Living abroad can be exciting, but without the right financial safety net, it’s risky. For global nomads, managing irregular income, navigating currency fluctuations, and staying tax-compliant are just a few challenges. Here’s how you can protect yourself financially while living internationally:

- Emergency Funds: Save 3–6 months of living expenses in accessible accounts.

- Insurance: Get international health, travel, and income protection insurance.

- Offshore Asset Protection: Consider trusts in jurisdictions like Nevis or the Cook Islands for legal and financial security.

- Multi-Currency Banking: Use tools like Charles Schwab, Wise, or Revolut to avoid high fees and simplify transactions.

- Tax Compliance: File FBAR and FATCA forms, track foreign income, and consult expat tax specialists.

Key takeaway: Build your financial safety net before issues arise. Diversify assets, secure insurance, and stay compliant to thrive as a global nomad.

Offshore Asset Protection Strategies

Offshore structures work by placing your assets in jurisdictions that do not recognize foreign court judgments. This forces creditors to re-litigate cases in the local courts, creating significant legal and procedural obstacles. These barriers are the cornerstone of effective asset protection strategies.

For instance, jurisdictions like Nevis require anyone filing a claim to post a $25,000 bond just to begin a lawsuit. Additionally, the timeframe for creditors to challenge asset transfers is much shorter in places like the Cook Islands and Belize – just 1–2 years compared to longer periods in the U.S.. On top of that, creditors must meet a higher standard of proof, demonstrating fraudulent intent "beyond a reasonable doubt", unlike the "preponderance of evidence" standard used in U.S. civil cases.

These structures also provide geographic diversification, shielding assets from risks like government seizures, banking collapses, or economic instability. They enhance financial privacy and may offer potential tax advantages.

The high costs and complexities of pursuing offshore assets often lead creditors to settle for much less than their original claims. This makes offshore strategies appealing for individuals with substantial assets – typically starting at $2 million – despite setup costs ranging from $20,000 to $50,000 and annual maintenance fees between $7,000 and $20,000 or more.

Benefits of Offshore Asset Protection

Offshore strategies come with several key advantages:

- Deterring creditors: The need to hire local counsel, post large bonds, and navigate unfamiliar legal systems often discourages creditors from pursuing claims.

- Increased privacy: Many offshore jurisdictions do not keep public records of trust beneficiaries or LLC owners, reducing exposure to lawsuits.

- Tax advantages: Operating in low- or no-tax jurisdictions can help reduce income, capital gains, and inheritance taxes.

- Geographic diversification: Spreading assets across different countries minimizes risks tied to a single jurisdiction.

However, U.S. citizens are still subject to worldwide taxation and must report all offshore holdings under FBAR and FATCA regulations, with severe penalties for failing to comply.

Understanding these benefits is essential when deciding where to establish offshore structures.

Best Jurisdictions for Offshore Trusts and Companies

Not all jurisdictions offer the same level of asset protection. The best options are typically based on English Common Law, reject foreign judgments, enforce short statutes of limitations, and impose high procedural barriers.

| Jurisdiction | Key Advantage | Best For |

|---|---|---|

| Cook Islands | Long history of protection; crypto-friendly | High-value assets ($5M+); high-risk profiles |

| Nevis | $25,000 creditor bond; strong legal shield | Mid-market ($2M–$10M); cost-conscious protection |

| Belize | Short challenge periods; lower fees | Budget-conscious individuals ($2M–$5M) |

| Cayman Islands | Stability and advanced banking | Institutional investing and credibility |

| BVI | Minimal reporting; strong privacy | Flexible corporate structures and LLCs |

For example, the Cook Islands is particularly attractive for individuals with cryptocurrency or other digital assets, thanks to its long-standing reputation. Nevis offers strong protections at a lower cost, while Belize stands out for its short timeframes to contest fraudulent transfers. The Cayman Islands and BVI provide institutional-grade services and banking options but tend to be more expensive.

Timing is critical – offshore structures should be established before any legal threats arise. Transfers made after a claim becomes foreseeable could be considered fraudulent conveyances and may not hold up in court.

