Dual citizenship means you may have tax responsibilities in two countries. For U.S. citizens, taxes are based on worldwide income, regardless of where you live. This can lead to double taxation, complex reporting requirements, and strict compliance rules. However, tools like tax treaties, the Foreign Earned Income Exclusion (FEIE), and the Foreign Tax Credit (FTC) can help reduce or eliminate your tax burden.

Key Points:

- U.S. Tax Rules: U.S. citizens must report all global income annually using Form 1040, even if living abroad.

- Double Taxation: Dual citizens might face taxes in two countries, but relief options like treaties and credits exist.

- Reporting Requirements: Forms like FBAR (for foreign accounts over $10,000) and FATCA (Form 8938) are mandatory.

- Tax Reduction Tools:

- FEIE: Exclude up to $126,500 of foreign-earned income (2024 limit) if you meet residency or physical presence tests.

- FTC: Offset U.S. tax liability with foreign taxes paid, applicable to both earned and passive income.

- Compliance Risks: Non-compliance can lead to penalties, passport revocation, or expatriation taxes.

Navigating dual citizenship taxes requires understanding your obligations, selecting the right relief methods, and staying compliant with reporting rules.

How Dual Citizenship Affects Your Tax Obligations

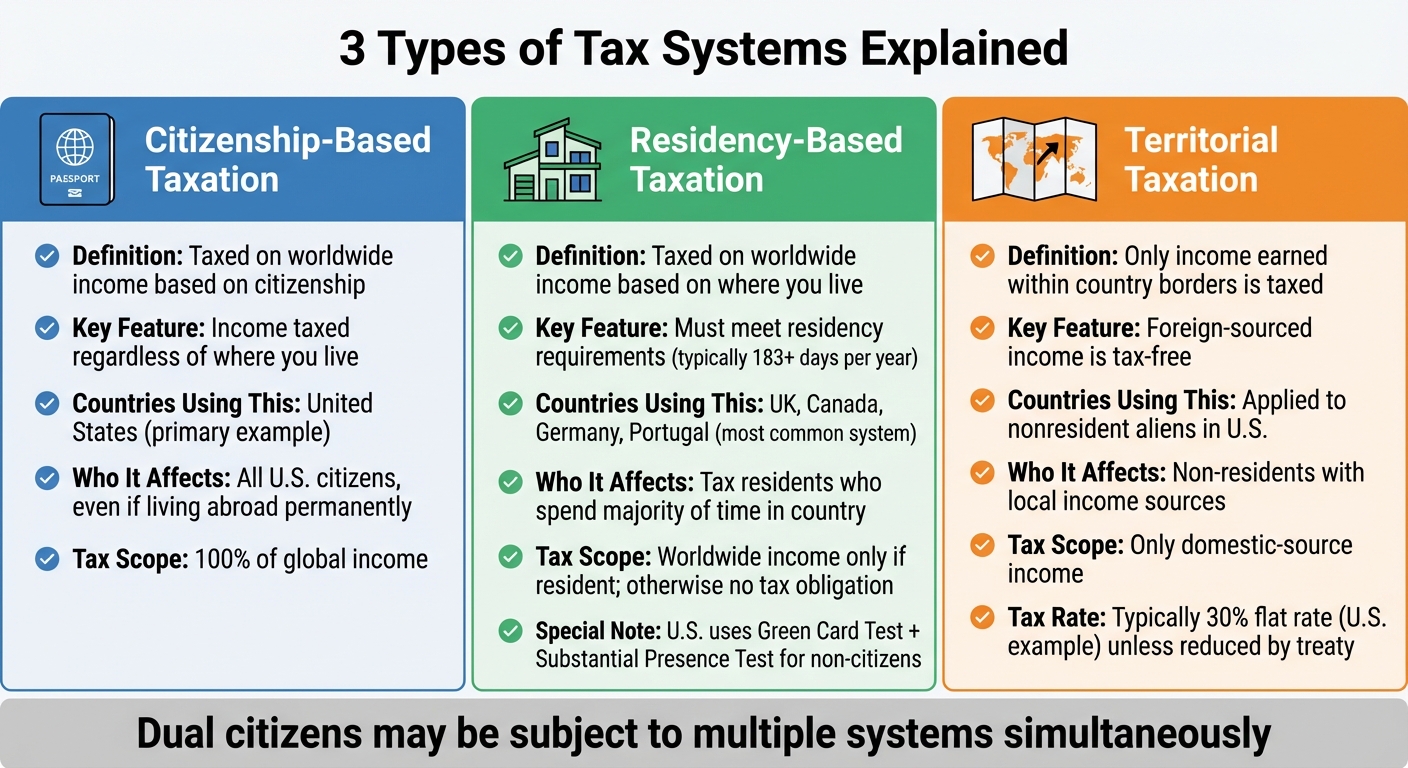

3 Types of Tax Systems: Citizenship, Residency, and Territorial

Countries use three main systems to tax their citizens and residents, and knowing which one applies to you is key to managing your tax responsibilities. Here’s a breakdown of how each system works and its impact on your obligations.

Citizenship-based taxation means you’re taxed on your worldwide income simply because you’re a citizen of a specific country. The United States follows this system, requiring all its citizens to report income earned anywhere in the world. According to the IRS:

"If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. You are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the Internal Revenue Code".

Residency-based taxation is the most common system, used by countries like the UK, Canada, Germany, and Portugal. Under this approach, you’re taxed on worldwide income only if you meet specific residency requirements. For example, in the U.S., non-citizens may become tax residents if they hold a Green Card (Green Card Test) or meet the Substantial Presence Test, which factors in the number of days spent in the country over three years. In most other countries, the rule is simpler: spend more than 183 days in a calendar year, and you’re considered a resident for tax purposes.

