Divestment is a sign the market is not very business friendly

August 29, 2016

By: Bobby Casey, Managing Director GWP

The San Francisco Bay Area is quite possibly the best example of private sector success and public sector failure. The private sector success is despite the public sector failures, I might add. They recently made an attempt at hiking the payroll taxes of their booming tech industry.

This “tech tax” was designed to raise money to battle the city’s homeless problem. But the economic rationale was epitomized in a statement by the bill’s author, Supervisor Eric Mar: “The rapid tech boom in our city and region threatens our city’s ability to thrive and prosper,” he said, in a Guardian report. “Five years after the boom, it’s time for San Francisco to ask the tech companies to pay their fair share.” (Source: Reason)

This measure failed… thank goodness! But the ideology isn’t totally defeated. San Francisco suffers some of the most expensive (and inflated) property prices in the United States. The tech tax was meant to address the homeless problem? What does the tech industry have to do with the homeless problem? They provide jobs! They brought prosperity to the bay area!

Here’s the theory: large tech corporations shuttle their employees to and from San Francisco to the Silicon Valley. You’d THINK shuttles would be a good thing! Ridesharing is ecologically conscientious. Nope. Apparently these folks are being blamed for rising property prices! I think I’ve officially heard it all. Of course they don’t shoulder ALL the blame. As we mentioned before, Airbnb and other home sharing businesses also contribute to the high costs of property, according to some.

Let’s set the record straight: it’s not the residents’ fault that prices are going up. It’s simple supply and demand. San Francisco has an obscene amount of regulations that prevent (or retard to a very extreme degree) property development. So the supply remains as it is, while demand goes up due to the tech industry growth. (Here’s a great video about the housing issue in San Francisco, in case you’re interested.)

What I don’t understand is why San Francisco would think about scapegoating the tech industry and its employees for their wrongheaded policies. It’s like biting the hand that feeds considering the amount of taxes they collect from them anyway.

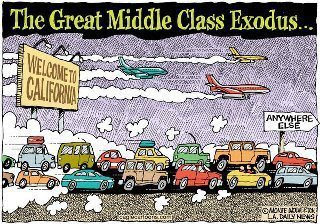

But this points to a bigger issue: corporate inversion. At some point, you push people and businesses too far, and you will see flight. California is seeing that. There have been about 10,000 “divestment events” over the last eight years in California where businesses either left the state or shifted or curtailed operations to reduce costs, according to a study by Spectrum Location Solutions.

What constitutes a “divestment event”?

- Relocate entire offices and facilities to an out-of-state location.

- Remain in the state but expand elsewhere with facilities that heretofore were built in California.

- Close completely with production moving to competitors in dispersed locations.

- Shift work to a foreign nation through offshoring, outsourcing or relocation.

- Cancel a project after it has been announced.

- Perform a “U-Turn” – which means considering a California location but rejecting it after studies favor a location outside of the state’s borders.

10,000 events that fell into one of these categories over the past eight years. Just in California alone.

These are the top counties in California that experienced this divestment activity: Los Angeles, Orange, Santa Clara, San Francisco, San Diego, Alameda, San Mateo, Ventura, Sacramento, San Bernardino, Riverside, Contra Costa, Santa Barbara, San Joaquin, and Stanislaus.

San Francisco, Alameda, and Contra Costa are all bay area counties, by the way.

And who are the beneficiaries of California folly? Well, domestically, these are your winners: Austin-Round Rock-San Marcos, Dallas-Fort Worth-Arlington, Phoenix-Mesa-Scottsdale, Reno-Sparks, Las Vegas-Paradise, Denver-Aurora-Lakewood, Portland-Vancouver-Hillsboro, Seattle-Tacoma-Bellevue, Atlanta-Sandy Springs-Marietta, and Salt Lake City-Ogden-Clearfield. Texas closes out the top two slots with Austin and Dallas.

California has some tax incentive programs for aerospace and entertainment, but that will never offset some of the plans that state has to impose new taxes on its constituents: “The state is considering imposing a broad set of taxes on businesses in 2016 and 2017, including higher fuel and motor vehicle taxes, and tax increases on business properties.”

A study out of California “found that regulatory compliance costs were almost five times the state’s general fund budget, about $493 billion, resulting in a loss of one job per small business or about $134,000 per small business in 2007”. California literally did a study on itself and came to this conclusion. Rarely does a government investigate itself and find itself guilty or culpable of wrong-doing. But despite its findings, they continue down the same tragic path.

Their own governor, Jerry Brown, admitted that his plan to raise the minimum wage was economically counter-intuitive!

This isn’t unique to San Francisco or California. This is a phenomenon the United States can expect to see on a global level. Sure, the US has incentives to draw in foreign investment. And without question, she offers a fantastic tax haven for everyone BUT Americans. If you look at even domestic preferred jurisdictions, especially Texas, it’s not that they have to give special exemptions to prospective businesses. It’s that they don’t have onerous policies at all to exempt people from in the first place! Likewise, there are countries out there that have a more business friendly environment regardless of whether you are a foreign investor or not. Hong Kong doesn’t require special exemptions because they are naturally a low tax country. Japan doesn’t require special exemptions on property development because they are naturally a country with strong property right laws.

So, what do small businesses want? Unlike a lot of larger businesses and industries, they aren’t looking for handouts at all. According to a survey by Thumbtack.com, they want:

“Chamber of Commerce-style training and networking; regulatory and licensing simplicity, helpful government websites to cut red tape, and taxes.”

This is a huge reason why Texas and Utah rank amongst the most small-business friendly states in the union. It turns out, entrepreneurs are just looking to cut costs and save time. THE NERVE! But the rankings corroborate this. How entrepreneurs view “friendliness” toward their business endeavors is linked to how they perceive the complications and overall burden of the tax codes, as well as the complications and overall burdens of regulation. Texas and Utah aren’t just waiving these things for those looking to relocate. They simply don’t have those policies at all.

And the companies who give places like California a shot, are finding that it’s more cost effective in the long run to operate out of places like Texas. Likewise, there are corporations in the United States that are finding that it’s more cost effective to send some of their operations offshore to other countries. People complain about corporations inverting out of the US, but I don’t hear that same complaint against those who invert out of one state in favor of another within the union. Why the double standard?

The reality is, your business doesn’t have to all be in one place or another. You can break it up, and store it all over the United States or all over the world. Maybe you have your finances managed out of the US, but you have your intellectual property held offshore? Maybe your manufacturing is in one country, but your storage and fulfillment is out of somewhere else? There are manufacturing businesses in California that store their finished products and fulfill orders out of Florida because California’s strict shipping regulations in and out of the state. All or nothing is a false dichotomy. Let’s work together to see if we can’t find ways to maximize your overall operations!

Click here to schedule a consultation or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.