Geopolitical events can directly impact your wealth by causing market volatility, disrupting supply chains, and increasing risks like inflation or currency devaluation. Events like military conflicts, trade wars, or sanctions often lead to falling stock prices, higher borrowing costs, and reduced asset values. Even if you’re not directly exposed to conflict zones, the ripple effects – like jurisdiction risk and regulatory changes – can affect your financial stability.

Key Points:

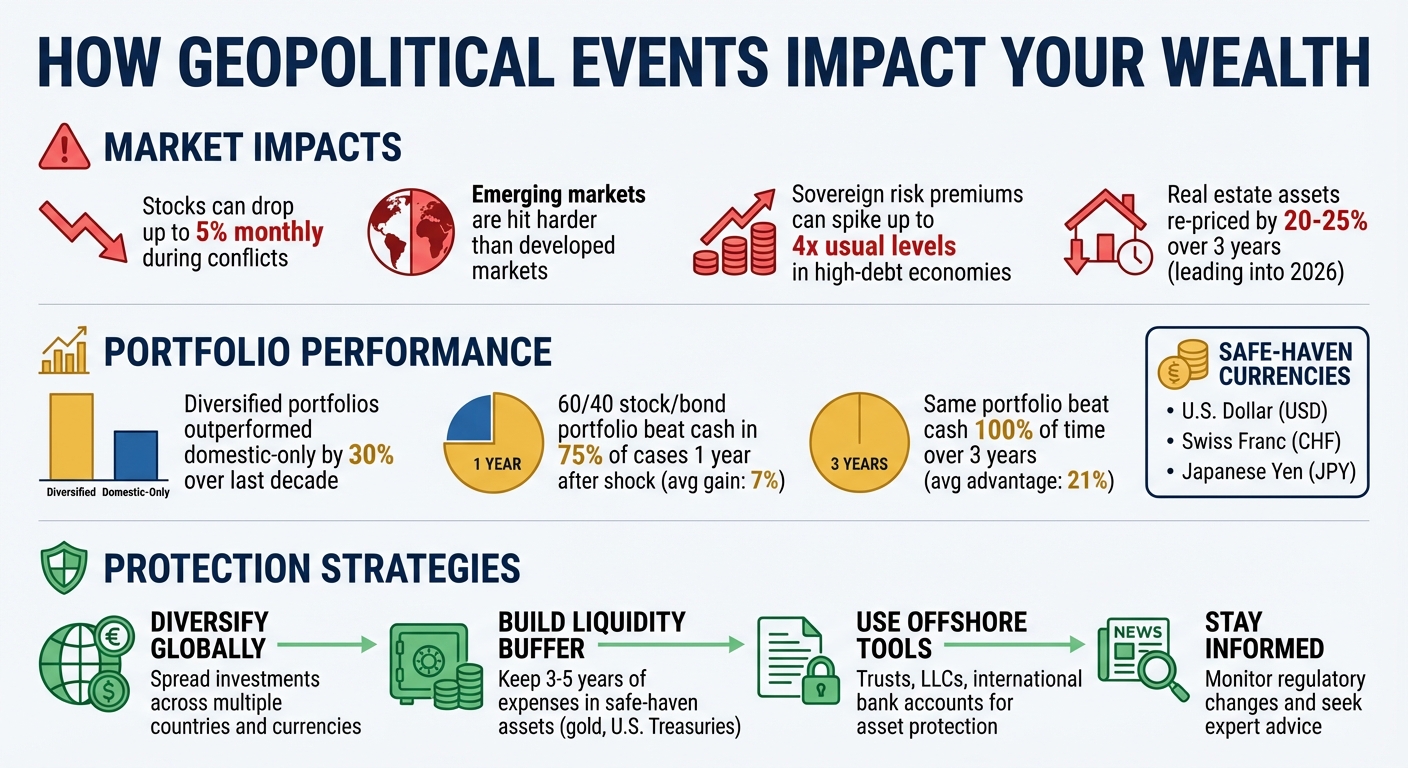

- Market Impact: Stocks can drop up to 5% monthly during conflicts; emerging markets are hit harder.

- Currency Volatility: Geopolitical tensions push investors toward safe-haven currencies like the U.S. dollar, hurting emerging economies.

