Managing finances abroad can quickly become a challenge for expats. From hidden fees to complex regulations, navigating international banking requires careful planning. Here are the key takeaways to avoid common pitfalls:

- Hidden Fees: International transfers and currency conversions often come with unexpected costs. Many banks mark up exchange rates or charge high transfer fees.

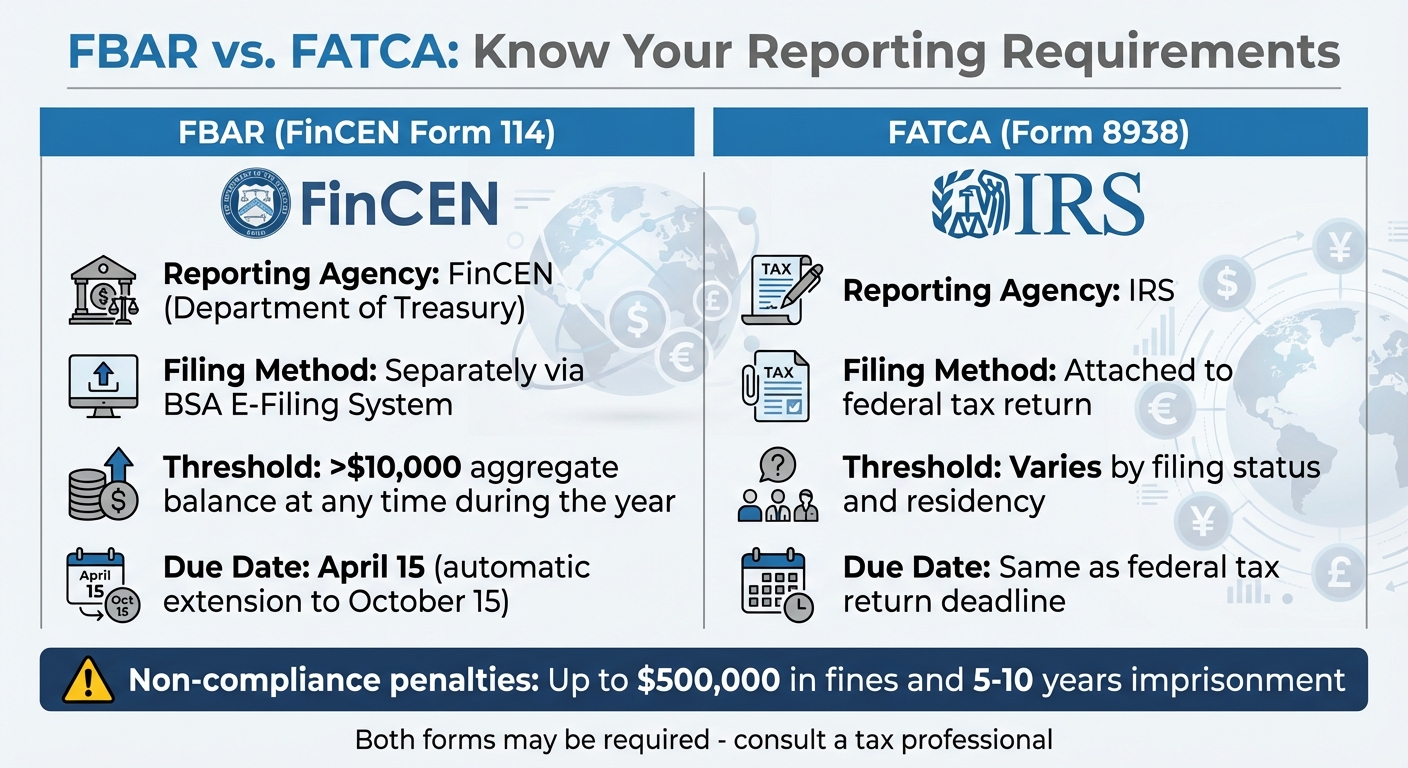

- Regulatory Compliance: U.S. citizens must report foreign accounts under FBAR (>$10,000) and FATCA (>$50,000). Non-compliance can result in severe penalties.

- Currency Fluctuations: Exchange rate changes can impact your purchasing power and savings.

- Banking Challenges: Opening local accounts abroad may require proof of address and income, which can be difficult for new expats.

Solutions:

- Use multi-currency accounts to save on conversion costs and simplify international payments.

