Offshore trusts are legal tools for protecting and managing assets by transferring ownership to a trustee in a foreign jurisdiction. They shield assets from domestic court rulings, enhance privacy, and bypass probate. Popular among high-net-worth individuals, these trusts can also provide tax advantages depending on the jurisdiction. Key takeaways:

- Key Players: Settlor (creator), Trustee (manager), Beneficiaries (recipients), and sometimes a Protector (overseer).

- Advantages: Asset protection, legal privacy, avoidance of probate, and potential tax benefits.

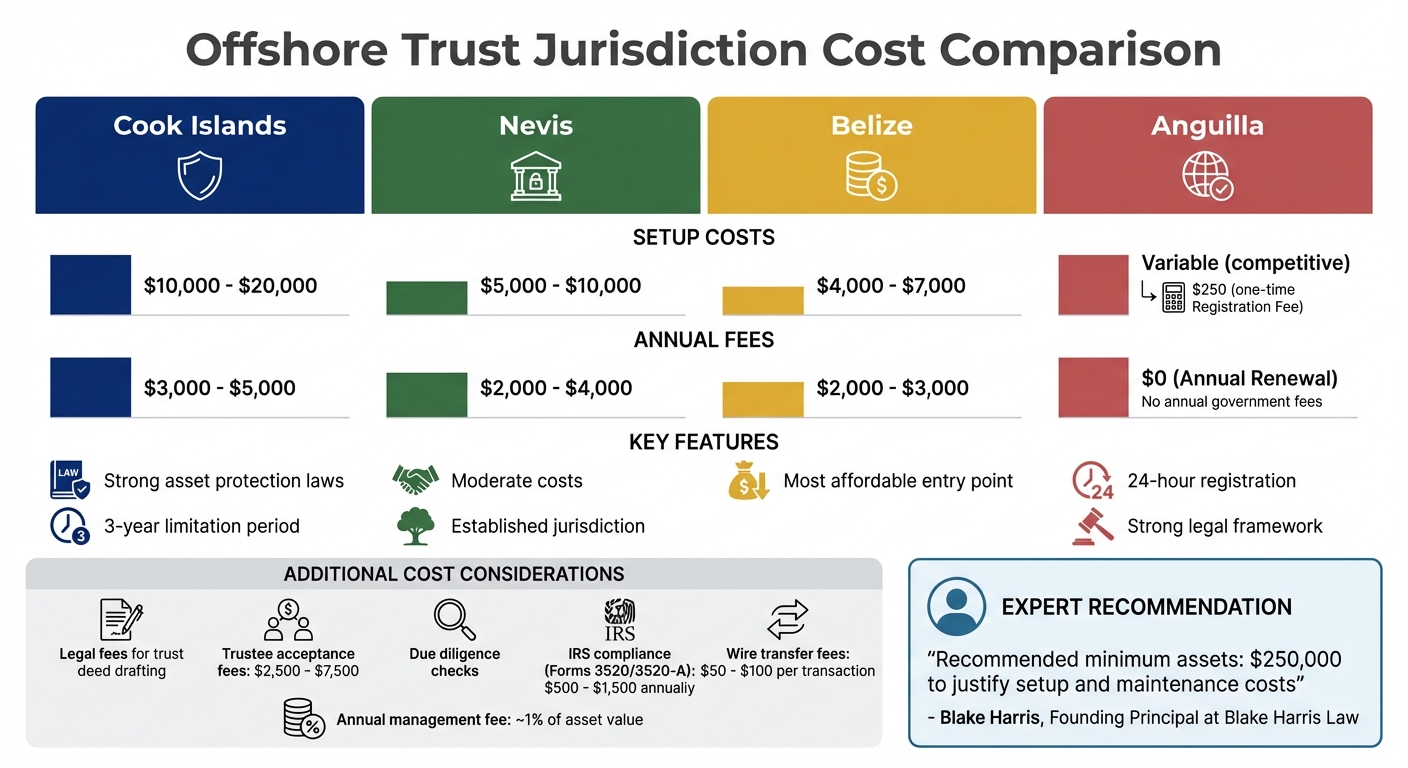

- Costs: Setup fees range from $4,000 to $20,000, depending on the jurisdiction, with annual maintenance fees.