- Jurisdiction Risks: Legal and policy changes in foreign countries can devalue investments or restrict capital movement.

- Industry-Specific Risks: Real estate, trade, and supply chains often face disruptions during global instability.

What You Can Do:

- Diversify Globally: Spread investments across multiple countries and currencies to reduce localized risks.

- Build a Liquidity Buffer: Keep 3–5 years of expenses in safe-haven assets like gold or U.S. Treasuries.

- Use Offshore Tools: Structuring offshore trusts, LLCs, and international bank accounts can protect assets from legal and regulatory risks.

- Stay Informed: Monitor global regulatory changes and seek expert advice to ensure compliance with tax and reporting rules.

Taking these steps can help safeguard your wealth and maintain financial stability, even in uncertain times.

How Geopolitical Events Affect Financial Markets and Assets

Building on earlier discussions about political instability and jurisdiction risk, this section delves into how such events reshape financial markets and asset values.

The Ripple Effect on Global Markets

Geopolitical shocks often disrupt cross-border trade and investment, pushing investors to navigate unfamiliar risks. These disruptions can stir up market turbulence. For instance, trade wars and tariffs often lead to shifts in investor sentiment and drive up the costs of protecting portfolios. Similarly, sanctions or military conflicts can trigger capital flight, leading to a rapid devaluation of major assets and shrinking government tax revenues.

The extent of market reactions largely depends on the economic climate at the time. If such events occur during a downturn, like when the ISM Manufacturing PMI dips below 50, stock market losses tend to be more pronounced. The uncertainty that follows major geopolitical events can linger for months, further dampening investor confidence.

These disruptions also destabilize currencies, a critical factor for those focused on preserving wealth.

Currency Volatility and Wealth Preservation

Geopolitical tensions often drive investors toward safe-haven currencies like the U.S. dollar, creating challenges for emerging market assets. Emerging markets, in particular, face heightened currency volatility due to limited liquidity, weaker regulatory frameworks, and more severe economic fallout from international conflicts. In economies with high public debt or low reserves, sovereign risk premiums can spike up to four times their usual levels.

For global investors, the concept of geopolitical distance – or the degree of foreign policy misalignment between nations – acts as a useful gauge of risks like sudden currency devaluations, sanctions, or capital controls. This fragmentation, where national security concerns take precedence over economic efficiency, can result in trapped capital or restrictions on profit repatriation.

Beyond currencies, geopolitical shifts also influence specific industries in profound ways.

Industry-Specific Impacts

Real estate markets have seen significant adjustments, with assets re-pricing by 20% to 25% over the three years leading into 2026, driven by macroeconomic and geopolitical stresses. The focus on national security has accelerated trends like "on-shoring" and "near-shoring", reshaping tenant preferences across different regions.

"The balance of real estate risks and opportunities is shifting from broad macroeconomic factors – such as trade uncertainties, interest rates, and fiscal stimulus – to more granular, sector-specific, market-driven, and asset-level dynamics." – Tony Charles, Managing Director, Morgan Stanley Real Estate Investing

sbb-itb-39d39a6

Strategies to Protect Your Wealth Against Geopolitical Risks

Geopolitical tensions can create significant financial uncertainty, but diversified portfolios have shown resilience, outperforming domestic-only ones by 30% over the last decade. By spreading investments and using other protective measures, you can shield your wealth from localized disruptions while seizing opportunities in more stable regions. Let’s explore a few practical strategies to safeguard your assets from the unpredictable effects of geopolitical shifts.

Diversify Investments Across Multiple Countries

Diversifying across multiple countries is a smart move because geopolitical crises rarely affect all regions equally. This strategy creates a natural hedge, especially when you hold assets in multiple currencies. Multi-currency holdings can help cushion the blow of volatility in any single national currency. As UBS Global puts it, "Since you cannot anticipate where the flare-up will happen, maintaining a geographically diverse portfolio is the favored basic hedge".

Historical data backs this up: a balanced 60/40 stock/bond portfolio has outperformed cash in 75% of cases one year after a market shock, with an average gain of 7%. Over three years, it has beaten cash 100% of the time, with an average advantage of 21%.

