significant crypto wealth are relatively young and may not be thinking about the possibility that they could die suddenly." – David Peterson, Head of Advanced Wealth Solutions, Fidelity

This case underscores the importance of a well-rounded approach: diversifying assets, securing storage, and regularly rebalancing the portfolio.

Example: Offshore Trusts for High-Net-Worth Crypto Investors

Offshore trusts are another powerful tool for protecting cryptocurrency wealth. In one example, a real estate investor with considerable crypto holdings set up an offshore trust in the Cook Islands, a jurisdiction known for its robust asset protection laws.

The biggest challenge? Finding a trustee willing to handle digital assets. Many institutional trustees shy away from crypto due to its volatility. She eventually partnered with a specialized trustee experienced in digital asset management. Her trust was carefully structured to bypass the typical prudent investor limits.

To maintain privacy, she avoided listing private keys in the trust documents, which could risk becoming public. Instead, she provided her trustee with a separate letter of instruction. Additionally, she implemented a "deadman" switch – an automated system that would release access credentials to her trustee if she failed to check in within 90 days.

For added security, she used a multi-signature wallet requiring cooperation from herself, her trustee, and her attorney to access the funds. This setup ensured no single individual had full control. The entire transfer process was meticulously documented to meet tax reporting requirements.

"The laws are starting to adjust and catch up to the digital asset class, but a lot of them haven’t yet been tested in a court." – Mike Christy, Regional Vice President of Advanced Planning, Fidelity

This comprehensive strategy combined offshore trusts, diversified cold storage, and multi-signature wallets to create multiple layers of security. Together, these measures made it incredibly difficult for creditors to breach.

Conclusion

Protecting cryptocurrency wealth in 2026 requires more than just owning digital assets – it calls for a well-rounded, strategic approach. At its core, this involves secure storage, diversification, disciplined risk management, and, for some, international legal structures.

The first step is secure storage. Keeping the majority of your crypto in offline cold wallets ensures greater safety, while hot wallets should only be used for active trading. As the SEC Office of Investor Education and Assistance cautions:

"If you lose your private key, you permanently lose access to the crypto assets in your wallet".

Diversification is another key pillar. Allocating a modest portion of your portfolio – around 5% – to digital assets can improve risk-adjusted returns while managing exposure to crypto’s notorious volatility. Spreading investments across Bitcoin, Ethereum, stablecoins, and other assets helps reduce the risks of over-concentration.

Risk management ties these elements together. Strategies like dollar-cost averaging, regular portfolio rebalancing, and meticulous adherence to tax regulations help safeguard your wealth. Staying compliant with evolving rules demands careful record-keeping, which is an essential part of managing crypto investments.

For high-net-worth individuals, international structures provide an additional layer of protection. Offshore trusts and private US LLCs can shield assets from domestic creditors when set up correctly. Coupled with thoughtful estate planning, these measures ensure your wealth is preserved for future generations. As David Peterson, Head of Advanced Wealth Solutions at Fidelity, emphasizes:

"Not having a plan to transfer your crypto assets at death can potentially make the consequences even more devastating for your loved ones".

FAQs

What are the best ways to securely store cryptocurrency and protect it from loss?

To protect your cryptocurrency and minimize the risk of loss, consider using a hardware wallet like Ledger or Trezor. These devices store your private keys offline, providing a strong defense against online threats. When setting up your wallet, you’ll be given a recovery seed phrase – a series of 12-24 words. Write this phrase down on paper or a fireproof material and store it in a secure place. Avoid saving it digitally or keeping it online under any circumstances.

For extra protection, make sure to set a strong PIN or password on your wallet, enable any available passphrase features, and regularly update the device’s firmware. It’s also wise to create a duplicate backup of your seed phrase and store it in a separate, secure location, like a safety deposit box. Never share your private keys or seed phrase with anyone, and stay alert for phishing scams or fake wallet applications. By taking these precautions, you can greatly improve the security of your cryptocurrency holdings.

What are the advantages of including cryptocurrency in a traditional investment portfolio?

Adding cryptocurrency to your investment portfolio comes with a range of potential advantages:

- Potential for high returns: Cryptocurrencies such as Bitcoin have historically delivered impressive gains, offering a chance to boost your portfolio’s overall performance.

- Diversification benefits: Unlike traditional assets like stocks and bonds, cryptocurrencies often move independently, which can help balance out risk and reduce overall volatility.

- Hedge against inflation: Many cryptocurrencies are designed with limited supply or mechanisms to maintain value, providing a possible safeguard against inflation and currency devaluation.

When incorporated thoughtfully into a well-rounded investment strategy, cryptocurrencies can contribute to diversification, protect wealth, and offer growth opportunities.

How can I comply with U.S. tax regulations for cryptocurrency?

To stay on the right side of U.S. crypto tax rules, treat every cryptocurrency transaction as a taxable event – just like the IRS handles stocks or property. That means you’ll need to keep detailed records of every purchase, sale, swap, payment, airdrop, or staking reward. For each transaction, jot down the date, the fair market value in USD at the time, the amount of cryptocurrency involved, and the reason for the transaction. This data will be essential when filling out Form 8949 and Schedule D to report capital gains or losses, which depend on how long you held the asset.

If you earn cryptocurrency as income – say, through mining, staking, or airdrops – you must report its fair market value on the day you received it as ordinary income on Form 1040. To ensure everything is filed correctly, consider using reliable tax software or consulting a qualified tax professional. Also, hang onto all supporting documents, like exchange statements and wallet records, for at least three years in case the IRS comes knocking for an audit. Staying organized and following the latest IRS guidelines will save you headaches and help you avoid penalties.