Keeping all your wealth in one country is risky. Economic downturns, sudden tax changes, currency devaluation, and political instability can jeopardize your financial security. International diversification offers a solution by spreading your assets across multiple jurisdictions, currencies, and economies to mitigate these risks.

Key Takeaways:

- Wealth Concentration Risks: Local laws, lawsuits, and economic shifts can threaten domestic assets.

- Global Wealth Migration: By 2026, 165,000 millionaires are expected to relocate, doubling from 2016.

- Tax Concerns: U.S. estate taxes can reach 40% or more, with forced heirship laws in some countries overriding personal wishes.

- Strategies for Diversification:

- Offshore bank accounts protect against currency fluctuations and legal risks.

- Foreign real estate offers stable returns and shields assets from domestic judgments.

- Offshore trusts in jurisdictions like the Cook Islands provide strong legal protection.

To secure your wealth globally, start early, stay compliant with U.S. tax laws, and consult professionals for tailored strategies.

The Dangers of Keeping All Your Assets in One Country

Placing all your wealth within a single jurisdiction can leave you vulnerable to a host of risks. For instance, a single court order can target and seize everything you own locally, as domestic courts have immediate authority over assets within their reach. This concentration makes your holdings easy to identify, increasing the likelihood of lawsuits.

From a legal standpoint, typical domestic asset structures offer little defense. Revocable U.S. trusts, for example, provide no real protection since they aren’t legally distinct from the individual. Even Domestic Asset Protection Trusts fall short, as they remain bound by U.S. federal and state laws, making them more accessible to creditors compared to international alternatives. Professionals in high-risk fields, such as medicine or law, are particularly exposed to malpractice claims that could result in the loss of their entire estate.

"An offshore asset protection trust prevents a judge in your jurisdiction from ordering that the trustee release funds within the trust to a creditor." – White & Bright, LLP

Beyond legal concerns, economic risks further highlight the dangers of keeping all assets in one country. Currency devaluation can diminish your global purchasing power, making foreign goods, travel, and property upkeep more expensive. For example, recent data indicates a decline in the U.S. Dollar Index against major international currencies. Additionally, concentrating assets domestically ties your portfolio’s performance to regional economic trends, leaving it vulnerable to slow growth and reduced appreciation potential.

Regulatory changes amplify these risks. Shifts in domestic policies can impose unexpected financial burdens. A case in point is the Secure Act 2.0, effective September 29, 2025, which introduced stricter retirement savings rules for Americans over 50 earning more than $145,000 – a move some have labeled a "hidden tax hike". Courts can also reverse asset transfers into protective structures if deemed fraudulent, meaning they were made to block creditors. When all your wealth operates under one legal and economic system, you’re left with few options if that system works against you. These challenges highlight the importance of diversifying internationally.