How to Set Up Private US LLCs for Asset Protection

Private U.S. LLCs can complement offshore strategies by providing operational flexibility and liability protection. A common approach involves combining both structures: an offshore trust owns 100% of a U.S. LLC, while you manage the LLC for day-to-day operations. In this setup, the foreign trustee retains ultimate ownership. This ensures that if a U.S. court orders the surrender of LLC assets, the trustee can maintain control.

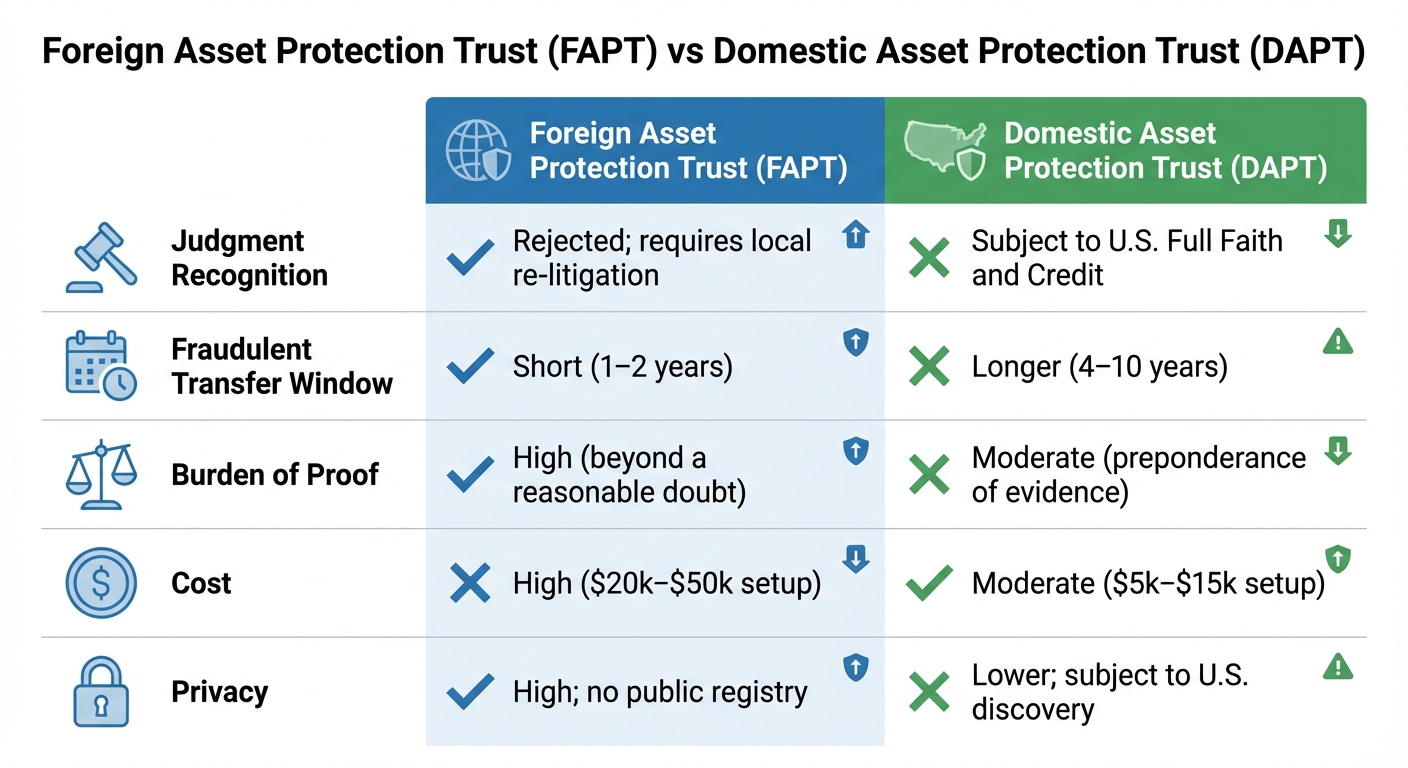

States like Wyoming, Delaware, and Nevada offer strong privacy protections for LLC owners. Additionally, as of 2024, at least 20 states allow Domestic Asset Protection Trusts (DAPTs). However, these trusts are still subject to federal bankruptcy laws and challenges under the Full Faith and Credit Clause, which offshore trusts avoid.