Territorial taxation limits taxes to income earned within a country’s borders. For nonresident aliens in the U.S., this means only U.S.-sourced income is taxable. Such income is typically taxed at a flat 30% rate unless a treaty reduces it, and it applies only to income not connected to a U.S.-based business.

Next, let’s dive into how U.S. tax rules uniquely affect dual citizens.

U.S. Tax Rules for Dual Citizens

If you’re a U.S. citizen, your tax obligations follow you no matter where you live. You’re required to file Form 1040 every year, reporting all worldwide income.

For U.S. citizens and resident aliens living abroad, there’s an automatic two-month filing extension, shifting the April 15 deadline to June 15. However, this extension only applies to filing – not to paying any taxes owed.

Additional reporting requirements also come into play. For example, FBAR (Foreign Bank Account Report) and Form 8938 are critical for meeting U.S. compliance standards.

Self-employed dual citizens face even stricter rules. If your net self-employment earnings are $400 or more, you must file a U.S. return. And don’t forget – virtual currency transactions are treated as taxable property transactions, requiring full disclosure.

Here’s an important point: even if you owe no U.S. taxes after applying exclusions or credits, you still need to file a return to claim those benefits officially.

Now, let’s look at how other countries handle dual citizenship and taxes.

How Other Countries Tax Dual Citizens

Most countries determine your tax residency based on where you live and spend the majority of your time. The 183-day rule is a common benchmark – spend more than half the year in a country, and you’re likely considered a tax resident there, subject to taxation on your worldwide income.

For example, if you’re a dual citizen living in Germany for 200 days in 2026, Germany will tax all your income, regardless of where it’s earned. But if you only spend 100 days in Germany while primarily living in Portugal, Germany won’t tax income earned outside its borders.

Some countries go beyond counting days and consider additional factors, such as where your permanent home is, where your family resides, where your financial interests are based, and even where you’re registered to vote. These "tie-breaker" rules become essential when you could qualify as a resident in more than one country during the same year.

