Trusts are a powerful way to protect and manage family wealth across generations. They help shield assets from taxes, lawsuits, and probate costs, ensuring privacy and control over how wealth is distributed. By 2026, the federal estate tax exemption will be $15 million for individuals and $30 million for couples, but many states have lower thresholds, making proper planning essential. Trusts can also safeguard assets from creditors and provide for specific needs like education or disability support.

Key points:

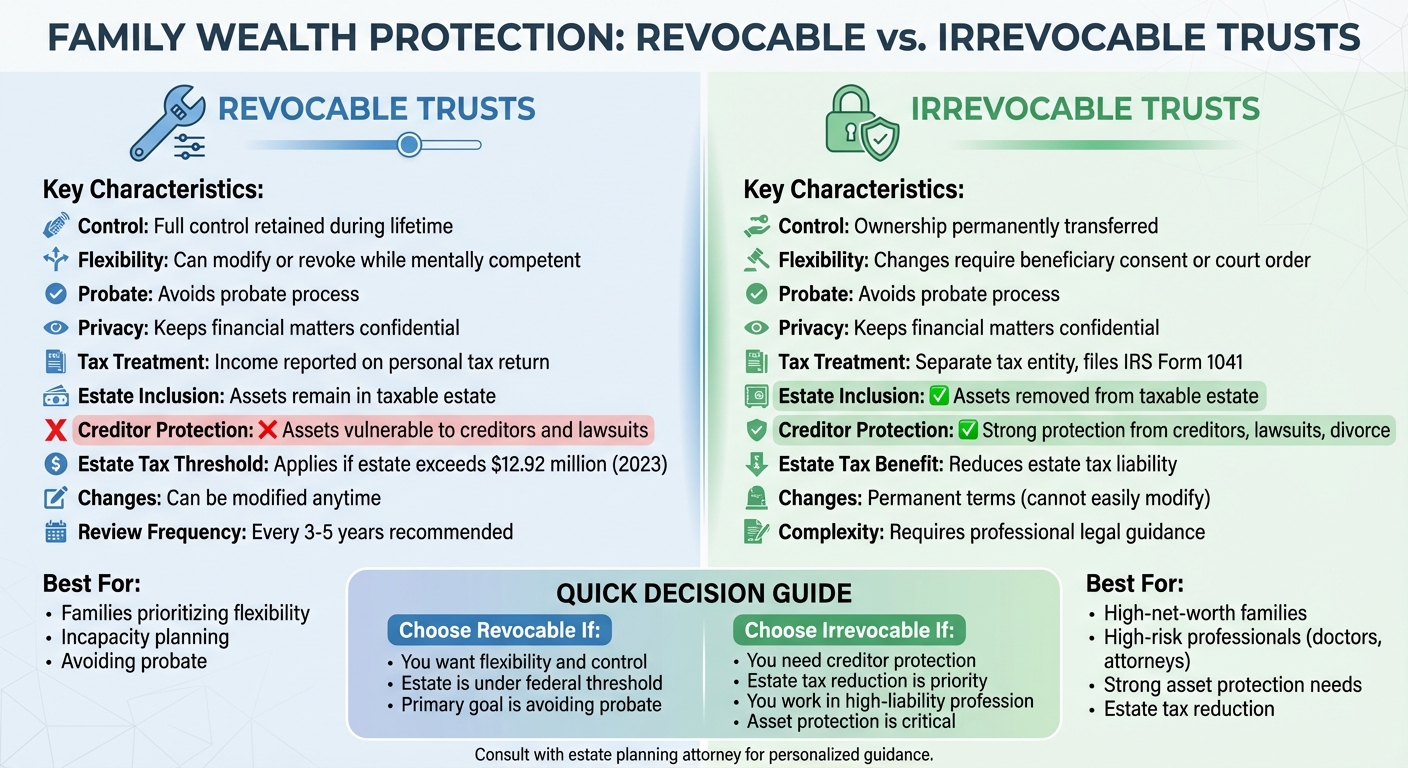

- Revocable trusts: Flexible, avoid probate, but assets remain part of your taxable estate.