| Feature | Foreign Asset Protection Trust (FAPT) | Domestic Asset Protection Trust (DAPT) |

|---|---|---|

| Judgment Recognition | Rejected; requires local re-litigation | Subject to U.S. Full Faith and Credit |

| Fraudulent Transfer Window | Short (1–2 years) | Longer (4–10 years) |

| Burden of Proof | High (beyond a reasonable doubt) | Moderate (preponderance of evidence) |

| Cost | High ($20k–$50k setup) | Moderate ($5k–$15k setup) |

| Privacy | High; no public registry | Lower; subject to U.S. discovery |

It’s critical to avoid making transfers into an LLC or trust to dodge known creditors. Such actions can be reversed under fraudulent-conveyance laws. Always document the business purpose and timing of asset transfers, and consult legal and financial professionals in both the U.S. and your chosen jurisdiction to ensure compliance.

Many offshore trust agreements include anti-duress clauses, instructing trustees to ignore instructions given under court pressure. This feature adds another layer of protection, reinforcing the effectiveness of offshore asset strategies.

sbb-itb-39d39a6

International Insurance Options for Global Nomads

When living or traveling abroad, having solid international insurance is a key part of protecting your finances. Domestic insurance plans, like U.S. Medicare and Medicaid, don’t cover medical care outside the United States. Without the right coverage, a single medical emergency could wipe out your savings or leave you without proper care. To fill the gap left by domestic policies, you’ll need to carefully evaluate international insurance options.

Insurance for global nomads typically falls into three categories: travel insurance for trip-related disruptions and emergency stabilization, travel health insurance for extended stays covering inpatient care, and international health insurance for long-term coverage, including routine and chronic care needs.

The Importance of Medical Evacuation Insurance

Medical evacuation insurance is an absolute must, especially in areas with limited healthcare facilities. Evacuation costs can range from $25,000 within North America to over $250,000 in remote locations. Keep in mind that insurers usually make the final call on whether evacuation is necessary.

Many international insurers require upfront payment for medical services. This could mean charging thousands of dollars to your credit card before you’re reimbursed. To avoid this, look for providers that offer direct payments to hospitals and provide 24/7 support from physician-backed call centers. Also, ensure the policy covers all destinations you plan to visit and review exclusions closely – activities like adventure sports, mental health emergencies, or injuries from civil unrest are often not covered.

Health and Travel Insurance

International health insurance is the backbone of your healthcare safety net while abroad. These policies should cover routine care, emergency services, and private medical and dental treatment. The key difference between plans lies in how long and how comprehensively they cover you. Short-term travelers have different needs compared to those living abroad indefinitely.

Pre-existing conditions can complicate coverage. Most policies exclude conditions treated within 90 days before your trip, and coverage becomes harder to obtain after age 75.

"The U.S. government does not pay medical costs for U.S. citizens traveling abroad." – Travel.State.gov

For medical evacuation, ensure your policy specifies evacuation to the United States, not just the nearest hospital. Providers like Aetna, Blue Cross Blue Shield, and Cigna offer plans tailored for expatriates.

Filing claims can be tricky. Insurance companies fully paid only about two-thirds of claims made by international travelers, often due to issues with pre-existing conditions or incomplete documentation. Always keep detailed records, including summaries, receipts, and charges. Also, have a credit card with a high limit, as many facilities require upfront payment before treatment.

Income Protection and Life Insurance

In addition to health coverage, protecting your income and securing life insurance are equally important. Income protection insurance provides a steady monthly income if you’re unable to work due to an accident or illness. Expat-focused plans typically cover up to 75% of your annual salary, with payments continuing until age 65, death, or plan cancellation. The deferred period – how long you wait before payments begin – can range from 3 to 12 months, with longer waiting periods lowering your monthly premiums.