To further reduce portfolio volatility during geopolitical escalations, consider building a liquidity buffer that covers 3–5 years of expenses. Adding safe-haven assets like gold, the Swiss franc, the U.S. dollar, or U.S. Treasuries can also help stabilize your portfolio. Tailoring your asset allocation to specific risks is another effective tactic – government bonds can shield against negative growth shocks, while real assets like infrastructure or timber can help counter inflation.

Use Offshore Asset Protection Tools

Beyond diversification, structural asset protection tools like irrevocable trusts and offshore asset protection trusts (OAPTs) offer another layer of defense. These tools remove assets from your personal estate, shielding them from creditors and legal risks. Jurisdictions like Nevis and the Cook Islands are particularly known for their strong protections, making it harder for domestic creditors to access your assets. However, it’s crucial to establish these structures proactively, as doing so during litigation or creditor disputes may lead to fraudulent transfer classifications.

Foreign holding companies and limited liability companies (LLCs) are also valuable tools. They can isolate liability for specific assets, such as real estate, while helping to manage tax exposure. These structures allow for swift exits from high-risk markets, providing flexibility in uncertain times. However, navigating complex tax regulations like PFIC (Passive Foreign Investment Company) and GILTI (Global Intangible Low-Taxed Income) requires expert advice to avoid steep penalties.

Use International Banking Solutions

International banking provides another layer of security and flexibility during periods of geopolitical instability. Multi-jurisdiction bank accounts, for instance, allow you to hold and transact in multiple currencies, reducing conversion risks. If a significant portion of your expenses is in euros, for example, holding a similar proportion of liquid assets in a euro-denominated account can help align your exposure with your spending habits.

Banking in politically stable jurisdictions with minimal foreign exchange controls and strong regulatory frameworks is also a wise move. Safe-haven currencies like the Swiss franc (CHF) and Japanese yen (JPY) have historically provided stability during crises. Some banking hubs even offer depositor protection schemes, such as the Jersey Bank Depositor Compensation Scheme, which covers eligible deposits up to £50,000.

However, U.S. persons should remain mindful of tax and reporting obligations. For example, you may need to file FBAR (FinCEN Form 114) and Forms 3520/3520-A for foreign trust involvement to avoid penalties. As Bernstein notes, "Jurisdictional diversification can help protect assets, provided you stay abreast of US tax and reporting requirements".

Adapting to Regulatory and Policy Changes

Geopolitical changes often rewrite the rules that govern wealth management. Tax treaties get renegotiated, transparency initiatives broaden, and compliance requirements shift across borders. Keeping up with these changes requires constant vigilance and systems that can adjust effectively.

Monitoring Regulatory Trends

Keeping an eye on international regulatory developments is crucial for protecting your assets. For instance, the Financial Action Task Force (FATF) updates its list of "high-risk jurisdictions" three times a year. These are countries with weak anti-money laundering measures that could face sanctions or increased scrutiny from financial institutions. If you hold assets in these regions, you may encounter unexpected hurdles with banking relationships or cross-border transactions.

Beyond the FATF, initiatives like the Common Reporting Standard (CRS) and FATCA have transformed the way financial information is shared internationally. Tax authorities now automatically exchange data about foreign accounts, making it nearly impossible to maintain undisclosed offshore holdings. To navigate these complex reporting requirements without penalties, it’s wise to consult cross-border tax advisors. As the IRS advises:

"The IRS encourages taxpayers to consult with professional tax or legal advisors in determining which option is the most appropriate for them".

For those managing more intricate portfolios, establishing a "nerve center" – a dedicated team of advisors who track regulatory changes across all jurisdictions where you hold assets – can be invaluable. McKinsey recommends this approach to proactively identify and address potential issues before they escalate. Conducting annual audits of trusts, offshore entities, and other asset holdings can ensure everything stays in compliance with current laws. This proactive monitoring works hand-in-hand with other asset protection strategies to safeguard your wealth.

Building Resilient Structures

Wealth structures that stand the test of time aren’t just compliant – they’re built to adapt. A recent example is HSBC’s decision in late 2024 to split its global operations into Eastern and Western markets. By March 2025, these divisions were rebranded as "Asia and the Middle East" and "Europe and Americas", enabling the bank to respond more swiftly to localized regulatory changes. Individual investors can apply a similar principle: structural separation provides flexibility in navigating shifting regulatory landscapes.

