Economic citizenship, or Citizenship by Investment (CBI), allows individuals to obtain a second passport by making financial investments in certain countries. These programs are fast, taking as little as 3–12 months, and provide benefits like visa-free travel, tax advantages, and a safety net during crises. However, they require significant investments and careful consideration of legal, tax, and long-term implications.

Key Points:

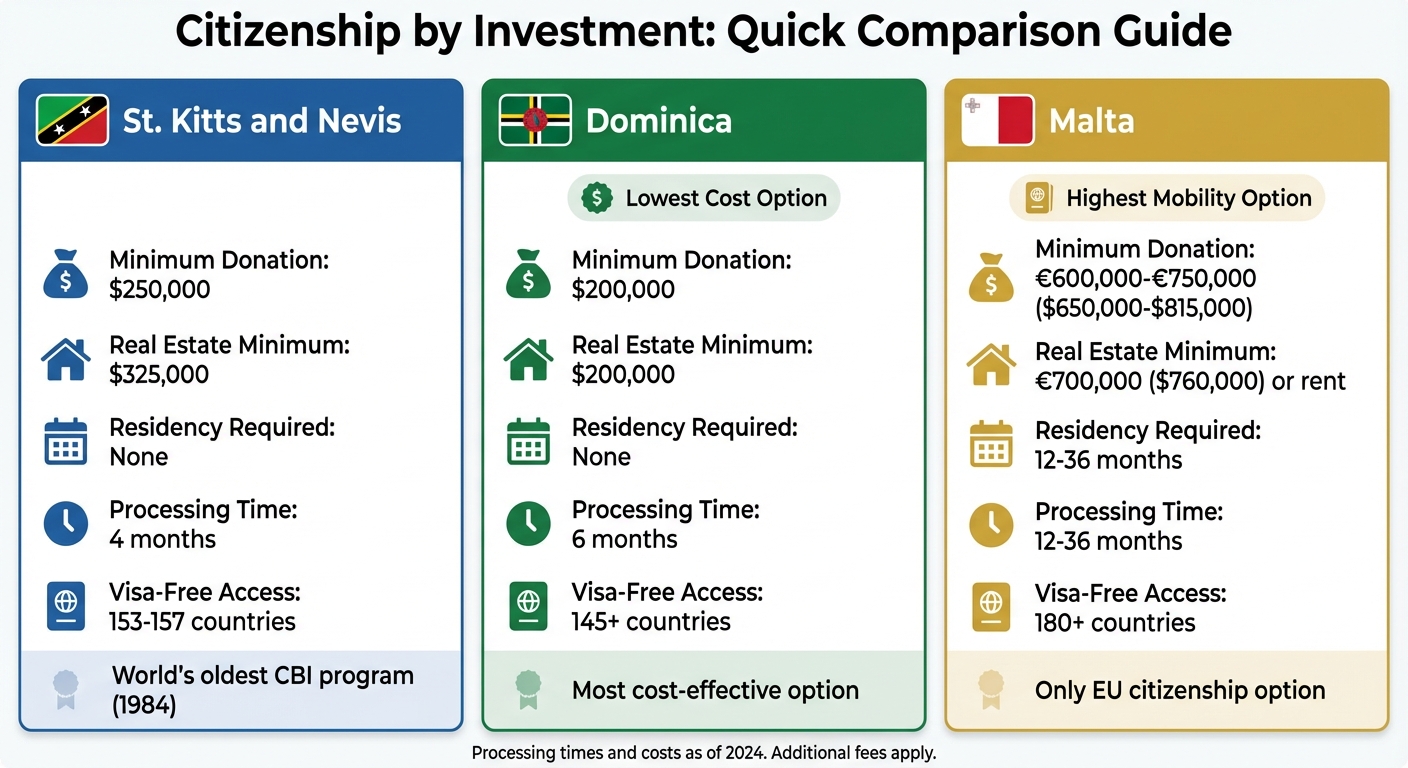

- Countries Offering CBI: About 22 countries provide the simplest citizenship programs, including St. Kitts and Nevis, Dominica, and Malta.