International term life insurance differs from domestic policies. Most U.S. life insurance policies remain valid during international moves unless they include specific travel exclusions. However, getting new coverage from a U.S. company becomes nearly impossible if you spend over six months a year outside the country.

"If you live more than six months of the year outside of the country, you most likely won’t be able to get coverage from an American company." – Policygenius

To avoid issues, secure life insurance before you move abroad. U.S. companies often require applicants to be physically present for medical exams and to sign applications. Beneficiaries may also need a U.S. bank account to receive death benefits and may have to file IRS Form W-8BEN.

For high-net-worth individuals, offshore Private Placement Life Insurance (PPLI) can be an option. With around $2,000,000 to invest and excellent health, you may qualify for this legal tax shelter, which offers tax-deferred growth on investments and tax-free death benefits.

For retirees, Medicare poses specific challenges. If you delay enrolling in Part B, your premiums increase by 10% for every 12-month period you were eligible but didn’t sign up – a penalty that lasts for life. Even if you use a local health system abroad, consider keeping Medicare Part A (hospital insurance) if it’s premium-free.

Global Banking and Financial Management Tools

U.S. banks often hit customers with hefty ATM fees, foreign transaction charges, and unfavorable exchange rates. For global nomads, this can add up to $3,200–$6,400 annually, compared to just $200–$500 when using an international banking solution. These savings create a solid base for managing finances globally while linking cash flow to broader asset protection strategies.

Multi-Currency Banking Solutions

A good place to start is with an account like Charles Schwab High Yield Investor Checking, which offers unlimited global ATM fee rebates and no foreign transaction fees.

"Charles Schwab… Unlimited global ATM fee rebates, no foreign transaction fees on the debit card. Game changer." – Sarah, Developer

Other platforms like Wise and Revolut provide multi-currency accounts with local banking details and transparent fees ranging from 0.3%–0.8%. These tools can save you $800–$1,200 annually while offering features like budgeting and spending analytics. For those handling larger balances, HSBC Premier includes options like "Global View" and "Global Transfers" for seamless international transactions. However, waiving monthly fees typically requires maintaining a combined balance of $75,000 or more. Also, steer clear of Dynamic Currency Conversion, which can sneak in hidden fees of 3%–6%.

Financial Management Apps and Platforms

Specialized apps can help you track cross-currency spending. Pairing a multi-currency account with apps ensures you’re prepared for unexpected situations. For example, Fidelity Cash Management and Capital One 360 offer fee-free access, serving as reliable backups if your primary card fails.

A smart strategy involves diversifying your accounts: use Charles Schwab for ATM withdrawals, Wise for everyday expenses, and Capital One for online transactions. This approach reduces fees and ensures you always have access to funds. This redundancy acts as a financial offshore escape hatch during emergencies. By optimizing banking and financial tools, you’ll not only cut down on costs but also strengthen your financial stability as a global nomad.

How to Diversify Income Streams

Just as multi-currency banking minimizes fees, diversifying your income sources protects you from economic fluctuations. For example, when the USD dropped over 10% against major global currencies in early 2025, nomads earning in multiple currencies were able to maintain stronger purchasing power.

Holding assets in the same currency as your expenses – like Euro-denominated assets for European living – can help reduce exchange rate risks. Setting up entities in locations like the UAE, which has a 0% personal income tax, can also lower tax liabilities. However, setup costs for such entities can range from $4,000 to $15,000 annually. U.S. citizens should take advantage of tax-advantaged accounts like Solo 401(k)s, which allow deferrals of up to $69,000 as of 2024.

Building multiple income streams – whether through diverse clients, passive income ventures, or expanding your skill set – adds another layer of financial security. Keep detailed monthly records of all foreign account balances to simplify FBAR reporting, which is required when combined balances exceed $10,000 at any point during the year.