Here’s where things get tricky: as a dual citizen, you might simultaneously be a U.S. tax resident (due to citizenship) and a tax resident of another country (due to physical presence). This overlap often leads to double taxation, where both countries claim the right to tax the same income. Fortunately, tax treaties and relief mechanisms are in place to help you avoid paying twice. We’ll explore those in the next section.

sbb-itb-39d39a6

How to Avoid or Reduce Double Taxation

Using Tax Treaties and Totalization Agreements

Tax treaties between the U.S. and other countries aim to prevent double taxation by reducing or eliminating taxes on income such as dividends, interest, royalties, and pensions. These treaties offer reciprocal benefits, ensuring that both U.S. citizens living abroad and foreign residents earning U.S.-sourced income can access reduced tax rates or exemptions. If you’re considered a tax resident in both countries, these treaties often include "tie-breaker" rules to determine which country has the primary right to tax you.

Most treaties also include a "saving clause", which allows the U.S. to tax its citizens as if the treaty didn’t exist, except for specific exemptions. If you believe you’re being taxed in a way that conflicts with a treaty, you can request help from the U.S. competent authority to resolve the issue.

To claim treaty benefits, you’ll need to file Form 8833. Additionally, foreign tax authorities might ask for Form 6166, which you can obtain by submitting Form 8802.

For social security taxes, totalization agreements come into play. These agreements ensure you’re only paying into one country’s social security system at a time, typically the country where you’re physically working. This prevents you from paying both U.S. Social Security and Medicare taxes as well as similar taxes in another country on the same income.

After addressing treaties and agreements, consider leveraging U.S. tax tools like the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC) to further reduce your tax burden.

U.S. Tax Tools: FEIE and Foreign Tax Credit

The U.S. provides two primary tools to help reduce your tax obligations on foreign income: the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC). Since you can’t use both for the same income, choosing the right one is essential.

The FEIE lets you exclude up to $126,500 of foreign-earned wages or self-employment income from U.S. taxes for 2024. To qualify, you must establish a tax home in a foreign country and meet either the bona fide residence test or the physical presence test, which requires spending 330 full days in a foreign country within a 12-month period. Use Form 2555 to claim this exclusion. However, keep in mind that the FEIE only applies to earned income – it doesn’t cover passive income like dividends, interest, or pensions. Additionally, if your foreign housing expenses exceed the base housing amount of $20,240 for 2024, you might qualify for a foreign housing exclusion.

The Foreign Tax Credit, on the other hand, provides a dollar-for-dollar reduction of your U.S. tax liability based on the foreign income taxes you’ve paid. Unlike the FEIE, the FTC applies to both earned and passive income. To claim the FTC, file Form 1116 and ensure the foreign tax is legally imposed on your income. If you don’t use all your credits in one year, you can carry them back one year or forward for up to 10 years.

Here’s a quick comparison of the two options:

| Feature | FEIE | Foreign Tax Credit |

|---|---|---|

| Maximum Benefit | Excludes up to $126,500 from taxable income | Dollar-for-dollar credit against U.S. tax |

| Income Types | Earned income only | Earned and passive income |

| Best For | Low-tax areas | High-tax areas |

| Carryover | None | 1-year back, 10-year forward |

| Required Form | Form 2555 | Form 1116 |

Your choice depends on your specific situation. For instance, in high-tax countries where local rates exceed U.S. rates, the FTC might eliminate your U.S. tax liability and even generate credits you can carry forward. In low-tax jurisdictions, the FEIE might be a better fit. However, using the FEIE can lower your adjusted income, potentially affecting IRA deductions and certain credits. Also, switching from the FEIE to the FTC typically locks you into that choice for five years unless you get IRS approval.

Along with these tools, structuring your income and residency strategically can further reduce your tax liability.

Structuring Your Income and Residency for Lower Taxes

The way you manage your time abroad and organize your income sources can significantly impact your tax obligations. For example, the FEIE’s Physical Presence Test requires you to spend 330 full days abroad. Importantly, a "full day" counts only if all 24 hours are spent outside the U.S. – even a partial day in the U.S. doesn’t qualify.