- Irrevocable trusts: Offer tax benefits, creditor protection, and remove assets from your estate, but terms are permanent.

- Specialized trusts (e.g., Medicaid Asset Protection Trusts, Charitable Remainder Trusts) address unique goals like long-term care or philanthropy.

- Location matters: States like South Dakota provide strong legal protections, tax advantages, and privacy.

To create a trust, you’ll need a legal document, a trustee, and funding (retitling assets into the trust). Regular reviews ensure the trust aligns with your goals and any life changes. Professional guidance is crucial to navigate complexities and preserve your family’s financial legacy.

What Are Trusts and How Do They Work?

A trust is a legal arrangement where you, the grantor, transfer ownership of your assets to a trustee. The trustee then manages these assets for the benefit of your chosen beneficiaries. Essentially, a trust allows you to safeguard your wealth while ensuring it’s managed and distributed according to your wishes.

There are three key roles in a trust. The grantor is the person who creates the trust and funds it with assets like real estate, cash, or even business interests. The trustee – which can be an individual, yourself, or a professional institution – legally holds and manages the assets based on the instructions outlined in the trust. Finally, the beneficiary is the person or entity (like a family member or charity) that receives income or assets from the trust. These roles form the backbone of how a trust operates.

Trusts differ from wills in some critical ways. A trust can manage your assets while you’re alive, provide for you if you become incapacitated, and distribute your wealth privately after your death. Unlike a will, a trust avoids public probate, keeping your financial matters confidential.

The Mechanics of Trust Formation

Setting up a trust requires two main steps: creating the legal document and funding the trust. The trust document spells out who manages the assets, who benefits from them, and the terms for distributions. However, without funding – transferring assets into the trust – the document alone has no effect.

Funding a trust involves retitling assets, such as real estate, bank accounts, or business interests, into the trust’s name. For example, you’d update property deeds to reflect the trust as the new owner. However, retirement accounts like IRAs or 401(k)s should not be directly transferred into a revocable trust, as this could lead to immediate taxation. Instead, you can name the trust as the beneficiary of these accounts.

It’s also crucial to appoint a successor trustee who will step in if you become incapacitated or pass away. Many people pair their trust with a "pour-over" will, which ensures that any assets not initially transferred to the trust are eventually included. Setting up a basic revocable trust typically costs between $1,000 and $3,000, though more complex arrangements can cost significantly more.

Why Use a Trust?

Trusts offer a blend of privacy, control, and protection. Unlike wills, which go through probate and become public records, trust documents remain confidential. This privacy ensures that your family’s financial matters and asset distribution stay out of the public eye.

Another major benefit is asset protection. Irrevocable trusts, for instance, can shield your wealth from creditors, lawsuits, or divorce settlements because the assets are no longer legally yours once transferred. Spendthrift provisions can also limit how beneficiaries access funds – such as requiring them to reach a certain age or achieve milestones like completing their education.

If you become ill or disabled, a trust allows your trustee to immediately step in and manage your affairs without the need for a court-appointed guardian. For families with significant wealth, specialized trusts like Generation-Skipping Trusts can help reduce estate taxes across multiple generations. Additionally, assets held in a revocable trust may qualify for a "step-up in basis" at your death, potentially saving your heirs from significant capital gains taxes.

"A trust can help you navigate specific tax concerns or creditor protection, ensure your wealth supports your family, or leave a legacy for a charitable cause you believe in." – Terry Ruhe, Senior Vice President and Regional Trust Manager, U.S. Bank Wealth Management

sbb-itb-39d39a6

Types of Trusts for Protecting Family Assets

When it comes to safeguarding family assets, selecting the right trust structure is crucial. Your choice will depend on your goals – whether you prioritize flexibility, strong asset protection, or specific tax advantages. Broadly, trusts fall into two main categories: revocable and irrevocable. Beyond these, specialized trusts can address unique needs like charitable giving, long-term care planning, or efficiently passing on appreciating assets. Let’s dive into how these trusts work and the benefits they offer.