- Top Jurisdictions: Anguilla, Cook Islands, Nevis, and Belize, each offering unique benefits like low fees, strong asset protection laws, and tax neutrality.

- Legal Requirements: Trust deed, trustee qualifications, and compliance with international regulations like FATCA.

- Ongoing Management: Trustees handle assets, ensure compliance, and provide financial updates. Regular reviews are essential to adapt to life changes.

Anguilla stands out for its low setup costs, quick registration (24 hours), and strong legal framework. However, professional guidance is critical to navigate legal complexities and common myths and ensure compliance with tax obligations.

What to Know Before Setting Up an Offshore Trust

Before diving into the world of offshore trusts, it’s essential to grasp the financial commitment, legal responsibilities, and the role of a trustee. These factors will help you decide if offshore asset protection aligns with your goals and prevent potential missteps.

Costs and Fees Involved

Setting up an offshore trust isn’t cheap – it comes with a range of upfront and ongoing costs. For example:

- Cook Islands trusts: Initial setup costs range from $10,000 to $20,000, with annual fees between $3,000 and $5,000.

- Nevis trusts: Setup costs are lower, around $5,000 to $10,000, with annual fees of $2,000 to $4,000.

- Belize trusts: These offer the most affordable entry point, with setup fees of $4,000 to $7,000 and annual costs of $2,000 to $3,000.

Your initial expenses will likely include legal fees for drafting the trust deed, trustee acceptance fees (ranging from $2,500 to $7,500), due diligence checks, government registration fees, and possibly the cost of setting up an offshore LLC. Anguilla stands out with a one-time registration fee of just $250 and no annual renewal charges. However, you’ll still need to budget for ongoing trustee services, registered agent fees, and bank account maintenance.

The complexity of your trust also plays a big role in determining costs. Trusts with multiple beneficiaries, assets like real estate or businesses, or those requiring active management will naturally be more expensive. Blake Harris, Founding Principal at Blake Harris Law, advises:

"We generally recommend that you have at least $250,000 in assets before setting up an offshore trust to justify the pricing of offshore trust upkeep, as well as setup fees".

Don’t forget tax compliance costs. U.S. residents must file IRS Forms 3520 and 3520-A, which often require specialized CPA services costing $500 to $1,500 annually. Other expenses include wire transfer fees ($50 to $100 per transaction) and currency exchange spreads. Some providers may also charge an annual management fee, typically around 1% of the trust’s total asset value.

Once you’ve accounted for costs, it’s time to focus on legal requirements and choosing the right trustee.

Legal Requirements and Compliance

To establish a valid offshore trust, several elements are required: a settlor (that’s you), named beneficiaries, a lawful purpose, and a formal trust deed or charter. Additionally, your trust must have a registered office and a licensed agent in the jurisdiction to handle legal and regulatory notices.

For example, in Anguilla, the Trust Charter must be filed with the government registry – a process that can be completed within 24 hours. Trustees must meet strict qualifications, demonstrating professional expertise, integrity, and experience. Trust companies offering these services are required to hold a valid license from the local Financial Services Commission.

Maintaining accurate financial records is non-negotiable. These records document all transactions and confirm the trust’s financial position, ensuring compliance with international standards like the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA). Both frameworks involve the automatic exchange of financial information between participating jurisdictions.

U.S. taxpayers face additional obligations. Failing to file IRS Forms 3520 and 3520-A can lead to hefty penalties. Before appointing a trustee, ensure they hold a valid trust license from the relevant jurisdiction’s Financial Services Commission. You’ll also need to disclose full beneficial ownership, though this information typically isn’t made public. Registered agents are required to keep it on file to meet international regulations.