If you’re self-employed, think carefully about where your income is generated. While the FEIE reduces U.S. income tax, it doesn’t eliminate U.S. self-employment taxes (Social Security and Medicare). For 2024, the Social Security portion applies only to earnings up to $168,600. To avoid paying into two systems, check whether a totalization agreement exists between the U.S. and the country where you’re working.

For passive income – such as dividends, interest, or capital gains – the Foreign Tax Credit is your go-to option since the FEIE doesn’t apply to these types of earnings. Properly structuring your investments and coordinating your residency status can help minimize your overall tax burden.

If you’re a location-independent entrepreneur juggling multiple income streams and residencies, professional advice is crucial. Complex situations involving business entities, tax planning, and asset protection across jurisdictions require specialized expertise. For tailored international tax strategies, consider consulting Global Wealth Protection for personalized solutions.

Step-by-Step: Managing Taxes as a Dual Citizen

Step 1: Identify Your Tax Obligations

Start by understanding your tax responsibilities in each country where you hold citizenship or residency. For U.S. citizens, taxes are based on worldwide income, no matter where you live. Most other nations, however, tax based on residency.

If you’re a U.S. citizen or green card holder, you’re automatically considered a U.S. tax resident. For non-citizens, meeting the Substantial Presence Test makes you a U.S. tax resident.

Next, check if your income exceeds the filing thresholds. For 2024, single filers must submit a U.S. tax return if their gross income surpasses $14,600, while married couples filing jointly must file if their combined income exceeds $29,200. Additionally, self-employed individuals earning $400 or more in net income must file, even if their gross income is below these limits.

Be mindful of differences in tax years. For example, the U.S. uses a calendar year (January 1–December 31), while the U.K. operates on a fiscal year (April 6–April 5). Keeping accurate records for both systems is crucial.

"If you are a U.S. citizen or resident alien, your worldwide income is generally subject to U.S. income tax, regardless of where you are living." – Internal Revenue Service

Once you’ve identified your obligations, you’re ready to explore strategies for avoiding double taxation in Step 2.

Step 2: Choose Your Double Taxation Relief Options

Deciding how to handle double taxation depends on your income type and where you live.

For wages or salary earned abroad, the Foreign Earned Income Exclusion (FEIE) is a popular option. In 2024, you can exclude up to $126,500 of foreign earned income if you meet the Bona Fide Residence Test or the Physical Presence Test (spending 330 full days outside the U.S.). To claim this, file Form 2555. Keep in mind that the FEIE doesn’t apply to passive income like dividends or capital gains.

If you earn passive income or live in a high-tax country, the Foreign Tax Credit (FTC) might be better. The FTC offers a dollar-for-dollar reduction in your U.S. taxes based on the foreign taxes you’ve paid. It applies to income from all sources, and you can claim it using Form 1116. If your foreign taxes exceed your U.S. tax liability, you can carry unused credits back one year or forward for up to 10 years.

For example, a U.S. citizen teaching in Germany earned $60,000 and paid $26,400 in German taxes. By using a carryover FTC, they reduced their $16,000 U.S. tax bill to just $3,360.

Additionally, check for tax treaties between the U.S. and your other country of citizenship. These agreements often reduce withholding rates on specific income types, such as pensions or investments. If you’re claiming treaty benefits, file Form 8833. However, you can’t claim a credit or deduction for taxes paid on income already excluded under the FEIE.

After selecting your relief method, the next step is ensuring you meet all reporting requirements.

Step 3: Stay Compliant with Reporting Requirements

Filing tax returns is just one part of staying compliant. Dual citizens must also meet strict reporting standards to avoid penalties.

If the total of your foreign financial accounts exceeds $10,000 at any point during the year, you must file the Report of Foreign Bank and Financial Accounts (FBAR) using FinCEN Form 114. Additionally, FATCA (Foreign Account Tax Compliance Act) may require Form 8938, with thresholds typically starting at $200,000 for expatriates. Other forms, like Form 5471 for foreign corporations or Form 3520 for foreign trusts and large gifts, may also apply. Transactions involving virtual currency or digital assets must be reported as taxable property.