- Investment Options:

- St. Kitts and Nevis: $250,000 donation or $325,000 real estate.

- Dominica: $200,000 donation or $200,000 real estate.

- Malta: €600,000–€750,000 donation plus property purchase or rental.

- Processing Time: 4–36 months depending on the program.

- Benefits:

- Visa-free access to 140–180+ countries.

- Tax advantages like no income or inheritance taxes in some jurisdictions.

- Asset protection and global mobility.

- Risks:

- High costs, including non-refundable donations.

- Potential political or program changes.

- Real estate investments may not guarantee returns.

Quick Comparison:

| Feature | St. Kitts and Nevis | Dominica | Malta |

|---|---|---|---|

| Minimum Donation | $250,000 | $200,000 | €600,000–€750,000 |

| Real Estate Minimum | $325,000 | $200,000 | €700,000 or rent |

| Residency Required | None | None | 12–36 months |

| Visa-Free Access | 153–157 countries | 145+ countries | 180+ countries |

| Processing Time | 4 months | 6 months | 12–36 months |

CBI can offer mobility, financial security, and asset protection, but it’s crucial to weigh the costs, legal requirements, and long-term goals before committing.

Economic Citizenship Programs by Country

Citizenship-by-investment (CBI) programs differ in their investment requirements, processing times, and benefits. Below are three well-known options, each catering to different priorities like speed, cost, or access to the European Union.

St. Kitts and Nevis

St. Kitts and Nevis is home to the world’s oldest CBI program, launched in 1984. It offers three main investment routes:

- Sustainable Island Contribution Fund (SGF): A non-refundable donation of $250,000 for a single applicant.

- Real Estate Investment: A minimum of $325,000 in government-approved property, which must be held for seven years.

- Public Benefit Option: A $250,000 contribution.

Standard processing takes about four months, but an Accelerated Application Process can reduce this to 45–60 days for an extra fee. The program’s passport allows visa-free travel to 153–157 countries and is inheritable by future generations, a feature unique among Caribbean CBI options. Applicants face restrictions based on nationality (e.g., citizens of Iran, Afghanistan, North Korea, and Cuba are ineligible) and must undergo biometric and fingerprinting checks. The program also permits dependent children up to age 25 and offers tax benefits, including no income, inheritance, or wealth taxes.

Malta

Malta’s Maltese Exceptional Investor Naturalisation (MEIN) program is the only CBI option that grants full European Union citizenship. However, it requires a significant financial commitment and a residency period before citizenship can be obtained. Applicants must:

- Contribute €600,000 (around $650,000) after three years of residency or €750,000 (approximately $815,000) after one year.

- Purchase property worth at least €700,000 (about $760,000) or rent property for a minimum of €16,000 annually (roughly $17,400) over five years.

- Donate €2,000 (around $2,175) to a registered NGO.

The Maltese passport, ranked 9th globally, provides visa-free travel to over 180 countries. Processing times range from 12 to 36 months, and dependent children up to age 28 can be included. Applicants undergo rigorous due diligence checks, including interviews. While Malta emphasizes EU access, Dominica’s program focuses on affordability and efficiency.

Dominica

Dominica stands out as one of the most cost-effective CBI options, prioritizing national development and climate resilience. Applicants can choose between:

- Contributing $200,000 to the Economic Diversification Fund.

- Investing at least $200,000 in approved real estate, which must be held for three to five years. After five years, the property can be resold to another program participant.