With these legal considerations in mind, the next step is selecting a qualified trustee to manage your trust effectively.

How to Choose the Right Trustee

The trustee you choose will oversee the day-to-day operations of your trust, so this decision is crucial. In Anguilla, trustees must hold either a general trust license (requiring at least $250,000 in paid-up capital) or a restricted trust license for specific trusts. These licenses ensure regulatory oversight, including annual audits and approval for changes in ownership or directors.

When evaluating a trustee, check their reputation, track record, and international experience. Make sure they’ve been vetted by a regulatory body like the Financial Services Commission and are deemed qualified to manage trust business. It’s often beneficial to select a trustee company based in your chosen jurisdiction, as they’ll have in-depth knowledge of local trust laws and compliance requirements.

To safeguard your trust even further, consider appointing a Protector. This individual has the authority to oversee the trustee, replace them if necessary, and appoint new ones to ensure your intentions are carried out. Another option is forming a council of professionals – such as CPAs, lawyers, and financial advisors – to guide your trustee in managing assets according to your goals.

Make sure your trust deed includes anti-duress clauses. These provisions prevent trustees from transferring assets if you’re under legal pressure in your home country. Lastly, schedule regular performance reviews to evaluate your trustee’s actions and ensure the trust continues to meet your changing needs.

sbb-itb-39d39a6

How to Choose the Right Jurisdiction for Your Offshore Trust

What to Look for in a Jurisdiction

Choosing the right jurisdiction for your offshore trust is a critical decision that impacts your asset protection, privacy, and overall costs. The legal environment you select will directly influence the security and effectiveness of your trust.

Start by examining the jurisdiction’s legal framework. English Common Law jurisdictions are often preferred because they provide a reliable foundation for interpreting trust laws. Regions known for political and economic stability, such as some British Overseas Territories, also offer long-term security for your assets.

Next, evaluate the jurisdiction’s asset protection laws. Look for robust statutes that make it harder for creditors to challenge your trust. For instance, jurisdictions with a three-year limitation period for fraudulent transfer claims offer a strong layer of protection. In these cases, creditors must prove that the settlor was insolvent at the time of the asset transfer.

Tax considerations are equally important. Many tax-neutral jurisdictions do not impose local corporate, income, or inheritance taxes on offshore trusts. However, it’s essential to remember that you’re still responsible for any tax obligations in your home country. Confidentiality is another key factor – ideally, the jurisdiction should only require the registration of a Trust Charter without making settlor or beneficiary names publicly accessible.

Finally, assess the jurisdiction’s flexibility and administrative ease. Does it allow perpetual trusts by eliminating the rule against perpetuities? Can registration be completed quickly, often within 24 hours? Are there burdensome annual meetings or audit requirements? A jurisdiction with a well-developed financial services sector, staffed by experienced legal and accounting professionals, can make trust administration much smoother. These legal, tax, and administrative considerations are vital for selecting the right jurisdiction for your offshore trust.

Why Anguilla is a Top Jurisdiction

Anguilla consistently stands out as one of the best jurisdictions for offshore trusts. As a British Overseas Territory with a legal system rooted in English Common Law, it provides a stable and secure environment for asset protection. Anguilla’s legal framework and efficient administrative processes align seamlessly with the principles of effective trust management.

The Anguilla Trust Act of 2014 introduced several modern updates to trust laws, including the abolition of the rule against perpetuities. This change allows trusts to last indefinitely, making Anguilla an excellent choice for multi-generational wealth planning. Asset protection is further strengthened by the Fraudulent Dispositions Ordinance, which requires creditors to prove insolvency at the time of an asset transfer and limits such claims to a three-year window.

Tax neutrality is another major advantage. Offshore trusts in Anguilla are exempt from local income, corporate, and inheritance taxes. Privacy is also a priority; while a Trust Charter must be filed, it does not disclose the names of the settlor or beneficiaries. Registration is quick and straightforward, with a one-time fee of just $250.