If you’ve fallen behind on filing, the Streamlined Foreign Offshore Procedures might help you catch up without penalties, provided the failure was non-willful. U.S. citizens living abroad automatically receive a two-month filing extension (until June 15), but interest on unpaid taxes starts accruing from the standard April 15 deadline.

The consequences of non-compliance can be severe. The IRS can report "seriously delinquent tax debt" to the State Department, which could lead to the denial or revocation of your U.S. passport. A notable example is Boris Johnson, the former London Mayor, who had to pay U.S. capital gains tax on the sale of his North London home due to his American citizenship, even though he had lived in the U.K. since childhood.

Advanced Tax Planning for Dual Citizens

Coordinating Tax, Residency, and Immigration Planning

Your residency status plays a crucial role in determining your tax obligations. For instance, if you meet the Substantial Presence Test but maintain stronger ties to another country, you can file Form 8840 under the Closer Connection Exception. This allows you to be treated as a nonresident alien for U.S. tax purposes, provided you spend fewer than 183 days in the U.S. during the year and maintain a tax home abroad.

For more complex situations, tax treaties can help. If you’re considered a resident in both the U.S. and another country, you may use Form 8833 to claim foreign residency and potentially lower your U.S. tax liability while safeguarding your immigration status. However, keep in mind that not all U.S. states adhere to federal tax treaties, so it’s essential to verify your specific state’s rules.

Timing is another key factor. Moving to or from the U.S. can result in a dual-status tax year. In such cases, you’re taxed as a resident on worldwide income for part of the year and as a nonresident on U.S.-source income for the remainder. If you plan to renounce a green card held for 8 of the past 15 years, be aware that this may trigger the expatriation tax. For 2025, you’ll be classified as a "covered expatriate" if your net worth exceeds $2 million or if your average annual net income tax over the previous five years surpasses $206,000. Under the mark-to-market regime, all your property is treated as sold the day before expatriation. However, you can exclude up to $890,000 in gains.

These strategies blend tax planning with residency and immigration considerations, offering a more comprehensive approach to managing your obligations.

Using Business Entities and Asset Protection Structures

Beyond personal tax strategies, structuring your business can provide additional benefits. Selecting the right business entity can help minimize taxes while protecting your assets. For example, U.S. LLCs offer pass-through taxation, meaning the income is taxed at the owner level rather than the entity level. This setup can align well with certain international tax strategies.

If you manage multiple businesses, holding companies can allow you to offset losses from one business against profits from another. Similarly, limited partnerships limit your liability to the amount you’ve invested while still offering pass-through taxation benefits.

For those with interests in foreign corporations, partnerships, or trusts, compliance with IRS reporting is critical. Filing requirements include Form 5471 for corporations, Form 8865 for partnerships, and Form 3520 for trusts. These forms come with strict guidelines, and failure to file can result in hefty penalties.

Managing Risks and Staying Updated

Effective tax planning doesn’t stop at strategy – it also requires ongoing compliance and risk management. Tax laws are constantly changing, so staying informed is essential. For instance, the U.S. terminated its tax treaty with Hungary as of January 1, 2024, and suspended key provisions of the treaty with Russia in August 2024. Reviewing your treaty positions regularly can help you avoid unexpected liabilities.

Be aware of potential consequences for noncompliance. For example, if you have seriously delinquent tax debt, the IRS can notify the State Department, which may result in passport revocation. If you’re planning to renounce citizenship or end long-term residency, you’ll need to file Form 8854 to certify compliance with all federal tax obligations for the past five years. Failure to do so can lead to a $10,000 penalty.

New regulations also continue to emerge. Under the Corporate Transparency Act, foreign entities doing business in the U.S. must file Beneficial Ownership Information reports with FinCEN, though reporting requirements were scaled back in 2025 pending further review. Additionally, the IRS now mandates reporting of taxable transactions involving digital assets, such as cryptocurrency and NFTs.

