When managing assets across multiple countries, estate planning becomes complex due to varying legal and tax rules. Without proper preparation, your heirs could face legal disputes, double taxation, or lose control over asset distribution. Here’s what you need to know:

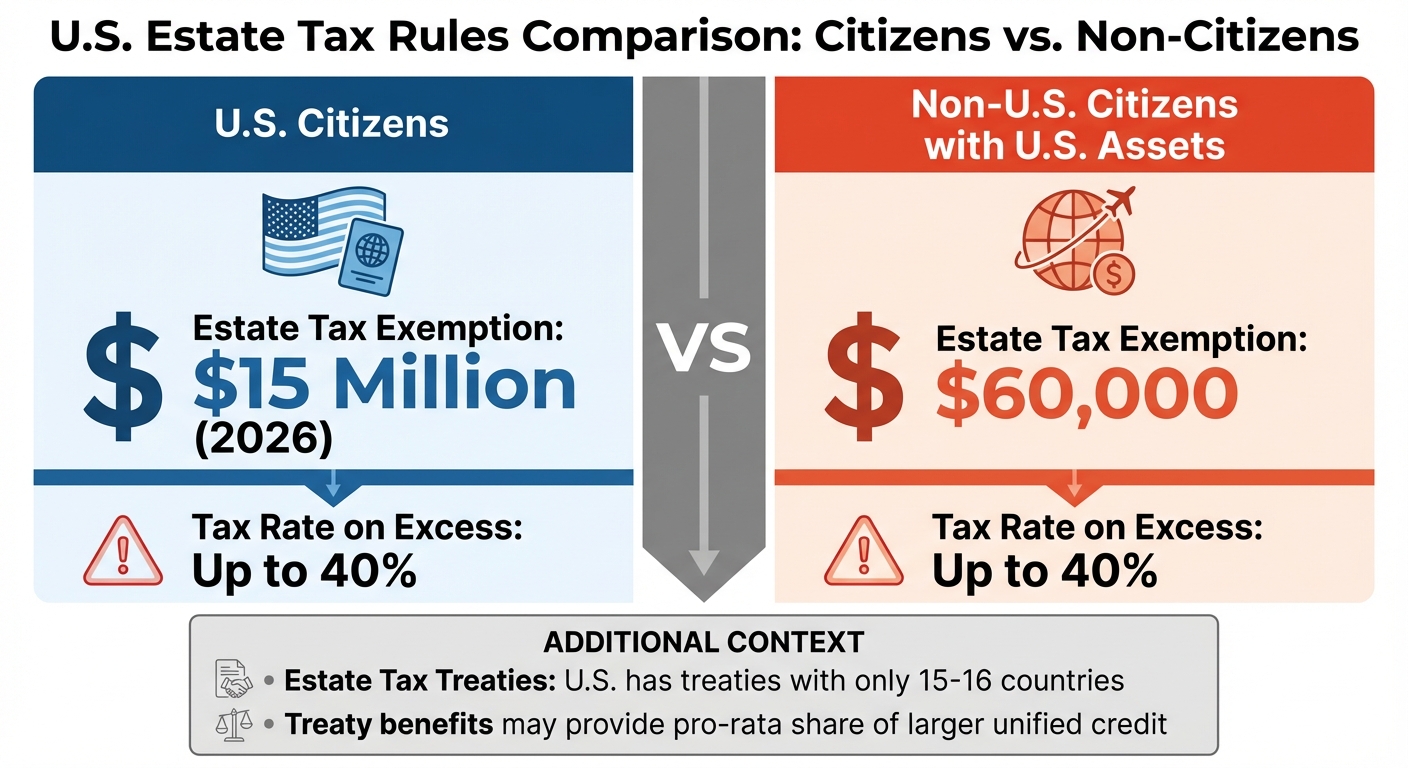

- U.S. Estate Tax Rules: U.S. citizens have a $15 million estate tax exemption in 2026, but non-U.S. citizens with U.S. assets only get a $60,000 exemption, potentially facing a 40% tax rate.

- Inheritance Laws: Common law countries (like the U.S. and U.K.) allow wills to dictate asset distribution, while civil law countries (like France and Germany) enforce forced heirship laws.