The processing time is approximately six months, and the passport allows visa-free travel to over 145 countries. Applicants aged 16 and older must complete an online interview. The program is flexible, allowing the inclusion of dependent children up to age 30 and grandparents. There are no physical residency or visitation requirements, and new citizens are exempt from taxes on wealth, inheritance, and capital gains.

| Feature | St. Kitts and Nevis | Dominica | Malta |

|---|---|---|---|

| Minimum Donation | $250,000 | $200,000 | €600,000 (around $650,000) |

| Minimum Real Estate | $325,000 | $200,000 | €700,000 (around $760,000) or rent |

| Residency Required | None | None | 12–36 months |

| Time to Passport | Approximately 4 months | Approximately 6 months | 12–36 months |

| Mandatory Interview | Biometric checks | Yes (for applicants aged 16+) | Yes (due diligence process) |

| Visa-Free Access | 153–157 countries | Over 145 countries | Over 180 countries |

These programs highlight the importance of understanding legal and financial considerations when choosing an economic citizenship pathway, as each offers distinct benefits tailored to different priorities like mobility, tax advantages, or global access.

sbb-itb-39d39a6

What to Consider Before Buying a Passport

Getting a second passport through investment isn’t as simple as meeting a price tag. It requires careful thought about legal, financial, and long-term strategic factors. From navigating compliance rules to understanding tax obligations, there’s a lot to weigh before making a decision.

Legal Requirements and Background Checks

Citizenship-by-investment programs don’t just take your money and hand over a passport. Governments run thorough background checks, digging into criminal records, financial behavior, and even political exposure (like whether you’re a high-profile figure). Applicants generally need to meet a few basic criteria: be at least 18, have a clean criminal record, be in good health (proven through medical reports), and show that their investment funds come from legitimate sources.

The paperwork can be extensive. For example, most programs require police clearance certificates from every country where you’ve lived in the past decade. These documents typically need to be less than six months old when you apply. Some programs also have nationality restrictions. St. Kitts and Nevis, for instance, currently excludes applicants from Iran and Afghanistan.

You can’t apply directly to these programs on your own. Instead, you’ll need to work with licensed agents approved by the government to ensure everything is above board. But be aware: citizenship acquired through investment can be revoked if fraud or criminal activity comes to light later.

Once you’ve cleared the legal hurdles, it’s time to think about taxes.

Tax Consequences

Holding a passport is one thing, but tax residency is what determines your tax obligations. Most countries tax worldwide income if you spend more than 183 days a year there. The U.S., however, takes it a step further, taxing its citizens on global income no matter where they live.

Many countries offering citizenship-by-investment programs have appealing tax systems. Take St. Kitts and Nevis, for example – it doesn’t impose income, wealth, or inheritance taxes on its tax residents. However, some programs have been flagged by the OECD as "high-risk" if they offer low tax rates (under 10%) on offshore assets without requiring much physical presence in the country (usually fewer than 90 days). Because of this, financial institutions often scrutinize passport holders from these jurisdictions to ensure compliance with global reporting standards like the Common Reporting Standard (CRS).

Double Taxation Agreements (DTAs) can also play a crucial role in avoiding being taxed twice on the same income. U.S. citizens, in particular, need to tread carefully. Renouncing U.S. citizenship or changing residency could trigger "exit taxes" on unrealized capital gains. It’s wise to consult an international tax expert who understands both your home country’s rules and the tax system of your chosen citizenship-by-investment jurisdiction. They can help you navigate complex reporting obligations like FATCA and CRS.

Beyond taxes, there are broader strategic benefits and risks to think about.

Long-Term Benefits and Risks

A second passport can be more than just a travel perk – it’s a long-term safety net. It guarantees the right to live in another country, which can be invaluable during political or economic turmoil at home. Many citizenship-by-investment programs also allow the status to be passed down to future generations, providing a layer of security for your family.

This kind of citizenship can open doors to global banking systems, make it easier to set up offshore companies, and help protect wealth in jurisdictions with strong privacy laws.

However, there are risks to consider. Real estate investments, for example, might not appreciate in value or could be hard to sell later. Non-refundable donations are the quickest way to get citizenship, but they offer no financial return. While some properties might generate rental income after the required holding period (usually 5–7 years), there’s no guarantee of profit or liquidity.

