People are fed up with state level regulations and taxes, leaving blue states for red, but often still choosing blue cities.

November 6, 2023

By: Bobby Casey, Managing Director GWP

Okay. I imagine the lack of income taxes was at least a nice bonus, if not also a contributing factor. Hell, maybe even the weather was a solid selling point.

No matter his stated or unstated reasons for leaving, one thing remains: Washington lost a huge whale of a taxpayer.

Many people are bothered by the idea that Amazon didn’t pay any federal corporate taxes. What they fail to acknowledge is Amazon and Bezos alike paid in local and state level taxes.

The property taxes alone on his property in Seattle was no small sum. A very rough estimation would be to use what he bought the house for $60 million. That was back in 1998 and 2005. It’s gone up significantly in value since then. But let’s use that with the current property tax rate of 1.05%… which comes to $630,000 per year in property tax revenue alone.

Put aside the sales tax on what he buys or any income taxes he might pay.

That’s just a lot of money to take with him.

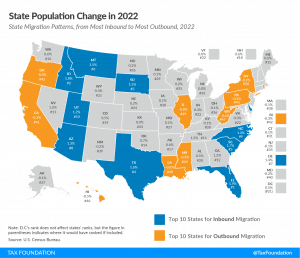

And that’s just one person. Maybe if it was just one person, that wouldn’t mean anything. But that’s not the case at all. According to a report from the Internal Revenue Service’s Statistics of Income Tax Stats – Migration Data, the wealth migration patterns in the US looks like this:

California, New York, and Illinois showed the most net negative outflow of wealth, focusing on high-income taxpayers. California lost $343.2 million, New York lost $299.6 million, and Illinois lost $141.7 million. On the other hand, Florida, Texas, and Arizona showed the highest positive inflow of wealth, with Florida gaining $12.4 billion, Texas gaining $10.7 billion, and Arizona gaining $9.4 billion.

This same article tries to refute the idea that wealthy people are leaving just because they disagree with the tax regime of their current state.

The claims go like this:

If a business in one state has customers or clients in that state, it would probably be inefficient to move to a new state where it may have to start from scratch.

Right, but this is the same reason companies moved their manufacturing to other countries. It’s not efficient to start from scratch… until it is! Tesla famously moved a good amount of its business out of California to Texas in 2021. Remember the Italian electrical components factory that just picked up in the middle of the night and moved from Italy to Poland back in 2013? The owner hadn’t turned a profit in five years. That’s extreme, but some businesses have a much lower threshold for nonsense.

(Lest we forget Marvin Heemeyer!)

If the wealthy are living comfortably, they are more likely to stay. Businesses will simply pass on the higher taxes to their customers.

Again, they will do this until they can’t. Passing on higher costs for choosing an expensive state from which to operate is only feasible if your competition did the same thing. Otherwise, they can offer savings you can’t. They will beat you in a price war without even breaking a sweat.

Maybe some businesses can afford this. But the small and mid-sized businesses cannot.

High-tax states are generally more desirable places to live due to culture, climate, and food. These states know this and believe that for every person who leaves, someone from another state or country will gladly take their place and pay the higher taxes.

Culture, climate, and food? New York and Chicago don’t have enviable climates. Culture and food perhaps… if the restaurants are still open, then sure. As for culture… the rising crime in these massive blue cities are putting a significant damper on that:

Los Angeles came in as the city with the highest rate of retail crime, while San Francisco and Houston were the next two. New York City and Seattle rounded out the top five

In fact, Nike permanently shut down its flagship factory store in Portland, OR for precisely this reason: theft.

One observation is that people are leaving blue states for red states, but moving to blue cities in those red states. You can argue that the combination of pro-business state regimes with more socially oriented local programs is a nice balance.

You could also argue cities are where the biggest talent pool and opportunities are, and a blue city in a red state is still not as bad as a red city in a blue state… or a blue city in a red state.

Whatever the case may be, whatever the stated purpose may be, the economic byproducts are undeniable. People are voting with their feet. Some are not even staying in the US at all, which is worth noting.

An estimated 8 million Americans are living abroad, and one poll found that 1 in 5 of them are seriously considering renouncing their US citizenship!

The interesting thing to watch will be the politics. With the migration out of blue states to blue cities, will the blue get a foothold in red states? Or will red states be fortified with their new cohorts?

Click here to get a copy of our offshore banking report, or here to become a member of our Insider program, where you are eligible for free consultations, deep discounts on corporate and trust services, plus a host of information about internationalizing your business, wealth and life.