Creating independent legal entities in multiple jurisdictions can help cushion against regulatory shocks. For example, if one country imposes unfavorable tax changes or capital controls, you can adjust your exposure without dismantling your entire structure. U.S. investors, in particular, should ensure trusts meet both the "court test" (supervised by a U.S. court) and the "control test" (controlled by U.S. persons) to qualify as domestic, thereby avoiding adverse tax consequences and additional reporting requirements.

Bob Sternfels, Global Managing Partner at McKinsey, highlights the importance of adaptability in today’s uncertain environment:

"The MNC model will need to move beyond enabling growth and efficiency to also embedding the adaptability to capture opportunities and the resilience to withstand geopolitical shocks".

For individual wealth holders, this means creating structures that can pivot in response to regulatory changes, reducing the need for rushed, last-minute adjustments. By planning ahead, you ensure that your wealth remains protected, no matter how the rules evolve.

Conclusion

Key Takeaways

Geopolitical events can shake up markets, but they don’t have to derail your financial goals. One of the most effective ways to safeguard your portfolio is by diversifying across multiple countries. This strategy helps reduce the impact of local crises, and historically, globally diversified investors have consistently outpaced those who stick to domestic-only investments.

A well-balanced asset allocation is another critical tool. Bonds can help absorb market shocks, while real assets like infrastructure and timber provide a hedge against inflation. Maintaining a liquidity buffer of 3–5 years ensures you have flexibility during periods of uncertainty. Offshore banking solutions, as previously discussed, offer multi-currency options and access to international expertise. Additionally, regularly rebalancing your portfolio promotes disciplined buying and selling, keeping your investments aligned with your goals.

These strategies form a solid foundation for navigating market volatility and making informed financial decisions. Expert guidance can further enhance these efforts.

The Role of Expert Guidance

While these strategies are powerful, having professional advice can make all the difference in managing geopolitical risks. Advisors help separate meaningful market signals from the noise of media headlines, ensuring that your decisions are grounded in analysis rather than fear.

Experts also play a vital role in navigating the complexities of international tax laws, offshore structures, and cross-border regulations. They can help you build wealth structures that are not only resilient but also adaptable to changing circumstances. Whether you’re opening offshore accounts or implementing currency hedges, professional support ensures compliance with legal requirements while maximizing the benefits of global diversification.

FAQs

How do geopolitical events affect financial markets and your wealth?

Geopolitical events – think trade disputes, sanctions, political instability, or regulatory shifts – can have a big impact on financial markets and, by extension, your personal finances. These events often introduce uncertainty, which tends to shake investor confidence and trigger sudden market swings.

Take global supply chain disruptions or rising tensions in critical regions as examples. These situations can lead to shifts in asset prices, currency exchange rates, and commodity markets. The resulting unpredictability often drives up risk premiums, making it harder to plan financially. Staying informed and ready to adapt is key to safeguarding your wealth during such turbulent times.

What are safe-haven assets, and how can they protect your wealth?

Safe-haven assets are investments that tend to maintain or even grow in value during periods of economic turbulence or geopolitical uncertainty. Popular examples include gold, the U.S. dollar, and government bonds. These assets are highly valued for their ability to provide stability when markets face volatility or unpredictability.

The role of safe-haven assets is crucial in safeguarding your wealth. They act as a protective shield against unexpected market declines or global disruptions. Adding these assets to your portfolio can help minimize risk and ensure a more stable financial footing during uncertain times.

What are offshore tools, and how can they help protect my wealth?

Offshore tools refer to legal and financial strategies designed to protect your wealth by spreading assets across different countries. These strategies might include establishing offshore trusts, creating offshore LLCs, opening bank accounts abroad, or purchasing property in foreign markets. Shifting a portion of your assets offshore can help shield them from risks like political upheaval, sudden regulatory shifts, or economic slumps in your home country.

However, using offshore tools isn’t just about moving money around – it requires careful planning and strict adherence to U.S. laws and tax rules. Working with a knowledgeable professional can help you navigate these intricate processes, ensuring your wealth remains secure while staying fully compliant with legal obligations.