Emergency Financial Planning for Global Nomads

When you’re living abroad, financial preparedness isn’t just a good idea – it’s essential. From unexpected medical bills to sudden relocations, having a robust plan in place can make all the difference. In 2023, only 54% of American adults had at least three months’ worth of emergency savings, and about 63% could handle a $400 emergency expense with cash on hand. For global nomads, the stakes are even higher, requiring a stronger safety net.

How to Build an Emergency Fund

Experts suggest saving three to six months’ worth of household expenses in an account that’s easy to access. For those moving to a new country, aim for at least six months of expenses to cover the costs of settling in. With average monthly household expenses in the U.S. at $6,440 in 2023, this translates to an emergency fund of $19,320 to $38,640.

"The most valuable first step in emergency proofing your finances is to have a grasp on monthly cash flow." – David Bigelow, Wealth Manager, Coldstream Wealth Management

To keep your savings both safe and accessible, consider High-Yield Savings Accounts (HYSAs) or money market accounts. Automating transfers from your checking account can help you build your fund steadily. Tools like HSBC Global View allow for quick, fee-free global transfers – up to $200,000 daily. Additionally, keep a small stash of physical cash in small bills at home. In emergencies like natural disasters, when ATMs or card systems fail, cash can be critical for essentials like food, fuel, and supplies.

| Savings Goal | Monthly Contribution (30 Months) | Monthly Contribution (60 Months) |

|---|---|---|

| $10,000 | $333.33 | $166.67 |

| $20,000 | $666.66 | $333.33 |

| $40,000 | $1,333.32 | $666.66 |

Opening a local bank account in your host country is also important. It helps you build a local credit history, which may be necessary for securing rentals, phone contracts, or utility services. To prepare for emergencies, store digital copies of vital documents – like financial records, insurance policies, and IDs – in the cloud or on an external drive.

A well-funded emergency account works best when paired with accessible credit, ensuring you’re ready for anything.

How to Access Credit in Foreign Countries

Once your emergency fund is in place, make sure you have reliable credit options abroad. Keep U.S.-based credit cards and accounts active to maintain established credit lines and benefit from FDIC and SIPC protections. In case of financial trouble, reach out to family, friends, or employers for immediate assistance.

For U.S. citizens in dire situations, the Department of State offers repatriation loans, covering transportation back to the U.S. along with temporary food, lodging, and medical care. Another option is the EMDA II Loan (Emergency Medical and Dietary Assistance) for those needing urgent care but not planning to return to the U.S. However, accepting these loans comes with a condition: your passport will be restricted until the loan is repaid.

If commercial options are unavailable, the OCS Trust Program allows family or friends to send funds through the Department of State for a $30 annual fee. For faster transfers, services like Western Union "Quick Collect" – using the code city "OVERSEASEMERGENCY DC" – can process funds during business hours.

With hospital stays costing an average of $3,025 per night, having access to high-limit credit or emergency savings is crucial. Given that credit card interest rates in the U.S. averaged 22.8% in 2024, paying off high-interest debt should be a priority to free up cash for emergencies.

Planning for Repatriation Costs

Emergency repatriation can be expensive, so it’s wise to plan for costs like flights, temporary housing, food, and medical care. Maintaining a bank account in your home country ensures you can receive emergency transfers and manage ongoing financial obligations. Also, make sure your passport is valid for at least six months beyond your planned stay, as airlines and visa offices may deny travel without it, causing delays.

"Living in another country is a dream for many people, but the reality is that it can be emotionally isolating if you don’t have a support system in place." – Susan Poss, Senior Wealth Advisor, Schwab Wealth Advisory

To prepare for emergencies, store electronic copies of key documents – like medical records, powers of attorney, and wills – on a secure cloud service. Retirees should also be aware that failing to enroll in Medicare Part B when eligible can result in a permanent 10% premium increase for every 12 months of delay. This can significantly impact long-term financial planning for repatriation.

Combining emergency savings with strategic banking and credit solutions creates a financial safety net that can withstand unexpected challenges.