Revocable Trusts

Revocable trusts allow you to retain full control over the assets during your lifetime. You can modify or revoke the trust as long as you’re mentally competent. Since you maintain ownership, any income generated by the trust assets is reported on your personal tax return.

The flexibility of a revocable trust makes it an excellent tool for avoiding probate and planning for incapacity. However, the assets in the trust remain vulnerable to creditors, lawsuits, and other legal claims. Additionally, these assets are included in your taxable estate. For estates exceeding the federal threshold (set at $12.92 million in 2023), estate taxes may apply. Regular reviews of your trust every three to five years – or after major life events – can help keep it aligned with your goals.

Irrevocable Trusts

Unlike revocable trusts, irrevocable trusts require you to permanently transfer ownership of your assets. Once the trust is established, changes can only be made with the consent of all beneficiaries or through a court order.

By removing the assets from your ownership, irrevocable trusts provide strong protection against creditors, lawsuits, and divorce settlements. They also exclude those assets from your taxable estate, which can reduce estate tax liability. However, these trusts are separate tax entities and need to file their own tax returns using IRS Form 1041.

"Irrevocable trusts benefit individuals who work in professions that may make them vulnerable to lawsuits, such as doctors or attorneys." – Investopedia

Irrevocable trusts are especially appealing to high-net-worth families and professionals in high-risk careers. Because of their complexity and permanence, consulting an estate attorney is highly recommended before setting one up.

Specialized Trust Structures

For more tailored solutions, specialized trusts can offer additional protection and tax benefits. Here are some common options:

- Grantor-Retained Annuity Trusts (GRATs): These trusts help transfer appreciating assets while keeping gift taxes low. The grantor receives annuity payments for a set period, and any appreciation above the IRS-assumed rate passes tax-free to beneficiaries.

- Irrevocable Life Insurance Trusts (ILITs): Designed to hold life insurance policies outside your taxable estate, ILITs ensure that death benefits pass to beneficiaries without incurring estate taxes, preserving more wealth for your family.

- Medicaid Asset Protection Trusts (MAPTs): These trusts help families qualify for Medicaid benefits for long-term care by structuring asset transfers to stay within eligibility limits. Since Medicaid has a five-year "look-back" period, early planning is essential.

- Charitable Remainder Trusts (CRTs): CRTs allow you to donate assets to charity while retaining an income stream for a specified time. After this period, the remaining assets go to the charity, offering immediate tax advantages and reducing your taxable estate.

- Qualified Terminable Interest Property (QTIP) Trusts: Ideal for blended families, QTIP trusts provide income to a surviving spouse during their lifetime, with the principal eventually passing to heirs from a previous relationship.

- Incentive Trusts: These trusts tie distributions to specific achievements, like earning a degree or maintaining steady employment, encouraging beneficiaries to meet certain milestones.

Each trust type serves a distinct purpose, and the right choice depends on your family’s needs and financial goals. Whether you’re planning for the next generation, supporting a cause, or securing your own future, these trusts offer a range of tools to help protect and manage your assets effectively.

Selecting the Right Location for Your Trust

Where you establish your trust is just as important as how you structure it. The jurisdiction you choose affects asset protection, tax implications, privacy, and the trust’s lifespan. Some U.S. states offer stronger legal protections than others, while offshore jurisdictions add a unique layer of security. Knowing the differences can help you safeguard your family’s wealth effectively.