- Tax Treaties: The U.S. has estate tax treaties with only 15 countries, offering limited double taxation relief.

- Compliance: Cross-border asset owners must meet reporting obligations (e.g., FBAR, FATCA) to avoid penalties.

- Non-Citizen Spouses: They don’t qualify for unlimited marital deductions, requiring strategies like Qualified Domestic Trusts (QDOTs) to defer taxes.

Key Takeaway: To protect your wealth and ensure smooth asset transfers, align your legal documents, comply with tax laws, and work with professionals familiar with the laws in each jurisdiction. Regular updates to your plan are crucial, especially after life changes or legal updates.

Challenges of Cross-Border Estate Planning

Handling assets spread across multiple countries comes with an array of legal and tax hurdles that can disrupt even the most carefully designed estate plans. These challenges stem from the fact that different countries have unique rules governing inheritance, taxation, and property ownership.

Different Laws Across Jurisdictions

One of the biggest obstacles is navigating the differences between common law and civil law systems. In common law countries like the United States and the United Kingdom, individuals generally have significant freedom to decide who inherits their assets through a will. On the other hand, civil law countries such as France, Germany, and Japan enforce forced heirship rules. These laws ensure that a specific portion of the estate automatically goes to certain relatives, often children or spouses.

Property transfer rules also vary widely. In many civil law jurisdictions, assets immediately pass to heirs upon the owner’s death. Meanwhile, in common law systems, a personal representative must oversee the transfer of titles through a probate process. Additionally, real estate is governed by the succession laws of the country where it is located.

Trusts, a key element in U.S. estate planning, can be problematic in other countries. Many civil law nations either do not recognize trusts as legitimate legal entities or impose heavy taxes on them.

These legal differences often lead to intricate tax challenges, which are explored in the next section.

Tax Issues Across Multiple Countries

Taxation becomes even more complex when dealing with cross-border estates. In the United States, an estate tax is applied to the total value of a deceased person’s assets before distribution. In contrast, many other countries impose inheritance taxes on individual heirs. This mismatch can result in double taxation, where both the estate and the beneficiaries are taxed.

Consider the U.S. estate tax rules: American citizens currently enjoy a $15 million federal estate tax exemption starting in 2026. However, non-U.S. citizens who own U.S.-based assets only qualify for a $60,000 exemption. With estate tax rates reaching 40%, nonresident aliens face significant tax exposure. While estate tax treaties with 16 countries offer some relief, many situations remain vulnerable to double taxation.

The U.S. approach to taxation adds another layer of complexity. Unlike most countries that tax based on residency, the United States taxes its citizens and green card holders on their worldwide assets, regardless of where they live. For example, an American retiree living in Portugal could be subject to U.S. estate taxes on overseas properties while also dealing with inheritance taxes in Portugal.

These tax challenges are further compounded by detailed reporting obligations.

Compliance and Reporting Requirements

Owning international assets comes with rigorous reporting demands. U.S. persons must file an FBAR (FinCEN Form 114) if their foreign accounts exceed $10,000. Additionally, FATCA (Form 8938) requires reporting of foreign assets above certain thresholds. Penalties for noncompliance start at 5% of the asset’s value per month and can reach a maximum of 25%.

Other forms add to the complexity. U.S. taxpayers must submit Forms 3520 and 3520-A for foreign trusts and Form 8621 for Passive Foreign Investment Companies (PFICs). If foreign gifts or inheritances exceed $100,000 in a calendar year, these must also be reported to the IRS.

Beyond U.S. requirements, many countries have their own rules for registering offshore structures and filing inheritance taxes. For nonresident non-citizens with U.S.-based assets exceeding $60,000, Form 706-NA is mandatory. Managing these overlapping obligations across jurisdictions demands careful record-keeping and professional expertise to avoid costly mistakes.

sbb-itb-39d39a6

Building an International Estate Plan

Once you’ve identified the challenges, the next step is to create a plan that safeguards and transfers your wealth across borders. This section walks through the specialized documents and strategies needed to align your estate plan with the varying legal and tax requirements of different countries.