"Anguilla requires creditors of the settlor to prove that the settlor was insolvent at the time he/she transferred assets into the trust, or became insolvent because of the transfers." – OffshoreCompany.com

"Anguilla offers a level of discretion which is rarely found elsewhere. There is also no requirement to register your trust." – WebsterLP.com

Anguilla also boasts a strong professional infrastructure. Its Financial Services Commission enforces strict licensing standards, requiring trust companies to maintain at least $250,000 in paid-up capital. This ensures that clients work with knowledgeable professionals who adhere to international standards.

How Anguilla Compares to Other Jurisdictions

Jurisdictions like the Cook Islands, Nevis, and Belize also provide asset protection and tax-neutral environments. However, Anguilla has a distinct edge thanks to its updated legal framework under the 2014 Trust Act, which allows for perpetual trusts and more efficient administration.

As a British Overseas Territory, Anguilla benefits from a legal system that restricts the recognition of certain foreign judgments. This adds an extra layer of asset protection. Additionally, English is the official language, simplifying legal documentation and communication for international clients.

With its strong legal foundation, straightforward registration process, excellent asset protection laws, and favorable tax policies, Anguilla is a top choice for establishing an offshore trust. Once you’ve selected the right jurisdiction, the next step is setting up your trust to meet your specific goals.

How to Set Up an Offshore Trust

Once you’ve selected a jurisdiction and laid the groundwork, it’s time to move forward with setting up your offshore trust. Careful planning at every step ensures your trust is legally sound and provides the protection you’re seeking.

Define Your Goals and Objectives

Start by pinpointing the purpose of your trust. Are you looking for asset protection, avoiding probate, simplifying wealth transfer, or planning for multiple generations? Your goals will shape the trust’s structure.

For instance, an irrevocable trust provides strong creditor protection, while a discretionary trust offers flexibility in how and when distributions are made. Additionally, consider appointing a Protector. This individual plays a key role in overseeing the trust and can even replace the trustee if necessary, ensuring your intentions are upheld.

It’s wise to consult both a domestic estate planning attorney and an offshore wealth management expert. Together, they can help you navigate tax laws in your home country while making the most of the benefits an offshore trust offers. Once your objectives are clear, the next step is to formalize them in the trust deed.

Draft the Trust Deed

The trust deed is the cornerstone of your offshore trust. This legal document outlines the trust’s terms, defines the roles of key parties, and specifies how assets will be managed and distributed. It must clearly identify:

- The Settlor (you, the creator of the trust)

- The Trustee (the entity responsible for managing the assets)

- The Beneficiaries (those who will benefit from the trust)

The deed also establishes the trustee’s responsibilities, including their fiduciary duties and management obligations. It should provide clear instructions on asset distribution, including any conditions or milestones beneficiaries must meet. For instance, if you’re setting up a discretionary trust, the deed should allow the trustee to adjust distributions or add beneficiaries as situations evolve.

"The deed of trust provides instructions for how the assets placed in the trust should be used and distributed." – First Anguilla Trust Company Limited

In jurisdictions like Anguilla, you may need to file a Trust Charter for government registration. This process enhances privacy since it doesn’t require public disclosure of the Settlor’s or Beneficiaries’ identities. Anguilla also offers a quick registration process – your trust can be registered in under 24 hours.

Once the deed is finalized, the next critical step is funding the trust.

Fund the Trust

A trust without assets is meaningless. After finalizing the trust deed, you must transfer assets into the trust to make it effective. This involves legally transferring asset titles to the trustee. If this step is skipped, the assets remain under your ownership, and the trust may not hold up legally.

"Trust property must be lawfully transferred to the Trustee in order to constitute a valid trust otherwise the assets remain in the beneficial ownership of the Settlor." – Webster Law Firm

You can fund your trust with a variety of assets, such as cash, real estate, investment accounts, or even ownership of foreign LLCs. Many people choose to have their offshore trust own a foreign LLC, which then holds specific assets. This setup adds another layer of protection and simplifies asset management.