Domestic Trust Jurisdictions

In the U.S., trust laws vary significantly by state, and not all states are created equal when it comes to protecting assets and optimizing taxes. States like South Dakota and Nevada consistently stand out as top choices. For instance, South Dakota offers no state income, capital gains, or estate taxes, which allows for greater asset growth and smoother wealth transfer. Additionally, South Dakota permits dynasty trusts, which can last indefinitely, bypassing the typical limitations imposed elsewhere by the Rule Against Perpetuities.

"South Dakota’s Domestic Asset Protection Trust laws are crafted to provide unmatched flexibility, privacy, and tax advantages, making South Dakota the top choice for individuals looking to safeguard their assets." – Stuart Green Law

Privacy is another standout feature. South Dakota doesn’t require public disclosure of the grantor, beneficiaries, or trust assets, ensuring your financial matters remain private. Its Domestic Asset Protection Trust (DAPT) laws also allow you to protect assets from future creditors while still retaining some control – something many other states don’t offer.

Modern legal provisions in South Dakota include the ability to "decant" trusts, meaning you can modify trust terms as circumstances change. You can also appoint a trust protector to oversee and adjust the trust over time, even if you live outside the state. In contrast, states with more restrictive laws provide far fewer benefits.

While these domestic jurisdictions can serve most families well, those with more complex needs, such as international interests, may find offshore trusts to be a better fit.

Offshore Trust Jurisdictions

For families requiring the highest level of asset protection, offshore trusts offer a compelling option. These trusts are governed by foreign laws, which often don’t recognize U.S. court judgments. This legal separation makes it much harder for domestic creditors to access assets held offshore, creating a strong barrier against lawsuits and other legal threats.

Structuring offshore trusts also provides enhanced privacy and legal independence. However, they come with additional costs and complexities. You’ll need to comply with foreign regulations, fulfill U.S. reporting requirements, and coordinate with international trustees. These added layers can make offshore trusts more expensive and challenging to manage.

Ultimately, the choice between a domestic or offshore jurisdiction depends on your specific circumstances. For most families, states like South Dakota strike an excellent balance between protection, tax benefits, and ease of access. Offshore trusts, on the other hand, are more suitable for high-net-worth individuals with significant legal risks or global business interests requiring the strongest possible asset protection.

How to Create and Manage a Trust

Steps to Establish a Trust

To set up a trust, the first step is deciding on its structure. You can choose a revocable trust, which offers flexibility, or an irrevocable trust, which provides stronger asset protection. The right choice depends on your goals: do you prioritize adaptability or safeguarding your assets?.

Next, as the grantor, you’ll need to appoint a trustee, a successor trustee, and beneficiaries. The successor trustee is especially important – they step in if you’re unable to manage the trust due to death or incapacity. This avoids the need for a court-appointed conservator. Before naming someone, it’s wise to discuss the role with them to ensure they’re ready and able to take on the responsibility.

The trust instrument, often called the Declaration of Trust, is the legal document that spells out how the trust will operate, including how assets will be managed and distributed. For the trust to be valid, you must sign this document in the presence of a notary public, adhering to your state’s requirements.

Once the paperwork is complete, you’ll need to fund the trust. This involves retitling assets – like real estate, bank accounts, and investments – so they are owned by the trust. For retirement accounts, naming the trust as the beneficiary can help avoid immediate taxation. As attorney Mary Randolph, J.D., from Nolo explains:

"To make your trust effective, you must hold title to trust property in your name as trustee".

Setting up the trust is just the beginning; ongoing management is crucial to ensure it remains effective.

Managing Your Trust Over Time

Once your trust is established, proper management is key to protecting your assets and ensuring the trust functions as intended. Trustees have a duty to act solely in the best interest of the beneficiaries and must follow the trust’s instructions precisely. This includes keeping detailed records of all transactions, distributions, and decisions related to the trust.

Tax responsibilities will depend on the type of trust. For revocable trusts, income is reported on your personal tax return. Irrevocable trusts, however, require filing IRS Form 1041 and are often taxed at higher rates. If the trust generates more than $600 in income annually, it may be subject to taxation.