Political and reputational risks are also worth noting. These programs are often under the microscope. Changes in government or international sanctions could lead to program suspensions or increased scrutiny from global banks. For example, the European Commission has been pushing to shut down citizenship-by-investment programs over concerns about money laundering and security. This has already led to closures in places like Montenegro. Additionally, some nations have raised their investment thresholds due to international pressure. St. Kitts and Nevis, for instance, recently increased its minimum donation requirement to $250,000.

How Economic Citizenship Supports Asset Protection

A second passport offers more than just travel perks – it’s a powerful tool for safeguarding wealth. By holding citizenship in multiple countries, you spread risk across different legal systems, making it far more difficult for any single government or court to freeze or seize all your assets.

This concept, known as jurisdictional diversification, is a cornerstone of asset protection. If you encounter lawsuits, political turmoil, or aggressive tax policies in your home country, having assets and legal ties in another jurisdiction creates a safety net. For instance, in Nevis, asset protection laws are designed to deter foreign claims. Creditors must post a hefty US$100,000 bond and meet a stringent "beyond reasonable doubt" standard for civil cases – an almost insurmountable challenge. This approach allows individuals to strategically diversify their holdings and utilize specialized offshore structures.

Additionally, a second passport can unlock access to global banking systems that might otherwise be out of reach. Citizenship in a stable country enables you to establish banking relationships in financial hubs like Switzerland, Singapore, or the UAE. These locations offer world-class banking infrastructure, currency diversification, and greater financial privacy.

Second Passports for Offshore Trusts and Companies

Economic citizenship isn’t just about personal wealth – it also facilitates the creation of offshore trusts and companies to further protect assets. These structures separate legal ownership from management, offering an extra layer of security. As a citizen of a jurisdiction with strong asset protection laws, you gain permanent legal standing, shifting your status from a foreign investor to a local with full rights. This makes it significantly harder for external parties to challenge your asset arrangements.

Take the Nevis International Exempt Trust as an example. This trust structure is built to shield assets from foreign claims. Nevis courts require challengers to post a US$100,000 bond and prove their case beyond reasonable doubt. On top of that, strict confidentiality ensures that trust ownership and beneficiary details remain private, as there are no public registries.

International Business Companies (IBCs) are another effective tool. These entities offer tax neutrality and operational flexibility for managing global investments. Registering an IBC in the same jurisdiction as your citizenship streamlines banking, reduces regulatory scrutiny, and takes full advantage of local asset protection laws.

Combining a second passport with offshore trusts, LLCs, or foundations in the same jurisdiction creates a robust, multi-layered defense against creditors or hostile government actions.

Benefits for Entrepreneurs and Investors

The advantages of these strategies go beyond asset protection – they also open doors for entrepreneurs and investors to operate globally. A second passport acts as a "Plan B", providing a hedge against risks like political instability. For instance, following a major political event in late 2024, there was a 392% surge in inquiries about citizenship-by-investment programs, reflecting a growing demand for geopolitical insurance.

"Dual citizenship has become a kind of insurance against political instability – an asset potentially as valuable as any physical investment."

- Sofia Meier, Head of Private Clients, CitizenX

For entrepreneurs from countries facing sanctions or international scrutiny, a neutral second passport can help bypass barriers to global business. Some programs, like Grenada’s, even offer eligibility for the U.S. E-2 Investor Visa, granting access to the American market – a key benefit for investors.

Many citizenship-by-investment programs also provide tax advantages. Non-residents in these jurisdictions often face no personal income, capital gains, or inheritance taxes. This allows investors to reduce their tax burden while adhering to international reporting standards. Additionally, multi-currency holdings help protect against inflation, currency controls, or punitive domestic policies.

Ultra-high-net-worth families are increasingly building "passport portfolios", acquiring citizenships in multiple countries to maximize their global options. For example, a Caribbean passport might provide tax neutrality and asset protection, while a European one offers enhanced mobility and business opportunities. This layered strategy demonstrates how economic citizenship can secure wealth across generations while broadening access to global opportunities.