Before transferring assets, confirm that you are financially solvent. This helps avoid fraudulent conveyance claims. For example, in Anguilla, creditors must prove that you were insolvent at the time of transfer or became insolvent because of it. They only have three years to file such claims.

During the funding process, expect to complete Know Your Customer (KYC) procedures with your offshore trust company. It’s crucial to provide proper documentation for all asset transfers to establish the trust as the legal owner. This also protects you from personal liability. If you’re a U.S. citizen, remember that even if your trust is in a tax-free jurisdiction, you still have tax reporting obligations, and distributions to U.S. beneficiaries may be subject to specific IRS rules.

How to Maintain and Manage an Offshore Trust

Setting up an offshore trust is just the beginning. To ensure it continues to serve its purpose and stays legally compliant, ongoing management and careful oversight are essential.

Trustee Responsibilities and Oversight

Trustees play a central role in managing the trust. Their duties range from handling investments and overseeing distributions to strictly following the trust deed. Trustees must act exclusively in the interest of the beneficiaries, often working alongside CPAs, attorneys, and financial advisors to ensure proper asset management. They are also responsible for keeping detailed records and providing regular updates to beneficiaries about the trust’s transactions and overall status.

"Trustees hold a paramount position, acting as the legal owners of the trust assets with a duty to manage them for the benefit of the beneficiaries".

Appointing a Trust Protector can add an extra layer of oversight. A Protector has the authority to monitor the trustee’s actions and can even replace them if they fail to meet their obligations or align with your intentions. As Craig Parker, Assistant General Counsel at Trust & Will, cautions:

"One must be wary to appoint individuals and entities that are trustworthy to help minimize the risk of Trust fraud or embezzlement".

In addition to managing assets, trustees must adhere to strict reporting and compliance standards.

Annual Reporting and Compliance

Compliance requirements go beyond the jurisdiction where your trust is registered. For U.S. citizens, reporting worldwide income and meeting foreign reporting requirements is mandatory, no matter where the trust is located. One critical aspect is the U.S. "throwback" rule, which taxes beneficiaries based on the income year, often with added penalty interest.

In jurisdictions like Anguilla, while there are no annual government renewal fees or mandatory accounting or audit requirements for trusts, you will still incur annual trustee fees for ongoing management. Trust Charters often include provisions for full accounting, giving you, the Protector, and beneficiaries the right to review all records.

To avoid potential legal or financial missteps, it’s wise to work with a financial advisor or attorney experienced in offshore trust management. Regular reporting also sets the stage for periodic trust reviews to ensure it aligns with any changes in your circumstances.

Review and Update Your Trust

Periodic reviews are essential to ensure your trust remains effective and aligned with your goals, especially as legal and financial conditions evolve. If your trust is revocable, you can make changes or terminate it altogether, as allowed in the trust deed. Discretionary trusts provide even greater flexibility, enabling trustees to modify distributions or add beneficiaries as needed.

You should also revisit the Protector’s oversight role periodically. In Anguilla, the 2014 Trust Act introduced optional provisions for Protectors, granting them the authority to replace trustees or appoint new ones.

Make it a habit to inspect trust records regularly to confirm the trustee is following the trust deed and maintaining accurate accounts. Legislative updates, like Anguilla’s decision to abolish the Rule against Perpetuities (allowing trusts to exist indefinitely), may offer opportunities to update your trust structure for new advantages.

Conclusion

Key Takeaways

Offshore trusts offer a reliable way to safeguard assets, maintain privacy, and simplify estate planning for lasting wealth security. By transferring legal ownership to a trustee in a favorable jurisdiction, you protect assets from lawsuits, creditors, and government actions while keeping details confidential – trust charters often exclude settlor and beneficiary names from public records. In tax-neutral jurisdictions like Anguilla, trusts are exempt from income, capital gains, inheritance, or gift taxes. Additionally, creditors face a limited three-year window to contest asset transfers, and these trusts can exist indefinitely.