Regulatory Compliance for Global Nomads

Building a strong financial safety net also means staying on top of international tax laws. Just because you live abroad doesn’t mean you’re off the hook when it comes to taxes. For U.S. citizens and resident aliens, the IRS taxes worldwide income no matter where you live or work. Ignoring this can lead to serious consequences like penalties, passport revocation, or worse.

"The United States is the most aggressive country in the world when it comes to personhood-based taxation, enforcing taxes on its people no matter where they live or work." – Bobby Casey, Managing Director, GWP

With frameworks like FATCA and CRS in place, hiding offshore assets has become nearly impossible. Banks in over 100 countries now automatically report account holder information to tax authorities every year, typically around September.

Understanding CRS and FATCA Requirements

The Common Reporting Standard (CRS) is an international agreement requiring banks in participating countries to report your tax residency, address, and Taxpayer Identification Number (TIN) to your home country’s tax authority. If you can’t prove tax residency in another country, banks often default to reporting you as a U.S. citizen.

For U.S. taxpayers, FATCA (Foreign Account Tax Compliance Act) mandates that foreign financial institutions report accounts held by U.S. taxpayers directly to the IRS. Non-compliant institutions face harsh penalties, including bans from trading in the U.S..

If you hold foreign assets, you’ll need to file two key forms:

| Requirement | Form | Threshold | Due Date |

|---|---|---|---|

| FBAR | FinCEN Form 114 | Aggregate value > $10,000 at any time | April 15 (Auto-extension to Oct 15) |

| FATCA | Form 8938 | > $200,000 on the last day or > $300,000 at any time (for singles living abroad) | With Form 1040 |

The FBAR (FinCEN Form 114) must be filed electronically through the BSA E-Filing System if your foreign accounts exceed $10,000 in aggregate value at any point during the year. This includes checking, savings, and investment accounts. Be sure to keep detailed records for at least five years, including account names, numbers, and the highest balances. Criminal violations can lead to fines and up to five years in prison.

Form 8938, filed with your annual tax return, applies to higher thresholds – $50,000 for most filers, but $200,000 on the last day or $300,000 at any time for singles living abroad. Failing to file can result in a $10,000 penalty, which can climb to $50,000 for continued non-compliance. Underpayments related to undisclosed foreign assets may also incur a 40% penalty.

Together, these rules establish the groundwork for staying tax-compliant across borders.

How to Maintain Tax Compliance Across Jurisdictions

Navigating tax obligations in multiple countries takes careful planning. For starters, track your time meticulously. Even being off by 30 minutes could disqualify you from the Physical Presence Test, which is required to claim the Foreign Earned Income Exclusion (FEIE). To qualify, you must spend at least 330 full days outside the U.S. within a 12-month period.

When reporting foreign income and expenses, convert amounts to U.S. dollars using the Treasury Bureau exchange rate from December 31, and include these figures on your U.S. tax return.

If you’ve fallen behind on filing, the Streamlined Foreign Offshore Procedures can help you catch up. This process requires you to file three years of amended tax returns and six years of FBARs, while certifying that your non-compliance was unintentional.

"Trying to evade your U.S. tax filing obligation has steep consequences – and it’s pretty easy to get caught." – H&R Block

Don’t assume you’re exempt from tax residency just because you stayed fewer than 183 days in a country. Residency can also depend on your permanent status rather than just time spent there. Check tax treaties between the U.S. and your host country to see if you qualify for relief from double taxation on pensions or investment income. For example, the new U.S.-Chile treaty taking effect in 2024 provides such benefits.

Lastly, verify whether your "sticky" home state – the last U.S. state where you lived – requires you to file a state tax return even while abroad. The IRS can notify the State Department of "seriously delinquent tax debt", which could result in the denial or revocation of your U.S. passport. Staying compliant not only safeguards your finances but also ensures your freedom to travel.

Conclusion

Living as a global nomad offers freedom and mobility, but it also comes with financial challenges that are less common in a more settled lifestyle. For instance, in 2023, the U.S. dollar fell over 10% against the DXY (a basket of major currencies), highlighting the unpredictable nature of currency fluctuations. This makes diversification and careful planning not just helpful but essential.