sbb-itb-39d39a6

Proven Methods for International Wealth Diversification

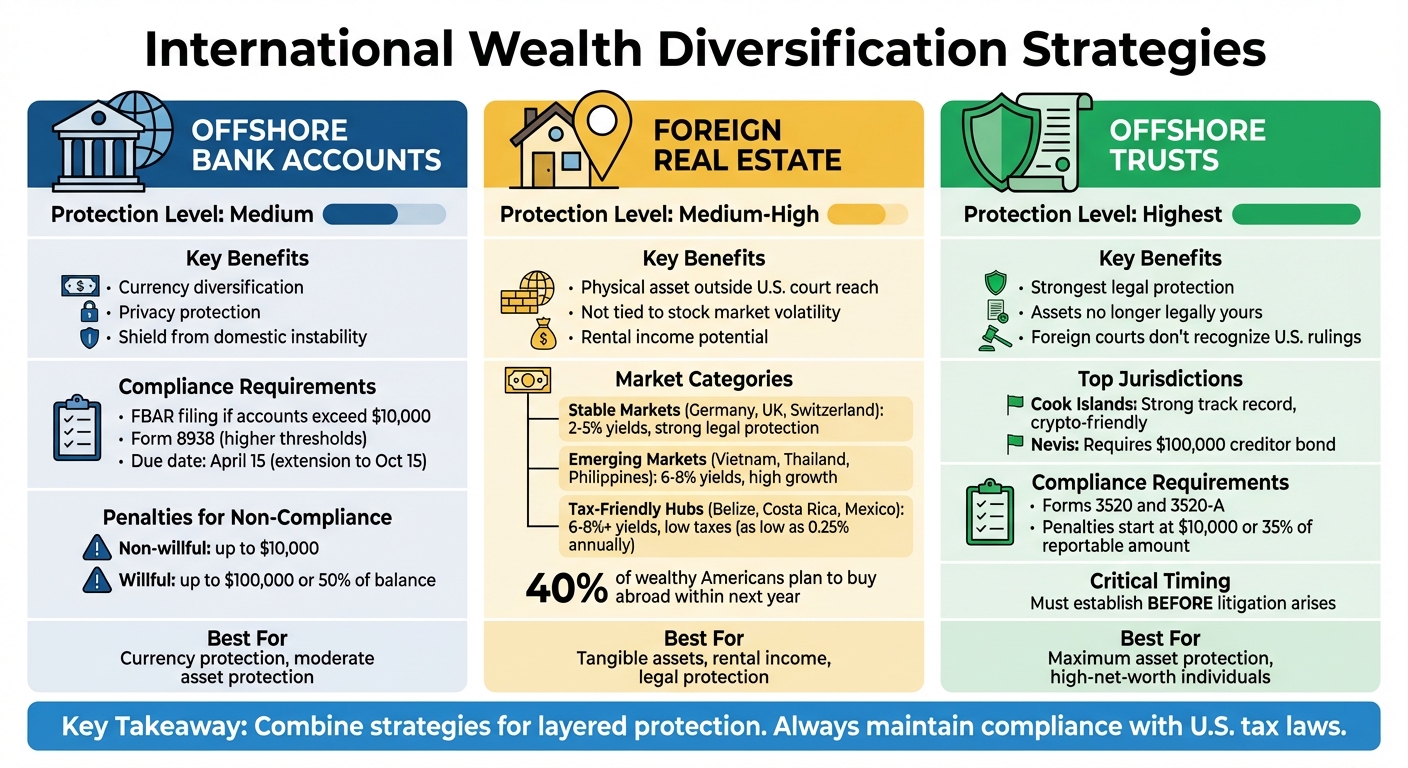

Diversifying your wealth internationally can provide a robust safety net and enhance your financial security. Three popular strategies to consider are offshore bank accounts, foreign real estate, and offshore trusts and private foundations. These approaches can be used individually or combined for added layers of protection. Let’s dive into each one.

Offshore Bank Accounts and Multiple Currency Holdings

Opening a foreign bank account can shield your assets from domestic financial instability while offering a level of privacy that U.S. banks may not. By holding funds in multiple currencies, you also protect yourself from fluctuations in the U.S. dollar. For instance, if the dollar loses value, your ability to buy international goods, travel, or invest abroad remains steady.

However, U.S. citizens with foreign accounts must comply with reporting requirements. If the total value of all foreign accounts exceeds $10,000 at any point during the year, you must file an FBAR (FinCEN Form 114). Depending on your situation, you might also need to file Form 8938. Failing to meet these requirements can lead to hefty penalties, ranging from $10,000 for non-willful violations to as much as $100,000 or 50% of account balances for willful non-compliance.

"Legitimate offshore planning is lawful; hiding assets or willfully failing to report is not. Full reporting and transparency are essential." – FinHelp

To strengthen your financial safety net, consider placing your offshore accounts within an International LLC or an Asset Protection Trust. This setup adds legal barriers, making it more challenging for creditors to access your funds. Keep thorough records, including account details and peak balances, for at least five years. Don’t forget to file your FBAR electronically through the BSA E-Filing System by April 15 each year. If you need more time, an automatic extension to October 15 is available.

Next, let’s look at how owning real estate abroad can provide tangible security.

Buying Real Estate in Foreign Countries

Investing in foreign real estate offers a unique form of asset protection. Unlike financial instruments, property is a physical asset that is not directly tied to stock market volatility. Additionally, owning property abroad places it out of reach from U.S. court judgments, offering an extra layer of legal security.

"Property in a foreign jurisdiction is safe from any U.S. court, meaning safe from any potential U.S. litigant." – Lief Simon, Editor, Offshore Living Letter

This strategy is gaining traction – nearly 40% of wealthy Americans plan to purchase a home abroad within the next year. Beyond protection, foreign real estate can also be a lucrative investment. Emerging markets in Asia and Latin America often yield rental returns of 6% to 8%, while stable European markets typically offer returns between 2% and 5%. Additionally, countries like Costa Rica offer low property taxes, sometimes as little as 0.25% annually.