Conclusion

Final Thoughts

Economic citizenship offers far more than just a passport – it creates a lasting legal bond with another nation, potentially reshaping your financial security and global mobility. Anne Morris, Founder and Managing Director of DavidsonMorris, sums it up well:

"Citizenship by investment should be approached as a long-term legal status with strategic implications, rather than as a short-term mobility tool or financial product".

From Dominica’s $200,000 donation option to Malta’s €600,000–€750,000 investment path, each program comes with its own set of advantages. The best choice depends on your goals – whether that’s visa-free travel, better tax planning, asset protection, or a safeguard against political uncertainties. With dual citizenship now allowed by more than 75% of countries (up from 50% two decades ago), the possibilities have expanded significantly.

However, it’s crucial to grasp the full financial picture. Beyond the core investment, additional costs like due diligence fees (up to $10,000), professional services ($6,000–$15,000), and government charges can add up quickly. If you’re considering real estate, keep in mind that properties often require a holding period of up to seven years and are subject to market fluctuations. Moreover, citizenship can be revoked under certain circumstances, such as misrepresentation or actions deemed against national interest.

This is not a decision to take lightly. Many programs face international scrutiny, with some high-profile options – like Spain’s Golden Visa and Cyprus’s Citizenship by Investment (CBI) – being discontinued in recent years due to regulatory concerns. Visa-free travel privileges can change with shifting diplomatic ties, and tax residency rules operate independently of your citizenship.

To navigate these complexities, it’s essential to consult professionals who understand the legal and financial nuances. A well-thought-out strategy can ensure that your second passport and offshore structures serve as reliable tools for wealth preservation and enhanced freedom for years to come. Global Wealth Protection can guide you through this intricate process, helping you secure both your assets and your legacy.

FAQs

What are the main benefits and risks of Citizenship by Investment programs?

CBI programs offer several appealing advantages. One of the standout perks is visa-free travel to numerous countries, simplifying international travel for both individuals and their families. Beyond convenience, these programs can also provide a safety net, especially during times of political or economic instability. For entrepreneurs and business owners, a second citizenship can unlock access to new markets and create global opportunities.

That said, these programs are not without risks. Unfortunately, some have been misused for illegal activities like money laundering or fraud, underscoring the need for rigorous due diligence. The long-term value of a second passport is also tied to the stability and reputation of the issuing country, which can vary widely. Before committing, it’s crucial to thoroughly assess the program’s transparency and legal framework to ensure a sound investment.

What are the tax implications of obtaining a second passport through investment?

The tax effects of acquiring a second passport through investment can vary widely based on the country granting citizenship and your existing tax residency. Many nations offering citizenship by investment – such as St. Kitts and Nevis, Malta, and Dominica – do not impose taxes on worldwide income, inheritance, or wealth for non-residents. This makes them appealing options for individuals looking to optimize their tax situation. However, it’s important to note that gaining citizenship doesn’t automatically make you a tax resident of the country, as most of these programs don’t require you to live there.

Your home country’s tax laws also play a major role. For example, U.S. citizens are taxed on their worldwide income, no matter where they reside. This means obtaining a second passport won’t exempt U.S. citizens from their tax obligations. In contrast, certain countries with favorable tax systems, particularly in the Caribbean, may provide advantages like no capital gains or inheritance taxes.

To navigate these complexities and ensure both compliance and tax efficiency, it’s essential to consult a qualified tax professional who understands international tax laws. They can help you evaluate your options and craft a strategy tailored to your unique situation.

What should I consider when selecting a Citizenship by Investment program?

When choosing a Citizenship by Investment (CBI) program, it’s crucial to weigh several factors to ensure it fits your objectives. Start by examining the investment amount, which can differ widely between programs, and the specific type of investment required – be it real estate, government bonds, or donations. Each program also has unique processing times and legal prerequisites, so make sure to review these carefully.

Next, evaluate the citizenship benefits, such as visa-free travel, tax perks, or added asset protection. Think about the long-term advantages of the passport, like improved global mobility or how it could secure your family’s future. Lastly, be mindful of potential risks, including reputational issues or ongoing legal responsibilities. Ensure the program aligns with both your personal and financial goals.