To navigate these risks, a multi-layered financial approach is key. Tools like offshore trusts and LLCs can provide legal protection against lawsuits, while multi-currency accounts and international banking solutions help mitigate the impact of currency devaluation and over-reliance on a single country. Add to this a robust emergency fund and comprehensive insurance, and you’ve got a safety net that can help you weather unexpected changes.

"True protection comes from being proactive – setting up structures before you ever need them." – The Nestmann Group

Staying compliant with regulations is another critical piece of the puzzle. Ignoring requirements like filing FBAR or FATCA forms can lead to penalties exceeding $10,000 and even the risk of losing your passport. By staying transparent with tax authorities, you protect your assets from private creditors while avoiding legal trouble. Keep track of your physical presence, report all foreign accounts, and work with expat tax specialists to navigate the complexities of multi-jurisdictional obligations.

The key takeaway? Build your financial safety net before you face any risks. Establish tax residency in a favorable jurisdiction, diversify your assets across countries and currencies, and keep three to six months’ worth of living expenses in an accessible emergency fund. The nomadic lifestyle rewards those who prepare ahead of time – and can be unforgiving to those who don’t.

FAQs

What are the advantages and potential risks of using an offshore trust for asset protection?

An offshore trust can serve as an effective way to safeguard assets, offering strong security and privacy benefits. These trusts are often established in jurisdictions with robust legal frameworks, making it more challenging for creditors or legal disputes to reach your assets. Places like the Cook Islands, Nevis, and the Cayman Islands are well-known for their laws that favor asset protection. Additionally, offshore trusts provide a level of financial confidentiality that appeals to those looking to preserve their wealth discreetly.

That said, there are a few factors to consider. Setting up an offshore trust can come with significant costs, typically ranging from $10,000 to $50,000 or more, plus ongoing administrative expenses. For U.S. citizens, compliance with strict tax reporting rules is a must. This includes disclosing trust holdings to the IRS to avoid potential legal issues. Moreover, legal changes in the chosen jurisdiction could affect the trust’s protective capabilities. To navigate these complexities and reduce risks, it’s crucial to work closely with a qualified professional.

How can U.S. citizens living abroad stay tax-compliant?

U.S. citizens living abroad must report their worldwide income to the IRS every year, no matter where they live. This means filing U.S. tax returns even if they’re already paying taxes in their country of residence. One key provision to understand is the Foreign Earned Income Exclusion (FEIE), which lets qualified individuals exclude a portion of their foreign income from U.S. taxation, potentially lowering their tax burden.

To stay on top of your tax obligations, it’s crucial to maintain thorough records of your income, foreign taxes paid, and residency details. Don’t overlook state tax requirements either, as these can vary based on your last U.S. address. Working with a tax professional who specializes in international tax laws can be a smart move, offering guidance tailored to your situation. Staying organized and planning ahead is the best way to avoid penalties and stay compliant with both U.S. and local tax rules.

What types of insurance do global nomads need to stay financially secure?

For those living the global nomad lifestyle, having the right insurance isn’t just a good idea – it’s a must. It’s what keeps you financially secure and gives you peace of mind as you navigate life in different countries.

One of the key types of coverage to prioritize is international health insurance. This ensures you’re covered for medical emergencies, hospital stays, and even repatriation if needed. Being in a new and unfamiliar environment can come with unexpected health challenges, so having access to reliable healthcare wherever you are is crucial.

Beyond health coverage, liability insurance is another important consideration. It protects you from potential legal claims or damages, which can be especially tricky to handle when you’re abroad. If you rely on tools like laptops or cameras for work, equipment insurance can be a lifesaver, covering the cost of repairs or replacements if something goes wrong.

Some nomads also explore offshore insurance solutions to secure their financial assets across different jurisdictions. These options help reduce risks and provide an added layer of stability, making it easier to maintain a secure and flexible international lifestyle.