International Wills and Trust Structures

At the heart of any cross-border estate plan is a well-crafted international will. Managing international assets often calls for a different approach. For instance, many advisors suggest situs wills – separate wills tailored for each country where you own property. These documents address local assets and adhere to the specific probate rules of those jurisdictions. It’s crucial to coordinate these wills to ensure they don’t conflict with one another and disrupt your broader estate plan.

An international will prepared under the Washington Convention is another option. This format meets strict formal requirements and is recognized in all participating countries. To qualify, each page must be signed in the presence of two witnesses and include a certificate from an authorized individual. However, most wills drafted by U.S. attorneys don’t meet these technical standards. Using these specialized documents can help ensure your international assets are managed efficiently across borders.

Trusts, a cornerstone of U.S. estate planning, often require adjustments in a global context. Many civil law countries either don’t recognize trusts or impose high taxes on them. For non-U.S. citizen spouses, a Qualified Domestic Trust (QDOT) is essential. Unlike U.S. citizen spouses, they don’t qualify for the unlimited marital deduction. A QDOT defers U.S. estate taxes until the surviving spouse’s death, potentially avoiding immediate taxation at rates as high as 40%.

"Holding U.S. property through a foreign corporation will typically enable the foreign investor to avoid U.S. estate and gift tax because shares in a foreign corporation are not U.S. situs assets."

– Anthony Diosdi, Tax Attorney

Estate and Gift Tax Treaties

Estate and gift tax treaties can be a powerful tool to avoid double taxation. The U.S. has such treaties with only 15 countries, including the UK, France, Germany, Canada, and Japan. These treaties help allocate taxing rights, offer tax credits, and provide tie-breaker rules for residency conflicts. They can even redefine where certain assets are considered located for tax purposes, potentially removing them from a country’s tax jurisdiction. Some treaties also provide benefits beyond standard laws. For example, while non-U.S. domiciliaries typically receive only a $60,000 estate tax exemption, certain treaties allow them to claim a pro-rata share of the larger unified credit, which will reach $15 million for citizens in 2026.

"Utilizing the taxes paid in the other country to offset any potential US tax liability is the key driver to reduce double taxation."

– Jasmine DiLucci, Tax Lawyer and CPA, DiLucci CPA Firm

To benefit from these treaties, you’ll usually need to file Form 8833 with the IRS. However, many popular expat destinations – like the UAE, Singapore, and Thailand – don’t have estate tax treaties with the U.S., leaving individuals exposed to double taxation. By strategically applying treaty provisions, you can navigate the complex tax scenarios discussed earlier.

Beneficiary Designations and Asset Ownership Structures

Beyond tax treaties, how you title your assets and designate beneficiaries plays a critical role in your estate plan. Assets like life insurance policies and retirement accounts pass directly to named beneficiaries, bypassing probate and potentially overriding the instructions in your will. This makes it essential to review these designations regularly, especially after major life changes like marriage, divorce, or relocation.

Strategic ownership structures can also offer key advantages. For instance, holding U.S. real estate through a foreign corporation allows non-U.S. domiciliaries to access exemptions unavailable through direct ownership. Similarly, properly structured debt can reduce the taxable value of real estate included in your gross estate. For U.S. citizens living abroad, the annual gift tax exclusion – set to $19,000 per recipient in 2025 – provides an opportunity to transfer wealth during your lifetime. However, gifts or inheritances from foreign individuals exceeding $100,000 must be reported to the IRS on Form 3520. Setting aside cash reserves or life insurance can also help cover foreign probate fees and inheritance taxes, preventing forced asset sales.

Managing Cross-Border Family Situations

When your family spans multiple countries or you’re married to someone who isn’t a U.S. citizen, estate planning becomes more complex. A plan that works for a family entirely based in the U.S. might not address the unique challenges that arise when, for instance, a child lives in Germany, a spouse holds Japanese citizenship, or inherited property is located in France.

Planning for Families with Multiple Residencies

Families with homes or ties in multiple countries face varying inheritance laws and tax rules. Inheritance law is typically governed by your permanent domicile, while residency in another country often triggers local tax or reporting obligations. To avoid being taxed as a domiciliary in more than one country, you’ll need to provide evidence of your primary connections – this can include voter registration, a driver’s license, or records of where your strongest social ties are established.