- Choose expat-friendly banks offering global account management and fee-free transfers.

- Consider digital banking platforms like Wise for transparency, low fees, and real-time updates.

- Stay compliant by filing required forms (FBAR, Form 8938) and keeping detailed account records.

Planning ahead and using modern tools can help you manage your finances smoothly while living overseas.

Common Problems When Banking Abroad

Moving to a new country comes with its share of financial challenges, especially when it comes to managing your money across borders. For many expats, three common issues can quickly become major headaches: hidden fees, unfavorable exchange rates, and strict regulatory hurdles. Knowing about these in advance can help you avoid unnecessary costs and complications.

Hidden Fees and Extra Charges

One of the first surprises for expats is the high cost of international money transfers. Using your home bank account to send money overseas or withdraw cash in a foreign country often comes with hefty fees. These charges can pile up fast, especially if your bank doesn’t have partnerships with international networks to reduce ATM withdrawal costs.

But it’s not just the fees themselves that can hurt your wallet. The way banks handle currency exchange can also take a toll on your finances.

Currency Exchange Rate Problems

You’ve probably seen banks advertising "zero-fee" transfers – sounds great, right? Unfortunately, many of these services hide their costs by marking up the exchange rate. This markup can end up costing you far more than a transparent service fee. For instance, transferring $30,000 USD to euros can result in hidden markups amounting to about $735.24.

Federal law does require providers to disclose the exchange rate, fees, and the exact amount the recipient will get before you complete the transfer. However, it’s still crucial to review these details carefully to avoid being caught off guard.

On top of these financial hurdles, expats also face strict compliance requirements that can complicate their banking experience.

Regulatory and Compliance Requirements

For U.S. citizens, navigating financial regulations abroad can feel like walking through a legal minefield. Two key rules to keep in mind are FBAR (Foreign Bank Account Report) and FATCA (Foreign Account Tax Compliance Act). FBAR requires reporting of foreign accounts holding more than $10,000, while FATCA mandates that foreign banks report details about accounts held by U.S. taxpayers to the IRS. Failing to comply can lead to severe penalties, including fines up to $500,000 and even prison sentences of up to 10 years.

The burden of FATCA compliance has led some foreign banks to refuse service to U.S. citizens altogether. For those that do, opening an account often involves extensive documentation, such as proof of tax residency and, in some cases, notarized powers of attorney. Understanding these requirements is essential to avoid costly mistakes and ensure smooth financial management while living abroad.

sbb-itb-39d39a6

How to Avoid Expat Banking Problems

Navigating banking as an expat can be tricky, especially when it comes to avoiding high fees and poor exchange rates. The right approach and tools, however, can make a world of difference.

Selecting Expat-Friendly Banks

When choosing a bank, it’s important to find one that caters specifically to expats. The best options allow you to hold, receive, and save money in multiple currencies, making international transactions much smoother.

Look for features like instant, fee-free transfers between accounts. For example, HSBC‘s Global View and Global Transfers service enables you to transfer up to $200,000 per day between eligible HSBC accounts worldwide without incurring transfer fees.

"Setting up your finances abroad before you move is not just about meeting your daily banking needs – it’s also financially prudent." – HSBC International Services

Decide whether you need a local account or an international account. Local accounts are useful for building credit and managing day-to-day expenses like utilities, while international accounts offer consistency as they stay with you regardless of where you relocate. Offshore accounts, such as those based in Jersey in the Channel Islands, provide added stability and deposit protection – up to £50,000 under the Jersey Bank Depositors Compensation Scheme.

Keep an eye on eligibility requirements and fees. Many expat-friendly banks waive monthly charges if you meet certain salary or investment thresholds, but they may impose "underfunding fees" if you don’t. Also, notify your current bank about your move to avoid issues with international transactions.

Using Multi-Currency Accounts

Multi-currency accounts are a great way to save on conversion costs. These accounts let you hold funds in multiple currencies, giving you the flexibility to convert money when exchange rates are in your favor.

One major advantage is the use of the mid-market exchange rate, which is free of the markups that traditional banks often apply. For example, in December 2025, Wise reported a $30,000 USD-to-EUR transfer costing $88.77, compared to $735.24 at Chase – a savings of $646.47 on a single transaction.