It’s also important to revisit your trust regularly. Schedule annual reviews with an estate planning professional to account for life events like births, deaths, marriages, or divorces. Unlike a will, trusts don’t automatically adjust to these changes, so you’ll need to update them manually. Any new assets you acquire should also be quickly re-titled in the trust’s name to keep it effective. Keep the original trust document in a fireproof safe and make sure your successor trustee knows where to find it.

Modern trusts often include decanting provisions, which allow trustees to transfer assets into a new trust with updated terms. This can be especially useful when laws or circumstances change. To navigate these complexities, consider working with professionals like estate attorneys, tax specialists, or even professional trustees for more intricate situations. This level of oversight is often managed through a private family office to ensure comprehensive asset protection. Their expertise ensures your trust remains compliant and effective as rules and regulations evolve.

Conclusion: Creating a Lasting Financial Legacy

Trust planning plays a key role in preserving wealth for future generations. Trusts offer a structured way to manage and distribute assets, protect them from creditors and lawsuits, bypass probate, and ensure continuity during times of incapacity. With over $106 trillion expected to transfer from Baby Boomers to younger generations by 2048, planning ahead is more important than ever.

Modern estate planning prioritizes control and protection. Current tax thresholds highlight the need for thoughtful strategies, with many families focusing on safeguarding assets from external risks or poor financial decisions by beneficiaries. Whether a revocable trust for flexibility or an irrevocable trust for stronger safeguards suits your needs, the choice depends on your family’s unique situation and goals.

Collaborating with professionals – estate attorneys, tax advisors, and financial planners – is essential. Catherine Neijstrom, Vice President at Fidelity Investments, underscores this:

"It’s all about planning. You want to make sure you have the right pieces in place and that your plan truly matches your wishes, so your family isn’t scrambling if something happens to you".

These experts ensure your trust is properly funded, aligns with legal requirements, and evolves with changes in your family or financial circumstances. It’s worth noting that an unfunded trust – one where assets aren’t properly retitled – could still face probate, defeating its purpose .

FAQs

What’s the difference between a revocable trust and an irrevocable trust?

The main difference comes down to flexibility and control. A revocable trust allows the grantor to make changes, updates, or even cancel it entirely during their lifetime. This makes it a more flexible option for managing assets. On the other hand, an irrevocable trust is set in stone once created, offering stronger asset protection and potential tax benefits.

Revocable trusts work well for individuals who want to maintain control over their assets while preparing for the future. In contrast, irrevocable trusts are often chosen to protect assets from creditors, minimize estate taxes, or provide long-term financial stability for beneficiaries. The right choice depends on your unique goals and financial situation.

How do trusts help high-net-worth families reduce estate taxes?

Trusts offer a smart way for high-net-worth families to manage estate taxes by moving assets out of the taxable estate. Irrevocable trusts are particularly powerful tools because once assets are placed in these trusts, they’re generally no longer considered part of the grantor’s estate. This can significantly reduce tax obligations.

Another option, generation-skipping trusts, helps families minimize transfer taxes when passing wealth directly to grandchildren or even further generations. These trusts work by leveraging tax exemptions, like the generation-skipping transfer tax exemption, to ensure more wealth remains intact for future heirs.

With thoughtful planning and structuring, trusts not only shield assets but also help families reduce estate taxes, paving the way for a stronger financial legacy.

Why does the location of a trust matter for protecting assets and maximizing tax benefits?

The location of a trust is a key factor in shaping the legal protection and tax benefits it provides. Laws differ from one jurisdiction to another, which can influence how effectively your assets are shielded from creditors, lawsuits, or other potential risks. On top of that, tax rules tied to a trust’s location can play a major role in determining how much of your wealth remains intact for future generations.

Choosing the right jurisdiction allows you to benefit from stronger asset protection laws and lower tax obligations, helping to safeguard and preserve your financial legacy over time.