For families in Europe, the EU Succession Regulation (EU 650/2012) offers some flexibility. It allows residents in many EU countries to choose the law of their nationality to govern their estate, which can help bypass local forced heirship rules. This can be a critical tool for aligning estate plans across jurisdictions. However, to ensure your wills and beneficiary designations are valid and don’t conflict, it’s crucial to work with local legal experts in every country where you hold significant assets.

Estate Planning for Non-Citizen Spouses

Planning for non-citizen spouses adds another layer of complexity. U.S. citizens married to non-citizens don’t benefit from the same tax advantages as those married to other U.S. citizens. For instance, transfers between U.S. citizen spouses are tax-free, no matter the amount, but this doesn’t apply to non-citizen spouses. Without the unlimited marital deduction, a non-citizen spouse could face estate taxes if the estate exceeds the exemption amount (expected to be $15 million in 2026). In such cases, estate tax rates could reach up to 40%.

"If your spouse isn’t a US citizen, the usual estate tax rules don’t apply the same way. Normally, you can leave unlimited assets to a spouse tax-free, but for non-citizen spouses, there’s no unlimited marital deduction."

– Wise

One way to address this issue is through a Qualified Domestic Trust (QDOT). A QDOT can delay estate taxes until the principal is distributed or the surviving spouse passes away. This type of trust allows the non-citizen spouse to receive income during their lifetime, but it comes with specific requirements – at least one trustee must be a U.S. citizen or a U.S. corporation to meet IRS rules. Additionally, some estate tax treaties, like those with the U.K. or Germany, may provide enhanced marital deductions or higher credits for non-citizen spouses. Reviewing treaty protections could be a key part of your planning.

Managing Inherited Assets in Foreign Countries

Handling cross-border inheritances requires careful planning to avoid costly mistakes. For example, inheritances over $100,000 must be reported to the IRS on Form 3520, with penalties for non-compliance starting at 5% per month, up to a maximum of 25%.

Foreign inheritances often benefit from a "step-up" in basis at the time of death, which can reduce future capital gains taxes. To prepare, obtain professional appraisals for foreign assets and consult experts on managing PFIC (Passive Foreign Investment Company) classifications to simplify tax reporting. It’s also wise to set aside cash to cover probate fees, inheritance taxes, and administrative costs in the country where the assets are located. This can help avoid having to sell valuable assets, such as real estate, under pressure.

Maintaining Compliance and Updating Your Plan

International estate planning isn’t a set-it-and-forget-it process. Even the most carefully crafted plan can unravel if it’s not regularly updated, potentially leaving your heirs to deal with unexpected tax burdens. Below, we’ll explore key steps to keep your plan compliant and current.

Working with Legal and Tax Professionals

Managing an international estate plan is no small feat – it requires a team of professionals working in harmony. You’ll need an estate attorney, local counsel, and a tax advisor to address the specific legal and tax requirements of each jurisdiction. This includes compliance with regulations like FBAR, FATCA, and other essential forms. As the American Bar Association wisely points out, “The additional cost [of coordination] now will prevent any additional costs and headaches during probate”.

It’s crucial to stay on top of mandatory filings, such as FBAR, FATCA, and IRS Forms 8621 and 3520. Missing these filings can lead to steep penalties. Regular reviews of your estate plan ensure that your team’s coordinated efforts remain effective, especially as laws evolve.

Regular Reviews and Updates

Set a habit of reviewing your estate plan annually, and make it a priority after any major life events. Relocating to a new country, getting married or divorced, or acquiring foreign property are all triggers for an update. Changes in tax treaties or local laws – like the EU Succession Regulation (EU 650/2012) – can also shift how your assets are distributed.

To streamline updates, secure a formal determination of your legal domicile and maintain a detailed inventory of your assets by country. Include key documents like title deeds, bank statements, insurance policies, and business registrations. This level of organization will make updates far more manageable.

Common Mistakes in International Estate Planning

One of the most frequent missteps is relying on a single will to cover multiple jurisdictions. Frederic Behrens, Partner at Cerity Partners, cautions, “A single country-focused estate plan may create unforeseen and undesirable consequences when executed in a different country”.