Multi-currency accounts also make it easier to receive payments. They provide local bank details for different regions, such as an IBAN for Europe or a routing number for the U.S. This allows you to receive payments as if you were a local resident, avoiding expensive international wire fees. If you’re freelancing for European clients while living in Asia, for instance, they can pay directly into your EUR account without triggering costly SWIFT fees.

Some platforms even allow you to lock in exchange rates for up to 40 hours, shielding you from market fluctuations while your transfer is being processed. These features make multi-currency accounts a powerful tool for managing international finances.

Digital Banking Platforms for Expats

Digital-first banking platforms have transformed the way expats manage their money. With these platforms, you can open and maintain accounts entirely online, eliminating the need for physical branch visits – a huge plus when you’re living or traveling abroad.

These platforms provide real-time notifications through mobile apps, keeping you updated on every transaction. They also let you monitor exchange rates for your preferred currencies, giving you greater control over your finances. Impressively, about 70% of transfers through platforms like Wise are completed in under 20 seconds.

"You can save thousands every year by choosing the right bank." – Nomad Gate

One of the standout benefits of digital platforms is their transparency. Unlike traditional banks, which often hide fees in exchange rate markups, digital platforms display all costs upfront. With transfer fees as low as 0.1% depending on the currency route, you’ll know exactly what you’re paying before confirming a transaction.

Wise, for instance, serves 14.8 million customers and processes £36 billion every quarter worldwide. With a Trustpilot rating of 4.3/5 from over 278,000 reviews, it’s clear that expats are increasingly turning to digital platforms for their banking needs. Some platforms even offer competitive interest rates on USD balances, allowing you to earn a bit of extra income from your account.

Legal and Tax Requirements for Expat Bank Accounts

Opening a bank account abroad is perfectly legal, but it comes with strict reporting rules that can be easy to overlook. Ignoring these obligations can lead to serious consequences, including steep fines or even criminal charges.

Local Banking Laws and Requirements

Banking regulations differ from country to country, so it’s important to familiarize yourself with the specific rules of the region where you’re opening an account. In most cases, foreign banks require U.S. expats to declare their tax status when setting up an account. This is largely due to the Foreign Account Tax Compliance Act (FATCA), which mandates that banks worldwide report details about accounts held by U.S. taxpayers directly to the IRS. Failing to disclose U.S. citizenship could even be considered fraudulent.

"While it is absolutely legal to own a foreign bank account, there are some additional reporting and tax requirements that US persons should be aware of so that they can remain in IRS tax and reporting compliance." – Golding & Golding

Tax Reporting for U.S. Expats

As a U.S. citizen, you’re taxed on your worldwide income, regardless of where you live. This means filing U.S. tax returns and reporting all foreign accounts, even if those accounts don’t generate taxable income.

Two essential forms come into play here: FBAR (FinCEN Form 114) and Form 8938 under FATCA.

- FBAR: You’re required to file this form if the total value of all your foreign accounts exceeds $10,000 at any point during the calendar year. This threshold applies to the combined balance of all accounts, not just individual ones. FBAR filings are due April 15, but there’s an automatic extension to October 15. It must be submitted electronically through FinCEN’s BSA E-Filing System, separate from your tax return.

- Form 8938: This has different filing thresholds depending on your residency and filing status. Unlike the FBAR, this form is submitted with your federal income tax return.

Failing to comply with FBAR rules can result in severe penalties, including fines and even prison sentences of up to five years. Accuracy is crucial, and you should retain detailed records – such as account names, numbers, bank addresses, and maximum balances – for at least five years. When reporting foreign currency, use the Treasury Bureau of the Fiscal Service exchange rate from the last day of the calendar year.

| Requirement | FBAR (FinCEN Form 114) | FATCA (Form 8938) |

|---|---|---|

| Reporting Agency | FinCEN (Dept. of Treasury) | IRS |

| Filing Method | Separately via BSA E-Filing System | Attached to federal tax return |

| Threshold | >$10,000 aggregate at any time | Varies by filing status/residency |

| Due Date | April 15 (extension to Oct 15) | Same as federal tax return |

If you’ve missed filings in previous years, the IRS offers Streamlined Filing Compliance Procedures to help non-willful violators catch up without facing most penalties.

Asset Protection Through Financial Structuring

Once you’ve met your reporting obligations, you might want to consider ways to safeguard your wealth. Financial structuring tools like private U.S. LLCs, offshore trusts, or private interest foundations can provide protection against lawsuits, creditors, and even political instability.