When choosing a property, research the local legal landscape. For example, in Mexico, coastal properties require a bank trust (fideicomiso), while in Thailand, land ownership for foreigners is restricted. Building a reliable local team – comprising a real estate attorney, property manager, and international tax advisor – will help you navigate these complexities. It’s also wise to set up a local bank account for managing rental income and currency exchanges when rates are favorable.

| Market Category | Examples | Primary Advantage | Typical Yields |

|---|---|---|---|

| Stable Markets | Germany, UK, Switzerland | Strong legal protection, low risk | 2–5% |

| Emerging Markets | Vietnam, Thailand, Philippines | High growth potential | 6–8% |

| Tax-Friendly Hubs | Belize, Costa Rica, Mexico | Low taxes, residency incentives | 6–8%+ |

Offshore Trusts and Private Foundations

For the highest level of legal protection, offshore trusts are a powerful tool. Jurisdictions like the Cook Islands and Nevis are particularly advantageous because they don’t recognize foreign court rulings. Creditors would need to re-litigate any claims under local laws, which often involve higher burdens of proof and costly legal fees.

"Offshore trust jurisdictions are typically friendly to debtors – foreign trustees are not subject to the laws of the United States and they are not required to comply with any orders issued by domestic courts." – White and Bright, LLP

An offshore trust typically involves three key roles: the settlor (you), the trustee (a foreign entity managing the trust), and the beneficiary (usually you or your family). Once assets are transferred into an irrevocable trust, they are no longer legally yours, making them much harder for creditors to claim. For example, Nevis requires creditors to post a bond – often $100,000 – before filing a claim against a trust. The Cook Islands, on the other hand, has a strong track record for protecting assets, including cryptocurrency holdings.

To retain some control, many investors use a combination trust/LLC structure. In this setup, the offshore trust owns an LLC, which you can manage on a day-to-day basis. This structure is especially popular for safeguarding domestic IRAs from legal risks.

Timing is everything. These trusts must be established and funded before any sign of litigation arises. Transferring assets to avoid a known or pending creditor can be considered fraudulent. U.S. citizens must also report offshore trust activities using Forms 3520 and 3520-A. Penalties for non-compliance start at $10,000 or 35% of the reportable amount.

U.S. Tax and Reporting Requirements for Offshore Assets

When securing offshore assets, staying compliant with U.S. tax and reporting rules is a must to ensure uninterrupted protection.

U.S. citizens and residents are required to report their worldwide income, even if foreign accounts don’t generate taxable income. Two key regulations govern these obligations: the Foreign Account Tax Compliance Act (FATCA) and the Bank Secrecy Act’s FBAR requirement. Knowing the ins and outs of these rules can help you avoid hefty penalties while benefiting from international diversification.

FBAR (FinCEN Form 114) is mandatory if the total value of your foreign accounts surpasses $10,000 at any point during the year. This form is independent of your tax return and must be submitted electronically through FinCEN’s BSA E-Filing System by April 15, with an automatic extension to October 15. On the other hand, Form 8938, required under FATCA, applies to higher thresholds depending on your status. For instance, unmarried U.S. residents must file if their foreign assets exceed $50,000 on December 31 or $75,000 at any time during the year.

"The Foreign Account Tax Compliance Act, more commonly known as FATCA, became law in March 2010, and is designed to make sure U.S. taxpayers with foreign accounts pay the taxes they owe." – Taxpayer Advocate Service

Failing to comply comes with steep penalties. Non-willful FBAR violations can cost up to $10,000, while willful violations may result in penalties of up to $100,000 or 50% of the account balance – whichever is greater. For Form 8938, the initial penalty is $10,000, with an additional $10,000 for each month of non-compliance after IRS notification, capped at $50,000. Additionally, there’s a 40% penalty on any tax underpayment tied to undisclosed foreign assets. These penalties highlight the importance of keeping accurate records.