To stay compliant, regularly consult resources like IRS.gov/Pub54 for updates on new legislation. Working with international tax specialists can ensure your strategy remains effective and meets all legal requirements. For personalized advice, you might consider reaching out to Global Wealth Protection for a private consultation.

Conclusion

Handling taxes as a dual citizen involves focusing on three main areas: understanding your obligations, utilizing available relief options, and staying compliant with reporting requirements. Since the U.S. taxes its citizens on their worldwide income, you’re required to report all earnings to the IRS, no matter where you live or work. While this can make things more complicated, it doesn’t necessarily mean you’ll end up paying taxes twice.

Relief mechanisms like tax treaties, the Foreign Earned Income Exclusion (FEIE), and the Foreign Tax Credit (FTC) are essential tools to help avoid double taxation. At the same time, compliance with reporting requirements – such as the FBAR and FATCA – is critical to staying on the right side of the law. Strict reporting rules for foreign accounts and assets are a key part of this process.

Interestingly, about 62% of Americans filing taxes from abroad owe $0 in U.S. federal taxes after applying credits and exclusions. However, fewer than 20% of the estimated 9 million Americans living overseas are fully compliant with their tax obligations. If you’re behind on filings, the Streamlined Filing Compliance Procedures might be a way to catch up without penalties.

Because tax laws and personal situations change over time, what works for you one year may not be the best approach the next. For personalized advice on structuring income, managing business entities, or navigating complex matters like renunciation, consider consulting with Global Wealth Protection. With the right strategies, dual citizenship doesn’t have to come with unnecessary tax headaches.

FAQs

What can dual citizens do to avoid being taxed twice?

Dual citizens have several ways to manage and reduce the impact of double taxation. Key strategies include utilizing tax treaties, claiming the Foreign Tax Credit, or applying the Foreign Earned Income Exclusion. Additionally, it’s crucial to determine your residency status correctly and ensure you’re filing the appropriate U.S. tax return. These approaches not only help you comply with international tax laws but also work to lower your overall tax liability.

For personalized guidance, consider consulting a tax professional who specializes in the unique challenges of dual citizenship. Their expertise can help you navigate complex tax rules, optimize your obligations, and safeguard your financial well-being.

How do the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC) differ for dual citizens?

Dual citizens have two key tools to help reduce the burden of double taxation: the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC). While both aim to ease tax obligations, they work in distinct ways.

The FEIE lets you exclude up to a specific limit of foreign-earned income from U.S. taxes, provided you meet the bona fide residence or physical presence test. However, this exclusion applies strictly to earned income, such as wages or salaries, and does not extend to passive or other types of foreign income.

The FTC, on the other hand, offers a dollar-for-dollar credit for foreign taxes paid on any foreign-source income, including passive income like dividends or interest. The credit is capped at the amount of U.S. tax owed on that foreign income, but any unused credits can often be carried forward to offset future tax liabilities.

The FEIE tends to be more advantageous when your foreign-earned income falls below the exclusion limit and your foreign tax rate is relatively low. Meanwhile, the FTC is typically better when you face higher foreign taxes or have substantial non-earned foreign income. In some situations, you can even use both tools in the same tax year to optimize your tax savings.

What are the consequences of not following U.S. tax rules as a dual citizen?

As a dual citizen, ignoring U.S. tax laws can lead to serious consequences. These may include hefty fines, accumulating interest on unpaid taxes, and even potential legal action by the IRS. The U.S. requires all its citizens – no matter where they reside – to report their worldwide income and submit annual tax returns.

Additionally, failing to comply might create issues with foreign bank accounts. Under the Foreign Account Tax Compliance Act (FATCA), many financial institutions are obligated to share account details with the U.S. government. To steer clear of these challenges, it’s crucial to understand your tax responsibilities and consult a professional if you need help navigating the rules.