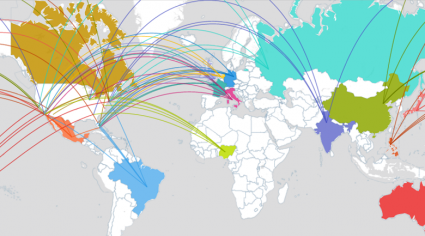

Where businesses go after divestment depends on the opportunities.

September 1, 2016

By: Bobby Casey, Managing Director GWP

Of course divestment can also include just shutting down and going out of business, which is unfortunate. There are still many others that simply relocate part or all of their businesses elsewhere. But where do they go? Where CAN they go?

We touched on this before when we discussed Estonia and their e-residency program. That’s a fantastic streamline incentive package they have, and it’s only going to improve.

Several other countries also have programs to draw in new investors and businesses. For as much as people love to complain about foreigners buying up our real estate and businesses… the US government has several programs in place to incentivize just that! That’s awkward since all politicians seem to do is complain about how everything is going offshore, while simultaneously reserving all their incentives for foreign investors rather than their own residents.

It’s like the phone or cable provider that has all these marvelous deals for NEW customers, but only rate hikes for their existing customers. Ironically, there is a greater incentive for Americans to invest offshore, than stay here in the US… and that is because other countries also have appealing programs that draw in foreign investment over domestic.

Malaysia, Chile, and even Columbia all have incentive programs to draw in investments. Of course the biggest selling point is lower corporate tax rates! That requires no paperwork or bureaucrats to implement. But there are also further tax advantages that you can take advantage of, as well as, in some cases, residency opportunities.

This is by no means an exhaustive list, but rather, just one to get you thinking.

Malaysia

Seems this country has some high hopes over the next few years, and they are turning to the private sector to take them there! Here is their topline to-do list:

- Cut subsidies and deficit

- Improve on education

- Add jobs

- Achieve “Developed Status” by 2020

Unlike many other developed nations, they aren’t looking to tax and spend their way into prosperity.

“Prime Minister Najib Razak is dismantling decades of subsidies and increasing his focus on luring foreign investment, boosting education standards and adding high-quality jobs to propel the economy into developed status by the end of this decade. The government is depending on the private sector to drive capital spending as it cuts operating expenditure to narrow a budget deficit.” (Source: Bloomberg)

Dismantling decades of subsidies and depending on the private sector: if only the developed West could take some notes!

Najib introduced the Economic Transformation Program in 2010 to attract $444 billion of local and foreign private sector-led investment in Malaysia by 2020. This includes general tax incentives as well as customized incentives depending on the scale.

Their economy is shaping up, too! They are getting global recognition as well. They went from 8th in 2013 to 6th in 2014 in the world for “ease of doing business” according to World Bank’s Doing Business Report. They have quite the corporate endorsements as well with the likes of Intel, Citibank, PayPal, Pinewood Studios, and Credit Suisse all expressing praise for this up and comer.

Chile and Colombia

These guys wanted technology to guide them up and forward.

Chile has their programs Start-Up Chile and SCALE which offer stipends, visas, and even office space to encourage businesses to start up in Chile. It has worked in some ways, but failed in others. On the one hand it has successfully attracted over 1,200 entrepreneurs from 72 different countries who’ve gone on to make over $100 billion. It’s become so successful in fact, that Chile is often referred to as “The Chile-con Valley”. So what’s the problem? It’s a 6 month program with a 1 year visa. Not many stay to continue expanding their businesses in Chile, but rather move out to other countries like the US. SCALE was designed to address that problem.

In addition to the incentive programs, they are very business friendly. They have one of the fastest incorporation processes, and are low on the regulatory burdens. So unlike some jurisdictions in the United States that lure businesses in with shiny introductory packages but require bureaucratic acrobatics to stay, Chile is not that way. In fact, it outranks the United States by four places in terms of economic freedom overall, according to the Heritage Foundation (Chile ranked 7th, and the US ranked 11th).

Colombia also wants some of the innovation and tech pie! They are looking for venture capital, and have also resorted to some public funding to spur along the spirit of business. They aren’t focusing just on international businesses, but domestic entrepreneurs as well.

iNNpulsa: Founded in 2012 to support and promote tech innovation and new ventures; recently awarded three grants of up to $800,000 in 2013 to investor groups establishing operations in Colombia.

Apps.co: More tech-specific government incentive program. By the end of 2014, it’s expected to have awarded $33 million in funding to accelerators and university partnership programs

There’s a culture that is very foreign to me as an American, but I’m finding more and more in other developing countries: governments with new regimes asking the simple question, “How can we help you?” … and actually MEAN it.

Colombia does have some quasi-government agencies designed to help businesses. Socialatom Ventures helps new start-ups avoid the “painful, hard work” of navigating regulatory hurdles with dedicated government relations teams. (Although one must ask why such a service is necessary. If your processes are so complicated you needed to create another team of people to help you wade through it, perhaps the process is not as helpful or necessary as they think?)

Still, it is something. It is difficult to get private capital when you haven’t got much on your resume suggesting it is a worthwhile investment. But you can’t have a private capital success story if you don’t first receive private capital. This is the struggle of many countries wanting to abandon the old socialist blocks in favor of capitalism and private industry.

This is not a plug for foreign welfare. This is to let you know that there are some eager countries out there looking to work with small start-ups! You don’t have to be some large multinational corporation (although they would certainly welcome you with arms wide open if you were!). They want businesses who stay. Businesses want a profit, and there are places around the world who don’t condemn you for it. They just want you to employ their people and refer others!

If you are considering moving or inverting any part of your life or business out of a high tax and regulation jurisdiction, to a developing country with lower taxes and less regulations, look into the incentive programs they have. Perhaps a little leniency on your taxes? A simplified registration process? A visa for a business?

Click here to schedule a consultation or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.