To stay compliant, maintain detailed records for at least five years for each foreign account, including account names, numbers, bank addresses, and peak values. When converting foreign currency to U.S. dollars, use the Treasury Bureau of the Fiscal Service exchange rate from the last day of the calendar year. If you’ve missed reporting in prior years, the IRS offers streamlined filing compliance procedures to help you catch up and potentially reduce penalties.

| Feature | FBAR (FinCEN Form 114) | FATCA (Form 8938) |

|---|---|---|

| Reporting Threshold | $10,000 (aggregate) | $50,000–$600,000 (varies by status/residency) |

| Where to File | FinCEN (BSA E-Filing System) | IRS (attached to your tax return) |

| Due Date | April 15 (automatic Oct 15 extension) | Same as your income tax return |

| Assets Reported | Financial accounts only | Financial accounts and other specified assets |

Conclusion: Start Protecting Your Wealth Today

The numbers don’t lie – international diversification works. Take the S&P 500’s "lost decade" (2000–2009) and its more recent performance in 2025 as examples. During these periods, global exposure outperformed, with non-U.S. equities delivering returns 12.1% higher. Considering that the U.S. accounts for just 60% to 65% of global equity markets, keeping all your investments domestic means you’re overlooking a significant portion of the world’s opportunities.

Expanding internationally offers multiple advantages. It reduces portfolio volatility, protects against inflation and currency depreciation, opens doors to emerging markets, and strengthens asset protection. These benefits are essential for building a resilient financial future.

"Asset protection trusts must be set up and funded before litigation is on the horizon. It is unlawful to move assets in order to hide them from a known creditor." – White and Bright, LLP

But here’s the catch: international strategies require planning. You need to act early – before litigation, economic downturns, or currency issues arise. Many foreign jurisdictions enforce shorter statutes of limitation than the U.S., so waiting until a crisis hits could leave you exposed.

To get started, evaluate your risk tolerance and investment goals. U.S.-listed ETFs can provide international exposure, while more advanced offshore structures may require specialized legal and financial advice. Stay compliant by keeping thorough records and ensuring all foreign holdings are properly reported to avoid hefty penalties. Regularly rebalancing your portfolio is another key step to locking in gains and maintaining a balanced strategy.

Whether it’s through offshore bank accounts, foreign real estate, or trusts, international diversification isn’t just about spreading risk – it’s about building a comprehensive plan for long-term wealth protection. As the global financial landscape evolves, those who act now will be better prepared for the challenges ahead.

FAQs

What are the main advantages of diversifying your wealth internationally?

Diversifying your wealth across international borders comes with several benefits, such as reducing risk, seizing global growth opportunities, and shielding yourself from local economic or political instability. By allocating assets across multiple countries, you can lessen the impact of issues like currency devaluation, inflation, or sudden political shifts in any one area.

This approach also opens the door to investments in both emerging markets and established economies, giving your portfolio a broader reach and the chance for higher returns. Plus, holding assets in various currencies and industries can provide steadier long-term growth, offering protection against economic slumps in specific regions. It’s a forward-thinking way to secure your financial future while leveraging opportunities on a global scale.

How do offshore trusts help protect my assets from legal claims in the U.S.?

Offshore trusts offer a robust way to protect your assets from legal claims within the U.S. These trusts are established in foreign jurisdictions – such as the Cook Islands, Nevis, or the Cayman Islands – where laws are designed to make it much harder for creditors or legal challengers to access the assets placed within them.

One key feature of offshore trusts is that they are typically irrevocable, meaning once assets are transferred, they are no longer under your direct control. This creates a significant hurdle for anyone attempting to make a claim against those assets. While you are still required to adhere to U.S. tax laws and reporting obligations, the structure of these trusts adds layers of complexity and cost for potential creditors trying to pursue your holdings.

To set up an offshore trust that is both effective and fully compliant with legal requirements, it’s crucial to work with professionals who specialize in legal and tax matters. Their expertise ensures that your trust is not only secure but also aligned with all applicable regulations.

What do U.S. citizens need to know about reporting foreign assets?

U.S. citizens holding foreign assets must follow specific reporting rules to stay compliant with federal tax laws. If the total value of their foreign financial accounts exceeds $10,000 at any point during the year, they must file the Foreign Bank and Financial Accounts Report (FBAR). This report is submitted electronically via the FinCEN BSA E-Filing System. The standard deadline is April 15, though an automatic extension pushes it to October 15 if needed.

In addition, individuals may need to file Form 8938, Statement of Foreign Financial Assets, if their foreign asset values exceed certain thresholds. These thresholds vary based on factors such as filing status and whether the individual resides in the U.S. or abroad. Failing to comply with these requirements can lead to hefty penalties, starting at $10,000 or more. To avoid these penalties, it’s crucial to understand the rules, meet deadlines, and ensure all filings are accurate.