- A private U.S. LLC can help separate business activities from personal assets, offering liability protection and privacy.

- For those with significant assets, offshore trusts in jurisdictions such as Anguilla can add an extra layer of security.

However, transparency is key. U.S. persons – including entities like LLCs, estates, or trusts organized in the U.S. – must adhere to FBAR and FATCA reporting requirements. This isn’t about hiding assets; it’s about organizing them in a way that protects your interests while staying fully compliant with tax laws.

"U.S. persons maintain overseas financial accounts for a variety of legitimate reasons, including convenience and access. They must file Reports of Foreign Bank and Financial Accounts (FBAR) because foreign financial institutions may not be subject to the same reporting requirements as domestic financial institutions." – Internal Revenue Service

Conclusion: Effective Banking for Expats

Managing finances as an expat doesn’t have to be overwhelming. Combining forward-thinking strategies, compliance awareness, and modern banking platforms can simplify the process and help you avoid unnecessary headaches. Hidden fees and compliance hurdles can eat into your hard-earned money, but with the right approach, these risks can be minimized.

Start by planning ahead. Opening bank accounts before you relocate can save you from the hassle of proving your address or income in a new country. While global banking options for expats are extensive, knowing where to look is key.

For U.S. citizens living abroad, compliance isn’t optional. In 2020, roughly 9 million Americans resided overseas, yet only 1.4 million filed the required FBARs. This leaves many vulnerable to hefty penalties – fines reaching up to $500,000 and even prison time. Staying compliant is non-negotiable if you want to avoid these serious consequences.

Choosing the right banking setup can make all the difference. Multi-currency accounts offer a reliable financial foundation, no matter how often you move. Meanwhile, digital platforms provide the convenience of managing multiple accounts and tracking transactions in real time.

In addition to selecting the right banking tools, staying organized is essential. Keep detailed records of your foreign accounts, including maximum balances, account numbers, and bank addresses, for at least five years. Inform your bank of any travel plans to prevent unexpected security freezes, and consider setting up a notarized power of attorney to grant a trusted family member access in case of emergencies. With these measures in place, you can focus on enjoying your expat journey without financial stress.

FAQs

What hidden fees should expats watch out for when banking abroad?

Expats often face unexpected hidden fees when handling finances abroad. These might include intermediary charges on international wire transfers, inflated currency exchange rates, foreign transaction fees on card purchases, and ATM withdrawal costs. If you’re not paying attention, these small charges can snowball into a sizable expense.

To cut down on these costs, look into banks or digital platforms designed with expats in mind – ones that clearly outline their fees. Using a multi-currency account can help you sidestep poor exchange rates, and it’s always smart to double-check for any fees before transferring money or withdrawing cash. A little effort upfront can lead to big savings in the long run.

What steps should expats take to comply with FBAR and FATCA rules?

To meet FBAR (Foreign Bank Account Report) requirements, expats must file an FBAR electronically with the Financial Crimes Enforcement Network (FinCEN) if the total value of their foreign accounts surpasses $10,000 at any point during the calendar year. This applies to various types of foreign financial accounts, including savings, checking, and investment accounts.

For FATCA (Foreign Account Tax Compliance Act), expats might need to report specific foreign financial assets to the IRS. The need to file depends on the value of these assets and the individual’s tax filing status. Keeping track of annual reporting thresholds and deadlines is crucial to avoid potential penalties.

To make compliance easier, consider seeking help from a tax professional familiar with expat finances or using tools designed to monitor and report foreign accounts efficiently.

What are the advantages of using digital banking for expats?

Digital banking brings ease and flexibility, making it a great choice for expats. You can open and manage accounts entirely online, often before or soon after your move. This eliminates the hassle of visiting physical branches or dealing with piles of paperwork, allowing you to handle your finances smoothly during a major transition.

Many platforms offer multi-currency accounts, which are perfect for avoiding hidden fees and reducing currency exchange risks. With features like international transfers and currency exchange services, these accounts cater specifically to the needs of expats. Plus, some platforms include multilingual support and intuitive tools, helping you navigate banking systems that might otherwise feel unfamiliar.

In short, digital banking gives expats better control, lower costs, and easy access, making financial management abroad far less stressful.