Another pitfall is using uncoordinated local wills that conflict with your primary estate plan. If you choose to create local wills for specific jurisdictions, make sure they include language that prevents one document from invalidating another. Overlooking beneficiary designations or failing to allocate sufficient funds for foreign probate fees can cause delays in settling the estate. In some cases, families are forced to sell valuable assets under financial pressure.

Finally, neglecting regular updates or mishandling cross-border documentation can erode even the strongest estate plan. Staying proactive is the key to avoiding these challenges.

Conclusion

Handling estate planning across borders is essential for safeguarding your international assets. Without a well-coordinated strategy, your heirs could face double taxation, conflicting inheritance laws, drawn-out probate processes, and hefty penalties for noncompliance. As Roger Healy, MBA, CFP®, EA, TEP at Creative Planning, explains, "Standard U.S. estate planning techniques will likely fail to protect wealth in cross-border situations and may even produce unintended, counter-productive results".

Ignoring reporting requirements can lead to severe penalties. For non-U.S. domiciliaries, the situation is even more pressing. With only a $60,000 estate tax exemption on U.S. situs assets – compared to the much higher exemption for U.S. citizens – proper planning becomes absolutely essential.

To address these challenges, consider these key steps: Start by creating a detailed inventory of your assets by country. Clearly establish your legal domicile and coordinate multiple wills to avoid conflicts between jurisdictions. Ensure there’s enough liquidity to cover foreign probate fees and inheritance taxes, which can help prevent the forced sale of valuable assets. Most importantly, build a team of cross-border estate attorneys and tax advisors who are well-versed in the laws of both your home country and the countries where your assets are located. These measures can provide the expertise and structure needed to protect your wealth.

International estate planning requires specialized knowledge. Frederic Behrens, Partner at Cerity Partners, emphasizes, "Failing to consider these multijurisdictional estate planning implications may create dramatic consequences, including assets passing to the wrong beneficiaries and excessive taxes". Working with qualified professionals ensures that your plan is tailored to your unique circumstances, providing the protection your international assets deserve.

FAQs

How can I prevent double taxation on international assets in my estate plan?

To steer clear of double taxation on international assets, leveraging tax treaties between the U.S. and other nations is essential. These agreements spell out how estate, gift, and inheritance taxes are handled across borders, reducing or even eliminating the risk of being taxed twice on the same assets. Many of these treaties also offer benefits like foreign tax credits or exemptions, which can significantly lighten the tax load for expatriates or those with global investments.

Another smart approach is to organize your assets through tools like offshore trusts or foreign corporations. These legal setups can help manage tax liabilities and streamline wealth transfers. Since tax laws differ greatly from one country to another, working with an expert in international estate planning is critical. They can ensure you stay compliant while making the most of the available options. Careful planning not only safeguards your wealth but also ensures a smoother process for passing it on to your heirs.

How can non-citizen spouses reduce estate taxes in the U.S.?

Non-citizen spouses have several options to help reduce estate taxes under U.S. laws. One effective method is utilizing estate tax treaties between the U.S. and other nations. These treaties can offer tax relief and lower financial obligations for couples with international ties. Another approach involves setting up wills and trusts that are internationally recognized, ensuring a smooth transfer of assets while keeping tax liabilities in check.

For those non-citizen spouses who own assets in the U.S., understanding specific tax regulations, like the requirements for filing estate tax returns, is crucial. Tools such as offshore trusts and strategic planning can be particularly useful in navigating the complexities of cross-border inheritance laws. These steps can also help limit exposure to estate taxes in more than one country. For personalized guidance, working with an experienced estate planning professional is strongly advised.

How can I make sure my will is valid in multiple countries?

To make sure your will is valid across multiple countries, you need to meet the legal requirements of each country where you own assets. This might mean drafting a will that complies with the laws of those countries or creating separate wills tailored to each jurisdiction to avoid potential legal conflicts.

It’s a good idea to consult an estate planning attorney with expertise in international law. They can guide you through treaties like the Hague Convention on the Recognition of Wills, which can streamline the process of cross-border recognition. Additionally, specifying the governing jurisdiction in your will and using clear, straightforward language to outline your intentions can help minimize disputes.

By combining careful planning, expert legal advice, and compliance with international regulations, you can greatly improve the chances that your will is honored in all applicable countries, ensuring your assets are passed on smoothly to your beneficiaries.