Anguilla streamlines the registration process, completing it in under 24 hours for a one-time fee of $250, with no minimum capital requirement. Beyond asset protection, these trusts bypass probate, override forced heirship rules in your home country, and ensure family assets are distributed in an orderly manner.

"An offshore trust is a powerful strategy for individuals and families seeking to protect their wealth and plan for the future."

– First Anguilla Trust Company Limited

These advantages highlight the critical role of expert advice in setting up and managing an offshore trust.

Why Professional Guidance Matters

Setting up an offshore trust involves navigating complex legal and regulatory frameworks, making professional expertise essential. U.S. citizens, for example, must comply with IRS, FATCA, and CRS requirements, regardless of where the trust is established. Skilled attorneys, CPAs, and licensed trustees ensure the trust deed is legally sound, tailored to your specific objectives, and integrated with your domestic estate plan. They also ensure compliance with international regulations, such as Anguilla’s Fraudulent Dispositions Ordinance. Regular reviews by professionals are crucial to adapting the trust to life changes – like marriage, divorce, or the birth of children – and staying current with evolving legal standards.

"Working with experienced professionals to draft a comprehensive and customized trust agreement is key."

– First Anguilla Trust Company Limited

Engaging experts not only strengthens the protection your trust provides but also ensures it remains flexible and effective over time.

FAQs

What are the main advantages of creating an offshore trust in Anguilla?

Setting up an offshore trust in Anguilla comes with several appealing benefits. For starters, the jurisdiction offers tax neutrality – non-residents are not subject to income, capital gains, or inheritance taxes. This makes it an excellent option for those looking to preserve wealth while optimizing their tax strategy.

Anguilla also provides strong asset protection, helping safeguard trust assets from creditors and legal disputes. On top of that, it ensures privacy, as trusts in Anguilla don’t need to be publicly registered. The legal system, based on English common law, supports the establishment of perpetual trusts, meaning they can last for multiple generations.

What’s more, the process of setting up and managing a trust is straightforward. Anguilla’s ACORN online registration system makes forming and administering trusts simple and efficient. With its combination of security, confidentiality, and ease of use, Anguilla stands out as a prime destination for offshore trust formation.

What factors should I consider when choosing a jurisdiction for my offshore trust?

When choosing where to establish an offshore trust, there are several critical factors to weigh. These include legal stability, the strength of asset protection laws, potential tax advantages, the level of confidentiality, and the expertise of local trustees. Don’t forget to also consider the costs involved in setting up and maintaining the trust.

Anguilla often ranks high on the list for good reason. Its 2014 Trust Act supports perpetual trusts, enforces strong asset protection measures, and has no income or inheritance taxes. On top of that, Anguilla boasts a network of experienced and reputable trustees, making it a dependable choice for protecting your assets.

What are the legal requirements for setting up an offshore trust in Anguilla?

To set up an offshore trust in Anguilla, you’ll need to collaborate with a licensed trustee approved by the Anguilla Financial Services Commission. These trustees must meet specific standards, such as maintaining a minimum paid-up capital of $250,000 for a general license, submitting annual audited financial statements, and promptly reporting any changes to directors or beneficial owners. The trust deed itself must align with the Trusts Act 1994, which outlines the roles and responsibilities of trustees, protectors, and beneficiaries.

Anguilla also has stringent anti-fraud measures in place under its Fraudulent Dispositions Ordinance. These regulations ensure that the settlor is not insolvent when transferring assets into the trust. Creditors are given a three-year window to file claims, after which the trust’s assets are shielded from foreign judgments. To stay compliant, it’s crucial to maintain thorough records, draft a comprehensive trust agreement, and adhere to Anguilla’s legal framework as well as any U.S. reporting obligations, such as filing IRS Forms 3520 and 3520-A. By following these guidelines, you can create a trust that is secure, legally compliant, and structured to optimize tax efficiency.